Transforming the Semiconductor Supply Chain through Collaboration

Collaboration has become essential for the Semiconductor Supply Chain. The industry faces rising regulations, tariffs, and shifting demand across multiple markets. Manufacturing new sites often takes years, making quick responses difficult. Companies now see long lead times and must manage capacity in regions with fewer trade barriers. Chief Supply Chain Officers work closely with partners to find new solutions. These partnerships help turn risks into opportunities, ensuring the industry can keep pace with constant change.

Key Takeaways

The semiconductor supply chain is complex and vulnerable to disruptions from natural disasters, geopolitical tensions, and market changes.

Collaboration across companies and countries breaks down silos, enabling faster problem-solving and stronger partnerships.

Using data and digital tools helps companies spot issues early, improve efficiency, and respond quickly to challenges.

Sharing innovation and working with universities and governments builds talent and drives new solutions for the industry.

Diversifying suppliers and locations reduces risks and builds trust with customers and investors, making the supply chain more resilient.

Semiconductor Supply Chain Challenges

Complexity and Interdependence

The semiconductor supply chain stands out for its intricate structure and high level of interdependence. Each chip passes through many stages, from raw material sourcing to manufacturing, assembly, testing, and distribution. These stages often take place in different countries, making the process vulnerable to disruptions.

The supply chain is highly concentrated in regions like Northeast Asia, where a few suppliers control critical materials and components.

Events such as the 1999 Taiwan earthquake and the 2011 disaster in Japan have shown how a single incident can halt global production.

The Russian invasion of Ukraine in 2022 disrupted over half of the world’s purified neon gas supply, forcing companies to seek alternatives.

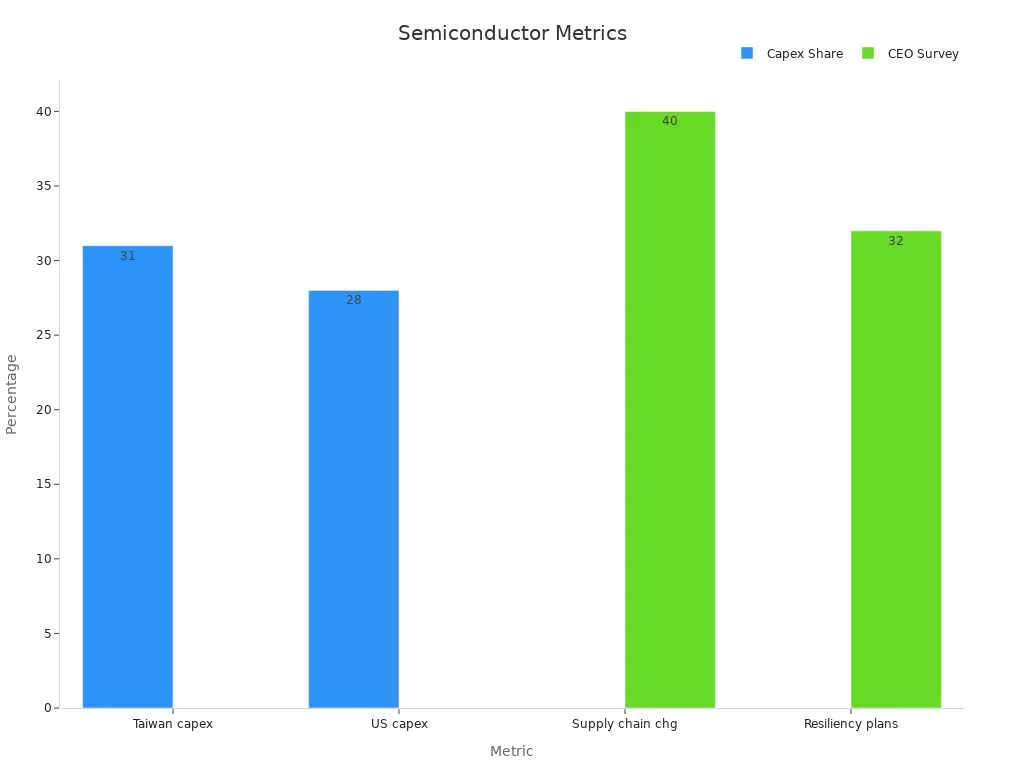

Metric/Aspect | Value/Description |

|---|---|

Market share concentration points | Over 50 points in the supply chain where a single region controls >65% of the global market share |

Taiwan's capital expenditure share | 31% of semiconductor capex from 2024 to 2032 |

US capital expenditure share | 28% of semiconductor capex from 2024 to 2032 |

Projected wafer fabrication investment | $2.3 trillion from 2024 to 2032 |

CEO survey: supply chain changes | 40% of global CEOs have changed supply chains due to geopolitical issues |

CEO survey: resiliency plans | 32% of global CEOs plan to make supply chains more resilient in next 6 months |

Geopolitical and Market Risks

Geopolitical tensions and market shifts create ongoing risks for the semiconductor supply chain.

The U.S.-China trade war led to tariffs and restrictions, disrupting global chip flows and impacting companies like Huawei, Intel, and Qualcomm.

Regional conflicts, such as the Russia-Ukraine war, have caused shortages of key materials and increased costs.

Rising raw material and energy prices, along with labor shortages, add to the pressure.

Western governments now push for onshoring or nearshoring to reduce risk.

Companies must monitor political changes and diversify sourcing to protect against sudden disruptions.

Sustainability and Talent Gaps

Sustainability and workforce shortages present major hurdles.

One-third of U.S. semiconductor workers are nearing retirement, creating a need for rapid knowledge transfer.

Technical job postings in the U.S. rose by over 75% from 2018 to 2022, but the talent gap could exceed 100,000 engineers.

77% of industry executives report a critical talent shortage, and 60% of companies struggle to attract younger workers.

The CHIPS and Science Act aims to create 58,000 new jobs, but companies still face challenges in training and retaining staff.

Environmental, social, and governance (ESG) pressures require firms to adopt greener practices and improve workforce diversity.

The traditional siloed approach cannot address these complex challenges. Companies must shift to ecosystem thinking, working together to build a resilient and sustainable future.

Collaboration as a Competitive Edge

Breaking Down Silos

The semiconductor industry once relied on isolated operations. Each company focused on its own tasks, rarely sharing information or resources. This approach created barriers that slowed progress and increased risk. Today, leaders recognize that breaking down these silos is essential. Companies now form partnerships across the entire Semiconductor Supply Chain. They connect material suppliers, chip designers, foundries, and end users in a trusted network. This shift allows decision-makers to share ideas, solve problems faster, and respond to disruptions with greater agility.

The International Semiconductor Industry Group (ISIG) and the Digital Supply Chain Institute (DSCI) have introduced the “Constellation of Value” model. This model views the supply chain as an interconnected network, not a simple line. It helps companies identify key partners and high-impact nodes. By working together, organizations can optimize speed, resilience, and sustainability. The result is a stronger, more flexible supply chain that can handle unexpected challenges.

Breaking down silos transforms competition into collaboration, turning risks into shared opportunities.

Data-Driven Ecosystems

Modern supply chains depend on data. Integrated ecosystems use advanced technologies like AI, robotics, and automation to improve efficiency. These tools analyze production metrics and sensor data in real time. They detect problems quickly and help companies adjust workflows without delay. For example, software-defined warehouses use intelligent systems to manage tasks and resources. This flexibility allows companies to scale operations, introduce new products, and maintain high performance even during disruptions.

Unified data views bring together information from many sources—warehouses, robotics, IoT sensors, and ERP systems. This approach gives leaders actionable insights. They can spot bottlenecks, optimize resource use, and make better decisions. Studies show that big data analytics and digital tools improve supply chain performance, resilience, and sustainability. Integrated, data-driven ecosystems support continuous improvement and real-time decision-making. These benefits drive operational efficiency and help companies stay ahead in a fast-changing market.

Shared Innovation

Collaboration fuels innovation in the Semiconductor Supply Chain. When companies, suppliers, and customers work together, they create new solutions and share knowledge. Blockchain technology offers a clear example. By using a shared, secure ledger, partners increase transparency and reduce the risk of counterfeit parts. This trust speeds up process changes and supports secure collaboration across the value chain.

International partnerships also show the power of shared innovation. The U.S.-EU semiconductor collaboration uses existing research networks and partnerships between companies, universities, and research groups. These alliances help address supply chain disruptions and ramp up production quickly. The US-Japan Upwards partnership brings together universities and industry to develop talent and align education with industry needs. These efforts bridge gaps between research and manufacturing, strengthen the global workforce, and boost resilience.

Shared innovation turns the Semiconductor Supply Chain into a source of new ideas, stronger partnerships, and lasting growth.

Building a Resilient Semiconductor Supply Chain

Diversification Strategies

Companies and policymakers can strengthen the Semiconductor Supply Chain by spreading operations across different regions and suppliers. This approach helps reduce the risk of disruptions from natural disasters, political changes, or supply shortages. Many organizations now track their progress using key performance indicators (KPIs):

Return on Resilience Investment (RoRI) compares the cost of diversification with the savings from avoiding disruptions.

Operational efficiency often improves when companies diversify, as seen during recent crises.

Market share stability can result from these strategies. For example, Toyota’s early stockpiling and supplier diversification helped it become the top-selling automaker in the U.S. during the 2021 chip shortage.

Customer retention and investor confidence also increase when companies maintain steady supply and clear communication.

Diversification protects operations and builds trust with customers and investors.

Transparency and Data Sharing

Transparency and data sharing play a key role in building supply chain resilience. Companies use digital tools to track shipments, monitor risks, and share information with partners. The Covid-19 pandemic showed that clear data helps businesses respond quickly to problems. Regulatory acts in countries like Germany, the UK, and Australia now require companies to report on supply chain risks. Data platforms such as Maxsight™ and Supplier Performance Risk indicators help organizations spot issues early and act fast.

Scenario modeling and inventory buffering help companies prepare for sudden changes.

Unified risk platforms allow teams to work together using shared data.

Quantitative risk measures guide leaders in making smart decisions.

Digital transformation and open data sharing make the supply chain stronger and more agile.

Talent and Academia Partnerships

A resilient supply chain needs skilled workers. Companies partner with universities and training centers to develop talent. These partnerships create programs that teach the latest skills in chip design, manufacturing, and logistics. Collaborative pilot projects connect students with real-world challenges. Peer networks help share best practices and support ongoing learning.

Joint programs with schools help fill talent gaps.

Industry-led training ensures workers stay up to date.

Peer networks foster a culture of shared growth.

Investing in people and education ensures the Semiconductor Supply Chain can adapt and thrive.

Future of Collaboration

Ecosystem-Oriented Culture

The culture of the semiconductor industry is changing. Companies once guarded their processes and data. Now, they see value in sharing information and working together. This shift from secrecy to shared value helps everyone respond faster to challenges. Teams across the Semiconductor Supply Chain now use shared KPIs and daily communication to manage risks. They also use digital tools to see beyond their direct suppliers, making it easier to spot problems early.

A culture of openness builds trust and speeds up innovation. When companies share ideas and resources, they solve problems that no single company could handle alone.

This new mindset does not stop at manufacturing. Partnerships with schools and local governments help train workers for future jobs. Flexible training programs and AI-based tools help companies find and develop talent. These efforts create a steady pipeline of skilled workers, which is vital for long-term growth.

Policy and Investment

Governments play a big role in shaping the future of the industry. Policies like the US CHIPS Act and the European Chips Act encourage companies to work together and invest in new technology. These acts support public-private partnerships and aim to build strong, resilient supply chains.

The US CHIPS Act focuses on building advanced chip factories, boosting memory chip production, and supporting packaging facilities.

The European Chips Act plans to invest over €43 billion to increase Europe’s share of global chip production and address workforce needs.

Companies like Intel and Amkor have received major investments to expand manufacturing and testing, showing the power of policy-driven collaboration.

Foreign direct investment in US manufacturing more than doubled in 2021, with $334 billion invested, much of it in sectors tied to domestic chip production.

These trends show how policy and investment drive collaboration. The Semiconductor Supply Chain now serves as a model for other industries. By working together, companies and governments can build stronger, more flexible supply chains in fields like energy, healthcare, and advanced materials.

Collaboration shapes a robust, future-ready Semiconductor Supply Chain. Moving from silos to ecosystems unlocks transparency, resilience, and shared value. Leaders can drive progress by:

Adopting AI-driven analytics and blockchain for real-time coordination

Building global partnerships and multi-sourcing strategies

Investing in talent and digital tools for agility

These steps help companies respond to disruptions and foster innovation. The Semiconductor Supply Chain stands ready to lead other industries into a new era of transformation.

FAQ

What makes the semiconductor supply chain so complex?

Many companies and countries take part in making chips. Each step, from raw materials to finished products, depends on others. A single delay can affect the whole process.

How does collaboration improve supply chain resilience?

Collaboration lets companies share data and resources. They solve problems faster and plan for risks together. This teamwork helps keep products moving, even during disruptions.

Why is data sharing important in the semiconductor industry?

Data sharing gives everyone a clear view of the supply chain. Companies can spot issues early and make better decisions. This leads to fewer delays and stronger partnerships.

What role do governments play in supporting the supply chain?

Governments create policies and invest in new factories. They support training programs and encourage companies to work together. These actions help build a stronger, more secure supply chain.

How can companies address the talent gap in the industry?

Companies partner with schools and training centers. They offer hands-on programs and support ongoing learning. This approach helps develop skilled workers for future needs.

See Also

Transforming Industries Through Advanced Cloud-Based Supply Chains

Unveiling Key Quality Control Practices Within Semiconductor Manufacturing

Discover Five Cutting-Edge Methods To Optimize Supply Chains

Adopting Eco-Friendly Strategies To Manage Supply Chain Risks

Preparing For The Future With New Transport Tech In Supply Chains