EXCLUSIVE PREVIEW OF THE 2024 AIRPORT RANKINGS

The 2024 airport rankings reveal critical insights into the evolving dynamics of global aviation. These rankings spotlight the resilience of airports worldwide as passenger traffic surges. For instance, Irish airports experienced an 8% rise in passenger numbers in 2024, handling over 59,000 flights—a testament to the sector's recovery. Globally, aviation demand remains robust, with passenger traffic projected to reach 9.9 billion by 2025. This data underscores the importance of these rankings for understanding the performance of key travel hubs, guiding travelers, businesses, and industry leaders in navigating an interconnected world.

Key Takeaways

The 2024 airport rankings show air travel is bouncing back. Passenger numbers hit 9.5 billion, up 9% from 2023.

Hartsfield-Jackson Atlanta Airport is still the busiest. It served over 108 million passengers, showing steady success.

Shanghai Pudong Airport jumped from 21st to 10th place. This is due to easier visas and more international flights.

New tech like face scans and automated systems help airports run better. They also make travel easier for passengers.

Airports in Southeast Asia and Africa are growing fast. Big spending on buildings and tech will boost their rankings.

Top 10 Busiest Airports in 2024

Overview of the top 10 airports by passenger traffic

The 2024 airport rankings highlight the busiest airports globally, reflecting the resurgence of air travel. Hartsfield-Jackson Atlanta International Airport (ATL) continues to dominate as the busiest airport, serving over 108 million passengers. Dubai International Airport (DXB) and Dallas Fort Worth International Airport (DFW) follow closely, with 92 million and 87 million passengers, respectively. These airports remain critical hubs for international and domestic connectivity, showcasing their operational efficiency and strategic importance.

The table below provides a detailed breakdown of the top 10 busiest airports by passenger traffic in 2024:

Rank | Airport | 2024 passengers | 2023 ranking |

|---|---|---|---|

1 | Hartsfield-Jackson Atlanta International Airport (ATL) | 108,067,766 | 1 |

2 | Dubai International Airport (DXB) | 92,331,506 | 2 |

3 | Dallas Fort Worth International Airport (DFW) | 87,817,864 | 3 |

4 | Haneda Airport (HND) | 85,900,617 | 5 |

5 | Heathrow Airport (LHR) | 83,884,572 | 4 |

6 | Denver International Airport (DEN) | 82,358,744 | 6 |

7 | Istanbul Airport (IST) | 80,073,252 | 7 |

8 | O'Hare International Airport (ORD) | 80,043,050 | 9 |

9 | Delhi Indira Gandhi International Airport (DEL) | 77,820,834 | 10 |

10 | Shanghai Pudong International Airport (PVG) | 76,878,039 | 21 |

Hartsfield-Jackson Atlanta International Airport has maintained its top position for 26 of the last 27 years, a testament to its consistent performance. The 2024 rankings also reflect a global passenger count of nearly 5 billion, marking a 9% increase from 2023 and surpassing pre-pandemic levels by 4%.

Notable changes in rankings from 2023

The 2024 airport rankings reveal significant shifts compared to the previous year. Shanghai Pudong International Airport (PVG) experienced the most remarkable leap, climbing from 21st to 10th place. This growth stems from China's expanded visa policies and the resurgence of international flights in the Asia-Pacific region. Haneda Airport (HND) in Tokyo also rose to 4th place, overtaking Heathrow Airport (LHR), which dropped to 5th. These changes highlight the dynamic nature of global air travel and the impact of regional recovery efforts.

O'Hare International Airport (ORD) moved up from 9th to 8th place, reflecting its growing importance as a hub for both domestic and international flights. Meanwhile, Delhi Indira Gandhi International Airport (DEL) solidified its position in the top 10, climbing from 10th to 9th place. These shifts underscore the resilience and adaptability of airports in meeting increasing passenger demands.

Emerging airports to watch in future rankings

Several airports are poised to make significant strides in future rankings. Shanghai Pudong International Airport's recent leap demonstrates the potential of emerging hubs in the Asia-Pacific region. As China's aviation market continues to expand, other airports in the region, such as Beijing Daxing International Airport, may also climb the rankings.

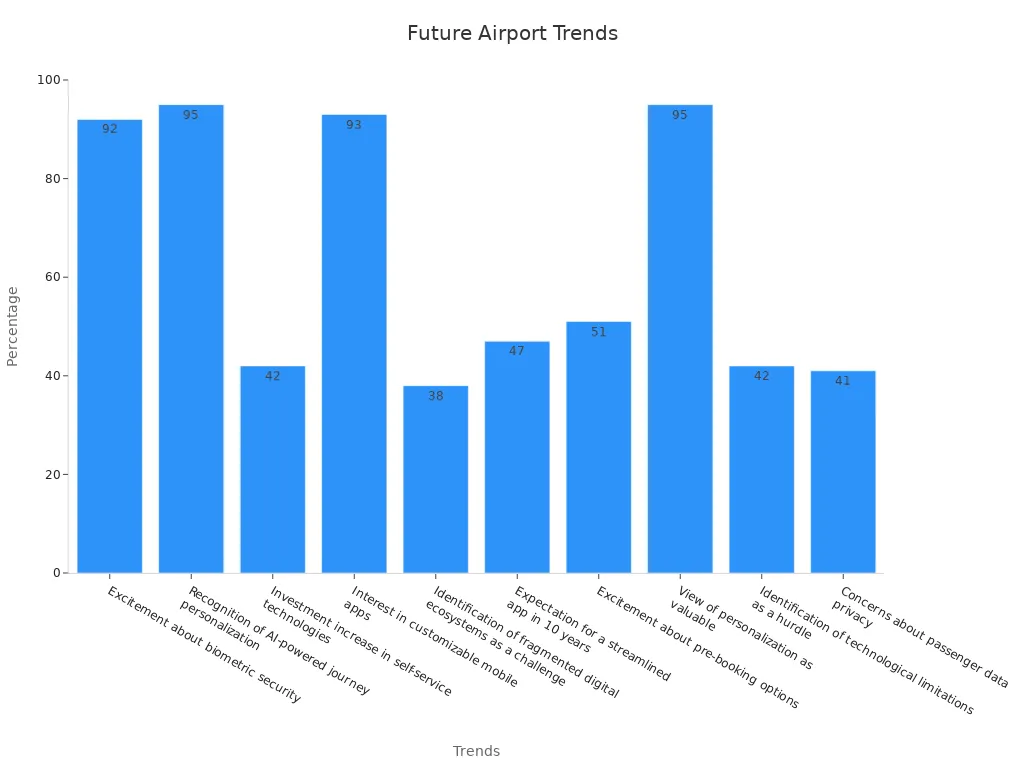

Technological advancements and passenger-centric innovations will play a crucial role in shaping future rankings. A recent survey revealed that 95% of travelers value AI-powered journey personalization, while 93% appreciate customizable mobile apps. Airports investing in biometric security, self-service technologies, and streamlined digital ecosystems are likely to gain a competitive edge.

Airports in regions with growing economies, such as Southeast Asia and Africa, are also expected to rise. These regions are investing heavily in infrastructure and technology to accommodate increasing passenger traffic. As global air travel continues to recover and evolve, these emerging hubs will play a pivotal role in shaping the future of the aviation industry.

International Passenger and Cargo Traffic Rankings

Leading airports for international passenger traffic

The 2024 airport rankings highlight the dominance of key hubs in international passenger traffic. Dubai International Airport (DXB) leads the list, serving over 92 million passengers annually. Heathrow Airport (LHR) and Istanbul Airport (IST) follow closely, reflecting their strategic importance in connecting Europe, the Middle East, and Asia. These airports excel in offering seamless transit experiences and maintaining high operational standards.

Airports Council International (ACI) data reveals that international passenger traffic has surged due to increased global mobility and relaxed travel restrictions. Monthly updates from OAG further validate these trends, showcasing the busiest airports based on total airline capacity. This data underscores the critical role of these hubs in facilitating global connectivity.

Top airports for global cargo operations

Cargo operations remain a cornerstone of the aviation industry, with several airports excelling in this domain. Hong Kong International Airport (HKG) continues to lead in cargo volume, followed by Shanghai Pudong International Airport (PVG) and Incheon International Airport (ICN). These airports benefit from their proximity to major manufacturing hubs and robust logistics networks.

The table below highlights key data on cargo operations:

Criteria | Evidence |

|---|---|

Cargo Volume Rankings | |

Selected Airports | HKG, PVG, ICN, LHR, and CDG dominate cargo operations. |

Data Sources | Reports from ACI, airport websites, and global databases. |

ACI reports an 8.4% year-over-year increase in air cargo volumes, driven by e-commerce growth and supply chain demands. This trend emphasizes the importance of these airports in supporting global trade.

Insights into the busiest international routes

The busiest international air routes reflect the growing demand for travel between major economic and cultural hubs. Routes connecting Dubai (DXB) to London (LHR) and Hong Kong (HKG) to Los Angeles (LAX) rank among the most traveled. These routes cater to both business and leisure travelers, highlighting their significance in the global aviation network.

The table below provides a snapshot of passenger and freight volumes on key routes:

Airport Name | Passenger Numbers | Freight Volume |

|---|---|---|

Dubai (DXB) - London (LHR) | 100 million | 500,000 tons |

Hong Kong (HKG) - Los Angeles (LAX) | 90 million | 450,000 tons |

These routes demonstrate the interconnectedness of global cities and the pivotal role of aviation in fostering economic growth.

Key Trends and Factors Influencing the 2024 Airport Rankings

Post-pandemic recovery and its impact on air travel

The aviation industry has demonstrated remarkable resilience in the aftermath of the COVID-19 pandemic. The 2024 airport rankings reflect this recovery, with global passenger traffic nearing pre-pandemic levels. Airports have adapted to fluctuating travel demands, showcasing their ability to rebound from unprecedented challenges.

The table below illustrates the recovery trajectory of airline capacity compared to 2019 levels:

Time Period | Airline Capacity Compared to 2019 | Notes |

|---|---|---|

Early May 2020 | < 33% of May 2019 levels | Lowest point of airline capacity during pandemic |

2022 | Recovery begins in some regions | Initial signs of recovery |

End of 2023 | Many markets returned to 2019 capacity levels |

By the end of 2023, airline capacity had recovered to just 3.7% below 2019 levels, signaling a strong rebound. Airports in regions like Asia-Pacific have seen significant growth, driven by relaxed travel restrictions and increased international flights. This recovery has not only boosted passenger numbers but also revitalized global connectivity, underscoring the importance of these hubs in the aviation ecosystem.

Role of technology in airport efficiency

Technological advancements have played a pivotal role in enhancing airport operations and passenger experiences. Airports that invest in cutting-edge solutions are better positioned to handle increasing traffic volumes and maintain their rankings.

The table below highlights key technologies and their impact on airport efficiency:

Technology Type | Impact Description |

|---|---|

Biometric technology | Speeds up check-in, reduces waiting times, and minimizes human error through identity verification. |

Automated baggage handling systems | Enhances baggage sorting and transport, reducing lost baggage incidents and increasing efficiency. |

Mobile technology | Enables check-in and flight tracking via apps, decreasing queue times and improving passenger convenience. |

Self-service kiosks | Allows passengers to check-in and tag baggage independently, speeding up the process and reducing staffing needs. |

Biometric technology, for instance, has revolutionized identity verification, enabling faster check-ins and reducing human error. Automated baggage handling systems have streamlined luggage processing, minimizing delays and lost baggage incidents. Mobile apps and self-service kiosks have empowered passengers to manage their journeys independently, enhancing convenience and reducing congestion.

Airports that prioritize these innovations are not only improving operational efficiency but also enhancing passenger satisfaction. This focus on technology will continue to shape the future of airport rankings.

Geopolitical and economic factors affecting rankings

Geopolitical and economic dynamics have significantly influenced the 2024 airport rankings. These factors have created both opportunities and challenges for airports worldwide.

Supply chain challenges and aircraft production delays have increased operational costs, impacting flight planning and airport operations.

Geopolitical tensions have introduced uncertainty into the aviation sector, affecting passenger and cargo growth.

Proposed trade tariffs and global construction inflation have posed risks to infrastructure development and expansion.

Emerging markets, however, present a bright spot. Increased infrastructure investment and rising travel demand among middle-income populations are driving growth in regions like Southeast Asia and Africa. Advanced economies, on the other hand, face capacity constraints and slower economic growth, which could limit their ability to expand.

Global passenger growth remains subject to evolving economic and geopolitical landscapes. Airports must navigate these complexities to maintain their competitive edge and adapt to shifting market conditions.

Future Projections for 2025 and Beyond

Predicted growth in passenger and cargo traffic

The aviation industry is poised for significant growth in both passenger and cargo traffic by 2025. Passenger numbers are expected to reach 9.9 billion globally, reflecting a 4.8% year-over-year increase. This growth is driven by macroeconomic trends, demographic shifts, and evolving consumer behavior. The table below highlights key drivers influencing this expansion:

Key Drivers | Description |

|---|---|

Macroeconomic trends | GDP per capita and trade intensity. |

Demographics | Population changes, including age distribution. |

Travel costs | Airfares and exchange rates. |

Consumer behavior | Confidence levels and spending patterns. |

Sustainability efforts | Influence of environmental policies on travel. |

Cargo traffic is also set to rise, fueled by the booming e-commerce sector. In 2022, U.S. e-commerce sales reached a record $1.04 trillion, with further acceleration in 2023. This trend underscores the growing reliance on air freight to meet consumer demands.

Emerging hubs and their potential impact on rankings

Emerging airport hubs are reshaping the global aviation landscape. The expansion of hub connectivity plays a pivotal role in determining their future rankings. Airports in regions like Southeast Asia and Africa are investing heavily in infrastructure and intermodal connectivity, enhancing their ability to handle increased passenger and cargo volumes. For instance, intermodal systems at city and regional levels streamline the movement of goods and people, boosting the importance of these hubs.

Technological innovations further amplify the potential of emerging hubs. Airports adopting advanced systems, such as AI-driven operations and biometric security, are better positioned to climb the rankings. The classification of airport nodes using statistical models also highlights their growing roles within airline networks. As these hubs expand their connectivity and technological capabilities, they are likely to challenge established leaders in the coming years.

Long-term trends in the aviation industry

Several long-term trends are shaping the future of aviation. U.S. airlines carried 194 million more passengers in 2022 compared to 2021, marking a 30% year-over-year increase. This recovery highlights the resilience of the industry. Additionally, the integration of advanced technology and sustainability practices is transforming operations. Airlines are prioritizing fuel efficiency and reduced emissions to align with global environmental goals.

The defense sector also influences aviation trends. In 2022, the U.S. accounted for 39% of global defense spending, with significant investments in military aviation. These developments underscore the multifaceted nature of the industry, where commercial, cargo, and defense sectors intersect. As these trends continue, the aviation industry is set to evolve, adapting to new challenges and opportunities.

The 2024 airport rankings provide a comprehensive snapshot of the aviation industry's recovery and growth. Passenger traffic surged to an estimated 9.5 billion, marking a 9% increase from 2023 and surpassing pre-pandemic levels. Hartsfield-Jackson Atlanta International Airport retained its top position, while Shanghai Pudong International Airport made a notable leap into the top 10. Cargo traffic also grew by 8.4%, underscoring the critical role of airports in global trade.

Category | Key Statistics |

|---|---|

Global Passenger Traffic | Estimated 9.5 billion passengers in 2024, a 9% increase from 2023 and a 3.8% increase from 2019. |

Busiest Airports (Overall) | 1. ATL 2. DXB 3. DFW 4. HND 5. LHR 6. DEN 7. IST 8. ORD 9. DEL 10. PVG |

Cargo Traffic Growth | 8.4% year-over-year increase, with top ten airports representing 26% of global output. |

Future Traffic Prediction | ACI predicts 9.9 billion passengers in 2025, a 4.8% increase from 2024. |

These rankings highlight the resilience of the aviation sector and its pivotal role in global connectivity. Staying informed about these trends equips travelers, businesses, and industry stakeholders to navigate the evolving landscape effectively.

FAQ

1. What criteria determine the busiest airports in the rankings?

Airports Council International evaluates passenger traffic, cargo volume, and aircraft movements. These metrics reflect operational efficiency and connectivity, highlighting the airport's role in global aviation.

2. Why did Shanghai Pudong International Airport rise significantly in the rankings?

Expanded visa policies and increased international flights contributed to its growth. Enhanced infrastructure and operational improvements also played a key role in its leap from 21st to 10th place.

3. How does technology impact airport rankings?

Technological advancements improve efficiency and passenger satisfaction. Airports investing in biometric security, automated baggage systems, and AI-driven operations gain a competitive edge in handling higher traffic volumes.

4. Which regions are expected to dominate future rankings?

Asia-Pacific and Africa are emerging as key players due to infrastructure investments and growing economies. Airports in these regions are expanding connectivity and adopting advanced technologies.

5. What is the significance of cargo traffic in airport rankings?

Cargo operations support global trade and e-commerce growth. Airports excelling in cargo volume, like Hong Kong International Airport, play a vital role in meeting supply chain demands.

See Also

Discover The Best Logistics Programs For 2024

Get Prepared: The Latest Innovations In Transport Technology

Enhancing Efficiency: JUSDA Unveils New Warehousing Solutions