Business opportunities and challenges in e-commerce logistics

The e-commerce sector continues to transform rapidly, making e-commerce logistics a decisive factor for business success. Companies see vast opportunities as online shopping expands, with the global market projected to reach USD 3,721.53 billion by 2034.

Aspect | Data / Insight |

|---|---|

Market Size 2024 | USD 500.76 billion |

Market Size 2025 (projected) | USD 609.59 billion |

Market Size 2034 (projected) | USD 3,721.53 billion |

CAGR (2025-2034) | 22.3% |

Key Growth Drivers | Surge in online shopping, AI-powered route optimization, automated warehouses, autonomous delivery vehicles |

Impact on Logistics | Increased investment in technology and infrastructure to meet demand for fast, reliable delivery |

E-commerce logistics value elements—such as delivery speed, tracking, and flexible returns—directly influence customer satisfaction and loyalty. Understanding both opportunities and challenges helps businesses decide where to invest and how to prepare.

Key Takeaways

E-commerce logistics is growing fast worldwide, with Vietnam as a key market due to rising online shopping and digital adoption. Investing in technology and infrastructure helps businesses meet customer demands for fast, reliable delivery.

Advanced technologies like AI, IoT, robotics, and blockchain improve tracking, warehouse management, and delivery efficiency. Using digital platforms can reduce costs and speed up order fulfillment.

Challenges like limited infrastructure, costly last-mile delivery, and complex regulations require smart solutions. Companies that adopt technology, collaborate with partners, and focus on customer needs can succeed in Vietnam's competitive e-commerce market.

E-commerce Logistics Opportunities

Market Growth

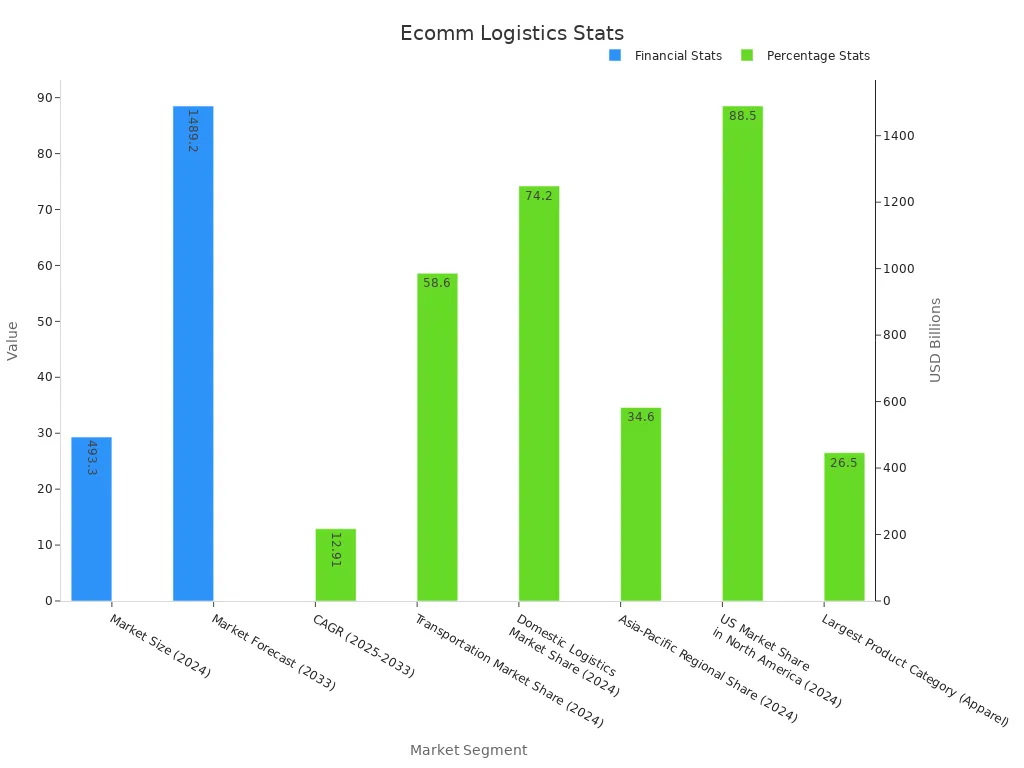

E-commerce logistics presents remarkable opportunities for businesses worldwide. The market has experienced rapid growth, driven by the surge in online shopping and the expansion of e-commerce platforms. In 2024, the global e-commerce logistics market reached USD 493.3 billion. Projections show it will climb to USD 1,489.2 billion by 2033, with a CAGR of 12.91%. Transportation holds a 58.6% market share, while domestic logistics accounts for 74.2%. The Asia-Pacific region, including the vietnam market, leads with a 34.6% share. Vietnam stands out as a key player due to its strong economic development and digital adoption.

The demand for faster delivery and flexible fulfillment solutions continues to rise. Companies invest in logistics infrastructure and technology to meet these expectations. The growth of e-commerce sales, especially in vietnam, creates new opportunities for logistics providers. JUSDA, as a global supply chain leader, supports this growth with advanced solutions and a strong presence in the vietnam market.

Statistic/Segment | Value/Description |

|---|---|

Market Size (2024) | USD 493.3 billion |

Market Forecast (2033) | USD 1,489.2 billion |

CAGR (2025-2033) | 12.91% |

Transportation Market Share (2024) | 58.6% |

Domestic Logistics Market Share (2024) | 74.2% |

Asia-Pacific Regional Share (2024) | 34.6% |

US Market Share in North America (2024) | 88.5% |

Largest Product Category (Apparel) | 26.5% |

Vietnam’s e-commerce logistics sector benefits from rising internet penetration and the popularity of e-commerce platforms. The country’s logistics services adapt quickly to changing consumer needs, making vietnam a hotspot for investment and innovation.

Technology Trends

Technology shapes the future of e-commerce logistics. Companies use IoT devices for real-time shipment tracking and environmental monitoring. AI and machine learning automate tasks, optimize routing, and improve warehouse management. Robotics and automation, such as AGVs and drones, boost warehouse efficiency and speed up last-mile delivery. Blockchain technology ensures secure, transparent tracking and supports smart contracts.

IoT devices provide real-time visibility across the supply chain.

AI-driven analytics predict demand and optimize inventory.

Robotics and automation reduce errors and increase productivity.

Blockchain and cloud computing enhance collaboration and data security.

Autonomous vehicles and drones transform transportation and delivery.

JUSDA leads the industry with its Supply Chain Management Collaboration Platform and JusLink. These platforms integrate IoT, AI, and cloud computing to deliver real-time insights and seamless collaboration. In the vietnam market, JUSDA’s digital solutions help businesses manage complex logistics networks and respond quickly to market changes.

The Sharp case demonstrates the power of technology and collaboration. Sharp partnered with JUSDA to optimize its global e-commerce logistics. By using JusLink and advanced automation, Sharp reduced logistics costs by 20%, cut labor costs by 70%, and improved order delivery times by 30%. This success story highlights how technology-driven logistics services create value and drive growth.

Cross-Border Expansion

Cross-border e-commerce opens new markets for businesses of all sizes. Platforms enable companies to reach global customers without a physical presence. Vietnam’s strategic location and growing digital economy make it a gateway for cross-border e-commerce in Southeast Asia. The cross-border e-commerce market reached $1.56 trillion in 2023 and is projected to hit $5.06 trillion by 2028, growing at a 26.4% CAGR. Cross-border sales grow 219% faster than overall e-commerce.

Aspect | Evidence |

|---|---|

Market Size 2023 | $1.56 trillion |

Projected Market Size 2028 | $5.06 trillion |

Compound Annual Growth Rate | 26.4% CAGR |

Growth Speed vs Overall E-commerce | Cross-border sales growing 219% faster than overall e-commerce |

Key Growth Drivers | Improved internet access, enhanced shipping networks, increasing mobile shopping |

Benefits of Marketplaces | Handle complex logistics, payments, and customer support, allowing businesses to focus on product and marketing |

Vietnam’s e-commerce logistics sector supports cross-border expansion by offering efficient customs clearance, advanced tracking, and reliable delivery. JUSDA’s platforms help businesses navigate regulatory differences and manage international shipments. The company’s expertise in the vietnam market ensures smooth cross-border operations and timely fulfillment.

Note: Cross-border e-commerce platforms in vietnam empower small businesses to expand globally, providing access to large buyer-seller networks and valuable market insights.

New Service Models

Innovative service models drive the next wave of growth in e-commerce logistics. Companies adopt overseas warehousing, direct mailing, and data-driven logistics to improve efficiency and reduce costs. In vietnam, these models help businesses meet rising consumer expectations for fast, accurate, and reliable delivery.

Overseas warehousing enables faster order fulfillment and reduces shipping times.

Direct mailing streamlines the delivery process and lowers costs.

Data-driven logistics optimize inventory management and route planning.

Personalized delivery services and real-time tracking enhance customer satisfaction.

Empirical studies show that new service models, such as those implemented in Guangdong province, China, accelerate transaction efficiency and reduce logistics costs. Quality dimensions like timeliness, accuracy, and communication influence customer loyalty and repeat business. Logistic regression models help companies segment customers, predict demand, and optimize inventory.

JUSDA’s value-added logistics services, including cloud warehousing and integrated digital platforms, support these new models. The company’s solutions in the vietnam market enable businesses to scale quickly and respond to changing market demands. The Sharp case illustrates how innovative service models, combined with technology, deliver measurable results in e-commerce logistics.

Tip: Businesses in vietnam can leverage JUSDA’s advanced logistics services to gain a competitive edge in the fast-growing e-commerce sector.

E-commerce Logistics Challenges

E-commerce logistics in vietnam faces a range of challenges that impact business growth and customer satisfaction. Companies must address infrastructure limits, last-mile delivery issues, cost pressures, and regulatory barriers to succeed in the competitive vietnam market.

Infrastructure Limits

Infrastructure remains a major obstacle for e-commerce logistics in vietnam and other emerging markets. Many regions lack modern road networks, efficient ports, and advanced logistics technology. In the Middle East, for example, poor infrastructure and fragmented regulations increase operational costs and slow down express delivery. Vietnam also experiences high demand for urban logistics space, but vacancy rates remain low. E-commerce requires three times more logistics space than traditional retail, putting pressure on warehouse availability.

E-commerce businesses need both large storage facilities and smaller last-mile urban warehouses.

Urban logistics space is scarce, making it difficult to support fast express delivery.

Warehouses must support automation and cross-docking to meet delivery expectations.

Governments may need to balance logistics growth with environmental and labor concerns.

Empirical studies in China show that logistics density boosts e-commerce transactions, but regional differences and lag effects slow growth. The vietnam market must invest in infrastructure upgrades and new technologies to keep pace with rising e-commerce demand.

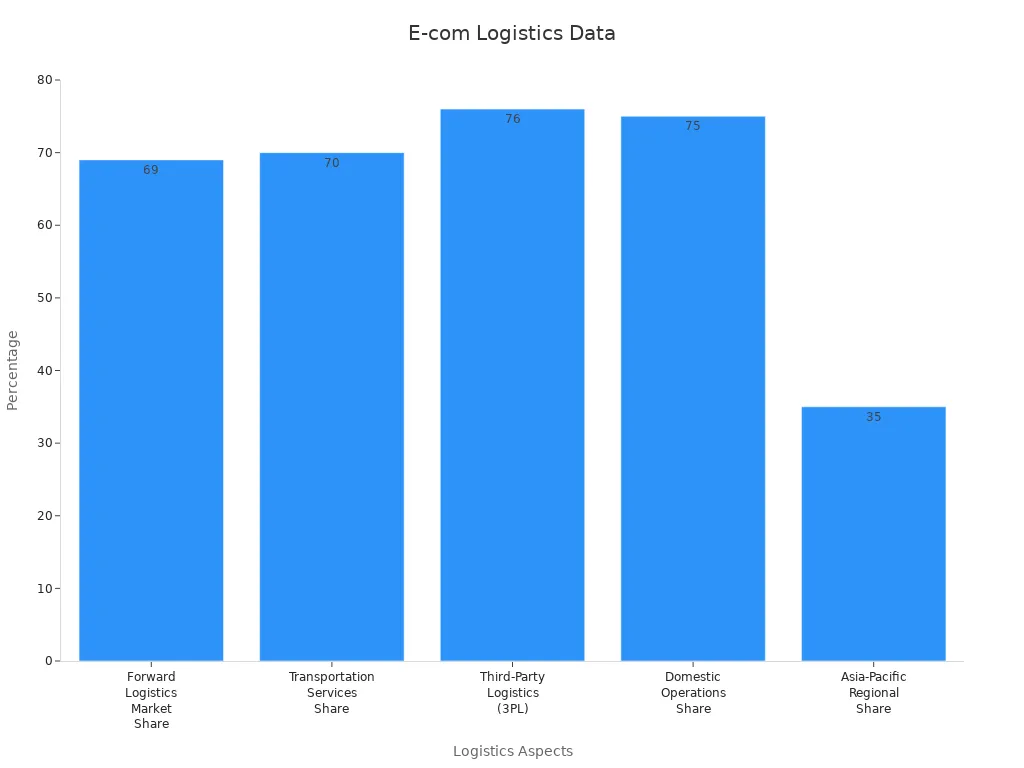

Aspect | Statistic / Insight | Explanation / Challenge Highlighted |

|---|---|---|

Forward Logistics Market Share | Dominates logistics, showing the scale of goods flow management. | |

Transportation Services Share | 70% | Critical for fast and reliable delivery, emphasizing cost and complexity. |

Third-Party Logistics (3PL) | 76% | Majority preference, indicating reliance on outsourcing for scalability and cost efficiency. |

Domestic Operations Share | 75% | Focus on local logistics, reflecting delivery speed demands. |

Asia-Pacific Regional Share | 35% | Leading region due to rapid e-commerce growth and infrastructure. |

Last-Mile Delivery Costs | High (no exact %) | Most expensive logistics segment, major cost challenge. |

Supply Chain Disruptions | Not quantified but emphasized | Includes pandemics and geopolitical issues causing delays and costs. |

Scalability Issues | Not quantified but emphasized | Difficulty in expanding logistics without quality loss. |

International Logistics | Complex due to customs, tariffs, regulations | Adds cost and time, complicating global e-commerce logistics. |

AI Impact | $1.3 to $2 trillion annual boost (McKinsey estimate) | Potential cost reduction and scalability improvement over 20 years. |

Last-Mile Delivery

Last-mile delivery stands out as the most expensive and complex part of e-commerce logistics. In vietnam, express delivery services must overcome traffic congestion, limited urban space, and high consumer expectations. Last-mile delivery accounts for 53% of total shipping costs, making it a major cost driver for express delivery companies.

Poor customer experience remains common, with a negative Net Promoter Score of -9 for delivery services.

Package damages and inefficient returns management increase costs and reduce customer loyalty.

Rigid workflows do not allow for flexible delivery locations or schedules.

Many express companies struggle with ground-level logistics visibility, causing delays and route inefficiencies.

High rates of first-attempt delivery failures lead to extra costs and lost sales.

Over half of consumers in vietnam find shipping and delivery times the most frustrating part of online shopping. Nearly two-thirds of last-mile delivery complaints involve shipping delays, missing items, or damaged packages. Inaccurate address data causes up to 25% of failed deliveries, yet only 47% of businesses see address accuracy as critical. Failed deliveries cost retailers $10-$17 per order and often drive customers to switch brands.

Tip: Companies in the vietnam market can improve last-mile delivery by investing in GPS tracking, real-time updates, and flexible express delivery options.

Cost Pressures

Cost pressures challenge every part of e-commerce logistics in vietnam. Express delivery companies must balance fast delivery with rising expenses for labor, fuel, and technology. A study of online sellers in Thailand shows that cost pressures directly affect customer satisfaction. Technology adoption helps reduce these pressures by improving efficiency and product condition. However, service quality and transportation time have less impact on cost control.

Technology plays a key role in lowering logistics costs and improving express delivery.

Maintaining product integrity during delivery is essential for customer satisfaction.

Companies must invest in automation and digital platforms to stay competitive in the vietnam market.

The Sharp case highlights how JUSDA’s technology-driven approach reduces costs. By using JusLink and advanced automation, Sharp cut logistics costs by 20% and labor costs by 70%. These improvements show the value of process optimization in managing cost pressures.

Regulatory Barriers

Regulatory barriers create additional complexity for e-commerce logistics, especially in cross-border express delivery. In vietnam, businesses face diverse customs regulations, tariffs, and documentation requirements. About 94% of companies experience delays in cross-border shipping due to incorrect item classification and paperwork. Customs rules and duties vary by country, increasing costs and slowing delivery.

Companies must comply with local laws on consumer rights, product standards, and data protection.

Customs clearance delays are common, raising costs and complicating logistics coordination.

Stricter data policies in some countries limit cross-border e-commerce exports, especially for high-tech products.

Research shows that regulatory compliance is time-consuming but essential to avoid penalties. The legal environment in the importing country can reduce the negative impact of strict data policies. JUSDA’s experience in the vietnam market helps businesses navigate these barriers with digital platforms and expert support.

Note: Companies that invest in compliance and digital documentation can reduce delays and improve express delivery performance in cross-border e-commerce.

JUSDA Solutions for E-commerce

Intelligent Platforms

JUSDA delivers advanced digital platforms that help businesses in vietnam manage complex e-commerce operations. The Supply Chain Management Collaboration Platform and JusLink use IoT, AI, and cloud computing to give real-time visibility across the entire supply chain. These platforms allow companies to track shipments, monitor inventory, and coordinate with partners instantly. Real-time data helps businesses respond quickly to changes in demand or supply. JUSDA’s technology supports e-commerce platforms by making fulfillment faster and more accurate.

Integrated Services

JUSDA offers integrated logistics services that combine transportation, warehousing, and customs management. This approach streamlines operations for companies in vietnam. Businesses benefit from centralized data, automated order processing, and real-time shipment tracking. Key systems like ERP, TMS, and WMS work together to improve planning, reduce errors, and speed up deliveries. Companies see lower costs and higher customer satisfaction. Automated inventory management and optimized transportation routes help businesses meet the fast-paced needs of e-commerce. JUSDA’s logistics services support both local and cross-border fulfillment, making it easier for businesses to grow on e-commerce platforms.

Customer Success Stories

Sharp, a leading electronics manufacturer, partnered with JUSDA to transform its global e-commerce logistics in vietnam. By using JusLink and integrated solutions, Sharp reduced logistics costs by 20% and labor costs by 70%. Order delivery times improved by 30%, and customer satisfaction increased. JUSDA’s ongoing support, consulting, and innovation help clients like Sharp stay competitive in the fast-changing e-commerce market. Many businesses in vietnam trust JUSDA to deliver reliable fulfillment and logistics solutions that drive growth.

Strategies for Success

Technology Adoption

Businesses in vietnam achieve success by investing in digital platforms and advanced technology. Strategic innovation and research drive e-commerce growth. Companies that adopt information and communication technology (ICT) improve productivity and reduce costs. Reliable internet connectivity and strong data management help businesses compete in express delivery. Many small and medium enterprises in vietnam face barriers like limited skilled workers and low R&D activity. Overcoming these challenges with technology adoption supports sustainable growth. Digital platforms enable real-time tracking, efficient order management, and rapid response to market changes. JUSDA’s intelligent supply chain solutions set a benchmark for technology-driven express delivery services.

Strategic innovation reduces production costs and boosts productivity.

ICT adoption and big data management are essential for e-commerce success.

Digital platforms improve collaboration, inventory management, and delivery speed.

Collaboration

Collaboration with logistics partners and technology providers strengthens operations in vietnam. Real-time inventory tracking and system integration reduce backorders and shorten fulfillment cycles. Automation technologies, such as barcode scanners, increase picking efficiency and reduce errors. Micro-fulfillment centers near high-volume delivery zones lower last-mile express delivery costs. JUSDA’s integrated services and partnerships help businesses in vietnam achieve high order accuracy and on-time delivery rates.

System integration enables real-time decision-making.

Automated returns processing improves customer satisfaction.

Service Level Agreements with partners drive continuous improvement.

Customer Focus

Customer-focused strategies drive loyalty and repeat business in vietnam. Fast shipping, real-time tracking, and easy returns build trust. Many shoppers in vietnam increase their purchase amounts to qualify for free shipping. High delivery accuracy and timely updates improve satisfaction. JUSDA’s express delivery solutions prioritize speed, transparency, and reliability. Companies that optimize logistics networks and train staff deliver better shopping experiences.

Tip: Regular customer feedback helps businesses adjust express delivery services and meet changing expectations.

Regulatory Readiness

Regulatory readiness protects businesses from costly delays in vietnam’s e-commerce market. Accurate shipment data, including tariff codes and declared values, prevents customs issues. Automated customs filing and real-time monitoring reduce risks of shipment seizures and penalties. JUSDA’s digital platforms automate compliance and provide real-time visibility. These strategies ensure express delivery shipments meet all regulatory requirements, supporting smooth cross-border operations and continued growth.

JUSDA Solutions

To provide you with professional solutions and quotations.

Vietnam offers strong growth in e-commerce sales, but companies face unique logistics challenges.

Amazon and Walmart adapt strategies for fast delivery in vietnam, raising customer expectations.

Many studies show vietnam needs efficient logistics for cost reduction and customer satisfaction.

Companies in vietnam should use technology, focus on efficiency, and partner with experts like JUSDA.

Vietnam’s market rewards those who balance risks and opportunities. Vietnam’s evolving logistics landscape demands innovation. Vietnam’s leaders invest in logistics technology. Vietnam’s businesses must monitor logistics trends. Vietnam’s consumers expect fast delivery. Vietnam’s cities require smart logistics solutions. Vietnam’s rural areas need better logistics. Vietnam’s cross-border trade depends on logistics. Vietnam’s government supports logistics upgrades. Vietnam’s startups drive logistics innovation. Vietnam’s retailers rely on logistics partners. Vietnam’s manufacturers optimize logistics networks. Vietnam’s exporters improve logistics processes. Vietnam’s importers streamline logistics. Vietnam’s future in logistics looks promising.