How to Rent a Warehouse Step by Step in 2025

If you want to rent a warehouse, you need to plan ahead and know your business needs. Careful planning and budgeting help you make smart choices and avoid costly mistakes.

Warehouse rents have climbed each year, reaching $7.21 per square foot in Q3 2018, the highest since 1989.

Rents have increased by an average of 5.6% each year since 2012.

Distribution costs can push up to 12% of companies into unprofitability.

You can use data and tools to make better decisions:

Key Takeaways

Plan your warehouse needs carefully by assessing space, location, and budget to avoid costly mistakes.

Use online listings and real estate agents to find and shortlist warehouses that fit your business requirements.

Evaluate each warehouse’s suitability by checking key performance indicators and ensuring compliance with safety rules.

Understand different lease types and costs to negotiate terms that protect your budget and business flexibility.

Prepare a clear Letter of Intent and use digital tools to speed up signing and move-in for a smooth start.

Plan Your Needs

Space and Features

You need to start by figuring out how much space your business requires. Think about the number of employees, the type of goods you store, and the equipment you use. Most businesses plan for 150–175 square feet per person. You should also look at features like ceiling height, loading docks, and security systems.

Key features to measure include:

System uptime for continuous operation

Bin presentation per port per hour for efficiency

Modern warehouses use tools like Unify Analytics to turn complex data into easy-to-read dashboards. These tools help you track system uptime and bin presentation rates. You can use this information to boost productivity and make sure your warehouse meets your business goals. Traditional KPIs such as inventory accuracy and order picking accuracy are still important. Many companies now add automation and AI-driven analytics to improve layout and throughput.

Tip: Set clear goals for each metric and review them often. Use dashboards to keep everyone on your team informed.

Location

Choosing the right location can make a big difference in your business success. You should look at rent rates, taxes, and how close you are to highways, airports, and ports. Check if the area has enough skilled workers and what the local labor costs are.

Important factors to consider:

Accessibility to transportation

Proximity to suppliers and customers

Local weather risks and traffic conditions

Demographics like education and income levels

Many businesses use decision-making tools to compare locations. These tools help you weigh things like tax incentives, labor force, and transportation quality. Picking the right spot helps you save money and serve your customers better.

Budget

Setting a realistic budget is key when you rent a warehouse. Costs can vary based on location, lease terms, and market demand. Here is a quick look at what affects your budget:

Factor | Impact | Considerations |

|---|---|---|

Location | Up to 15% premium in rental costs | Proximity to highways, ports, and urban centers |

Lease Agreement Terms | Annual escalations of 3% to 5% | Fixed vs. variable rates; flexibility in scaling |

Influences incremental cost escalations | Monitor local industrial trends |

Most warehouse rentals cost between $10 and $20 per square foot each year. Lease expenses can take up to 30% of your total operating costs. You should research market rates, negotiate lease terms, and consider flexible lease durations. Using AI inventory management and real-time analytics can help you control costs and get better deals.

Search and Shortlist

Online Listings

You can start your search for a warehouse by exploring online listings. Many websites let you filter by size, location, and price. These platforms often show photos, floor plans, and key features. You can compare several options quickly. This step helps you create a shortlist before you visit in person.

Tip: Use filters to narrow down choices and save time. Look for listings that match your business needs and budget.

Real Estate Agents

Working with a real estate agent can make your search easier. Agents know the local market and have access to more listings than you might find online. They help you find properties that fit your needs and guide you through the process to rent a warehouse.

Agents track important metrics:

Listing to meeting ratio shows how well they connect buyers with properties.

Average commission per sale reflects their experience.

Days on market tells you how quickly properties move.

Client feedback ratings show how satisfied other clients feel.

About 89% of buyers use an agent, and 75% of sellers would use their agent again. Agents often help you get fair prices and negotiate better terms.

Site Visits

After you create a shortlist, you should visit each warehouse in person. Walk through the space and check if it meets your needs.

During your visit, pay attention to:

Months on hand, which shows how long inventory stays in the warehouse.

Dwell time, or how long goods sit idle. High dwell time can mean slow operations.

Trailer utilization rate, which affects how quickly you can load and unload goods. These checks help you see if the warehouse supports your business goals. Take notes and compare each site before making a decision.

Evaluate and Inspect

Suitability

You need to make sure the warehouse fits your business operations. Start by checking if the space supports your daily tasks. Look at how goods move in and out, how inventory is stored, and how orders are picked and shipped. Use key performance indicators (KPIs) to measure if the warehouse meets your needs.

Warehouse Function | |

|---|---|

Receiving | Dock utilization, receiving time per unit, receiving accuracy, cost of receiving per line, receiving efficiency, receiving cycle time |

Put-away | Put-away time, put-away accuracy, put-away utilization |

Storage | Inventory accuracy, space utilization, carrying costs |

Picking | Pick accuracy, pick rate, travel distance per pick |

Distribution | Order fulfillment rate, on-time delivery, order cycle time |

Reverse Logistics | Return processing time, return rate, disposition accuracy |

Employee Safety | Accident/incident rate, near-miss incidents, safety training completion rates |

Labor Productivity | Units per hour, cost per unit handled, labor utilization rate |

Equipment & Maintenance | Downtime, maintenance cost per asset, mean time between failures (MTBF) |

Sustainability & Energy | Energy consumption, waste reduction, CO₂ emissions per unit shipped |

You can use these steps to check suitability:

Measure receiving efficiency by tracking how fast and accurately goods arrive.

Check put-away time to see how quickly items move to storage.

Review order picking accuracy to avoid mistakes.

Track order cycle time to ensure fast delivery.

Calculate inventory turnover to see how often you sell and replace stock.

Tip: Use warehouse management software to monitor these KPIs in real time. This helps you spot problems early and keep operations smooth.

Compliance

You must also confirm that the warehouse follows all safety and legal rules. Warehouses need to meet federal, state, and local regulations. Regular inspections help you find and fix hazards before they cause harm.

Aspect | Details |

|---|---|

Program Name | OSHA Warehouse Distribution Operations (WDO) National Emphasis Program (NEP) |

Effective Date | July 13, 2023 |

Main Objectives | Risk identification, outreach, compliance inspections |

Inspection Process | Site selection, scheduled cycles, OSHA procedures, outreach programs |

Data Collected | Employers covered, workers removed from hazards, abatement measures, violations |

Covered Industries | Warehousing and storage NAICS codes (e.g., 493110, 493120) |

Programmed inspections target high-risk warehouses based on injury rates.

Unprogrammed inspections respond to urgent dangers or worker complaints.

Inspections may result in citations, corrective actions, or removal of workers from unsafe areas.

Warehouses must keep clear safety programs, train employees, and document all incidents.

Note: Using technology like IoT sensors and compliance software can help you track safety and stay up to date with regulations.

Lease Terms

Lease Types

When you rent a warehouse, you need to understand the different types of leases. Each lease type changes what you pay for and what the landlord covers. Here are some common lease types you might see:

Gross Lease: You pay a fixed rent. The landlord pays for property taxes, insurance, utilities, maintenance, and repairs. This lease gives you predictable costs each month.

Modified Gross Lease: You pay base rent plus some shared expenses. For example, you might pay for utilities or any costs above a set amount. This lease lets you and the landlord split costs in a way that fits your needs.

Net Lease: You pay rent plus some or all operating expenses. There are three main types:

Single Net (N): You pay property taxes.

Double Net (NN): You pay property taxes and insurance.

Triple Net (NNN): You pay property taxes, insurance, and maintenance.

Absolute Net Lease: You pay all expenses, even major repairs. The landlord has no financial duties.

Percentage Lease: You pay base rent plus a percentage of your sales. This lease is more common in retail but can appear in some warehouse deals.

Ground Lease: You lease the land and may build on it. After the lease ends, any buildings usually go to the landlord.

Synthetic Lease: A separate company buys the property and leases it back to you. This can help with accounting and taxes.

Here is a table to help you compare these lease types:

Lease Type | Expense Responsibility | Example/Details |

|---|---|---|

Gross Lease | Tenant pays fixed rent; landlord covers property taxes, insurance, utilities, maintenance, repairs. | Full-service gross lease: landlord covers all operating expenses; tenant has predictable monthly costs. |

Modified Gross Lease | Tenant pays base rent plus some operating expenses shared or capped; landlord and tenant share costs. | Tenant pays utilities or expenses above a base year; e.g., landlord covers property taxes and insurance, tenant covers maintenance and utilities. |

Net Lease | Tenant pays rent plus all or some operating expenses (taxes, insurance, maintenance, utilities). | Triple Net (NNN): tenant pays property taxes, insurance, maintenance; Double Net (NN): tenant pays taxes and insurance, landlord pays maintenance; Single Net (N): tenant pays property taxes only. |

Absolute Net Lease | Tenant pays all expenses including major repairs; landlord has no financial obligations. | Tenant responsible for all building costs as if owning the property without purchase. |

Percentage Lease | Tenant pays base rent plus a percentage of gross sales over a threshold. | Common in retail; landlord benefits from tenant's business success; requires tenant sales reporting and audits. |

Modified gross leases give you flexibility. For example, if your base rent is $10,000 per month and operating expenses are $5,000 per month, you might pay half of those expenses. Your total rent would be $12,500. You can set expense sharing as a fixed percentage, a cap, or a base year stop. This helps you balance cost predictability with shared responsibility.

You should always check which costs you must pay. Some leases make you pay for repairs, utilities, or even property taxes. Others include these costs in your rent. A 2025 study in Korea showed that tenant responsibilities and cost burdens can shift when new policies or lease types appear. For example, mixed leases with both deposits and monthly payments have become more common, and average rents have risen by 17.7% in some areas.

Tip: Always read your lease carefully. Ask the landlord to explain any costs you do not understand.

Costs and Fees

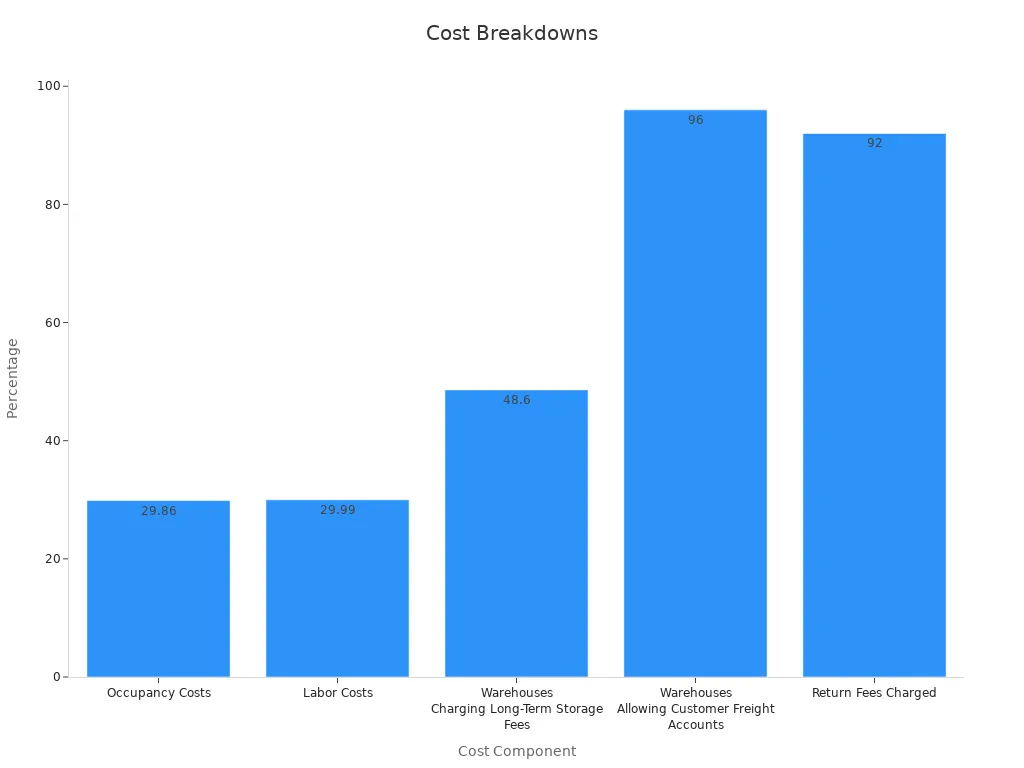

When you rent a warehouse, you need to know all the costs and fees. These can add up quickly and affect your budget. Here is a table showing the latest cost breakdowns for warehouse leasing in 2025:

Cost/Fee Component | Percentage or Fee Detail (Recent Data) |

|---|---|

Occupancy Costs | Approximately 29.86% of total revenues (2025) |

Labor Costs | Approximately 29.99% of total revenues (2025) |

Corporate Profit Percentage | Around 9.27% to 11% over recent years |

Minimum Monthly Spend | Increased from $337.50 (2024) to $517 (2025) |

Warehouses Charging Long-Term Storage Fees | 48.6% in 2025, up from 23.33% in 2024; fees $5-$10 per pallet/month |

Storage Costs per Cubic Foot | Decreased from $0.55 to $0.46 |

Bin Storage Costs | Increased from $2.67 to $3.08 |

Square Foot Storage Costs | Increased from $1.22 to $1.73 |

Receiving Costs per Pallet | Decreased from $12.91 to $10.52 |

Per-Container Receiving Costs | Increased from $350 to $500 |

B2C Pick and Pack Rates | Slight increase from $3.18 to $3.20 |

B2B Pick and Pack Rates | Slight increase from $4.79 to $4.80 |

Warehouses Allowing Customer Freight Accounts | Increased from 83% to 96% |

Return Fees Charged | Increased from 79.33% to 92%; average fee rose from $3.95 to $4.06 |

You should look at more than just the base rent. Many warehouses now charge long-term storage fees, which have nearly doubled in the past year. Storage costs per square foot and bin storage costs have also gone up. Receiving costs per pallet have dropped, but per-container costs have increased. Return fees are now charged by over 90% of warehouses.

You also need to review how rent increases work. Some leases have fixed increases each year. Others use an index, like the Consumer Price Index (CPI), to adjust rent. Renewal options can help you lock in your space for longer, but you must check the terms. Some leases let you renew at a set price, while others require new negotiations. Maintenance duties can also change. You might need to handle small repairs, like changing lightbulbs or filters, while the landlord covers big repairs.

Here is a quick comparison:

Factor | Leasing | Renting |

|---|---|---|

Renewal Options | Requires renegotiation or vacating at term end | Often automatic renewal unless notice given |

Rent Increases | May include fixed or indexed increases during renewal | Typically subject to periodic adjustments, often monthly |

Maintenance Responsibilities | Tenant may handle minor tasks (e.g., HVAC filters, lightbulbs) | Usually landlord responsible for major repairs |

A renewal option clause should clearly state how long you can renew, how much notice you must give, and how rent will change. Some leases use fixed increases, while others use market rates. You should always get these details in writing to avoid disputes.

Note: Renewal options and rent increases can protect you from sudden price jumps. They also help you plan for the future.

Letter of Intent

Before you sign a lease, you should use a Letter of Intent (LOI). This document sets out the main business terms before you start the legal paperwork. The LOI helps you and the landlord agree on key points early. This makes the rest of the process smoother.

The LOI lets you set clear expectations for rent, lease length, and other terms.

You can use the LOI to ask for special terms, like exit options or expansion rights.

Tenant representatives often use their market knowledge to help you get better terms.

The LOI helps you manage risks by making sure both sides understand the deal.

You can use the LOI to secure terms that fit your business needs before you spend money on legal fees.

Tip: Always review the LOI with your team or a legal expert. Make sure it covers all important points before moving forward.

A strong LOI can save you time and money. It helps you avoid surprises and makes it easier to rent a warehouse that fits your needs.

You can rent a warehouse successfully by following each step: plan your needs, search and shortlist, evaluate, negotiate, and move in. Stay alert during every stage.

Check all lease details before signing.

Track your costs and warehouse performance.

Ask experts for help if you feel unsure.

Tip: Visit industry forums or connect with local real estate groups for more advice and support.

FAQ

Can you negotiate the rent or fees?

Yes, you can negotiate rent, fees, and lease terms. Research local rates and prepare your requests. Landlords often agree to lower costs or better terms if you show you are a reliable tenant.

What happens if you need to leave early?

If you break your lease early, you may pay a penalty or lose your deposit. Some leases offer early exit clauses. Always read your lease and ask about early termination before you sign.

Do you need insurance for a warehouse lease?

Yes, you need insurance. Most landlords require general liability and property insurance. Insurance protects your goods and covers accidents. Ask your landlord which policies you must have.

See Also

The Importance Of Automating Your Warehouse Operations

How Robotics Enhance Efficiency In Modern Warehousing

Advantages Of Advanced Automation In Manufacturing Warehouses

Inside JUSDA’s Latest Warehouse Facilities Driving Efficiency

Boosting Warehouse Productivity Through Logistics Robotics Technology