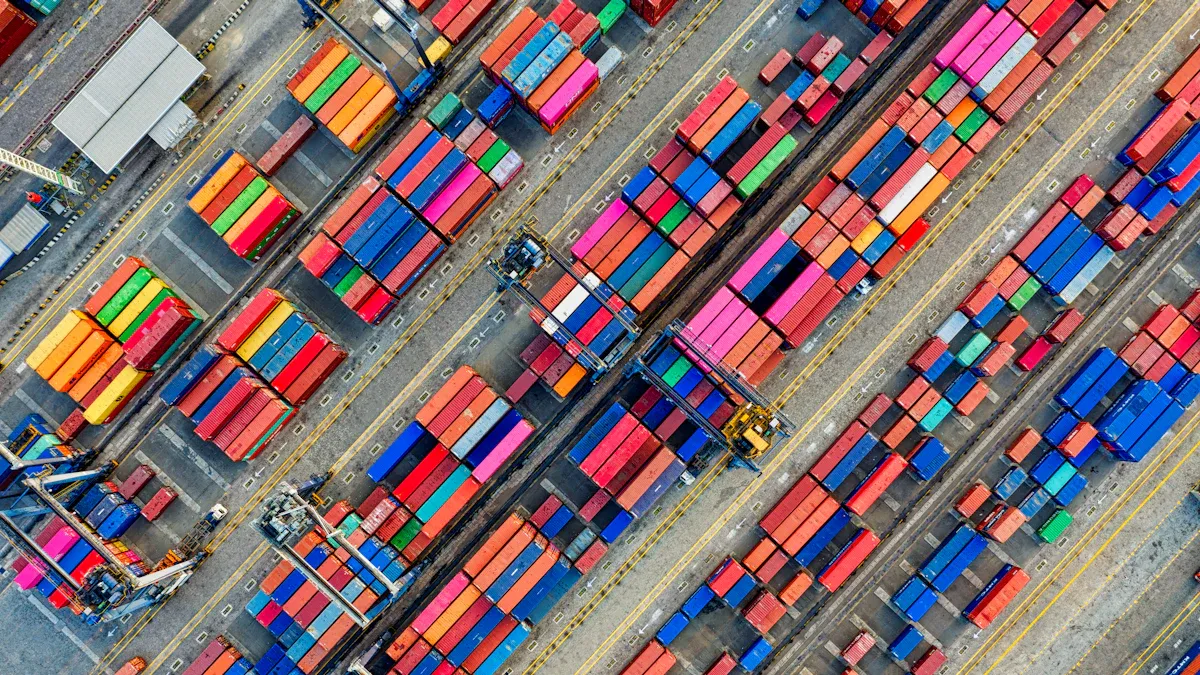

The Impact of Trade Policies on Global Manufacturing and Supply Chain Realignment

Trade policies play a pivotal role in shaping global manufacturing and supply chains. Recent shifts, including new tariffs on imports from China and other regions, highlight their transformative impact. Industries like automotive and technology face rising costs due to these tariffs, which also disrupt long-standing supplier relationships. Manufacturers must adapt swiftly to avoid operational setbacks.

Procurious warns that retaliatory tariffs in other regions could further exacerbate challenges, creating a ripple effect across supply chains.

The urgency for businesses to realign strategies has never been greater. Companies that embrace innovation and diversification will thrive in this evolving landscape.

Understanding the Current Trade Policy Landscape

Geopolitical Tensions and Their Influence on Trade Policies

Geopolitical tensions have become a critical factor influencing trade policies. These tensions often lead to shifts in trade patterns and increased economic fragmentation. For example, the correlation between geopolitical distance and U.S. exports reveals a negative impact on trade. Technology exports, such as royalty payments, also show a strong negative correlation with geopolitical distance. These findings highlight the challenges businesses face when navigating trade in a fragmented global economy.

Measure | Correlation with Geopolitical Distance |

|---|---|

Dollar value of U.S. goods exports to population ratio | -0.40 |

Technology exports (royalty payments) | Strong negative correlation |

The Role of International Trade Agreements

International trade agreements play a vital role in shaping global trade dynamics. These agreements promote efficiency among domestic producers, encourage innovation, and introduce new products to the market. They also contribute to economic growth, as seen in GDP improvements. However, challenges arise when increased imports negatively affect domestic production and employment. Companies must adapt to these changes by leveraging the dynamic benefits of trade, such as improved efficiency and competitiveness.

Access to detailed statistics and market intelligence enhances understanding of trade agreements. Monthly import and export data from over 115 countries provide valuable insights into trade dynamics. Expert guidance further simplifies the complexities of navigating international trade, enabling businesses to make informed decisions.

The Impact of Trade Policies on Global Manufacturing

Effects on Major Industries (e.g., Automotive, Electronics, Textiles)

Trade policies have reshaped the landscape of major industries, including automotive, electronics, and textiles. Recent tariff increases have placed significant financial burdens on these sectors. The average effective tariff rates (AETR) have risen from 7.1% to 10.4%, with manufacturing industries bearing the brunt. For instance, fabricated metal products now face tariffs exceeding 30%, while textiles and apparel experience steep increases due to their reliance on imports from China. The automotive sector has also been heavily impacted, with transportation equipment subjected to tariffs above 25%. These changes highlight the growing challenges for industries dependent on global supply chains.

📊 Did you know? Textiles and electrical equipment now face tariff rates between 18-22%, further complicating production and pricing strategies.

Shifts in Manufacturing Hubs and Regional Dynamics

Trade policies have also driven shifts in manufacturing hubs and regional dynamics. Countries are increasingly focusing on regional trade relationships to mitigate the impact of tariffs and geopolitical tensions. For example:

Findings | Implications |

|---|---|

Intra-regional forward linkages in South America have increased. | Strengthens regional trade relationships. |

Re-orientation towards Asia, with China and the U.S. as hub-nations. | Reflects a shift in manufacturing focus. |

Brazil is emerging as a regional hub. | Highlights Brazil's strategic role in manufacturing. |

Brazil's domestic market has positioned it as a key player in South America. Meanwhile, Asia continues to dominate as a manufacturing powerhouse, with China and the U.S. acting as central hubs. These shifts underline the evolving nature of global manufacturing.

The Influence of Tariffs and Trade Barriers on Production

Tariffs and trade barriers significantly influence production levels across industries. Higher tariffs raise prices, reduce the availability of goods, and lower economic output. While they offer short-term protection for domestic industries, they often disadvantage consumers and create inefficiencies. For instance:

Evidence Description | Impact on Production Levels |

|---|---|

Results in lower income and reduced employment. | |

Short-term protection for domestic industries. | Leads to inefficiencies and disadvantages consumers. |

Regressive nature of tariffs. | Burdens lower-income consumers and slows economic growth. |

These barriers disrupt supply chains, forcing companies to reevaluate sourcing strategies and production locations. Despite these challenges, trade liberalization has historically led to higher income levels and greater consumer choice, emphasizing the need for balanced trade policies.

Supply Chain Realignment Driven by Trade Policies

Nearshoring and Regionalization Trends

Nearshoring and regionalization have gained momentum as businesses adapt to evolving trade policies. Companies are shifting production closer to their primary markets to reduce risks and improve supply chain resilience. For example, sourcing patterns now favor Vietnam and Mexico over China. This shift reflects a broader trend of regionalization, supported by government incentives in industries like automotive and alternative energy.

Key Findings | Description |

|---|---|

Shift in Sourcing Patterns | Movement away from China towards Vietnam and Mexico. |

Government Incentives | Policies encouraging regionalization in critical industries. |

Decline in China’s Share | China’s share of U.S. imports dropped from 21.6% in 2017 to 16.5% in 2022. |

Growth of Vietnam and Mexico | Vietnam excels in electronics and textiles, while Mexico leads in auto parts. |

📈 Apple’s supply chain diversification highlights this trend. Vietnam and India have emerged as key locations, with a fourfold increase in Apple products assembled outside China. Foxconn’s investment in Vietnam further underscores the regionalization movement.

Diversification Strategies to Mitigate Risks

Diversification has become a cornerstone of supply chain strategies. By spreading procurement across multiple regions, companies reduce their exposure to political instability and trade restrictions. Approximately 75% of firms now prioritize supplier diversification to enhance flexibility and responsiveness. This approach has proven more effective than maintaining large inventories, as evidenced by a reduction in average inventory levels from 10.2 weeks in 2022 to 8.6 weeks in 2024.

42% of executives believe diversification improves supply chain resilience better than inventory-building.

37% of firms consider both strategies equally effective, while only 20% favor inventory-building alone.

Supplier diversification not only mitigates risks but also fosters leaner operations, enabling businesses to adapt swiftly to market changes.

Emerging Manufacturing Hubs (e.g., Southeast Asia, Eastern Europe)

Emerging manufacturing hubs are reshaping the global industrial landscape. Southeast Asia, particularly Vietnam, Thailand, and Indonesia, has seen significant growth in sectors like electronics, textiles, and automotive. Vietnam, for instance, benefits from competitive labor costs and free trade agreements, attracting major companies like Samsung and Nike. However, challenges such as limited infrastructure persist.

In Eastern Europe, countries like Poland, Hungary, and Romania are gaining traction. These regions offer skilled labor and integration with the EU market, making them attractive for industries like automotive and electronics. Companies such as BMW and Bosch have already invested heavily in these areas.

Vietnam: Electronics, textiles, and footwear dominate.

India: Pharmaceuticals and IT are key sectors, supported by government initiatives.

Eastern Europe: Strong industrial sectors align with Southeast Asia’s growing consumer base.

The reconfiguration of global value chains demonstrates how trade policies drive adaptive strategies. Firms adjust their operations to ensure long-term competitiveness, leveraging the strengths of emerging hubs.

Challenges in Adapting to Trade Policy Changes

Visibility and Transparency in Complex Supply Chains

Modern supply chains span multiple countries, making visibility and transparency critical for effective management. Companies increasingly prioritize transparency to share information with trading partners and consumers. This approach enhances compliance, reduces risks, and improves operational efficiency. Regulatory frameworks, such as California's Transparency in Supply Chains Act, require businesses to disclose supply chain details to combat unethical practices like forced labor. Similarly, the Drug Quality and Security Act mandates electronic systems to trace prescription drugs, ensuring accountability.

To address these challenges, businesses leverage advanced technologies like blockchain, artificial intelligence, and analytics. These tools improve data management and enable real-time tracking across complex supply chains. Accurate data collection from suppliers remains essential for achieving transparency and meeting compliance standards. Companies that adopt these practices benefit from enhanced brand loyalty and streamlined operations.

Resource Scarcity and Rising Costs

Shifting trade policies have exacerbated resource scarcity and increased costs for manufacturers. Tariffs function as an added tax on imports, raising the prices of materials and products sourced from affected countries. This financial burden forces businesses to reevaluate their sourcing strategies and adapt quickly to changing conditions. Rising import costs often lead to logistical challenges, tighter margins, and disruptions in production schedules.

For example, manufacturers dependent on global supply chains face significant hurdles when tariffs inflate the cost of raw materials. These challenges compel companies to explore alternative suppliers or invest in nearshoring to mitigate risks. However, such adjustments require time and resources, further straining operational budgets. Businesses must balance cost management with maintaining supply chain resilience.

Geopolitical and Economic Risks

Geopolitical tensions have reshaped global trade dynamics, introducing new risks for businesses. The redistribution of trade flows reflects the growing influence of geopolitical distance as a barrier. The concept of "friend-shoring" has emerged, where countries prioritize trade relationships with politically aligned partners. This shift underscores the increasing role of geopolitics in shaping economic decisions.

Trade restrictions have surged, tripling since 2019, as highlighted by the BlackRock Geopolitical Risk Indicator. Events like the US-China tariff war and Russia’s invasion of Ukraine have intensified these restrictions, disrupting global trade. The geopolitical risk index spiked in 2022, reflecting heightened concerns among businesses. Private sector mentions of trade fragmentation in corporate earnings calls have also increased, signaling widespread apprehension. Companies must navigate these risks by diversifying trade relationships and adopting flexible strategies to ensure stability.

Strategies for Navigating Trade Policy Shifts

Leveraging Technology for Supply Chain Optimization

Technology plays a critical role in optimizing supply chains under evolving trade policies. Advanced tools like artificial intelligence (AI), the Internet of Things (IoT), and blockchain enhance visibility, efficiency, and resilience. AI and IoT enable predictive analytics and real-time monitoring, allowing businesses to anticipate disruptions and respond swiftly. Blockchain technology improves traceability by creating tamper-proof records, which is essential for combating fraud and ensuring compliance.

Companies also benefit from real-time visibility tools that monitor global shipments and streamline documentation management. These technologies support regulatory adherence and reduce delays caused by trade policy changes. For example, advanced analytics optimize sourcing, transportation, and warehousing strategies, ensuring cost-effective operations. By integrating these innovations, businesses can navigate trade complexities with greater agility and precision.

Strategic Sourcing and Supplier Diversification

Strategic sourcing and supplier diversification have become essential for mitigating risks in global supply chains. Companies reduce reliance on single suppliers by spreading procurement across multiple regions. This approach enhances flexibility and minimizes exposure to geopolitical tensions or trade restrictions.

Several organizations have successfully implemented these strategies. Toyota focuses on building enduring partnerships and flexible sourcing, resulting in stronger supplier relationships. L’Oréal evaluates 97% of its strategic suppliers based on environmental and social performance, aligning sourcing with sustainability goals. IKEA combines local sourcing with community engagement, tailoring products to regional markets while investing in workforce development. These examples highlight how diversification fosters resilience and innovation.

Company | Strategy Description | Key Outcomes |

|---|---|---|

Toyota | Building enduring partnerships and flexible sourcing strategies. | Enhanced efficiency and stronger supplier relationships. |

L’Oréal | Evaluating suppliers based on sustainability and ethical principles. | 97% of strategic suppliers assessed for environmental and social performance. |

IKEA | Local sourcing with sustainability and community engagement. | Tailored products and investment in local workforce development. |

Building Resilience Through Risk Management

Resilience in supply chains requires a proactive approach to risk management. Companies must assess vulnerabilities, share critical information with partners, and foster collaboration. Agility, or the ability to adapt quickly to changes, remains a cornerstone of resilience. For instance, organizations that prioritize transparency and trust among supply chain members improve decision-making and responsiveness.

Emergency planning and sustainable practices also strengthen resilience. Businesses that develop contingency plans for disruptions can minimize uncertainty and maintain operations during crises. Additionally, adopting environmentally responsible practices reduces long-term risks and aligns with global sustainability goals. By embedding a risk management culture and leveraging technology, companies can build adaptive and robust supply chains.

Strategy Type | Description |

|---|---|

SC Agility | Quickly adapting to changes in the supply chain environment. |

Collaboration | Enhancing resilience through partnerships. |

Emergency Planning | Developing contingency plans for potential disruptions. |

Sustainable Practices | Implementing environmentally responsible strategies to mitigate risks. |

Technological Capabilities | Using technology to improve supply chain operations and resilience. |

🌟 Companies that embrace these strategies position themselves to thrive in a volatile trade environment, ensuring long-term competitiveness and stability.

Trade policies have reshaped global manufacturing and supply chains, driving shifts in production hubs, supplier diversification, and regionalization. Industries face challenges like rising tariffs, geopolitical risks, and resource scarcity, yet opportunities emerge through technological innovation and strategic planning.

Proactive adaptation remains essential for businesses to thrive. Companies that embrace strategic planning and leverage emerging technologies will navigate the complexities of the global trade landscape effectively.

See Also

Exploring How Global Trade Policies Shape Economic Landscapes

Understanding the Importance of Supply Chains in Global Trade

Addressing Challenges of Supply Chain Growth in Global Markets

Enhancing Strategies to Tackle Supply Chain Problems in Tech

Transforming Logistics Through Innovative Supply Chain Solutions