Auto Tariff War: From Higher Prices to Near‑Shoring and Tech Self‑Reliance

The automotive industry is experiencing a seismic shift, and the auto tariff war is at the heart of it. Higher tariffs on imported cars and parts have created ripple effects across the globe. For instance, analysts predict that tariffs will increase vehicle costs in the U.S. by $2,000 to $4,000 in just 6-12 months. A 25% duty on a $25,000 car from Mexico or Canada adds $6,250, a cost that consumers are likely to bear. These changes are forcing automakers to rethink their supply chains, pricing strategies, and production methods.

Recent reports highlight how these tariffs are reshaping the industry. Companies now face challenges like disrupted logistics and rising production expenses. At the same time, they’re exploring new strategies, such as investing in local production and accelerating innovation. This transition marks a pivotal moment for the global automotive landscape.

Auto Tariff War and Its Impact on Prices

Rising Costs for Consumers

The auto tariff war has left consumers facing higher price tags on vehicles. A 25% tariff on imported cars and parts has significantly increased the cost of new vehicles. Analysts estimate that the average price of a new car could rise by $3,000, with some models seeing hikes of $4,000 to $12,000. Imported vehicles are hit the hardest, with potential price increases reaching as high as $12,500. These added costs are often passed directly to buyers, making car ownership more expensive than ever.

For many, this means rethinking their purchasing decisions. Some may delay buying a new car, while others might opt for used vehicles instead. However, even the used car market feels the ripple effects, as higher new car prices push demand for pre-owned options. This creates a domino effect, driving up prices across the board.

🚗 Note: The automotive industry is projected to incur an additional $60 billion in costs due to tariffs, much of which will be transferred to consumers.

Increased Manufacturing Expenses

Manufacturers are also grappling with rising costs. Tariffs on imported parts have disrupted production budgets, forcing companies to absorb or pass on these expenses. For instance, profit margins for automakers have dropped to 1.9%, a sharp decline from the 2015-2019 average of 4.2%. This reduced capacity to absorb costs leaves manufacturers with limited options.

Low inventory levels further complicate the situation. Dealers can no longer delay purchases to avoid tariff-related expenses. As a result, production costs have surged, impacting the overall pricing structure of vehicles. Companies are now exploring ways to streamline operations and reduce dependency on imported components.

📊 Quick Fact: Increased production costs due to tariffs have become a significant challenge, with some manufacturers reporting billions in additional expenses.

Effects on Small and Medium-Sized Suppliers

Small and medium-sized suppliers are among the hardest hit by the auto tariff war. These businesses often lack the financial resources to absorb rising costs. For example, Aisin reported an additional ¥1 billion in expenses, while Denso faced potential increases of ¥2 billion. Smaller suppliers, unable to pass on these costs to automakers, risk severe financial strain.

Key Insights | Description |

|---|---|

Increased Costs | Suppliers face higher expenses, especially for components imported from China. |

Reduced Sales Volumes | Lower sales volumes significantly impact profit margins. |

Cost Pass-Through | Smaller suppliers struggle to pass on costs to automakers. |

Many suppliers are now exploring alternative strategies to stay afloat. Some are relocating production to low-tariff regions, while others are diversifying their customer base. These efforts aim to build resilience and reduce reliance on volatile markets. However, the road ahead remains challenging for smaller players in the industry.

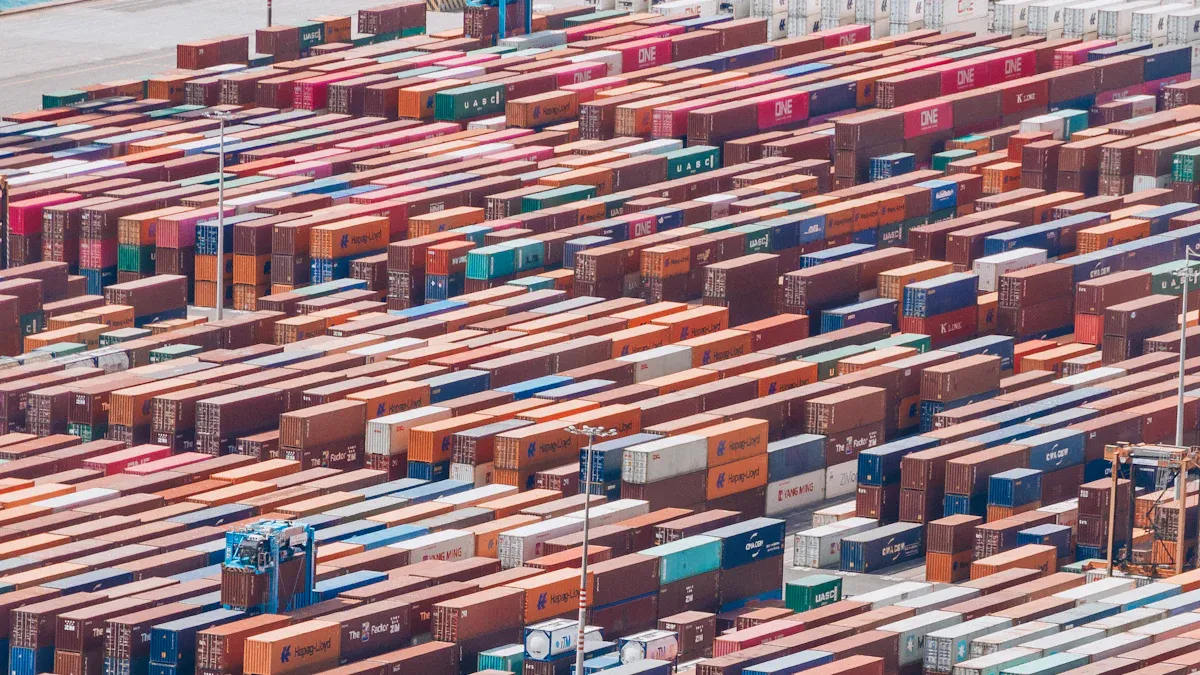

Supply Chain Disruptions in the Auto Tariff War

Challenges in Global Logistics

The auto tariff war has thrown global logistics into disarray. Customs enforcement at major border crossings, such as Laredo, Texas, and Detroit, Michigan, has caused delays of up to 24 hours. These bottlenecks disrupt the timely delivery of vehicles and parts, forcing automakers to rethink their logistics strategies.

The automotive industry is reeling from the US’s hugely disruptive reset of the world economic order, and this will have profound ramifications for logistics providers around the world.

Automakers are also shifting production to avoid tariff-related complications. Volvo, for instance, has ramped up output at its South Carolina plant to reduce reliance on North American imports. However, this shift comes with challenges. Companies must invest heavily in new facilities and adapt to operational complexities, which can strain resources and delay production timelines.

Dependence on Imported Auto Parts

The reliance on imported auto parts has amplified the impact of tariffs. Manufacturers face higher costs due to the 25% tariff on parts, which directly affects pricing strategies. Repairs that once took a week now stretch to two or three weeks because of sourcing delays. This has led to a 17% increase in repair costs and a 22.8% rise in auto parts prices between 2021 and 2022.

This dependence on imported components has created a ripple effect across the industry. Insurers report higher claims costs, while consumers face longer wait times and inflated repair bills. The situation underscores the need for manufacturers to diversify their supply chains.

Strategies to Mitigate Supply Chain Risks

To navigate these challenges, companies are adopting innovative strategies to mitigate risks. Some are relocating production to regions with lower tariffs, while others are redesigning products to qualify for reduced tariff categories. For example:

Apple Inc. diversified production by moving assembly operations to Vietnam and India.

Columbia Sportswear added small pockets to women's shirts, reclassifying them under a lower tariff category.

Automakers are also investing in inventory management and exploring partnerships with local suppliers. These strategies aim to reduce dependency on volatile markets and build resilience against future disruptions. While these measures require upfront investment, they offer long-term benefits by stabilizing supply chains and minimizing tariff exposure.

Near-Shoring as a Response to the Auto Tariff War

Mexico’s Role in Near-Shoring

Mexico has emerged as a key player in near-shoring strategies, especially in the wake of the auto tariff war. Its proximity to the U.S., competitive labor costs, and trade agreements like the USMCA make it an attractive destination for automakers looking to relocate production. The Inter-American Development Bank estimates that near-shoring could bring Mexico approximately USD 35 billion in investments, with the automotive sector standing to gain the most. This shift is reshaping the country’s role in global supply chains.

Trade policies have also played a significant role in Mexico’s growing importance. In January 2025, the Mexican government introduced incentives to reduce imports from China. These measures align with the country’s strategy to strengthen ties with the U.S. and Canada while enhancing its position as a near-shoring hub. Automakers are increasingly viewing Mexico as a viable alternative to Asia for manufacturing and assembly operations.

Tip: Mexico’s strategic location allows companies to cut transportation costs and reduce delivery times, making it a win-win for both manufacturers and consumers.

Foreign Investments and Tariff Avoidance

Foreign investments have surged as companies seek to avoid high tariffs by relocating production. For instance:

Cambodian exports to the U.S. grew from $3 billion in 2016 to over $13 billion last year, accounting for nearly 30% of Cambodia’s GDP.

More than half of Cambodia’s factories are now Chinese-owned, with total investments reaching $9 billion.

A KPMG survey revealed that 48% of Canadian businesses plan to shift production or investments to the U.S. to sidestep tariffs.

These trends highlight how businesses are adapting to the challenges posed by the auto tariff war. By moving operations closer to their target markets, companies can minimize tariff exposure and maintain competitive pricing. This strategy not only reduces costs but also enhances supply chain resilience.

📊 Quick Fact: As of April 2025, the U.S. imposed a 145% baseline tariff on Chinese imports, further accelerating the shift toward near-shoring.

Technological Self-Reliance in the Automotive Sector

Innovation Driven by Tariffs

The auto tariff war has sparked a wave of innovation in the automotive sector. Automakers are now prioritizing research and development to reduce reliance on imported components. For example, companies are investing in advanced manufacturing techniques like 3D printing to produce parts locally. This approach not only cuts costs but also shortens production timelines.

Another area of focus is software development. Automakers are creating proprietary systems for autonomous driving and vehicle connectivity. By doing so, they can avoid the high costs associated with importing tech-heavy components. These innovations are reshaping the industry, making it more self-reliant and future-ready.

🚀 Tip: Companies that embrace innovation today will likely lead the market tomorrow.

Localized Production of EVs and Batteries

Localized production of electric vehicles (EVs) and batteries has gained momentum as a direct response to tariff challenges. Automakers are forming joint ventures with Chinese EV manufacturers to transfer technology and boost local production. Governments are also stepping in with tiered tariffs that reward sustainable practices.

Strategy | Description |

|---|---|

Joint Ventures | Encouraging partnerships with Chinese EV manufacturers to enhance local manufacturing and technology transfer. |

Tiered Tariffs | Implementing conditional tariffs based on environmental and ethical performance metrics to promote sustainable practices. |

Infrastructure Investment | Investing in charging infrastructure and consumer incentives to stimulate domestic EV demand and support local production. |

These efforts are transforming the EV landscape. By focusing on local production, companies can reduce costs, meet environmental goals, and cater to growing consumer demand for sustainable vehicles.

Barriers to Achieving Full Tech Self-Reliance

Despite progress, achieving full technological self-reliance remains a challenge. High initial costs for setting up local production facilities deter many companies. Additionally, the shortage of skilled labor in advanced manufacturing and battery technology slows down progress.

Regulatory hurdles also complicate the process. Different regions have varying standards for safety, emissions, and technology, making it difficult for automakers to streamline operations. Overcoming these barriers will require coordinated efforts between governments, manufacturers, and suppliers.

🌍 Note: Collaboration across the industry is essential to build a resilient and self-reliant automotive ecosystem.

Broader Implications of the Auto Tariff War

Shifting Dynamics in Global Trade

The auto tariff war is reshaping global trade patterns, forcing industries to adapt to new realities. Higher tariffs have disrupted supply chains, increased production costs, and altered trade volumes. Companies that once relied on international suppliers now face challenges in maintaining profitability.

Key Insights | Description |

|---|---|

Industries Most Impacted | Automotive market faces disruption due to global supply chains and higher parts costs. |

New Trade Paradigm | Companies must adapt to a dynamic economic strategy influenced by tariffs. |

Retaliatory Measures | Tariffs lead to decreased imports and exports, affecting trade volumes. |

Sector-Specific Repercussions |

These shifts highlight the need for businesses to rethink their strategies. Many are exploring near-shoring and localized production to reduce dependency on volatile markets. While these changes bring opportunities, they also demand significant investment and operational adjustments.

🌍 Note: The auto tariff war has accelerated the transition to regionalized trade, creating both challenges and opportunities for global industries.

Long-Term Trends in Automotive Manufacturing

The automotive industry is undergoing a transformation driven by tariffs and evolving trade policies. Manufacturers are prioritizing supply chain resilience and technological innovation to stay competitive. Localized production of electric vehicles (EVs) and batteries is becoming a cornerstone of this shift.

Trend | Description |

|---|---|

Focus on Localization | Automakers are investing in local facilities to reduce reliance on imports. |

Rise of EV Manufacturing | Companies are ramping up EV production to meet consumer demand and avoid tariffs. |

Supply Chain Resilience | Diversifying suppliers and near-shoring are key strategies for mitigating risks. |

These trends reflect a broader move toward sustainability and self-reliance. Automakers are not just adapting to tariffs; they’re reimagining their business models to align with future market demands.

🚗 Tip: Companies that embrace these trends will likely emerge as leaders in the next era of automotive manufacturing.

The Auto Tariff War has reshaped the automotive industry, pushing it toward a more regionalized and adaptive model. Manufacturers are moving away from globalized supply chains, opting instead for near-shoring strategies in countries like Mexico and India. This shift reduces reliance on distant suppliers and builds resilience against trade disruptions.

Pricing has also seen a dramatic shift. A 25% import tax on vehicles has driven up retail prices, impacting both imported and U.S.-made cars. Meanwhile, companies are diversifying their supplier base and collaborating with local manufacturers to mitigate risks. Over 50% of manufacturing CFOs are now prioritizing supply chain diversification, reflecting the industry's focus on long-term adaptability.

These changes highlight the need for innovation and strategic planning. By enhancing domestic production capabilities and fostering regional partnerships, the automotive sector is preparing for a future defined by resilience and technological self-reliance.

FAQ

What is the auto tariff war?

The auto tariff war refers to the imposition of higher taxes on imported cars and parts. These tariffs aim to protect domestic industries but often lead to higher prices, disrupted supply chains, and shifts in global trade dynamics.

How do tariffs affect car prices?

Tariffs increase production costs, which automakers pass on to consumers. For example, a 25% tariff can add thousands of dollars to the price of imported vehicles, making car ownership more expensive.

Why are automakers near-shoring production?

Near-shoring reduces reliance on distant suppliers and avoids high tariffs. Countries like Mexico offer lower labor costs and proximity to the U.S., making them ideal for relocating manufacturing operations.

What is technological self-reliance in the auto industry?

Technological self-reliance means automakers develop and produce key components, like EV batteries, locally. This reduces dependency on imports, lowers costs, and fosters innovation.

How can consumers adapt to rising car prices?

Consumers can explore alternatives like buying used cars, leasing vehicles, or delaying purchases. These options help manage costs while the industry adjusts to tariff-related challenges.

See Also

Transforming Logistics for Tomorrow with AI Supply Chain Solutions

Maximizing Your Automotive Supply Chain's Potential for Success

Enhancing Supply Chain Efficiency Through AI Innovations

Expert Advice for Overcoming Automotive Supply Chain Challenges

Advantages of Automation in Modern High-Tech Manufacturing Warehouses