Trade and logistics disruption as small packages lose duty-free status

The Impact on Trade & Logistics is significant as the US scraps the $800 tariff exemption on small packages. This change, starting August 29, 2025, will affect small businesses across the United States. Kristin Trainor, who owns a boutique, expects the wholesale price of a linen sundress to rise from $30 to $43 due to the end of the $800 duty-free status. The removal of this exemption marks a major shift in Trade & Logistics for businesses importing small packages.

Key Takeaways

The $800 duty-free status for small packages is ending. This will make things cost more for small businesses. They may need to charge more money and could lose some customers.

Small businesses should look for more than one supplier. They should also think about nearshoring. This can help with new tariffs and shipping delays.

Joining industry groups can help small businesses learn about changes. It can also help them speak up for what they need when trade policies change.

Impact on Trade & Logistics: US Scraps $800 Tariff Exemption

Immediate Effects on Small Businesses

Taking away the $800 de minimis exemption has made things harder for small businesses. Now, owners must pay new tariffs on every shipment. This changes how they run their businesses. The number of low-value packages affected has grown a lot:

In 2015, about 139 million packages got the $800 tariff exemption.

By 2024, almost 1.36 billion packages qualified.

Now, small businesses have to pay tariffs on all low-value shipments. This makes costs go up and forces them to change their prices. Many owners feel unsure about what will happen next.

"This is really bad for us, because our customers are confused," said Haley Massicotte.

"The new customs and duty charges starting Aug. 29 will make things less affordable."

The timeline for these changes is easy to follow:

Date | Event Description |

|---|---|

July 30, 2025 | President Trump signs an order to stop duty-free treatment for low-value imports. |

The $800 de minimis exemption ends right away on this date. |

Small businesses now worry about how tariffs will hurt their ability to compete. Some owners are scared that higher prices will make customers leave.

"Raising prices to cover import charges could help with shipping and logistics costs, but Trainor is afraid customers will not want to pay more."

"For small businesses, this is scary. If we can't find another way to get supplies, it could put us out of business," Pomije said.

The impact is not just about money. It also changes how small businesses plan, order, and deliver products. For some, the extra costs can be tens of thousands of dollars.

"For us, it can mean tens of thousands of dollars when we order a lot of inventory," she said.

Customs and Shipping Delays

Ending the de minimis exemption has changed how express carriers and postal agencies work. Every low-value shipment now needs customs entry and tariffs. This brings new problems:

Express carriers like FedEx, UPS, and DHL now focus on Delivery Duty Paid (DDP) shipments to the US.

Delivery Duty Unpaid (DDU) shipments are being turned down more often.

Merchants must follow stricter paperwork rules.

New shipping surcharges are expected.

All shipments, even under $800, need customs forms.

Shipping delays are now common. Customs checks take longer because every package must be checked for tariffs. Shipments over $2,500 need formal customs entry. Shipments under $2,500 need informal entry, which is still harder than before. Some big carriers, like Deutsche Post and Royal Mail, have stopped sending packages to the US because of new rules.

Big customs and shipping delays are happening because of new rules.

All shipments to the US now need customs entry and must pay duties and taxes.

Longer customs checks mean deliveries take more time.

The effect on trade & logistics is clear as the US ends the $800 tariff exemption for small packages. Small businesses must deal with new tariffs, more paperwork, and slower shipping. The way low-value shipments work has changed, so businesses must find new ways to save money and keep customers happy.

$800 Tariff Exemption: What Changed

Policy History

The United States started a tariff exemption for small packages in 1938. The limit was only $5 back then. This rule let people send small gifts without extra fees. Over time, the government raised the limit to help shoppers and businesses. In 2015, the limit went up to $200. This helped small businesses grow and made buying and selling from other countries easier.

In 2016, the government raised the limit again to $800. This change helped global e-commerce grow fast. Many online sellers could now ship to the U.S. without paying big duties. This made cross-border sales quicker and cheaper. The table below shows how the exemption changed and how it helped e-commerce:

Year | Change in Tariff Exemption | Impact on E-commerce |

|---|---|---|

1938 | Started at $5 | Allowed people to send small gifts |

2015 | Raised to $200 | Helped small businesses grow |

2016 | Raised to $800 | Made sales faster and cheaper |

2025 | Ended | Costs go up and supply gets harder |

Reasons for Removal

The government ended the tariff exemption for a few reasons. They wanted fair trade for American companies. Some sellers used the old rule to skip paying duties. This hurt U.S. businesses and lowered tariff money. The government also wanted to stop illegal goods, like fake items and drugs, from coming in small packages. By ending the exemption, leaders hope to keep people safe and help fair competition in global e-commerce.

Small Businesses: Operational Impact

Increased Costs

Small and medium-sized businesses now pay more because of new tariffs. The $800 duty-free status is gone, so every package gets taxed. Many e-commerce sellers on Etsy and Shopify are affected. They used to ship lots of low-cost items to keep prices down. Now, they must pay extra for each item they bring in.

All imported goods now have tariffs. This makes prices go up and can cause problems with getting supplies. Companies like Shein, Etsy, and Shopify used to ship many cheap items. Now, prices for things like clothes, supplements, and kitchenware can go up by 24% to 60%.

Many small businesses say these higher costs make money tight. Owners pay new customs fees and flat rates, sometimes up to $200 per package. These costs add up fast for businesses that import lots of small things.

Kristin Trainor owns Diesel and Lulu’s. She says new customs charges will make her products too expensive. Most of her items come from Europe.

She thinks a linen sundress will cost $43 instead of $30 because of these fees.

Shannen Knight owns A Sight For Sport Eyes. She expects rugby goggles from Italy to cost 50% more. These goggles are special and hard to find in the US.

Medium-sized businesses also feel these changes. They pay more for stock, which means they make less money. Competing gets harder. The new tariffs make things tough for companies that trade with other countries. Many owners worry about what will happen next.

Pricing and Profit Margins

Small businesses must change how they set prices to survive. Many owners raise prices to cover new tariffs and shipping costs. Some use value-based pricing to show their products are special. This helps them stand out even if prices go up.

Small businesses change their pricing plans to deal with higher costs.

They use value-based pricing to show quality and special features.

Some use tiered pricing to help cover tariff costs and keep some options premium.

Medium-sized businesses also try to keep their profits safe. They talk with suppliers to get better deals and change what they sell. Some cut costs to keep making money.

Owners talk with suppliers to lower price increases.

They change what they sell to fit new costs.

Cutting costs is another way to keep profits up.

Tariffs make it hard for small business owners to plan ahead. Many worry about losing money and customers if prices get too high. The new tariffs force businesses to make hard choices about what to sell and how to stay open. If prices go up too much, customers may stop buying. Some businesses may need new suppliers or new ways to work.

Getting rid of the $800 exemption has changed how small and medium-sized businesses work. Higher costs, new tariffs, and money problems are now common. Owners must change fast to keep their businesses going.

Logistics Disruption

Compliance Burden

Big carriers like FedEx, UPS, and DHL have new customs rules for every package going into the United States. They must check all packages, no matter how much they are worth. This means more forms and extra steps for each shipment. Carriers need to collect duties, which can be a percent of the value or a flat fee, depending on where the package is from. If customers do not pay these charges before the package arrives, they might not accept it. This can cause failed deliveries and wasted effort.

Compliance Requirement | Description |

|---|---|

All parcels entering the U.S. will now be assessed duties regardless of their value. | |

Duties applied in two ways | Duties can be a percentage of the value or a flat fee depending on the country of origin. |

Higher risk of failed deliveries | If duties aren’t prepaid, customers may refuse the package due to surprise charges at delivery. |

Slower delivery times | All shipments will require formal customs clearance, leading to potential delays. |

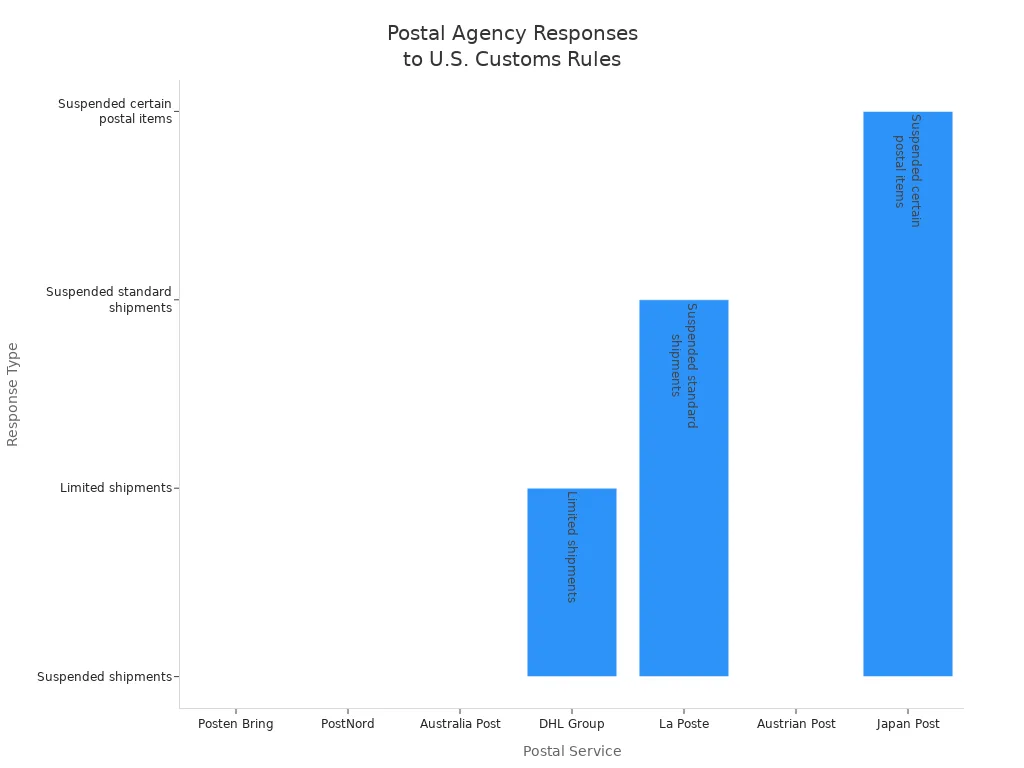

Many foreign postal agencies have stopped sending packages to the U.S. The chart below shows how different agencies have reacted:

DHL Group said, "The reason for these expected temporary restrictions is new steps required by U.S. authorities for postal shipping, which are different from the old rules."

Supply Chain Delays

Ending the $800 duty-free rule has caused many supply chain delays. More than 30 countries have stopped or limited shipments to the U.S. This makes it harder for businesses to get goods and keep their supply steady. Logistics companies now warn about flat import charges that make shipping cost more. Private couriers add extra tariffs and fees, making the process harder.

Small and medium businesses may pay $71 billion more for supplies.

Many companies must change their supply plans.

Taking away the exemption has caused more canceled shipments, especially for small businesses. Global postal networks now have problems, so goods take longer to arrive. U.S. buyers also pay more because of these new tariffs. The supply chain now has more problems, and companies must act fast to keep goods moving.

Broader Market Impact

Consumer Behavior

People now pay more for many imported goods. Tariffs made shoes cost 37% more. Clothes now cost 35% more. Many families lose about $2,300 each year because of this. Companies try to handle these costs. Some take the loss or try new ways to sell. Shoppers look for cheaper things or buy less, so the market changes.

Evidence Type | Description |

|---|---|

Price Increase | Tariffs made goods cost more, so people spend less. |

Consumer Impact | Families lose about $2,300 each year from higher prices. |

Specific Goods | |

Market Response | Companies struggle with costs, so they try new ideas or take the loss. |

Many people now think before they buy something. Some pick local products to skip extra fees. Others wait for sales or discounts. Fewer people buy imported goods now. Businesses must change to fit new shopping habits.

Competitive Disadvantages

Small businesses feel the loss of the tariff rule more than big stores. They pay more and have supply chain problems, especially on eBay and Etsy. Big stores handle tariffs better because they ship more at once. The market changes as small sellers have trouble keeping up.

Business Type | Effects of Tariff Removal |

|---|---|

Small Businesses | Higher costs and supply problems, especially on eBay and Etsy. |

Large Retailers | They are used to tariffs on big shipments, so it is easier for them. |

Small businesses must find new suppliers or sell different things. Big stores use their money and size to keep prices steady. Small sellers lose customers to bigger stores. Many small businesses worry they might have to close if costs keep going up.

Adapting to Change

Sourcing Strategies

Small businesses are finding new ways to deal with higher tariffs and shipping costs. Many owners use more than one supplier for each product. This helps if one supplier has high tariffs. Some companies move their assembly work closer to the United States. This can help them save money over time. Others use smart technology to find and fix problems in their supply chain.

Strategy | Notes | Example or Proof Point |

|---|---|---|

"China + 1" & Multisourcing | Use two or more suppliers for each product. | 32% of global business leaders now build dual supply chains. |

Near & Reshoring CapEx | Move assembly to North America for faster savings. | Toyota plans to shift RAV4 assembly to Kentucky to avoid a 25% import tariff. |

Smart Factory Solutions | Use technology to spot and fix delays. | Schneider Electric saved money with AI-driven maintenance in its smart factory. |

Engineering Tweaks | Change designs to add tariff-heavy parts after import. | Trane Technologies swaps materials to lower costs from new copper tariffs. |

Many businesses also use new logistics tools. They pick carriers that handle customs better. Some use software to track shipments and avoid failed deliveries. Over half of manufacturing CFOs now plan to use more suppliers. Nearly 40 percent buy extra stock before tariffs start. Some look for new suppliers in other countries.

Advocacy and Policy

Industry groups and business associations help small businesses adjust. They thank the government for closing the loophole that let untaxed goods enter the country. The U.S. textile industry says this change protects local jobs and communities. Gap Inc. supports the new rule, saying it makes the supply chain safer.

Many groups, including manufacturers and retailers, support the new policy.

They believe it stops illegal imports and keeps people safe.

These groups work with lawmakers to make sure small businesses have a voice.

Small businesses can join these groups to stay informed and share their concerns. Working together helps them adapt to new rules and protect their interests.

Small businesses now pay more money and have fewer products to sell. They also have a harder time beating bigger companies.

Financial Impact | Description |

|---|---|

Increased Costs | Small businesses spend more because of higher tariffs. |

Price Increases | They might need to raise prices, so they could lose customers. |

Competitive Viability | Big companies can handle these extra costs better than small ones. |

To deal with this, small businesses can:

Find new suppliers

Use tech tools to follow rules

Join trade groups

Learning about new rules and acting early helps them handle these problems.

FAQ

What is the de minimis exemption?

The de minimis exemption let packages under $800 come into the U.S. without paying extra import taxes. The government stopped this rule in August 2025.

How will the new tariffs affect shipping times?

Shipping might take longer now. Customs workers have to check every package. Companies like FedEx and UPS do more paperwork and collect more duties.

Can small businesses avoid these new tariffs?

Small businesses cannot skip the new tariffs. They can try new suppliers, join business groups, or use technology to help with customs rules.

See Also

Exploring How Global Trade Policies Shape Economic Landscapes

Understanding Current Trends in Logistics Risk Management

Discovering Innovations in Sea Freight Logistics for 2024