Recent Tariff Changes and Their Global Impact in 2025

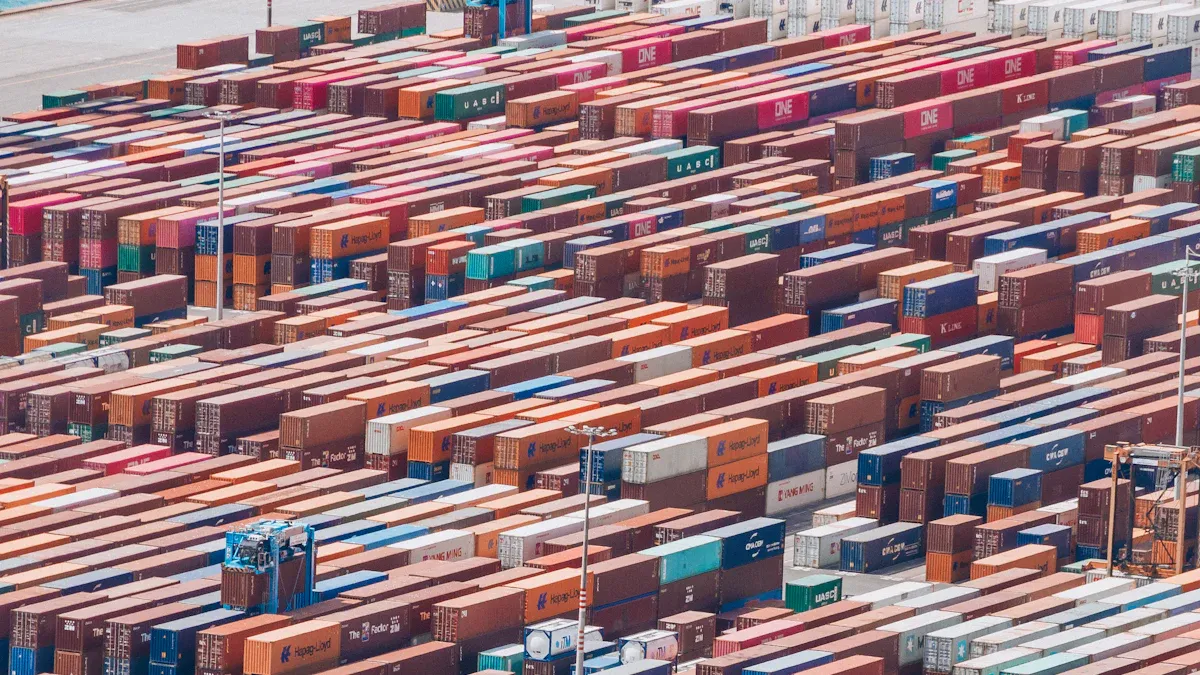

The year 2025 brought big changes to world trade. New tariffs included a 10% tax on imports, 25% on car parts, and 20% more on goods from China. These taxes caused problems in supply chains and raised prices. Shoppers had to pay more, and inflation got worse. The WTO said trade would shrink by 2.4%, and global growth would drop below 2%. In the US, inflation for personal spending went up by 2.2%. These tariffs showed how protectionist rules can affect economies everywhere.

Key Takeaways

In 2025, tariffs made imports more expensive, raising global prices by 40%.

Companies should use different suppliers to avoid depending too much on one country, like China, to handle tariff problems.

Tools like JusTrade can make customs easier and help businesses follow new trade rules better.

2025 Tariff Updates and Key Changes

Overview of 2025 tariff updates

In 2025, global trade rules changed a lot. New tariffs made international trade more expensive. The average tariff rate hit 28%, the highest since 1901. Later, it dropped to 18%, a level last seen in 1934. These changes aimed to help local businesses but raised costs for everyone. The U.S. expected to make over $2.4 trillion from tariffs by 2035. However, families felt the impact quickly. Lower-income families paid $2,200 more, while wealthier ones paid $10,500 extra.

The table below shows key numbers before and after the changes:

Metric | Before Changes | After Changes |

|---|---|---|

Average Effective Tariff Rate | 28% | 18% |

Average Price Impact | 3.0% increase | 1.6% increase |

Real GDP Growth Impact | -1.1pp | N/A |

Unemployment Rate Increase | 0.57pp | N/A |

Payroll Employment Reduction | 770,000 | N/A |

Long-run Real GDP Impact | -0.6% | N/A |

Revenue from Tariffs | $2.4 trillion | N/A |

Short-run Household Cost (2nd Decile) | $2,200 | N/A |

Short-run Household Cost (Top Decile) | $10,500 | N/A |

These changes show the struggle between helping local industries and managing the economy.

Industries and countries most affected by 2025 tariffs

The 2025 tariffs hit some industries and countries hard. Metal products had the highest tariffs, over 30%, due to steel and aluminum taxes. Car parts and vehicles faced over 25% tariffs, causing supply problems and higher costs. Clothes, leather, and textiles also saw big increases because they depend on imports from China and nearby countries.

The table below lists the hardest-hit industries:

Industry Sector | Average Tariff Rate (%) | Impact Description |

|---|---|---|

Fabricated Metal Products | Above 30 | High tariffs from steel and aluminum taxes. |

Leather, Apparel, and Textiles | Steep increases | Depend on imports from China and nearby countries. |

Transportation Equipment | Above 25 | Supply chain issues due to imported parts and vehicles. |

Oil and Gas, Agriculture | Lower tariffs | Less affected due to trade deals. |

Manufacturing and Mining Industries | Highest exposure | Over 50% of manufacturing leaders planned to change suppliers. |

In the U.S., areas like the Great Lakes and Midsouth were hit hardest. These regions lost jobs and faced slower economies as businesses struggled with higher costs.

Timeline of major tariff changes in 2025

The 2025 tariffs caused big problems for trade and industries. Early in the year, border delays slowed deliveries. Car parts and vehicles were late, disrupting production. By mid-year, U.S. car sales dropped to 15.5–15.8 million, below the 16.3 million forecast. Automakers tried to boost sales with discounts, but the tariffs still hurt.

Key events in the timeline include:

Early 2025: Border delays slowed deliveries of goods.

Mid-2025: U.S. car sales dropped due to supply issues.

December 2025: Automakers gave discounts, but sales stayed low.

These events show how hard it was for businesses to adjust to the new tariffs.

Economic Impact of 2025 Tariffs

Short-term effects on global trade and GDP

The 2025 tariffs caused problems for trade and slowed growth. The U.S. economy shrank by 0.5 percentage points in GDP. When all tariffs were included, the drop reached 0.9 percentage points. Exports fell by 10%, dropping trade volumes to 18.1%. Inflation rose 40% higher than the 2.5% expected rate, making things worse.

Car prices went up by 8%, and farm exports dropped 5%. Inflation in industries ranged from 1.5% to 2%, adding to a 1.2% overall rise. These changes made it hard for businesses to handle higher costs and supply chain issues.

Economic Indicator | Change (%) |

|---|---|

Automotive sector CPI | 8% |

Agricultural exports | -5% |

Overall inflation | 1.2% |

Industry-specific inflation rates | 1.5% to 2% |

U.S. agricultural exports decline | 10% |

Technology exports drop | 7% |

The tariffs showed how costly it was for industries using imports. Farming, retail, and factories were hit hardest. The U.S. lost $1.4 trillion, forcing businesses to rethink their plans.

Long-term economic impact on labor markets and commodity prices

Tariffs caused long-term problems beyond trade issues. Prices rose by 3%, cutting household spending power by $4,900 yearly. Unemployment went up by 0.57 percentage points, and 770,000 jobs were lost. These numbers showed how tariffs hurt jobs and raised prices.

Higher tariffs and fewer workers made labor shortages worse. Construction jobs became harder to fill, raising wages and delaying projects. Costs for building materials also went up, adding to the problem. A strong U.S. dollar made metal-based goods more expensive, hurting industries.

Slower growth and less demand for metals affected many sectors. These trends showed how hard it was for businesses to stay competitive with rising costs and job market changes.

Ripple effects on supply chains and consumer costs

The 2025 tariffs disrupted supply chains and raised prices. Industries like cars and electronics, which rely on imports, faced higher costs. These costs were passed to shoppers, lowering demand.

The Federal Reserve said tariffs on Chinese goods added 0.1% to inflation. Business investment goods saw a 0.4% inflation rise. Tariffs also made imported goods pricier, hurting global trade systems.

The 2021–2023 supply chain crisis showed weak trade networks.

Steel and aluminum tariffs earlier raised costs for cars and buildings.

New U.S. tariffs on Chinese goods made things worse, raising prices.

These effects showed how tariffs hurt global trade and efficiency. Companies tried to adapt by finding new suppliers and changing strategies. But these changes were costly for both businesses and consumers.

Sector-Specific Effects of 2025 Tariffs

Impact on electronics and technology industries

Electronics and tech companies faced big problems in 2025. Tariffs on Chinese goods hit 125%, while U.S. exports faced 84%. These high taxes made trade harder and raised costs for companies like Apple and Intel. Parts became more expensive, so prices for gadgets went up. This caused fewer people to buy electronics.

Stores like Dollar Tree and BJ’s Wholesale Club, which rely on Chinese goods, also struggled. Their costs rose, cutting into profits and lowering sales. Tech companies, which depend on global suppliers, found it hard to adjust to these new rules.

Effects on automotive and steel sectors

The car and steel industries were hit the hardest by tariffs. U.S. car sales dropped by 1.8 million, with demand falling 15-20%. Car prices went up by $5,000 to $15,000, making them too pricey for many buyers.

Evidence Type | Description |

|---|---|

Forecast | U.S. car sales may drop by 1.8 million in 2025. |

Expert Opinion | Experts predict a 15-20% drop in new car demand. |

Price Impact | Car prices could rise by $5,000 to $15,000 due to tariffs. |

Higher tariffs made it costlier to make cars, cutting company profits. Some firms got tax breaks, but most faced higher costs. Supply chains were disrupted, and steel-based products became pricier, hurting the industry further.

Implications for agriculture and food production

Farming and food production also felt the effects of tariffs. A 25% tax on Canadian peat moss raised costs for farmers, who had to find other options. Tariffs on potash and steel made greenhouse upgrades more expensive, delaying projects.

Aspect | Impact Description |

|---|---|

Input Costs | |

Equipment Tariffs | Steel tariffs increased costs for greenhouse upgrades. |

Produce Availability | Tariffs on Mexican produce reduced supply during off-seasons, raising prices. |

Investment and Innovation | Higher costs pushed some U.S. firms to consider local production. |

These tariffs made fruits and vegetables harder to find in off-seasons, raising prices for shoppers. Some companies explored making goods locally, but uncertainty slowed long-term plans.

Global Reactions and Trade Relationships

How countries responded to U.S. tariffs

Countries hit by U.S. tariffs in 2025 fought back. China added a 34% tax on U.S. goods. It also taxed coal, LNG, and farm machines by 10-15%. Canada placed CAD $30 billion in taxes on U.S. items. These focused on goods from areas with strong Republican support. Mexico used a "carousel" system, changing taxed items often. This made it harder for U.S. businesses to adjust. The European Union thought about using the Anti-Coercion Instrument. This could mean new taxes and limits on U.S. companies.

Country | Response Actions | Details |

|---|---|---|

China | 34% tax on U.S. goods | Targeted coal, LNG, and farm machines with extra taxes. |

Canada | CAD $30 billion in taxes | Focused on goods from key Republican areas. |

Mexico | "Carousel" tax system | Changed taxed items often to confuse U.S. businesses. |

European Union | Anti-Coercion Instrument | Could add taxes and rules for U.S. companies. |

These actions hurt supply chains and pushed countries to form new trade groups. For example, the RCEP boosted trade between Asian nations to counter U.S. policies.

New trends in global trade rules

Global trade stayed strong despite problems. The DHL Trade Atlas 2025 showed trade growing, led by India, Vietnam, Indonesia, and the Philippines. These countries are expected to grow trade from 2024 to 2029. The report said political issues and trade limits are changing trade patterns. Countries now focus more on local partnerships and spreading out supply chains to avoid relying on one market.

JUSDA’s role in solving trade problems

JUSDA helped businesses deal with the 2025 tariffs. It used smart tools like IoT and telematics to improve shipping. Real-time tracking and better routes cut costs and made deliveries more reliable. JUSDA also invested in transport systems across regions like the CIS. These upgrades made trade smoother and helped businesses handle global trade challenges in 2025.

Strategies for Businesses to Adapt to 2025 Tariffs

Using JusTrade for easier customs clearance

In 2025, businesses faced higher tariffs and needed better solutions. JusTrade helped by offering smart tools for customs clearance. Its SAAS platform uses AI and big data to simplify processes. This system connects teams like logistics, finance, and procurement. It ensures smooth communication and fewer mistakes. JusTrade also provides real-time tracking and faster approvals. Their expertise in cross-border trade, especially between China and Vietnam, is valuable. By using JusTrade, companies avoided delays and kept production running smoothly, even with tough tariffs.

Finding new suppliers and diversifying supply chains

Businesses hit by tariffs started looking for new suppliers. Many reduced their dependence on one country, especially China. They built new partnerships in Canada and Mexico under USMCA agreements. The auto industry saw the biggest changes, with 37% shifting supply chains. Overall, 17% of firms changed their sourcing strategies. The table below shows how diversification helps:

Evidence Type | Details |

|---|---|

Supply Chain Strategy Change | |

Industry-Specific Disruption | Auto sector had a 37% shift in supply chain setups. |

Supplier Diversification | Companies relied less on single-country suppliers like China. |

Capital Flow Redistribution | Higher costs led to investments in new sourcing areas. |

New Supplier Relationships | More partnerships formed in Canada and Mexico under USMCA. |

By diversifying, businesses reduced risks and became stronger against trade issues.

Staying compliant and cutting costs

Good compliance plans helped companies handle tariff costs. Tariff engineering let them reclassify goods into cheaper tax categories. Automated systems and AI tools made managing rules easier and faster. Improving supply chains also lowered costs, balancing out tariff increases. These methods not only kept businesses compliant but also boosted their performance.

Tip: Using tech-based compliance tools helps businesses adapt quickly to new trade rules.

JUSDA Solutions

To provide you with professional solutions and quotations.

The 2025 tariffs changed global trade, slowing growth and raising costs. Companies need smart strategies to adjust. Key numbers show the problem:

Statistic | Value |

|---|---|

Trade growth worldwide (2023) | |

Drop in global goods trade | -2% |

Slowest trade growth in 50 years | N/A |

JUSDA and JusTrade offer helpful tools to make customs easier. They also improve supply chains, helping businesses stay strong.

See Also

Exploring How Global Trade Policies Shape Economic Landscapes

Five Key Trends Shaping Future Supply Chain Effectiveness

Understanding Current Trends in Logistics Risk Management

Addressing Global Supply Chain Expansion Challenges Effectively