What Is a Bonded Warehouse and How Does It Work

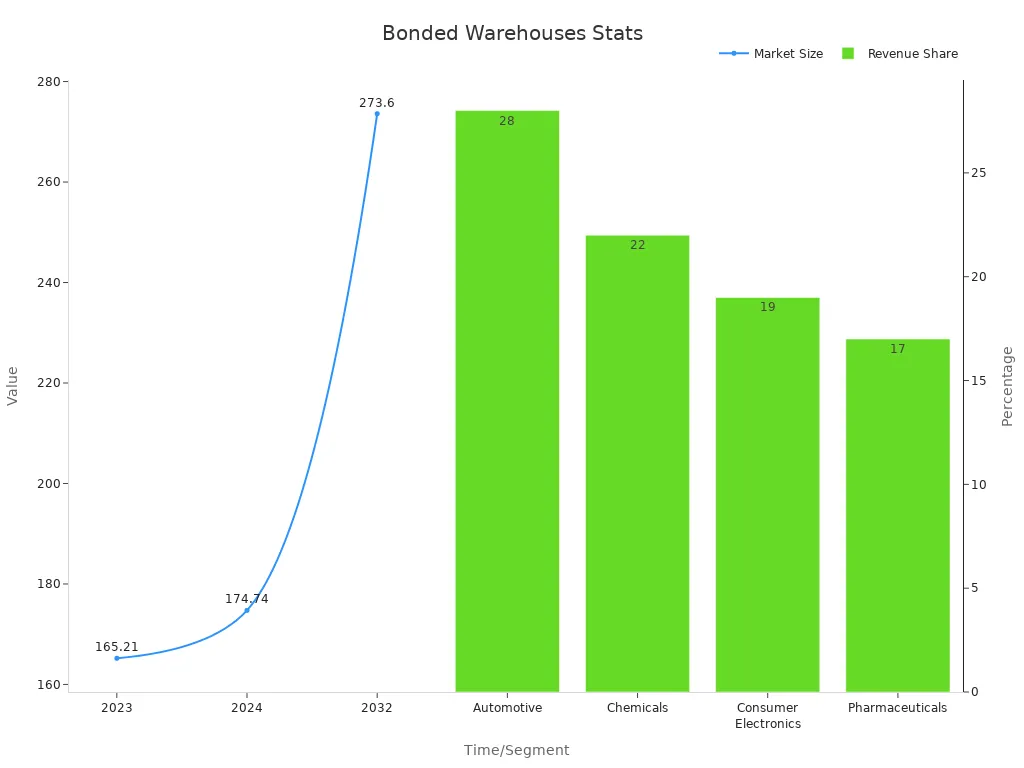

A bonded warehouse lets you store imported goods securely before you pay any import duties. You can keep your products under customs control, which means customs officers supervise your inventory and help you follow all the rules. Many businesses use bonded warehouses to delay duty payments, improve cash flow, and reduce the risk of theft or non-compliance. The global market for bonded warehouses keeps growing, showing their value in international trade.

Duty Payment (USD) | Cash Flow Impact (USD) | |

|---|---|---|

Immediate Payment | 100,000 | -100,000 (immediate outflow) |

Deferred Payment (6 months) | 100,000 | 0 initially, -100,000 after 6 months |

Key Takeaways

A bonded warehouse lets you store imported goods safely without paying import duties right away, helping you manage cash flow better.

Customs officers supervise bonded warehouses to keep your goods secure and ensure you follow all rules, reducing risks of theft and fines.

You can store goods for months or years, sort or repackage them under customs control, and only pay duties when you sell or use the goods locally.

There are three types of bonded warehouses: public for flexible shared space, private for full control, and specialized for goods needing special care.

Using a bonded warehouse helps you delay duty payments, improve inventory flexibility, and avoid paying duties if you export goods again.

Bonded Warehouse Basics

Definition

A bonded warehouse gives you a safe place to store imported goods before you pay any customs duties. Customs authorities approve and supervise these warehouses. You do not need to pay duties, taxes, or customs charges right away. Instead, you can wait until you remove your goods for sale or use in the country. This system helps you manage your cash flow and reduces upfront costs.

A bonded warehouse is a secure, customs-controlled environment for storing dutiable goods. You can process or repackage your goods under customs supervision while duties remain deferred.

Here is how a bonded warehouse works:

Goods arrive and move into a customs-authorized bonded warehouse without immediate duty payment.

Customs officers supervise the storage, keeping your goods in a "not yet imported" status.

You may sort, label, or repackage goods under customs control.

You pay duties only when you take goods out for domestic sale. If you export them again, you do not pay duties at all.

This process highlights the main advantage: you only pay duties when you actually need to.

Bonded Goods

Bonded goods are items you store in a bonded warehouse under customs supervision. These goods have not yet cleared customs, so you do not pay import duties or taxes until you decide to release them for sale in the country. Customs officers keep track of your inventory and make sure you follow all rules.

You can keep bonded goods in storage for a long time, sometimes up to several years. During this period, you can inspect, sort, or even improve your products, but you must always follow customs regulations. If you choose to export the goods instead of selling them locally, you avoid paying any duties.

How It Works

Import and Storage

When you import goods, you can send them directly to a bonded warehouse. This facility gives you a secure place to keep your products before you pay any import duties. Many industries, such as manufacturing, retail, and pharmaceuticals, use bonded warehouses to manage their inventory. The rise of e-commerce and global trade has made these warehouses even more important. Advanced technology, like warehouse management systems (WMS), barcode scanning, and automation, helps you track your goods and keep inventory accurate. These tools also reduce mistakes and make storage more efficient.

You can store your goods in a bonded warehouse for several months or even up to five years, depending on local regulations. This long storage period gives you flexibility to plan your sales or exports.

A recent industry report shows that the average storage time in a bonded warehouse is about eight months. This extended period allows you to wait for the best market conditions before paying duties or moving your goods.

Customs Supervision

Customs officers supervise all goods inside a bonded warehouse. They make sure you follow the rules and keep your products safe. You can sort, label, or repackage your goods, but you must do so under customs control. This supervision helps prevent theft and ensures that you meet all legal requirements.

Customs supervision reduces delays in the clearance process.

You can stage inventory and perform value-added services, such as repackaging or labeling, while your goods remain under customs control.

Technology, like geofencing and GPS, helps customs track goods and speed up inspections.

Secure storage under customs supervision supports international trade and reduces the risk of non-compliance.

Research shows that technology-driven customs management improves security and speeds up the clearance process. For example, IKEA Italy used advanced tracking to cut customs costs by 30% and reduce container transit times by up to 35%.

Duty Payment

You do not need to pay import duties right away when you use a bonded warehouse. Instead, you can defer payment until you remove your goods for sale or use in the country. This system helps you manage your cash flow and avoid large upfront costs.

Payment Timing | Duty Amount | Cash Flow Impact |

|---|---|---|

Immediate Payment | Immediate outflow of $100,000 | |

Deferred Payment (6 months) | $100,000 | No initial outflow; $100,000 paid after 6 months |

This table shows how deferring duty payments can improve your short-term cash flow. Many businesses use this advantage to invest in other areas while their goods remain in storage.

Industry reports highlight that bonded warehouses require strict compliance with customs rules. You must keep accurate records and follow all security guidelines. Federal certification and regular inspections ensure that only approved goods enter or leave the warehouse.

Release or Re-export

When you decide to sell your goods in the local market, you pay the required duties and remove them from the bonded warehouse. If you choose to export the goods to another country, you do not pay any import duties at all. This option gives you flexibility to respond to changes in demand or market prices.

You can keep your goods in a bonded warehouse for several years, giving you time to find the best buyers or export opportunities.

Bonded warehouses help you avoid unnecessary costs if you decide not to sell your goods locally. You can re-export products without paying duties, which supports efficient international trade and reduces financial risk.

Types of Bonded Warehouses

When you look for a bonded warehouse, you will find three main types: public, private, and specialized. Each type serves different business needs and offers unique benefits.

Public

A public bonded warehouse gives you flexible storage if you do not want to own or operate your own facility. Third-party logistics companies usually manage these warehouses. You can rent space for short or long periods, which helps if your storage needs change with the seasons. Many businesses use public warehouses because they share costs and get extra services like inventory management or order fulfillment. You often find these warehouses near ports or airports, making it easy to move goods in and out quickly.

Tip: If you run a small or medium business, a public warehouse can help you save money and stay flexible.

Private

A private bonded warehouse is owned and operated by one company. You use this type if you want full control over your inventory and operations. Large importers or exporters often choose private warehouses because they handle sensitive or high-value goods. You can set up special systems and security to match your needs. Private warehouses are usually located close to your main business or near major trade routes. This setup gives you more privacy and control but requires a bigger investment.

Private warehouses can be tailored for specific products, such as electronics, clothing, or food.

You decide who enters the warehouse and how goods move in and out.

Specialized

Specialized bonded warehouses handle goods that need special care. For example, you might need a warehouse with cold storage for food or climate control for pharmaceuticals. Some specialized warehouses store hazardous materials and have trained staff and safety equipment. These warehouses follow strict rules to keep your goods safe and meet government standards. You often find specialized warehouses in regions with high demand for certain products, such as near large food markets or industrial zones.

Type | Who Uses It | Typical Location | Special Features |

|---|---|---|---|

Public | Many businesses | Ports, airports | Shared space, flexible services |

Private | Single company | Near business hubs | Full control, tailored security |

Specialized | Niche industries | Industrial/food zones | Special equipment, trained staff |

You can choose the right bonded warehouse based on your product type, business size, and location. Each type supports different supply chain strategies and helps you meet customs rules while keeping costs under control.

Benefits

Duty Deferral

When you use a bonded warehouse, you do not have to pay import duties right away. You can wait until you remove your goods for sale or use. This helps you keep more money in your business and gives you better control over your cash flow. Many companies choose this option because it lets them pay duties only when they actually sell their products.

A study by the International Air Transport Association (IATA) shows that importers can save up to 10% on total landed costs by deferring duty payments until goods leave the warehouse. This means you can invest your money in other parts of your business while your goods stay in storage.

Here is an example of how duty payments can change based on when you withdraw goods:

Week | Tariff Rate | Withdrawal Value | Duty Paid |

|---|---|---|---|

1 | 145% | $1,000 | $1,450 |

2 | 245% | $1,000 | $2,450 |

3 | 10% | $1,000 | $100 |

You pay duties only as you take out goods, not all at once. This makes it easier to match payments with your sales.

Inventory Flexibility

A bonded warehouse gives you the freedom to store goods for months or even years. You can wait for the best time to sell or export your products. If market prices change, you can hold your goods until you find the right buyer. You can also sort, label, or repackage items while they stay in storage. This flexibility helps you respond quickly to changes in demand.

Tip: Use this flexibility to plan your sales and avoid rushing your products to market.

Security and Compliance

Customs officers watch over your goods in a bonded warehouse. They make sure you follow all the rules and keep your products safe. You get strong security, which lowers the risk of theft or loss. Regular checks and strict records help you stay compliant with customs laws. This protects your business from fines and delays.

You can trust that your goods will stay safe and legal until you decide what to do with them.

Bonded vs Non-Bonded

Key Differences

When you compare a bonded warehouse to a non-bonded warehouse, you see some clear differences. In a bonded warehouse, customs officers supervise your goods. You do not pay import duties until you remove your items for sale or use. This setup lets you store goods for a longer time and gives you more flexibility. In a non-bonded warehouse, you must pay all duties before you store your goods. Customs does not watch over your inventory, and you cannot defer duty payments.

Here is a table to help you see the main differences:

Facility Type | Customs Control and Duty Obligations Summary |

|---|---|

Bonded Warehouse | Goods stored under customs supervision; duties deferred until goods enter domestic market or are re-exported; some processing allowed. |

Non-Bonded Warehouse | Duties paid before storage; stricter time limits on restricted goods; no customs duty deferral. |

Foreign Trade Zone | Outside customs territory; allows manufacturing and processing without duty payment until goods enter domestic market. |

Note: Bonded warehouses help you manage high-tariff or restricted goods by letting you delay duty payments and store items under customs control.

Pros and Cons

Both warehouse types have strengths and weaknesses. You should weigh these before making a choice.

Bonded Warehouse Pros:

Duty payment deferral improves your cash flow.

Customs supervision increases security and compliance.

Longer storage periods suit slow-moving or seasonal goods.

You can re-export goods without paying duties.

Bonded Warehouse Cons:

You must follow strict customs rules and record-keeping.

Some processing is limited by customs regulations.

Non-Bonded Warehouse Pros:

Faster access to goods after duties are paid.

Fewer customs procedures during storage.

Non-Bonded Warehouse Cons:

You pay duties upfront, which can strain your cash flow.

Limited storage time for restricted goods.

No option to re-export without duty loss.

Choosing the Right Option

You should choose a bonded warehouse if you want to delay duty payments, store goods for a long time, or plan to re-export items. This option works well for importers who handle high-value or restricted products. If you need quick access to goods and do not mind paying duties right away, a non-bonded warehouse may fit your needs better.

Think about your business goals, cash flow, and the type of goods you import. The right warehouse can help you save money and stay compliant with customs laws.

A bonded warehouse gives you secure storage for imported goods and lets you delay duty payments until you sell or export your products. You gain better cash flow, strong security, and flexibility for your inventory. Compared to non-bonded options, you get more control and can avoid paying duties on re-exported goods.

Rapid growth in global trade and e-commerce increases the need for efficient, duty-deferred storage.

New technology in warehouse management improves tracking and operations.

Businesses in regions with high trade activity benefit most from bonded warehouses.

FAQ

What types of goods can you store in a bonded warehouse?

You can store almost any imported goods, including electronics, clothing, food, and machinery. Some warehouses offer special storage for items like chemicals or pharmaceuticals. Always check if your product needs special handling or approval.

How long can you keep goods in a bonded warehouse?

Most countries let you store goods for up to five years. The exact time depends on local customs rules. You should ask your warehouse provider about the maximum storage period for your products.

Can you process or change goods inside a bonded warehouse?

Yes! You can sort, label, or repackage goods under customs supervision. Some warehouses allow light assembly or repairs. You must follow all customs rules during these activities.

What happens if you do not remove goods from a bonded warehouse?

If you leave goods past the allowed time, customs may seize or auction them. You could lose your products and face extra fees. Always track your storage deadlines to avoid problems.

See Also

The Importance Of Automating Warehouses For Business Success

Discover How JUSDA’s New Warehouses Enhance Efficiency

How Robotic Automation Drives Greater Warehouse Efficiency

Strengthen Your Business Using Innovative Inventory Strategies

Advantages Of High-Tech Automated Warehouses In Manufacturing