Current State of Multimodal Transport Development in Mexico

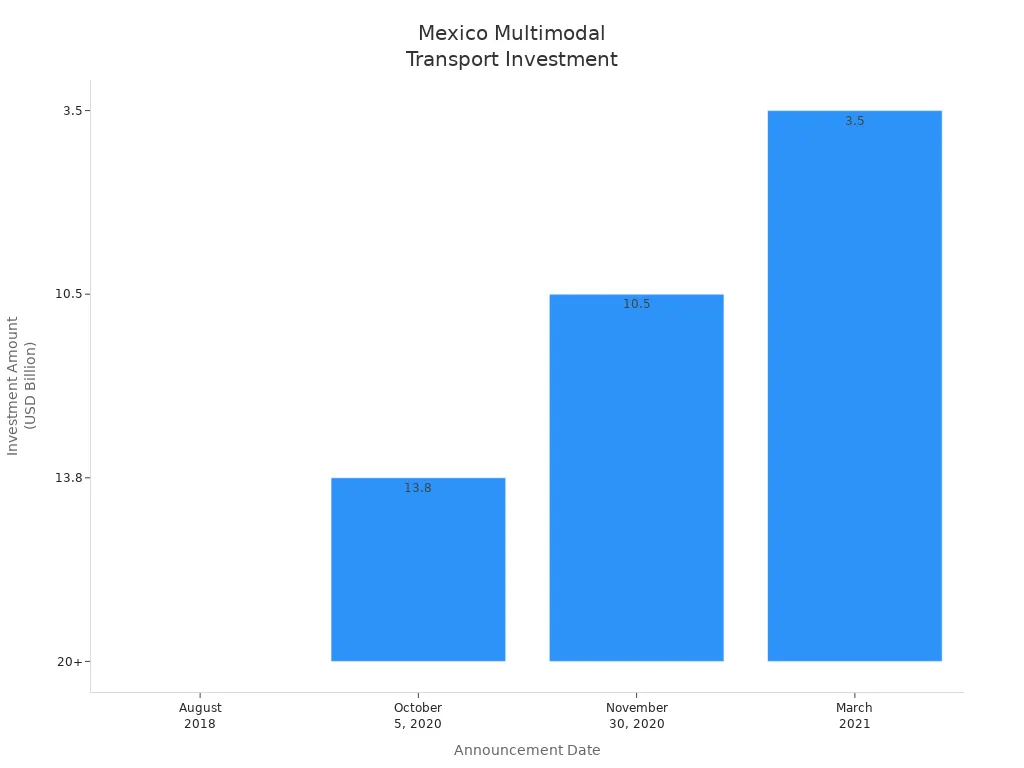

Mexico’s multimodal transport sector has seen rapid expansion, driven by major investments and flagship projects such as the Maya Train and the Interoceanic Corridor. The Construction and Modernization Program alone allocated over $20 billion to infrastructure upgrades, while recent agreements have attracted billions in private funding.

Program / Initiative | Announcement Date | Investment Amount (USD Billion) | Number and Types of Projects | Financing Source |

|---|---|---|---|---|

CMP | August 2018 | 20+ | 13 projects: airports, railways, multimodal transport | Public funds |

Economic Reactivation (1st) | Oct 2020 | 13.8 | 39 projects: roads, railways, ports, energy | 50% private |

Economic Reactivation (2nd) | Nov 2020 | 10.5 | 29 projects: roads, railways, ports, energy | 50% private |

Pacto Oaxaca | March 2021 | 3.5 | 36 projects: highways, tech parks, industrial parks | Private sector |

Integrated logistics providers like JUSDA support this growth by offering advanced supply chain solutions, helping businesses optimize operations and capitalize on Mexico’s expanding trade corridors. Policymakers and industry leaders now prioritize connectivity, efficiency, and technology adoption to sustain momentum and boost economic performance.

Key Takeaways

Mexico is investing billions to improve its multimodal transport system, including rail, road, and ports, to boost trade and economic growth.

Major projects like the Interoceanic Corridor and Maya Train create new trade routes and connect key industrial regions, improving passenger and cargo transport.

Challenges such as infrastructure gaps, complex regulations, and fragmented logistics slow down transport but are being addressed with technology and partnerships.

Government reforms and sustainability efforts support safer, more efficient, and greener transport networks across the country.

Advanced digital tools and platforms, like JUSDA’s JusLink, help businesses track shipments, manage risks, and optimize supply chains for better cross-border trade.

Projects

Major Corridors

Mexico continues to advance several flagship multimodal transport projects that reshape the country’s logistics landscape. The Interoceanic Corridor of the Isthmus of Tehuantepec stands out as a transformative initiative. This corridor creates a new trade route linking the Pacific and Atlantic coasts, offering an alternative to the Panama Canal. The project integrates rail, road, and port infrastructure, connecting ten industrial hubs and supporting industries such as automotive, energy, and agribusiness.

The Maya Train project also plays a key role in the Yucatán Peninsula. This initiative improves both passenger and cargo transport, connecting major cities, archaeological sites, and remote communities. The project promotes sustainable tourism and regional development by integrating rail and freight services.

A range of new intermodal routes and industrial corridors further strengthen Mexico’s logistics network. The following table highlights the most significant projects currently underway:

Project / Segment | Description / Status | Key Features / Impact |

|---|---|---|

Mexico City-Pachuca | Construction ongoing on 5 fronts; environmental viability approved | Expected to transport 80,000 passengers daily; focus on electrification |

Mexico City-Queretaro | Studies ongoing; construction to start mid-April | 226 km rail network; multiple stations planned |

Queretaro-Irapuato | Bidding in May; construction from July | Stations in Queretaro, Celaya, Villagran/Cortazar, Salamanca, Irapuato |

Saltillo-Nuevo Laredo | Pre-investment studies ongoing; construction planned for July | Stations in key industrial cities; cross-border connectivity |

Mayan Train Freight Phase | Construction of 10 cargo complexes; 4 multimodal hubs | Over 2,600 km railway in SE Mexico; integration with Interoceanic Corridor |

Isthmus Corridor (K Line) | 447 km track; 70% complete; section to open July 2024 | New viaduct; 1,500 direct jobs; linear park with recreational spaces |

Isthmus Corridor (FA Line) | Rehabilitation ongoing; 92 km branch to connect Dos Bocas refinery | Completion expected within 18 months |

CIIT Development Poles | 14 poles for automotive, energy, pharma, agribusiness | Land designated in multiple regions; industrial growth |

These projects reflect a coordinated effort to boost regional connectivity and economic growth.

Infrastructure Investment

Mexico prioritizes investment in multimodal transport infrastructure. The country allocates about 23% of its total inland transport budget to rail, a higher proportion than Canada or the United States. This focus supports the expansion of both passenger and freight networks. Recent projects include the México-Toluca line, the suburban train Ramal Lechería-AIFA, and the Tren Maya.

The Second Infrastructure Investment Plan, announced in 2020, dedicated approximately USD 5.5 billion to communications and transport, which includes highways and railways. The table below summarizes recent investments:

Sector | Number of Projects | Investment (MXN billion) | Investment (USD billion approx.) |

|---|---|---|---|

Communications & Transport (includes multimodal transport) | 18 | 110.2 | 5.5 |

Energy | 9 | 116.7 | 5.8 |

Water & Environment | 2 | 1.7 | 0.084 |

Private and foreign investment play a crucial role in funding these projects. Public-private partnerships (PPPs) often provide up to 80% of the capital for large-scale developments, such as port expansions and logistics hubs. The government supplies foundational planning and partial funding, while private capital drives project completion and innovation.

Note: JUSDA supports these investments by offering advanced logistics solutions, including real-time tracking, risk management, and compliance for cross-border and hazardous materials transport. Their JusLink platform enables seamless supply chain collaboration, helping businesses maximize the benefits of new infrastructure.

Connectivity Impact

The development of major multimodal corridors has a measurable impact on regional and cross-border connectivity. Projects like the Interoceanic Corridor and new intermodal routes improve the flow of goods between the Pacific and Atlantic coasts. They also enhance access to the United States, Mexico’s largest trading partner.

The following table illustrates the impact of these projects on cross-border trade:

Measure/Aspect | Evidence/Projection |

|---|---|

Increasing, with projections exceeding 8 hours by 2050 without improvements | |

Economic impact of delays | Potential $43 billion GDP reduction by 2050 without infrastructure investment |

Job impact | Over 1.2 million jobs could be lost without improvements |

Trade volume through Laredo-Eagle Pass-Del Rio corridor | $262 billion in binational trade (42% of all U.S.-Mexico cross-border trade) |

Eagle Pass commercial vehicle capacity | Currently serving twice its design capacity; projected to reach 714% capacity by 2050 |

Projected wait time at Eagle Pass | Expected to grow by over 7,000%, reaching 7-9 hours per vehicle by 2050 |

Rail infrastructure status | Existing single-track rail bridge built in 1922, nearing end of life |

Safety ranking | Eagle Pass / Piedras Negras is the safest U.S.-Mexico border crossing |

These statistics highlight the urgent need for new multimodal transport projects. Without continued investment, border crossing times and congestion will increase, threatening economic growth and job creation. By expanding rail, road, and port capacity, Mexico can reduce delays, support nearshoring, and strengthen its position in global trade.

JUSDA plays a vital role in this transformation. The company’s logistics solutions help businesses navigate complex cross-border regulations, manage risk, and optimize supply chains. Their presence in North America ensures reliable support for industries moving goods between Mexico and the United States.

JUSDA Solutions

To provide you with professional solutions and quotations.

Multimodal Transport Challenges

Infrastructure Gaps

Mexico faces several critical infrastructure gaps that hinder the effectiveness of multimodal transport. Deficiencies in physical infrastructure, especially in intermodal connectivity, slow down the movement of goods. Many logistics hubs lack the necessary links between rail, road, and port facilities. The digitalization of logistics remains in its early stages, which limits real-time tracking and efficient operations. Digital infrastructure gaps—such as limited coverage, high costs, and lack of access—reduce investor confidence and slow the adoption of modern logistics solutions.

Logistical deficiencies cost Mexico nearly $8.82 billion in 2023, about 4% of the country’s GDP.

Customs delays often exceed 20 days, severely impacting port traffic and supply chain efficiency.

The lack of synchronization between industry, logistics providers, and government agencies reduces the resilience of the entire system.

Notable deficits in intermodal transport capabilities and inefficient customs operations delay manufacturing exports.

Risks to growth include infrastructure shortfalls, talent shortages, and security challenges.

Impact on Competitiveness | |

|---|---|

Port Infrastructure | Reduces import/export delays, enhances supply chain flexibility, supports global trade routes |

Energy Infrastructure | Determines site viability, affects operating costs, critical for energy-intensive sectors |

Industrial Real Estate | Accelerates site readiness, reduces launch timelines, ensures compliance and infrastructure availability |

Transportation & Rail | Supports bulk and finished goods transport, enables multimodal logistics, reduces transportation costs |

Digital and Utility | Enables Industry 4.0, improves uptime and remote management, attracts technology-intensive manufacturers |

These gaps increase operational costs and cause delays. Transportation costs can represent over 40% of operational expenses for Latin American companies. Poor infrastructure leads to slower customs processes, higher storage fees, and operational uncertainty. Without improvements, Mexico risks losing competitiveness in global trade and nearshoring opportunities.

JUSDA addresses these challenges by investing in digital transformation, automation, and real-time tracking. Their JusLink platform provides end-to-end visibility and control, helping businesses overcome infrastructure limitations and streamline operations.

Regulatory Issues

Regulatory complexity presents another major challenge for multimodal transport providers in Mexico. Customs clearance for intermodal shipments often requires inland processing, which differs from the border clearance typical of road freight. Many shippers lack experience with these processes, leading to confusion and delays. Intermodal terminals act as regional hubs, not end-to-end delivery centers, so clients must plan for additional infrastructure and coordination.

Navigating customs regulations, documentation, tariffs, and trade restrictions is critical to avoid delays and fines.

Border delays result from inspections, high traffic, and security checks.

Security concerns, such as cargo theft, require investments in GPS tracking and secure packaging.

Trade policy changes, like the USMCA, introduce new rules that require businesses to adapt logistics strategies.

Documentation errors, traffic congestion, and regulatory compliance challenges further complicate cross-border operations.

JUSDA helps clients manage these regulatory hurdles by offering compliance support and adaptive routing. Their expertise in cross-border logistics, especially for hazardous materials, ensures that shipments meet all safety and documentation requirements. JUSDA’s quote management system and risk management tools provide transparency and help businesses stay ahead of regulatory changes.

Industry Fragmentation

Industry fragmentation remains a significant barrier to efficient multimodal transport in Mexico. The logistics sector includes many small and medium-sized providers, each with different systems and standards. This fragmentation leads to poor coordination, duplicated efforts, and inconsistent service quality. Lack of integration between supply chain partners makes it difficult to respond quickly to disruptions or changes in demand.

Coordination issues arise when rail, road, customs authorities, terminals, and customers do not collaborate effectively.

Many companies expect intermodal transport to function like traditional trucking, which leads to misunderstandings and inefficiencies.

The absence of scalable digital infrastructure and standardized processes limits the growth of integrated logistics solutions.

JUSDA addresses industry fragmentation by combining global reach with local expertise. The company tailors logistics solutions to the specific needs of each market, rather than using a one-size-fits-all approach. JUSDA’s JusLink Smart Supply Chain Management Platform offers end-to-end visibility, real-time tracking, and dynamic inventory management. Automation in warehousing reduces manual errors and increases productivity. By focusing on high-value industries such as electronics, automotive, and medical equipment, JUSDA ensures that clients receive customized, reliable service. Their customer-centric approach and advanced digital tools enable seamless coordination across fragmented supply chains.

Note: Overcoming these challenges requires ongoing investment, public-private partnerships, and the adoption of advanced technologies. Providers like JUSDA play a key role in building a more competitive and resilient multimodal transport system in Mexico.

Government Initiatives

Strategic Plans

Mexico’s government agencies, including the Secretariat of Infrastructure, Communications, and Transport (SICT) and the Regulatory Agency for Rail Transport (ARTF), have developed robust strategic plans to advance multimodal transport corridors. These plans focus on:

Strengthening ARTF’s regulatory and operational capacity to support both passenger and multimodal railway transport.

Consolidating policies and programs to create an efficient, safe, and sustainable intermodal network.

Granting ARTF new powers to propose and execute development policies, manage concessions, and coordinate with federal, state, and municipal authorities.

Integrating resources from the General Directorate of Railway and Multimodal Development into ARTF.

Coordinating with SICT and the Ministry of Finance to secure budget resources for 2025.

These steps aim to optimize railway mobility and foster a modern, competitive system that supports both freight and passenger needs.

Policy Reforms

Recent policy reforms have transformed the landscape for multimodal transport in Mexico. In April 2025, the Chamber of Deputies approved a comprehensive railway reform that modernizes five key legal frameworks. This reform designates railway transport as a national strategic priority and expands its focus to include passenger services. The creation of ATTRAPI, a decentralized agency under SICT, centralizes planning and oversight for railway infrastructure. The reform also strengthens regulatory oversight, ensuring safety, transparency, and legal compliance. These changes promote public and private investment, improve passenger mobility, and support regional integration.

A table below highlights how these reforms facilitate integration of passenger and freight systems:

Reform Element | Contribution to Integration of Passenger and Freight Systems |

|---|---|

Creation of ATTRAPI | Centralizes management of rail infrastructure, enabling unified oversight of passenger and freight |

Strengthened Regulatory Agency | Ensures compliance and promotes interconnectivity across services |

Passenger Rail as National Priority | Elevates importance, encouraging integration with freight under a unified vision |

New Legal and Operational Frameworks | Clarifies project execution, supporting coordinated development |

Insurance and Financial Guarantees | Enhances accountability and safety for all operations |

Mandated Agency Creation | Ensures timely implementation for integrated system development |

Sustainability Efforts

Mexico prioritizes sustainability in its multimodal transport sector. Agencies implement the 4R strategy—Reduce, Recycle, Reuse, Recover—to optimize resource use and minimize waste. Many logistics providers pursue environmental certifications such as ISO 14001 and Clean Industry Certification. Sustainable logistics practices include route optimization, load balancing, and the use of electric or hybrid vehicles to lower emissions. Technology, such as AI and carbon footprint calculation software, enhances operational efficiency. Companies also promote collective intelligence and city logistics to reduce urban pollution and traffic. These efforts drive long-term planning that balances ecological, social, and economic factors, ensuring resilience and competitiveness for the future.

Logistics Hubs and Technology

Industrial Parks

Mexico’s industrial parks are expanding rapidly to meet the demands of nearshoring and increased cross-border trade. States like Nuevo León, Estado de México, and Guanajuato host dozens of parks, with Monterrey leading the way. The country expects 50 new industrial parks to become operational by 2025. Industrial real estate inventory has grown by 10.9% year-over-year, especially in regions such as Bajio, Guadalajara, and Saltillo. Rising rental prices reflect strong demand and limited supply of high-quality space. Foreign direct investment exceeded $35 billion in 2023, driven by U.S. and Asian companies seeking proximity to the U.S. border. These parks support manufacturing, distribution, and logistics, strengthening Mexico’s position in Multimodal Transport.

Nearshoring continues to fuel the expansion of logistics hubs, attracting multinational corporations and boosting Mexico’s freight and logistics market, which is forecast to grow at 5.40% annually through 2033.

Automation and Digitalization

Warehouses and logistics centers in Mexico are adopting Industry 4.0 technologies to improve efficiency. Companies invest in cloud-based warehouse management systems, AI-powered automation, and robotics. Retailers like Dportenis use cloud solutions to optimize inventory and standardize processes. Symbotic’s partnership with Walmart Mexico brings AI-driven automation to large distribution centers. Cloud adoption in Latin America grows at over 30% each year, supporting digital transformation. Mexico leads the region in automated warehouse management, especially in automotive and electronics sectors. Government incentives and strategic partnerships help accelerate adoption, while AI and IoT improve supply chain resilience and visibility.

JusLink, JUSDA’s intelligent platform, acts as a control tower for supply chain operations. It integrates data from multiple providers, enables real-time tracking, and supports collaboration among partners. Automation reduces manual errors and increases productivity, making logistics more reliable and efficient.

JUSDA in North America

JUSDA in North America delivers tailored logistics solutions for industries such as electronics, automotive, and medical equipment. The company provides cross-border logistics, warehousing, and distribution, ensuring seamless integration and efficiency. JusLink offers end-to-end visibility and control using advanced technologies like RFID and warehouse management systems. JUSDA’s customer-centric approach focuses on high-value markets and rapid response times, especially along the US-Mexico border. The company manages supply chains from raw materials to finished products, supporting manufacturing cycles and addressing national security concerns with detailed supply chain visibility. JUSDA’s localization strategy includes cross-border VMI services and consolidation centers, enhancing competitiveness in Multimodal Transport.

Logistics Hub | Role | Significance |

|---|---|---|

Monterrey | Industrial center near U.S. border | Strategic node for nearshoring and manufacturing |

Mexico City | Financial and logistical hub | Facilitates domestic and international distribution |

Laredo, Texas | Largest inland port on U.S.-Mexico border | Major hub for cross-border trade |

Dallas-Fort Worth | Warehousing and logistics facilities | Supports domestic and international trade |

Kansas City | Central intermodal transportation hub | Connects Canada, U.S., and Mexico |

JUSDA’s expansion in North America strengthens supply chain collaboration and supports the growth of logistics hubs, making cross-border trade more efficient and resilient.

Future Prospects

Investment Trends

Mexico’s logistics sector attracts significant investment. Companies like Mainfreight expand operations in Guadalajara and Monterrey, strengthening cross-border and warehousing services. Nearshoring increases demand for storage solutions, shifting investment focus toward warehousing and automation. Sustainability drives new projects, with electric vehicle fleets, solar power, and carbon tracking becoming standard. Rail operators add double-stack railcars and electric locomotives to improve container transit. Private investors support digital freight platforms and smart warehousing. Strategic investments through 2026 emphasize climate mitigation, risk adaptation, and self-sufficiency. The sector expects growth beyond USD 130 billion by 2032, fueled by e-commerce, automotive logistics, and green freight corridors.

International trade and e-commerce growth drive infrastructure modernization.

Technology adoption includes real-time tracking, AI route optimization, and warehouse automation.

Regulatory stability from USMCA encourages logistics investments and regional freight flows.

Training programs and workforce development improve transport operations and safety.

Regional Integration

Mexico deepens regional integration through upgraded infrastructure and policy alignment. The Interoceanic Corridor connects Pacific and Atlantic coasts, enhancing multimodal connectivity and serving as an alternative to the Panama Canal. USMCA strengthens trilateral trade, positioning Mexico as a manufacturing hub linked to U.S. and Canadian supply chains. Chinese investments in ports and railways improve intermodal connections. Governments promote modal shifts toward rail and short-sea shipping, supporting green logistics. Advanced digital technologies, such as AI-powered transport management systems, enable real-time optimization and resilience. Strategic border crossings and inland hubs facilitate efficient redistribution, supporting regional integration and supply chain agility.

Long-Term Vision

Mexico’s long-term vision for Multimodal Transport centers on sustainability, technology, and collaboration. Infrastructure upgrades, digital transformation, and environmental policies shape a resilient logistics network. Companies like JUSDA lead innovation by providing intelligent supply chain solutions, real-time tracking, and risk management. Their JusLink platform supports end-to-end visibility and collaboration, helping businesses adapt to market changes. Mexico aims to become a global logistics leader by integrating green freight corridors, smart ports, and automated warehouses. Continued investment and public-private partnerships will drive competitiveness and support economic growth.

Mexico’s commitment to modernization and sustainability ensures a future where multimodal transport supports efficient, secure, and environmentally responsible trade.

Mexico demonstrates strong progress in Multimodal Transport development. Strategic coordination and technology adoption drive efficiency and growth. Providers like JUSDA deliver advanced logistics solutions that support business needs. Continued investment and innovation will shape the future of the sector.

Companies and policymakers should evaluate how these changes impact their operations and strategies.

FAQ

What is multimodal transport and why does it matter for Mexico?

Multimodal transport uses two or more types of transportation, such as rail, road, or sea, to move goods. This approach helps Mexico move products faster, lower costs, and connect better with global markets.

How does JUSDA support cross-border logistics between Mexico and the United States?

JUSDA provides real-time tracking, risk management, and compliance solutions. Their JusLink platform helps companies manage shipments, meet regulations, and reduce delays at border crossings.

What are the main challenges for multimodal transport in Mexico?

Mexico faces infrastructure gaps, regulatory complexity, and industry fragmentation. These issues can cause delays, higher costs, and less reliable service for businesses.

How does technology improve logistics in Mexico?

Technology like AI, cloud platforms, and real-time tracking makes logistics faster and more accurate. Companies use these tools to manage inventory, automate warehouses, and improve supply chain visibility.

Which industries benefit most from JUSDA’s logistics solutions?

Industry | Benefit Example |

|---|---|

Automotive | Faster parts delivery |

Electronics | Secure, real-time tracking |

Medical Devices | Reliable, compliant shipments |

FMCG | Efficient inventory management |

JUSDA tailors solutions for each sector, improving efficiency and reliability.

See Also

Revolutionizing Efficiency With Native Smart Transportation Systems

Discovering Cutting-Edge Transport Tech Transforming Supply Chains

Preparing For The Upcoming Transport Technology Revolution

Affordable Transportation Management Solutions That Save Your Budget

Comprehensive Insights Into Eco-Friendly Transport For Supply Chains