Transforming Global Supply Chains: The Impact of Chinese Manufacturing Going Overseas

The overseas expansion of Chinese manufacturing is reshaping global supply chains at an unprecedented pace. Recent data shows China’s share of global exports continues to grow in sectors like autos, electronics, and solar energy, while new manufacturing hubs in Southeast Asia and beyond emerge as key players. Rising foreign direct investment and shifting trade patterns highlight the urgency for businesses to adapt. This transformation brings greater diversification and resilience, but also introduces new challenges and opportunities that every industry must consider.

Key Takeaways

Chinese manufacturers are expanding overseas to lower costs, access new markets, and reduce trade risks while keeping strong ties to China.

Global supply chains are diversifying as companies spread production across multiple countries, improving resilience against disruptions.

New manufacturing hubs like Vietnam, India, and Mexico attract investment due to lower labor costs and favorable trade agreements.

Digital tools such as AI, IoT, and big data help companies forecast demand, optimize routes, and manage risks for stronger supply chains.

Businesses must adapt to rising costs, policy changes, and quality demands by building flexible systems and forming strategic partnerships.

Chinese Manufacturing Shift

Overseas Expansion Trends

Chinese manufacturing companies have expanded their presence in global markets at a rapid pace. Many firms now operate affiliates in countries that have gained significant US import market share since 2018. These countries include Vietnam, Taiwan, Canada, Korea, Thailand, India, Indonesia, Mexico, Ireland, and Cambodia. This shift aligns with changes in global trade patterns and reflects a strategic approach to maintaining influence in global supply chains.

The share of Chinese manufacturing affiliates in these countries has increased sharply.

Chinese firms’ investments in overseas affiliates closely match the growth in US imports from these regions.

Exports of Chinese parts to these new manufacturing hubs have risen alongside their gains in US import share.

Regression analysis shows a strong link between Chinese parts exports and US imports of finished products, highlighting continued economic ties.

Chinese companies have strategically chosen affiliate locations to align with shifts in global demand and supply chain integration.

These trends show that Chinese manufacturers are not only moving production but also maintaining value-added links through parts exports and investments. The expansion supports both direct and indirect participation in global supply chains.

Why Now

Several factors make the current period ideal for Chinese manufacturing to expand overseas. Since 2019, China’s exports of electric vehicles have grown sevenfold, and solar cell exports in 2023 were five times higher than in 2018. Manufacturing capacity utilization rates returned to nearly 76% by late 2023, matching pre-pandemic levels.

Government policies since 2020 have focused on supporting manufacturing and exports. Tax credits, subsidies, and interest rate cuts have helped companies expand capacity. The 2024 National People’s Congress reinforced this focus by prioritizing high-tech manufacturing. Domestic consumption remains weak, so firms look abroad for growth. State support has allowed even less efficient firms to continue operating, pushing them to seek overseas markets.

Chinese manufacturers now benefit from scale, technology improvements, and strong policy backing. These advantages enable them to offer competitive prices and expand their global market share. The timing, policy environment, and capacity expansion together create a unique opportunity for overseas growth.

Drivers of Change

Economic Factors

Several economic trends have pushed Chinese manufacturing to expand overseas.

Demographic changes play a major role. China's working-age population continues to shrink due to low birth rates and longer life expectancy.

Employment shifts from agriculture to industry and services signal a move toward higher-value activities.

Rising industrial labor costs have reduced China's edge as a low-cost manufacturing center.

Labor productivity has grown, fueled by capital investment and foreign technology.

Although unit labor costs remain lower than in the US or Germany, the gap narrows as wages rise.

Education levels have improved, but many workers still lack advanced skills.

Government policies, such as the "Made in China 2025" plan, encourage innovation and reduce foreign dependence.

Foreign investment and technology transfer have improved product quality and efficiency.

A large pool of migrant workers still supports labor-intensive industries, but this advantage is fading.

These factors show a shift from low-cost, labor-intensive production to innovation-driven, high-value manufacturing.

Geopolitical Pressures

Geopolitical tensions have reshaped global supply chains. High US tariffs—reaching 25% on many Chinese goods—have increased export costs. Export controls, especially in high-tech sectors, limit access to critical technologies. Companies now seek stable production sites outside China. The "China+1" strategy has gained traction, with firms moving operations to Southeast Asia, India, Turkey, and Mexico. ASEAN countries benefit from favorable trade status with the US, avoiding some tariffs. Regional trade agreements like RCEP make Southeast Asia more attractive. The COVID-19 pandemic and trade wars have caused shortages and delays, pushing companies to diversify production networks.

Policy and Trade

Policy changes and trade data reveal a clear shift in manufacturing investment.

Region | Manufacturing Investment Change (USD Billion) | Key Industries Affected | Primary Trade Policy Drivers |

|---|---|---|---|

Southeast Asia | +20.5 | Electronics, Textiles, Machinery | Tariff avoidance, China+1 FDI surge |

China (US-bound) | -15.3 | Agriculture, Electronics | US tariffs, export controls |

Mexico | +10.4 | Automotive, Textiles | USMCA incentives, nearshoring |

India | +5.6 | IT, Light Manufacturing | Rising FDI, policy reforms |

European Union | -7.1 | Automotive, Machinery | Decline in US and Chinese demand |

Trade tensions, tariffs, and new agreements like USMCA have shifted investment and exports. Companies now diversify production to manage risks and meet changing global demands.

Impacts on Global Supply Chains

Diversification

Global Supply Chains have entered a new era of diversification as Chinese manufacturing expands overseas. Companies now spread production across multiple countries, reducing reliance on a single source. This shift does not mean a complete move away from China. Statistics show China still holds 31% of global manufacturing value-added. Even as foreign direct investment flows to countries like Vietnam and Bangladesh, only small portions of China’s output have moved offshore. For example, China’s share of labor-intensive manufacturing exports remains steady at around 30%, despite declines in sectors such as textiles for US and Japanese markets.

Diversification often involves relocating certain segments of production, such as final assembly, while companies continue to depend on Chinese inputs. Chinese firms themselves have invested in new facilities in ASEAN and other regions, keeping strong ties to their home base. Sensitive industries like semiconductors and electric vehicles diversify faster, but most sectors will take years to reduce their dependence on China. Trade tensions and tariffs have accelerated these changes, especially in automotive, electronics, and textiles. However, China remains a central player in Global Supply Chains, shaping the flow of goods and components worldwide.

New Manufacturing Hubs

The rise of new manufacturing hubs marks a major change in Global Supply Chains. Countries such as Vietnam, India, and Mexico have attracted significant investment from Chinese firms and global brands. These locations offer lower labor costs and favorable trade agreements. For instance, Vietnam and Bangladesh have seen a surge in greenfield investments, while Mexico benefits from its proximity to the US and the USMCA trade agreement.

A closer look at logistics and production data reveals the scale of this transformation:

U.S. business logistics costs reached $2.3 trillion, or 8.7% of GDP, showing the vast resources needed to support these new hubs.

Supply chain disruptions now occur every 3.7 years on average, lasting over a month, which highlights the need for flexible and diverse networks.

Half of supply chain organizations plan to invest in AI and analytics, aiming to manage the complexity of multi-country operations.

Many companies still struggle with visibility beyond their first-tier suppliers, making it harder to track risks and performance in these new hubs.

Dimension | Description | Key Aspects |

|---|---|---|

Adding manufacturing or supplier locations in different countries or regions | Reduces operational and compliance risks by spreading production across continents | |

Manufacturing & Supplier Network | Increasing the number of suppliers or capacities, including local additions | Lowers financial and operational risks by avoiding single-source dependencies |

Mode of Transportation | Using air, ocean, rail, and road for the same product or part | Diversifies shipping routes and provides backup options |

Logistics Operations | Expanding hubs, warehouses, and distribution centers | Ensures continuity during disruptions by offering alternative logistics solutions |

These new hubs do not replace China but work alongside it, creating a more complex and interconnected network. The coexistence of "China Plus One" strategies highlights the growing interdependence and resilience of Global Supply Chains.

Supply Chain Resilience

Supply chain resilience has become a top priority for companies worldwide. The experience of the COVID-19 pandemic showed that relying on a single country or supplier can lead to shortages and delays. By diversifying suppliers and production sites, companies can better withstand disruptions. Geographical diversification allows firms to select suppliers based on risk, using AI tools to make smarter choices. Additive manufacturing at production sites also helps maintain output when parts are scarce.

Working with multiple suppliers across different locations reduces the risk of disruption.

Spreading dependencies geographically increases agility and helps companies adapt to sudden changes.

Diversification supports product availability during crises, such as pandemics or trade disputes.

Companies may also see cost savings and more innovation as a result.

China’s integration of automation and AI in manufacturing further strengthens supply chain resilience. Investments in digital technologies improve forecasting, visibility, and operational continuity. As companies expand into new regions, they build redundancy into their networks, making Global Supply Chains more robust against future shocks.

Note: Even small disruptions in low-cost supplier chains can cause significant losses for global businesses. Balancing cost savings with resilience and diversification is now a key strategy for long-term success.

Sector Impacts

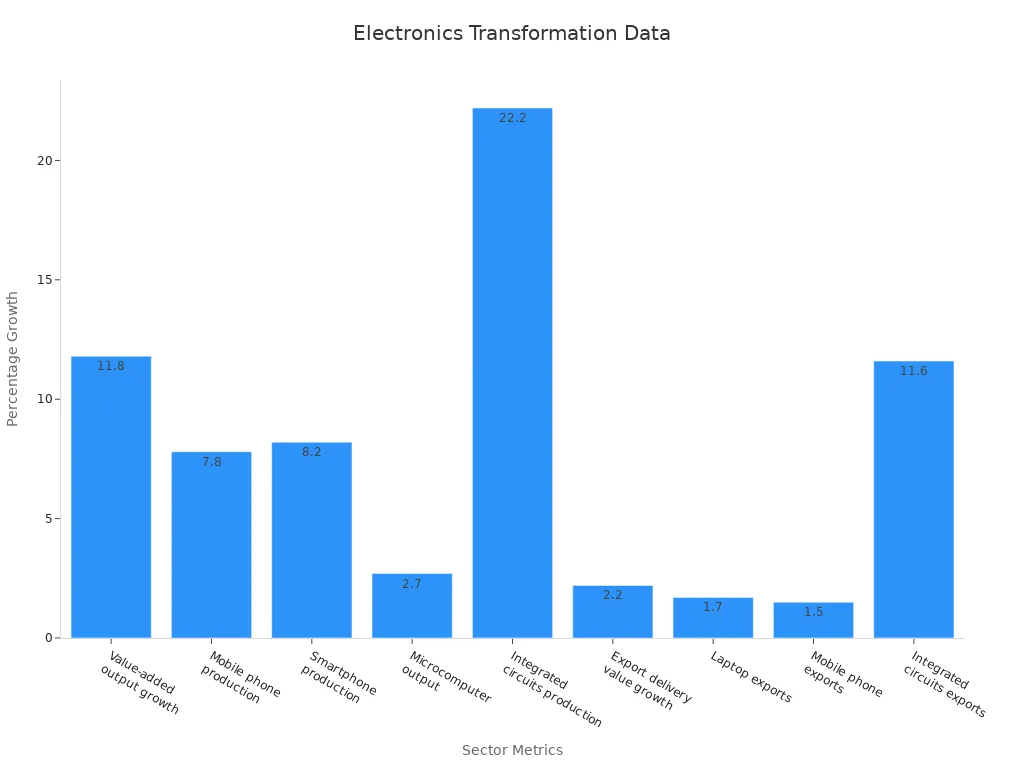

Electronics

China remains the world’s largest electronics manufacturing hub, with production centered in cities like Shenzhen and Dongguan. The sector benefits from a vast skilled labor pool and the world’s largest reserves of rare earth elements, which are essential for electronic components. Developed supply chains and major seaports, such as Shanghai, help reduce logistics costs and lead times. Despite rising wages and recent supply chain disruptions, China continues to attract manufacturers due to its component availability and ecosystem synergies. However, companies have started to diversify production to countries like Malaysia and India, seeking lower labor costs and government incentives.

Sector Metric | Data (2024) | Significance |

|---|---|---|

Value-added output growth | Outpaces overall industry growth, showing strong expansion | |

Mobile phone production | 1.67 billion units | Reflects robust consumer electronics manufacturing |

Integrated circuits production | 4,514 billion units | Highest growth rate, emphasizing semiconductor focus |

Export delivery value growth | +2.2% YoY | Indicates steady export recovery |

Automotive

China now produces one-third of the world’s vehicles and leads in new energy vehicles (NEVs). In 2023, China manufactured 30 million vehicles, including nearly nine million NEVs—about two-thirds of global NEV output. Chinese brands hold over half of the global alternative fuel vehicle market. Automakers like BYD, NIO, and XPeng have expanded into high-end markets. From January to April 2024, passenger vehicle production grew by 9%, with exports rising sharply. In April 2024, exports accounted for 21% of total passenger vehicle production, up from 16% the previous year. China’s complete industrial supply chain and focus on core parts, such as power batteries, support its leadership in smart electric vehicles.

Solar and Energy

China’s manufacturing overcapacity in clean energy technologies drives global cost declines. Solar module and battery storage costs have fallen significantly in 2024 and are expected to keep dropping. China can produce power-generating technologies at costs 11% to 64% lower than other markets. This cost advantage puts downward pressure on global prices, even as countries impose tariffs to protect domestic industries. For example, the US has set tariffs on solar imports from several Asian countries, causing shifts in sourcing and higher costs for domestic manufacturers. These changes have led to supply chain disruptions and increased uncertainty for solar projects worldwide.

JUSDA’s Role in Global Supply Chains

Intelligent Solutions

JUSDA stands at the forefront of global supply chain transformation. The company delivers intelligent solutions that help manufacturers adapt to the new era of diversified production and international expansion. JUSDA’s JusLink platform uses artificial intelligence to forecast demand, optimize routes, and manage risks. These tools allow companies to reduce operational costs and speed up delivery times. Cloud computing and big data analytics support real-time collaboration between suppliers and customers. This technology improves agility and helps companies respond quickly to changes in the market.

JUSDA Solutions

To provide you with professional solutions and quotations.

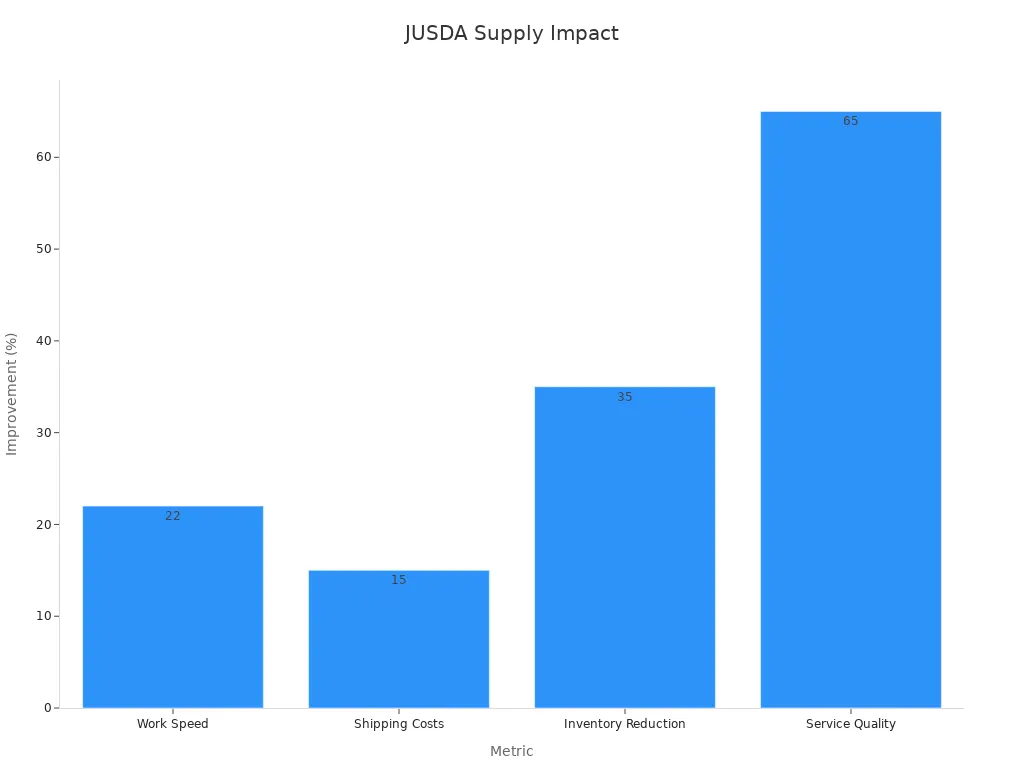

Customer Success Stories

JUSDA’s technology-driven approach has delivered measurable results for Chinese manufacturers expanding overseas. The company’s Supply Chain Management Collaboration Platform, powered by AI and blockchain, streamlines operations from procurement to delivery. Customers benefit from faster work speeds, lower shipping costs, and reduced inventory levels.

Metric | Improvement Percentage |

|---|---|

Work Speed | 22% |

Shipping Costs | 15% |

Inventory Reduction | 35% |

Service Quality | 65% |

JUSDA’s AI-powered tools, such as JusElsa and JusLink, enhance customer service and supply chain transparency. JusElsa provides quick and clear responses to customer inquiries. JusLink offers live tracking, which builds trust and loyalty. These features help manufacturers manage disruptions, such as those caused by the COVID-19 pandemic. One company reported a 20% reduction in logistics costs after following JUSDA’s recommendations.

JUSDA’s solutions also address complex challenges like global procurement and customs differences. The company integrates systems such as ERP, TMS, and WMS, creating a unified platform for data sharing and process automation. This integration reduces manual work and increases data accuracy. Customers experience smoother operations and better decision-making.

JUSDA’s success stories highlight its vital role in helping Chinese manufacturers achieve efficient, low-cost global expansion. The company’s intelligent solutions and customer-focused approach set a new standard for global supply chain management.

Future of Global Supply Chains

Scenarios

Leaders in supply chain management use scenario planning to prepare for the future. They build models that simulate the entire supply chain. These models use both numbers and expert opinions to test what might happen if there are sudden changes, like a spike in demand or a supplier failure. Companies can see how one problem affects the rest of the chain. They use simulations to test decisions before making them in real life. Advanced tools like artificial intelligence and machine learning make these simulations faster and more accurate. Businesses that invest in these skills and technologies become more resilient and efficient.

Experts at the World Economic Forum plan for the future using three time frames: 2030, 2040, and 2050. They look at important factors such as new rules, social fairness, technology, workforce skills, the environment, and global trade. Scenario planning helps leaders map out these factors and see how they might change. For example, they consider what happens if countries adopt new technology quickly or if trade tensions rise. Case studies from industries like food, electric vehicles, and healthcare help ground these scenarios in real-world examples.

Actionable Insights

Companies can take several steps to prepare for changes in global supply chains:

Move from old ways of measuring performance to using predictive metrics. These new metrics help companies forecast problems and act before they happen.

Build supply chain management systems that are flexible, timely, and aligned with business goals. This helps teams make decisions quickly.

Use business intelligence tools to get real-time insights. These tools support better planning and faster responses to disruptions.

Adopt predictive analytics and data mining. These methods turn raw data into alerts and forecasts, helping companies avoid risks.

Encourage collaboration across teams and partners. Sharing information leads to better decisions and stronger supply chains.

Companies that use these strategies can spot trends early, respond to risks, and find new opportunities in global supply chains.

Chinese manufacturing’s overseas expansion has transformed global supply chains.

China’s export share remains strong in sectors like electronics, apparel, solar, and autos.

Companies see new hubs in Vietnam, Bangladesh, and Mexico, but China still leads in production and investment.

Policy changes and trade barriers drive diversification, yet China shapes global prices and supply chain trends.

Businesses face both opportunities and risks. They should invest in flexible systems, monitor policy shifts, and build strong partnerships. Staying alert will help companies thrive as global supply chains continue to evolve.

FAQ

What drives Chinese manufacturers to expand overseas?

Chinese manufacturers seek lower costs, access to new markets, and reduced trade barriers. They also want to diversify risks and respond to global demand shifts. Policy support and advanced technology help them succeed in international markets.

How does JUSDA support global supply chains?

JUSDA provides intelligent logistics solutions, including air, land, ocean, and rail transport. The company uses AI and big data to improve efficiency, reduce costs, and offer real-time visibility. These services help businesses manage complex, international supply chains.

Why is diversification important in global supply chains?

Diversification spreads production across different countries. This reduces risks from disruptions, such as trade disputes or natural disasters. Companies gain flexibility and can respond faster to changes in demand or supply.

What challenges do companies face when moving production overseas?

Companies face higher costs, complex regulations, and quality control issues. They must manage new suppliers, comply with local laws, and adapt to different business environments. These challenges require careful planning and strong partnerships.

How do digital tools improve supply chain resilience?

Digital tools like AI, IoT, and blockchain provide real-time tracking and data analysis. They help companies predict risks, optimize routes, and automate processes. This leads to faster decisions and stronger supply chain performance.

See Also

Overcoming Global Supply Chain Growth Obstacles Effectively

Enhancing Supply Chain Strategies For Advanced Manufacturing

The Role Of Cloud Technology In Transforming Supply Chains

Innovative Supply Chain Advances Driving Logistics Transformation

Adjusting To Technology-Based Changes In Supply Chain Management