How to Navigate Import and Export Agency Compliance

You need to follow the rules to avoid big fines and slowdowns. Know which Import and Export Agency rules fit your business. Correct information, product classification, and right licenses are important. Using technology can lower compliance costs by 30%. Expert partners like JUSDA help you get real-time information for better compliance.

Key Takeaways

Follow the correct rules and get the right licenses. This helps you avoid fines, delays, and legal trouble in import and export. - Use technology and expert partners like JUSDA to track shipments. They help manage documents and keep you updated on changing trade rules. - Train your team often and keep clear records. This builds trust, lowers mistakes, and keeps your compliance strong.

Key Steps

Identify Regulations

You need to find out which rules apply to your business before you trade. Many federal agencies, like the FDA, USDA, CBP, FTC, and BIS, control different products. These rules can change often, so you must keep up to date to avoid trouble.

If you do not follow the rules, you might get fined, have your shipments delayed, or lose your goods.

You must use the right system, like the Harmonized System, to classify your goods for export.

You also need to think about data privacy rules from the FTC and CBP, and follow foreign trade rules if you deal with sensitive information.

Prepare Documentation

You have to get all the needed paperwork ready for trading with other countries. Important papers are commercial invoices, packing lists, bills of lading, and certificates of origin.

Use one system or digital tools to keep your papers in order and remember important dates.

Trackers and templates help you check the progress of your paperwork.

Checking your work often and training your team helps you follow the rules and make fewer mistakes.

Product Classification

It is very important to classify your products correctly for trading. In 2022, the U.S. sent out over $200 billion in IT equipment, and using the right codes was key for trade deals and following export rules.

If you use the wrong code, you might pay the wrong tariff, have your shipment held up, or face legal problems.

You must pick the right codes, like those in the NAICS or HS systems, to follow export rules.

Licensing Process

You need to get the right licenses and permits to trade with other countries.

Licenses are legal permissions you need for exporting and following export rules.

If you do not have the right licenses or permits, you could get fined, have your shipment delayed, or have your goods held.

Some items, like electronics or medicine, need special licenses.

Getting a license can take a long time, so start early to avoid problems.

Having the right licenses and permits helps you build trust with partners and makes customs go smoothly.

Import and Export Agency Roles

Knowing what each import and export agency does helps you follow the rules. These agencies work together to make sure trade rules are followed. They also check customs forms and help protect your business from getting in trouble. JUSDA has learned that using a good customs broker and new technology can help you follow all the rules and avoid waiting.

U.S. Customs and Border Protection

U.S. Customs and Border Protection is very important for trade. This agency checks if you follow the rules for importing and exporting. They look at customs forms, check your papers, and make sure you use the right tariff codes. You must use the Harmonized Tariff Schedule and give the correct value for your goods. If you do not follow the rules, you could get fined or lose your right to export. U.S. customs also has programs like CTPAT to help you follow the rules and keep the supply chain safe. They work with other agencies to help trade and keep the country safe.

Bureau of Industry and Security

The Bureau of Industry and Security is another important agency. This agency controls rules for exporting and watches over special goods and technology. You need to see if your products need special licenses before you ship them. The Bureau makes sure people do not break the rules and helps keep the country safe. JUSDA helps people follow these rules by working with customs brokers and making sure all papers are correct.

Other Key Agencies

Many other agencies help make sure people follow the rules for importing and exporting. The Food and Drug Administration, Department of Agriculture, and International Trade Administration each have their own rules for different products. These agencies work with U.S. customs to check forms and make sure rules are followed. You need to keep up with new rules and changes. JUSDA’s platform helps you watch for rule changes, handle customs, and follow all the rules from every agency.

Compliance Requirements for Importers and Exporters

Documentation Needs

Importers and exporters must follow strict rules. Every shipment needs the right paperwork to follow the law and avoid problems.

You need commercial invoices, packing lists, bills of lading, and certificates of origin for customs.

Some shipments need consulate certification or special licenses.

The Shipper’s Letter of Instruction tells freight forwarders what to do.

You must file with the Automated Export System (AES) if your shipment is over $2,500 or needs an export license.

Dangerous goods need special forms, and only trained staff can fill them out.

End-User Certificates are needed for some sensitive goods.

These papers prove your trade is legal, help with customs, and show what was traded. You should ask experts or use digital tools to handle paperwork and lower risks.

Record-Keeping

You have to keep records to follow the rules. Keep original papers for at least 120 days and electronic records for five years.

Store everything in approved electronic formats so you can find it fast.

Cross-reference records to link related information and make a clear audit trail.

Save emails and exception files too.

Write down your policies and procedures to keep things safe and easy to find.

Doing your own audits helps you avoid trouble for missing papers. U.S. Customs and Border Protection and Export Administration Regulations say you must keep records for five years.

Restricted Party Screening

You must check everyone involved in your trade. Importers and exporters need to see if customers, suppliers, or partners are on restricted or denied party lists.

Use the latest information from government sources.

Check before every deal to follow the rules and avoid trouble.

Automated systems help you check lists fast and keep proof of your checks.

Screening keeps your business safe and helps you meet all customs and compliance rules.

Import/Export Compliance Process

Following import/export compliance means you need to take clear steps. You must do each step carefully to avoid mistakes. This helps your trade business run well. JUSDA’s platform helps you at every step. It makes the process faster and more reliable.

Due Diligence

You begin with due diligence. This step helps you know the risks and rules before moving goods. Good due diligence keeps your business safe. It also helps you build trust with trade partners.

Make a plan for your compliance programs. Teach your staff about export and import trade compliance rules.

Get help from legal and compliance experts. They explain hard trade laws.

Watch compliance before, during, and after changes. Risks can change fast in global trade.

Use software to check compliance. This cuts down on mistakes and saves time.

Check everyone in your trade. Automated screening tools help you find risky people or companies.

Put your products in the right class. Automated tools help you use the correct codes.

Watch your licenses in real time. This keeps your trade legal and stops wrong shipments.

Check customers, vendors, and partners for risks. Look for forced labor, corruption, or sanctions.

Keep all your documents in one place. This makes audits easier and helps you be more accurate.

Tip: JUSDA’s platform lets you keep all compliance data together. It also automates many steps, so you can grow your trade business.

License Applications

Licenses are very important for import/export compliance. You need the right licenses to move goods legally. Each country and product may have different rules. You must pay close attention.

Find out which licenses your products need. Some things, like electronics or medical devices, need special licenses.

Get all your papers ready before you apply. Missing papers can slow down your trade.

Apply for licenses early. Some take weeks or months to get.

Watch your license status. Real-time tracking helps you avoid expired or missing licenses.

Update your records when you get new licenses. Keep everything neat for future audits.

JUSDA’s platform helps you track license deadlines and manage renewals. This lowers the risk of breaking rules and keeps your trade moving.

Reporting and Audits

Reporting and audits are needed for good import/export compliance. You must show your business follows all trade rules. Good reporting protects you from fines. It also builds trust with customs agencies.

Use technology to collect and watch data. Automated systems make audits easier and more correct.

Make clear rules for compliance. Leaders should support a culture of compliance.

Train your audit teams often. Workshops and courses keep your team up to date.

Plan your audits well. Check risks, write down what you find, and review your compliance plan.

Watch transactions for warning signs. Look for shipments to banned countries or odd routes.

Test your controls often. Regular checks help you find problems early.

Set up safe ways for workers to report issues. Anonymous hotlines help find problems sooner.

Work with legal, compliance, and supply chain teams. Teamwork helps you see risks and be more open.

Audit reporting rules need clear records of any problems. You must tell senior management about issues fast. This helps fix problems quickly and keeps your compliance program strong. In 2020, U.S. companies paid over $1.8 billion in fines for not following the rules. Good reporting and audits help you avoid these big mistakes.

Note: JUSDA’s platform gives you tools for reporting and audits. This makes it easier to meet all import/export compliance rules.

International Trade Challenges

Customs Differences

International trade is hard because each country has its own customs rules. These differences can make things confusing and slow down your business. You need to know how customs clearance, valuation, and reporting rules affect you.

Every country has its own way to record and report customs.

Some countries use FOB for exports, but others use CIF for imports.

Customs and tax rules are different, with special trade zones and normal systems.

Exchange rates change and different rules can cause mistakes in trade numbers.

Groups like the OECD try to help, but problems still happen.

Sub-indicator | Impact on Import/Export Trade Volume | Significance Level | Notes |

|---|---|---|---|

Customs Clearance Efficiency | Positive impact for large countries | Drives trade growth along major trade routes | |

Logistics Service Capacity | Positive impact | 10% significance | Helps increase trade volume |

Quality of Logistics Infrastructure | Positive impact | 1% significance | Supports higher trade volume |

International Freight Price Competitiveness | Significant for large countries | 1% significance | Key for large-scale international trade |

Customs differences can make big gaps in trade numbers. You have to pay attention to these changes to keep following the rules.

Cross-Border Delays

Delays at borders can hurt your trade business. Every extra day your goods wait can lower your trade by more than 1%. Slow customs and unclear rules make these delays worse.

Not knowing how long delays will last can stop export growth, especially in new places.

Bad roads and high transport costs slow down trade.

Changing exchange rates and other barriers make it harder to follow the rules.

The WTO Trade Facilitation Agreement could cut trade costs by up to 17.4% if used fully.

Digital systems and electronic windows help lower border checks.

You need to watch out for these problems and use good compliance plans to keep your trade moving.

Technology Solutions

Technology gives you strong tools to fix trade problems. Digital trade papers, fintech trade finance, and automated compliance systems help you follow rules and speed up customs.

Digital bills of lading save lots of money and help global trade grow.

Fintech tools make cross-border payments cheaper and faster.

Data platforms use OCR and language models to make trade data and compliance better.

Tech platforms help small businesses get money and handle long supply chains.

Electronic bills of lading and digital rules are now used by big shipping companies.

You can use these tech tools to follow the rules, save money, and grow your trade business.

JUSDA’s Compliance Solutions

Supply Chain Platform

JUSDA’s supply chain platform helps you follow the rules easily. It uses Vendor Managed Inventory (VMI) and Supplier Managed Inventory (SMI) to keep the right amount of stock. You do not have to place every order yourself. The system watches what you need and keeps inventory at Just-In-Time (JIT) levels. This means you do not need as much money for stock. It also helps you make fewer mistakes with orders. You get better control of your inventory and see fewer errors in your supply chain. JUSDA’s platform makes restocking simple and helps you avoid expensive delays.

Real-Time Tracking

JUSDA’s real-time tracking tools let you see your shipments and compliance status clearly.

You get updates all the time, so you always know where your goods are.

The system finds customs trends and risks before they cause trouble.

Real-time alerts help you act fast if something changes.

Automated paperwork and shipment tracking lower manual mistakes.

The platform gives you over 1,000 reports to study trade data.

It works with global agencies and brokers to help you see more and follow the rules.

With real-time tracking, you can find ways to save money, use resources better, and lower compliance costs.

Case Study: Sharp

Sharp’s story with JUSDA shows how good compliance solutions help. Sharp made a safety and health system that has ISO 45001 certification at many places. The company does yearly safety checks, online learning, and teaches workers to stay safe. Since 2013, Sharp has had no deadly work accidents and keeps its accident rate much lower than others.

Sharp’s culture supports reporting, learning, and being flexible.

The company shares progress and problems right away.

These actions help Sharp keep a safe workplace and always get better.

When you use a full compliance solution like JUSDA’s, you make your supply chain safer, more efficient, and more dependable.

Ongoing Compliance

Internal Programs

You need good internal programs to keep compliance strong. When you connect compliance tracking with business goals, you can see if your company is following the rules. This helps you find problems early and make better choices. You can use key numbers to check your progress and help your team get better.

Specific Metrics / KPIs | |

|---|---|

Training and Awareness | Training completion rates, training effectiveness, employee feedback, knowledge assessments |

Monitoring and Testing | Frequency and scope of monitoring, use of data analytics, responsiveness to findings |

Reporting and Investigation | Effectiveness of reporting mechanisms, whistleblower reports, incident response times, root cause analysis |

Compliance KPIs | Regulatory compliance rates, policy adherence, audit findings and remediation time, third-party compliance |

These numbers help you build a team that takes responsibility and works hard in international trade.

Employee Training

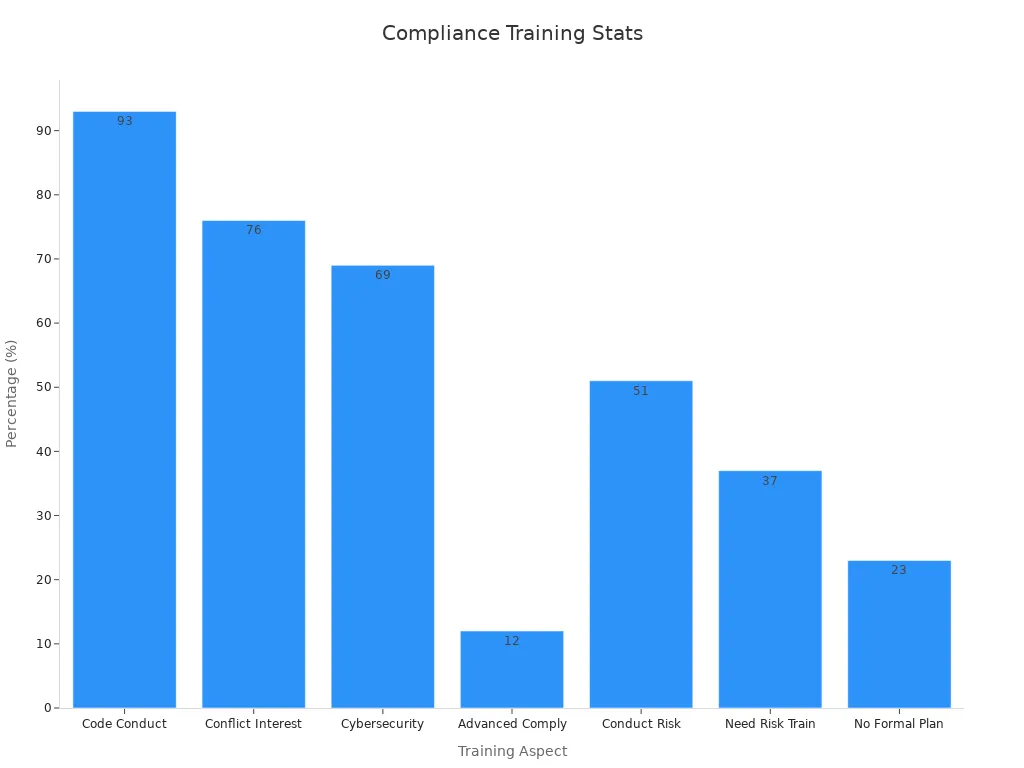

Employee training is very important for compliance. You need to teach many topics so your team is ready for trade. Most companies teach code of conduct, conflict of interest, and cybersecurity. Only some give advanced training, but many know they need more.

Training often helps your staff learn new rules and make fewer mistakes in trade.

Staying Updated

You must keep up with changing rules in compliance. New laws and actions happen often in trade. For example:

OFAC now says you must keep records for 10 years, which is twice as long as before.

BIS made new export controls for AI and space technology.

The UK made new due diligence rules for trade and shipping.

Recent fines show that rules are strict everywhere.

You also see updates that make trade easier, like new U.S. rules for space items and license exceptions for trusted partners. Staying informed helps you avoid risks and keep your compliance strong.

JUSDA Solutions

To provide you with professional solutions and quotations.

You can keep import/export compliance by making clear goals. Use automated tools to help you follow the rules. Check your steps often to make sure you do things right. Managing problems early and using technology makes compliance easier and safer. Many companies now pick expert partners to help with import/export compliance all the time. Keep learning about new rules and change your plans when needed. This helps you stay successful with import/export compliance.

See Also

Achieving Global Trade Success Through JUSDA Solutions

Expert Advice For Overcoming Automotive Supply Chain Issues

Comprehensive Guide To Managing Risks In Supply Chains