China and India: Differences in Manufacturing Supply Chains

Comparing China's and India's Manufacturing Supply Chains, it's clear that they play a crucial role in the global economy. In 2018, China accounted for almost 30 percent of global manufacturing output. Meanwhile, India has emerged as a manufacturing alternative to China due to changing global dynamics. Businesses worldwide recognize the need to diversify their supply chains. As a result, India’s position in the global supply chain is set to strengthen further. This comparative analysis aims to explore the differences between China’s and India’s manufacturing supply chains.

Comparing China's and India's Manufacturing Supply Chains

Production Output

China's Production Output

China leads the world in manufacturing output. The country produces around 35 percent of the world's manufactured goods. China's manufacturing sector accounts for 28 percent of its GDP. This dominance results from decades of investment in infrastructure, education, and technology. China has built an efficient and extensive supply chain network. Factories in China produce about 180 million units annually. This high production rate supports both domestic and international markets.

India's Production Output

India's manufacturing sector lags behind China's. India produces less than 3 percent of global manufactured goods. The sector accounts for only 17 percent of India's GDP. Despite this, India has potential for growth. The country aims to become a top manufacturer in Asia. To achieve this, India needs to improve infrastructure and reduce taxes. Currently, factories in India produce about 100 million units annually. Businesses are starting to view India as an alternative to China for supply chain needs.

Global Value Addition

China's Contribution to Global Value Chains

China contributes significantly to global value chains. The country accounts for 30 percent of global value added in manufactured goods. China's advanced infrastructure and technology enable high productivity. The country has a robust network of suppliers and manufacturers. This network supports various industries, from electronics to textiles. China's value addition strengthens its position in the global economy.

India's Contribution to Global Value Chains

India's contribution to global value chains is smaller. The country accounts for only 3 percent of global value added in manufactured goods. India's manufacturing sector faces challenges like inadequate infrastructure and complex regulations. Despite these hurdles, India is emerging as a serious contender. The country is gradually overshadowing China in certain areas. Businesses are diversifying their supply chains, which benefits India.

Trade Balance

China's Trade Balance

China maintains a balanced trade in manufactured goods. The trade balance ranges from -2 percent to +2 percent of gross production. This balance reflects China's strong manufacturing capabilities. The country exports a wide range of products, from consumer electronics to machinery. China's efficient supply chain network supports these exports. The trade balance indicates China's stable position in global trade.

India's Trade Balance

India's trade balance in manufactured goods is similar to China's. The balance ranges from -2 percent to +2 percent of gross production. However, India relies on Chinese components for many products. This reliance affects India's ability to ramp up production independently. Despite this, India is making strides in improving its manufacturing sector. The country aims to reduce dependency on imports and boost exports.

Infrastructure

China's Manufacturing Infrastructure

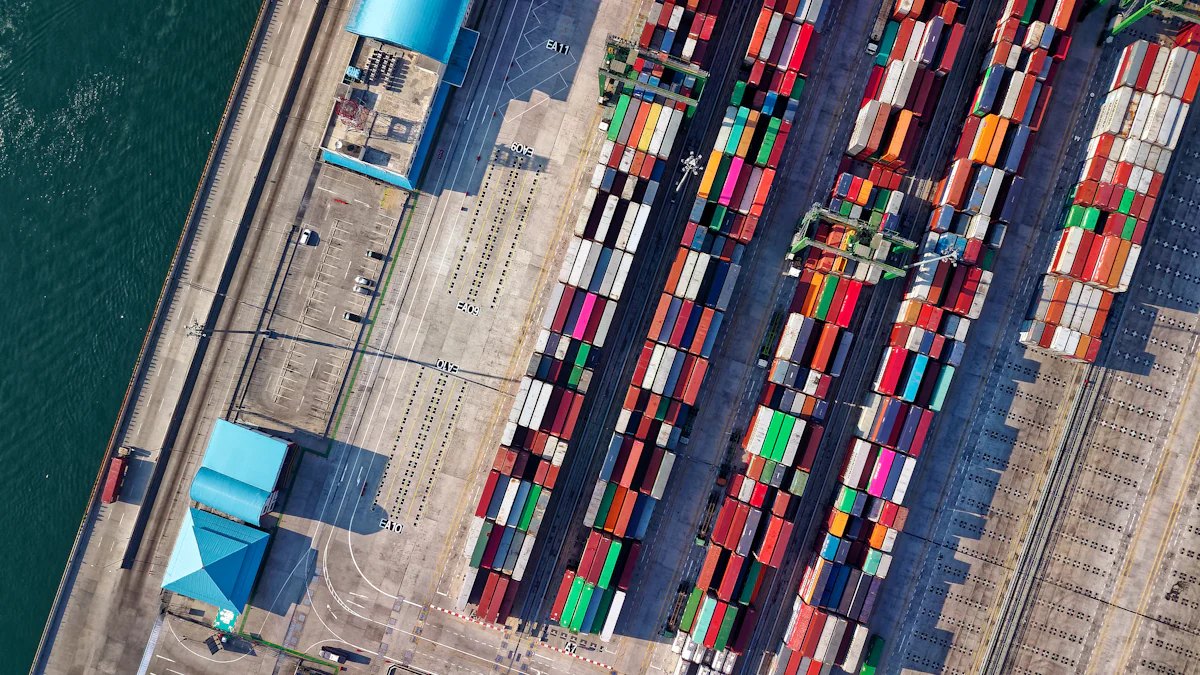

China's manufacturing infrastructure stands as a global benchmark. The country has invested heavily in modernizing its transportation networks. High-speed railways and extensive highways connect major industrial hubs. Ports in China handle large volumes of international trade efficiently. Advanced logistics systems ensure timely delivery of raw materials and finished goods.

China's energy sector supports its manufacturing needs robustly. The country has developed a mix of coal, hydroelectric, and renewable energy sources. This energy diversity ensures a stable power supply for factories. China's focus on technological innovation enhances productivity. Automation and artificial intelligence play significant roles in manufacturing processes.

Education and workforce development contribute to China's manufacturing success. The country emphasizes technical education and vocational training. Skilled labor is readily available to meet industry demands. China's government policies favor industrial growth. Tax incentives and subsidies attract foreign investment in manufacturing.

India's Manufacturing Infrastructure

India's manufacturing infrastructure faces several challenges. Inadequate physical infrastructure hampers growth. Roads and railways require significant upgrades. Ports in India struggle with congestion and inefficiency. These issues delay the movement of goods and increase costs.

India's energy sector also poses challenges. Power outages and inconsistent supply affect manufacturing operations. The country relies heavily on coal, which impacts environmental sustainability. Efforts to diversify energy sources are ongoing but need acceleration.

Regulatory procedures in India are complex. Businesses navigate through multiple layers of bureaucracy. Simplifying these regulations could boost manufacturing efficiency. India's government recognizes the need for reform. Initiatives like "Make in India" aim to improve the business environment.

Workforce development in India shows promise. The country has a large, young population. Education and skill development programs are expanding. However, more focus on technical and vocational training is necessary. India's potential as a manufacturing hub depends on addressing these infrastructure issues.

Comparing China's and India's Manufacturing Supply Chains reveals distinct differences and similarities. China leads in production output and global value addition. India, however, shows potential for growth. The future of manufacturing in both countries will depend on strategic investments and policy reforms.

Both countries must adapt to changing global dynamics to maintain their competitive edge.

See Also

Efficient Strategies for Supply Chain Challenges in High-Tech Manufacturing

Addressing Globalized World's Supply Chain Growth Hurdles

Investigating Robotics' Role in Revolutionizing the Supply Chain