How to Navigate Customs Clearance in Mexico for International Shipments

Navigating customs clearance in Mexico demands preparation and attention to detail. Accurate documentation ensures your shipments comply with regulations, avoiding unnecessary delays. A proactive approach can significantly improve efficiency. For example:

Shipments prepared in advance often clear customs within 24-48 hours of arrival.

This reduces lead time and minimizes risks of extra costs.

By prioritizing compliance and organization, you save time and streamline the process, keeping your supply chain on track.

Key Takeaways

Fill out all needed papers correctly to prevent delays or fines.

Work with a reliable customs broker to follow rules and save time.

Keep up with customs rules and updates to avoid problems.

Check forms twice and use online tools to reduce mistakes.

Learn about tariff categories to stop errors that cause extra costs.

Understanding the Customs Clearance Process in Mexico

Key Steps in the Process

Navigating customs clearance in Mexico involves several critical steps. First, you must prepare all necessary documentation, including the Customs Declaration and the Document of Operations for Customs Clearance (DODA). These documents provide customs authorities with essential details about your shipment, such as its value, origin, and classification. Once your shipment arrives at the port or border, customs officials will review the paperwork and inspect the goods if needed.

If everything complies with regulations, customs will release your shipment. However, any discrepancies in documentation or misclassification of goods can lead to delays or penalties. Recent trends highlight the growing efficiency of customs processes in Mexico. For example:

There was a 14.8% increase in overall box traffic in Mexico's ports during the first eight months of 2024 compared to the same period in 2023.

Lazaro Cardenas experienced a 28.7% rise in container throughput from January to September 2024.

Mexico's maritime customs generated MXN 271.183 billion (USD 13.09 billion) in the first half of 2024, accounting for 48.9% of the total customs revenue.

These figures reflect the increasing demand for streamlined customs procedures, driven by trends like nearshoring and the adoption of innovative systems such as Previo en Orgen.

Role of Customs Brokers

Customs brokers play a vital role in ensuring smooth customs clearance in Mexico. They act as intermediaries between you and customs authorities, handling the complex paperwork and ensuring compliance with regulations. A trusted customs broker can help you classify your goods correctly, calculate duties and taxes, and avoid common pitfalls like documentation errors.

By working with a knowledgeable broker, you can save time and reduce the risk of delays. Their expertise becomes especially valuable when dealing with specialized goods or navigating changes in customs regulations. For businesses engaged in international trade, partnering with a reliable customs broker is not just a convenience—it’s a necessity.

Importance of Accurate Documentation

Accurate documentation is the cornerstone of efficient customs clearance in Mexico. Essential documents like the Complemento Carta Porte (CCP) and the DODA must be completed with precision. The CCP ensures compliance with transportation regulations, while the DODA provides critical details for customs processing.

Errors in documentation can lead to significant delays, financial penalties, or even shipment rejections. For instance, inaccuracies in the Customs Declaration can result in incorrect tariff assessments, causing unnecessary complications. Ensuring that all paperwork is accurate and complete minimizes these risks and facilitates a smoother clearance process.

Tip: Double-check all documents before submission to avoid costly mistakes. Investing time in accuracy upfront can save you from delays and penalties later.

Common Challenges in Customs Clearance in Mexico

Documentation Errors

Errors in documentation often create significant obstacles during customs clearance in Mexico. Missing or incorrect information in forms like the Customs Declaration or the Document of Operations for Customs Clearance (DODA) can lead to delays or penalties. For example, incomplete details about the shipment’s value or origin may trigger additional scrutiny. You should always double-check your paperwork to ensure accuracy.

Even small mistakes can have big consequences. Customs officials rely on precise documentation to classify goods and calculate duties. If the information doesn’t match, your shipment might face rejection or require costly corrections. To avoid these issues, you should invest time in reviewing all forms before submission.

Tip: Use digital tools or templates to streamline your documentation process. These can help you catch errors early and ensure compliance.

Delays in Inspection

Inspection delays are another common challenge. Customs officials may select shipments for detailed examination, which can extend the clearance process. The duration of inspections varies widely. Some shipments clear customs in a few days, while others face delays lasting several weeks.

Several factors contribute to these slowdowns:

Incomplete or incorrect documentation.

High volumes of shipments at busy ports.

Additional inspections for goods flagged as high-risk.

You can minimize inspection delays by ensuring your paperwork is complete and accurate. Working with a trusted customs broker also helps. Brokers can guide you through the process and reduce the likelihood of your shipment being flagged for extra scrutiny.

Misclassification of Goods

Misclassification of goods can lead to unexpected costs and delays. Customs officials use tariff codes to determine duties and taxes. If your goods are classified incorrectly, you may face higher fees or penalties. For example, labeling a product as “electronics” instead of “industrial equipment” could result in a different tax rate.

You should familiarize yourself with Mexico’s tariff classification system to avoid these issues. Customs brokers can assist with this process. Their expertise ensures your goods are categorized correctly, saving you time and money.

Note: Misclassification not only affects costs but can also delay the release of your shipment. Accurate classification is essential for smooth customs clearance in Mexico.

Tips for Smooth Customs Clearance in Mexico

Work with a Trusted Customs Broker

Partnering with a trusted customs broker can simplify the complexities of customs clearance in Mexico. Brokers have the expertise to navigate regulations, classify goods correctly, and calculate duties accurately. Their knowledge reduces the risk of errors that could delay your shipment.

A reliable broker also acts as your advocate, ensuring your shipment complies with all requirements. They stay informed about regulatory changes and help you adapt quickly. For instance, if new import taxes are introduced, your broker can guide you on how to adjust your documentation and processes.

Tip: Choose a broker with experience in your industry. Specialized knowledge ensures they understand the unique requirements of your goods.

Ensure Documentation Accuracy

Accurate documentation is essential for avoiding delays and penalties during customs clearance. You must ensure all forms, such as the Customs Declaration and the Document of Operations for Customs Clearance (DODA), are complete and error-free. Missing or incorrect information can lead to shipment rejections or additional inspections.

To maintain accuracy, double-check every detail, including the value, origin, and classification of your goods. Using digital tools or templates can help you streamline this process. These tools reduce the likelihood of human error and ensure consistency across all documents.

Note: Even minor mistakes, like a typo in the shipment value, can cause significant delays. Always review your paperwork carefully before submission.

Stay Updated on Regulations

Staying informed about customs regulations is critical for ensuring smooth operations. Changes in policies, such as the introduction of new taxes or import restrictions, can directly impact your shipments. For example:

The introduction of VAT collection on imported goods in Mexico highlights the need to stay informed about tax regulations to avoid delays.

Evolving regulations require businesses to adapt quickly to maintain compliance and efficiency.

Delays in obtaining required documents often result from a lack of awareness about updated rules.

By keeping up with these changes, you can avoid unnecessary complications. Subscribe to industry newsletters, attend trade seminars, or consult with your customs broker regularly. These proactive measures ensure you’re always prepared for new requirements.

Tip: Create a checklist of current regulations that apply to your shipments. Update it frequently to reflect any changes.

Timeframes for Customs Clearance in Mexico

Typical Processing Times

Understanding the typical processing times for customs clearance in Mexico helps you plan your shipments effectively. On average, customs clearance takes between 48 and 72 hours after your shipment arrives at the customs broker's facilities.

Key Timeframes:

Customs clearance duration: 48 to 72 hours.

Customs Clearance Duration | Expected Time |

|---|---|

Standard Processing Time | 48 to 72 hours |

These timeframes represent standard conditions. However, delays may occur due to factors like incomplete documentation or high shipment volumes.

Factors That Affect Clearance Speed

Several factors influence how quickly your shipment clears customs. These include the accuracy of your documentation, the type of goods being imported, and the efficiency of the customs broker handling your shipment.

Factor | Time (hours) | Cost (USD) |

|---|---|---|

Time to export: Border compliance | Varies | Varies |

Time to import: Border compliance | Varies | Varies |

Time to export: Documentary compliance | Varies | Varies |

Time to import: Documentary compliance | Varies | Varies |

You can reduce delays by ensuring your paperwork is complete and accurate. Partnering with an experienced customs broker also helps streamline the process.

Strategies to Expedite the Process

To expedite customs clearance in Mexico, you should adopt proven strategies. One effective approach involves leveraging technology solutions like electronic data interchange (EDI). These tools facilitate faster communication with customs authorities and minimize delays at border crossings.

Pro Tip: Logistics partners with advanced technology solutions, such as EDI, can significantly speed up customs clearance processes.

Additionally, staying informed about regulatory changes and maintaining accurate documentation ensures smoother processing. Working with a trusted customs broker further reduces the risk of delays.

Key Regulations for International Shipments to Mexico

Import Restrictions

Understanding import restrictions is crucial for ensuring smooth customs clearance in Mexico. Mexico enforces specific rules to regulate the flow of goods into the country. For instance:

Under the USMCA, shipments valued up to USD $50 are tax-free.

Duty-free shipments can be valued up to USD $117.

Express shipments below these thresholds avoid customs duties, provided they are not part of a series intended to bypass regulations.

These restrictions aim to streamline trade while preventing misuse. Staying informed about these limits helps you avoid unnecessary costs and delays.

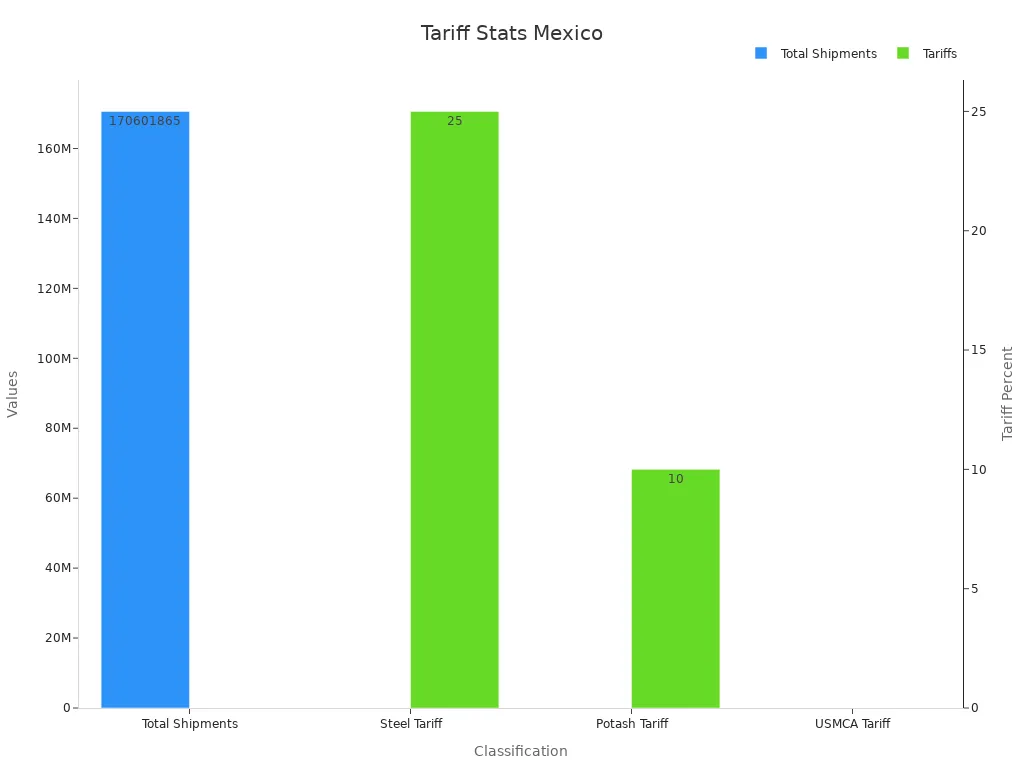

Tariff Classifications

Tariff classifications determine the duties and taxes applied to your goods. Mexico uses a structured system to categorize imports, and incorrect classification can lead to penalties or shipment delays. Here’s a snapshot of current tariff trends:

For goods qualifying under USMCA, no tariffs apply, making compliance with its rules of origin essential. Misclassification can result in higher tariffs, so working with a customs broker ensures accuracy.

Special Requirements for Certain Goods

Certain goods entering Mexico must meet additional requirements. Official Mexican Standards (NOMs) mandate a Conformity Assessment process for many products. Non-Tariff Restrictions, such as import licenses or permits, may also apply. For example:

Some goods require testing to meet safety or quality standards.

Admissibility requirements vary based on the commodity type, origin, and time of import.

These regulations frequently change, so staying updated is vital. Partnering with a knowledgeable customs broker can help you navigate these complexities and ensure compliance.

Tip: Always verify if your goods require NOM certification or special permits before shipping.

Preparation and compliance are the cornerstones of successful customs clearance in Mexico. By organizing your documentation and working with a trusted customs broker, you can avoid unnecessary delays and penalties. Reliable brokers ensure your shipments meet all regulatory requirements, reducing risks and saving time.

To streamline the process:

Ensure all documents, such as invoices and permits, are accurate and complete.

Familiarize yourself with HTS codes for proper classification of goods.

Check for special approvals required for regulated items.

According to Nate Barber, senior director of Mexico Services at Werner, "Compliance success hinges on building habits around proven templates and checklists. When team members make accurate documentation a routine part of their process, it becomes second nature, ensuring smooth cross-border shipping to and from Mexico."

Staying proactive and informed about regulations empowers you to navigate customs clearance efficiently. With the right preparation, you can keep your supply chain running smoothly and avoid costly disruptions.

FAQ

What documents are required for customs clearance in Mexico?

You need key documents like the Customs Declaration, Document of Operations for Customs Clearance (DODA), and Complemento Carta Porte (CCP). These provide shipment details, including value, origin, and classification. Missing any of these can delay the process.

Tip: Always double-check your documents for accuracy before submission.

Do I need a customs broker for shipments to Mexico?

Yes, a customs broker simplifies the process by handling paperwork, ensuring compliance, and avoiding errors. Their expertise is especially helpful for complex shipments or when regulations change.

Note: Choose a broker experienced in your industry for better results.

How can I avoid delays during customs inspections?

Ensure your documentation is accurate and complete. Misclassification or missing details often trigger inspections. Working with a trusted customs broker also reduces the likelihood of delays.

Pro Tip: Use digital tools to streamline your documentation process and minimize errors.

Are there special requirements for importing certain goods into Mexico?

Yes, some goods require additional permits, NOM certifications, or testing to meet safety standards. Examples include electronics, medical devices, and food products.

Reminder: Verify if your goods need special approvals before shipping to avoid penalties or rejections.

How do I classify goods correctly for customs in Mexico?

Use Mexico’s Harmonized Tariff System (HTS) to determine the correct tariff code. Misclassification can lead to higher duties or shipment delays. A customs broker can assist with accurate classification.

Emoji Tip: 🛠️ Familiarize yourself with HTS codes to save time and money.

See Also

Achieving Success in International Trade Through JUSDA

Mastering Lean Logistics for Success in Tech Manufacturing

Overcoming Automotive Supply Chain Challenges: Pro Insights