How Should Indian Manufacturing Industry Respond to U.S. Tariff Policies?

The U.S. tariff policies have introduced significant hurdles for the Indian Manufacturing Industry, creating a ripple effect across exports and supply chains. For instance, tariffs on Indian goods have surged to 27%, up from an average of 3.3%, threatening a potential decline in engineering exports by 20-25% within the first year. Adding to the complexity, a universal 10% tariff on imports and a 25% tariff on steel and aluminum have further strained cost structures. These challenges demand proactive measures to mitigate risks and leverage emerging opportunities, ensuring that manufacturers remain competitive in a rapidly evolving global trade landscape.

Key Takeaways

Sell goods to more countries, not just the U.S. This can lower risks from tariffs and find new buyers.

Use trade deals to sell products more easily. These deals can remove tariffs and help sell items like clothes and gadgets.

Build better roads, factories, and technology. Good infrastructure can cut costs and bring in foreign money.

Create new ideas and teach workers new skills. Training in areas like robots and AI can help with future problems.

Push for fair trading rules. Talking with global groups can lower tariffs and make trade fairer.

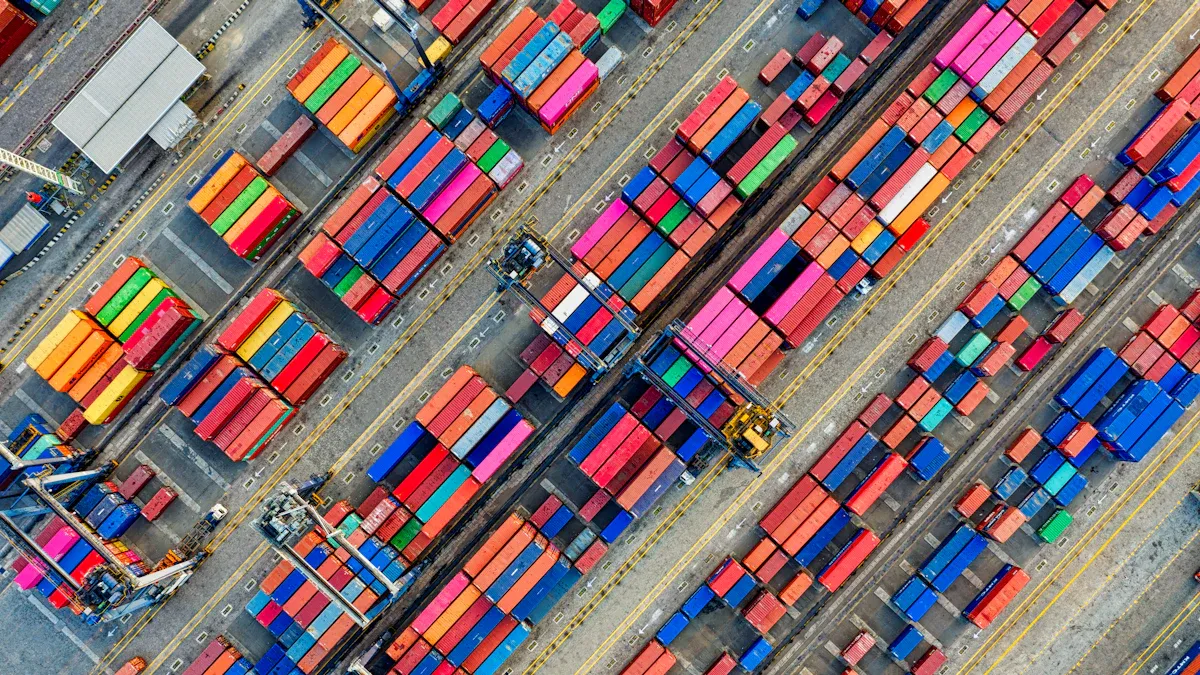

Immediate Impacts of U.S. Tariff Policies on the Indian Manufacturing Industry

Export challenges and reduced market access

The U.S. tariff policies have significantly impacted the Indian Manufacturing Industry's export potential. Higher tariffs on Indian goods, such as the 7% levy on specialty chemicals, have reduced the competitiveness of Indian exporters in the U.S. market. For example, companies like PI Industries face a projected 12% decline in EBITDA due to these increased costs. Similarly, the gems and jewelry sector, which exports over $8.5 billion annually to the U.S., has experienced substantial setbacks.

A January 2022 study estimated that retaliatory tariffs caused direct export losses of $27 billion between 2018 and 2019. These losses highlight the vulnerability of Indian exporters to sudden policy shifts. Furthermore, projections suggest that long-term GDP could decline by 6%, with wages dropping by 5%, underscoring the broader economic implications of reduced market access.

Supply chain disruptions and increased costs

The ripple effects of U.S. tariffs extend beyond exports, disrupting global supply chains and inflating production costs for Indian manufacturers. For instance, the global aviation supply chain has seen production costs for U.S.-made passenger planes rise by over 21% due to tariffs on imported components. In contrast, European manufacturers have faced only a 4% increase, showcasing the uneven burden of these policies.

Indian manufacturers, particularly in the automotive and electronics sectors, are grappling with similar challenges. U.S. tariffs on steel and aluminum have directly impacted the cost structures of fabricated metal industries, which are integral to automotive and electronics production. These disruptions have forced manufacturers to either absorb the additional costs or pass them on to consumers, thereby reducing their competitive edge in global markets.

Sector-specific vulnerabilities (e.g., textiles, electronics, automotive)

Certain sectors within the Indian Manufacturing Industry are more vulnerable to U.S. tariff policies due to their reliance on global supply chains and imported components. The automotive industry, for example, faces tariff impacts ranging from $2,000 to $12,000 per unit, with an average tariff rate of 25%. This heavy reliance on imported vehicles and parts exacerbates the sector's exposure to trade policy changes.

The textiles industry, another critical sector, is also under pressure. With tariff rates exceeding 30%, Indian textile exporters face stiff competition from countries benefiting from preferential trade agreements like the USMCA. Similarly, the electronics sector, which depends on intricate global supply chains, has been significantly affected by increased tariffs on components and finished goods.

Industry | Tariff Impact per Unit | Average Tariff Rate | Vulnerability Factors |

|---|---|---|---|

Automotive | $2,000 to $12,000 | 25% | High reliance on imported vehicles and parts |

Textiles | N/A | Above 30% | Dependence on imports from China and USMCA |

Electronics | N/A | N/A | Exposure to global supply chains |

Fabricated Metal | N/A | Above 30% | Direct inclusion under steel and aluminum tariffs |

These sector-specific vulnerabilities highlight the need for targeted strategies to mitigate risks and enhance resilience. Policymakers and industry leaders must collaborate to address these challenges and ensure the long-term sustainability of the Indian Manufacturing Industry.

Short-Term Strategies for the Indian Manufacturing Industry

Diversifying export markets and reducing dependency on the U.S.

To mitigate the risks posed by U.S. tariff policies, the Indian Manufacturing Industry must prioritize diversifying its export markets. Over-reliance on a single market, such as the U.S., exposes manufacturers to significant vulnerabilities during trade disruptions. Expanding trade relationships with regions like the European Union, ASEAN, and Africa can help reduce this dependency. For example, the Comprehensive Economic Partnership Agreement (CEPA) with the UAE has already demonstrated success, increasing exports by 11% to $31.3 billion in FY23.

Manufacturers should also explore opportunities in emerging markets where demand for Indian goods is growing. By tailoring products to meet the specific needs of these regions, businesses can establish a foothold in untapped markets. Additionally, leveraging India's competitive advantages, such as cost-effective labor and a robust manufacturing base, can further enhance its appeal to global buyers.

Tip: Diversification not only reduces risk but also positions Indian manufacturers to capitalize on global trade shifts, ensuring long-term stability.

Leveraging trade agreements to enhance market access

Trade agreements play a pivotal role in improving market access for Indian manufacturers. India has implemented several initiatives, such as the Production Linked Incentive (PLI) Scheme and the National Logistics Policy, to boost domestic manufacturing and attract foreign investment. These policies align with the broader goal of enhancing India's global trade footprint.

Key trade agreements, such as the Trade and Economic Partnership Agreement (TEPA) with EFTA countries, are expected to generate $100 billion in investments over 15 years, focusing on manufacturing and green technology. Additionally, duty-free access through agreements could increase Indian textile exports by 25-30% annually, creating millions of jobs.

Benefits of leveraging trade agreements include:

Eliminating tariffs on semiconductor machinery and electronics components to attract investment.

Providing preferential access for Indian-manufactured solar panels and wind equipment to Western markets.

Enhancing pharmaceutical exports by balancing intellectual property protections with expanded market access.

India's active participation in Free Trade Agreements (FTAs) and Comprehensive Economic Partnerships (CEPs) underscores its commitment to reducing trade barriers. These agreements have historically boosted sectors like textiles and pharmaceuticals, making them critical tools for navigating the challenges posed by U.S. tariffs.

Rationalizing tariffs and optimizing production costs

Rationalizing tariffs is essential for maintaining the competitiveness of the Indian Manufacturing Industry. Aligning value chains with evolving trade realities can help manufacturers secure a competitive edge. For instance, eliminating tariffs on key inputs like electronics components and raw materials can lower production costs and attract foreign investment.

Businesses must adopt a data-driven approach to optimize production costs. Analyzing customer preferences and refining pricing strategies can ensure that products remain competitive in both domestic and international markets. Companies should also reassess their product portfolios to focus on high-demand items while minimizing costs.

Key scenarios to consider when rationalizing tariffs:

Tariff pause or delay: Prepare for potential changes and prioritize critical business needs.

Tariff reductions: Adapt to new trade norms and reassess priorities.

Escalating retaliatory tariffs: Overhaul spend management and supply chain strategies.

Retaliatory subsidization: Explore new market opportunities while managing long-term costs.

Strategic patience and calculated responses to tariff changes are crucial. Avoiding knee-jerk reactions and focusing on long-term goals can help manufacturers navigate the complexities of global trade.

Long-Term Measures to Strengthen the Indian Manufacturing Industry

Investing in infrastructure and advanced manufacturing technologies

Infrastructure development plays a pivotal role in enhancing the manufacturing capacity of India. Recent data shows that infrastructure output in India grew by 3.8% year-on-year as of March 2025, marking seven consecutive periods of positive change. Key sectors such as cement (11.6%), fertilizers (8.8%), and steel (7.1%) have shown significant growth, reflecting robust progress in physical infrastructure.

To sustain this momentum, the Indian Manufacturing Industry must address deficiencies in both physical and digital infrastructure. Improved roads, ports, and power supply can reduce operational costs, while digital advancements like 5G connectivity can streamline production processes. Initiatives like the Production-Linked Incentive (PLI) Scheme have already boosted manufacturing in key sectors. Expanding this scheme to labor-intensive and emerging industries can unlock further growth. Additionally, attracting foreign direct investment (FDI) can bring in capital, technology, and expertise, enhancing global competitiveness.

Note: Strategic infrastructure investments not only improve efficiency but also position India as a preferred destination for global manufacturers.

Enhancing global competitiveness through innovation and skill development

Innovation and skill development are critical for maintaining a competitive edge in global markets. The rise of digital manufacturing and connected products generates approximately 2 petabytes of data annually, offering valuable insights for strategic decision-making. Metrics such as R&D spending, patents filed, and revenue from new products can measure the impact of investments in advanced technologies.

Metric Type | Example Metrics |

|---|---|

Input Metrics | R&D Spending (% of revenue), Talent Acquisition (Advanced degree hires) |

Process Metrics | Idea Generation Rate, Development Cycle Time |

Output Metrics | Patents Filed, Product Launches |

Impact Metrics | Revenue from New Products, Market Share Growth |

A data-driven approach enables manufacturers to identify trends, optimize processes, and innovate effectively. Upskilling the workforce is equally important. Training programs in areas like robotics, AI, and IoT can prepare workers for the demands of advanced manufacturing, ensuring that India remains competitive on the global stage.

Implementing regulatory reforms to streamline operations

Regulatory reforms can significantly enhance operational efficiency in the Indian Manufacturing Industry. Standardizing processes reduces variability, minimizes defects, and ensures compliance with industry standards. Statistical Process Control (SPC) techniques, for instance, can lower defects and warranty claims, leading to cost savings and optimized production.

Streamlined regulations also reduce errors and the time required for quality checks, improving overall productivity. Legal compliance provides additional benefits by safeguarding businesses against potential disputes. By adopting a proactive approach to regulatory reforms, India can create a more business-friendly environment, attracting both domestic and international investors.

Tip: Simplified regulations and standardized processes can act as catalysts for growth, enabling manufacturers to focus on innovation and expansion.

Leveraging Diplomacy and Trade Agreements

Strengthening bilateral trade relations with the U.S.

Strengthening bilateral trade relations with the U.S. offers Indian manufacturers a pathway to mitigate the adverse effects of tariff policies. The U.S. trade deficit, currently at $918.4 billion (3.1% of GDP), highlights the need for balanced trade partnerships. The largest bilateral trade deficit, $295 billion, exists with China, followed by $235 billion with the European Union. These imbalances present an opportunity for India to position itself as a reliable trade partner.

India can leverage its competitive advantages, such as cost-effective labor and a growing manufacturing base, to negotiate favorable terms. Establishing a bilateral trade agreement with the U.S. could reduce tariffs on key Indian exports like textiles and electronics. This would enhance market access and create a more predictable trade environment. Additionally, fostering collaboration in emerging sectors like renewable energy and technology could strengthen economic ties and drive mutual growth.

Participating in multilateral trade forums for global integration

Active participation in multilateral trade forums can help Indian manufacturers integrate into the global economy. India’s trade with Indian Ocean Rim Association (IORA) countries increased by 32% between 2018 and 2023, showcasing the benefits of economic collaboration. Multilateral initiatives, such as disaster management exercises, have also improved operational efficiency, reducing response times by 25% from 2020 to 2024.

Engaging in these forums allows India to influence global trade policies and advocate for reduced tariff barriers. It also provides a platform to address supply chain challenges and promote sustainable trade practices. By aligning with international standards and fostering regional partnerships, Indian manufacturers can enhance their global competitiveness and resilience.

Advocating for fair trade practices and reduced tariff barriers

Advocating for fair trade practices is essential for creating equitable trading conditions. Economic reciprocity ensures that all parties benefit from trade agreements, fostering long-term partnerships. Strategic tariff implementations can enhance global market competitiveness, while mutual concessions among nations promote balanced trade.

Organizations like the World Trade Organization (WTO) play a crucial role in regulating trade barriers and facilitating negotiations. By actively participating in WTO discussions, India can push for reduced tariffs on its exports and ensure compliance with global trade norms. This approach not only benefits Indian manufacturers but also contributes to a more stable and transparent global trade environment.

Note: Fair trade practices and reduced tariff barriers are vital for sustaining growth and fostering international collaboration in the manufacturing sector.

Opportunities for the Indian Manufacturing Industry Amid Global Trade Shifts

Positioning India as an alternative to China in global supply chains

India has emerged as a viable alternative to China in global supply chains, driven by its competitive advantages in labor costs and manufacturing capabilities. With a global manufacturing share of only 3.3%, India holds immense potential for growth as companies diversify their sourcing strategies. The country’s Manufacturing Competitiveness Index score of 87, coupled with labor costs ranging from $1.25 to $1.75 per hour, positions it favorably against China, where wages are significantly higher.

Country | Manufacturing Competitiveness Index (2020) | Manufacturing Sector Wages (per hour) |

|---|---|---|

India | 87 | $1.25 - $1.75 |

China | 95 | $5.00 - $8.00 |

Vietnam | 94 | $3.00 |

Mexico | 86 | N/A |

Thailand | 86 | N/A |

Malaysia | 83 | N/A |

Indonesia | 83 | N/A |

India’s strategic location near Southeast Asia and the Middle East further enhances its appeal as a manufacturing hub. By capitalizing on these strengths, the Indian Manufacturing Industry can attract businesses seeking to reduce dependency on China.

Capitalizing on U.S. tariffs on Chinese goods to expand market share

The U.S. tariffs on Chinese goods present a unique opportunity for Indian manufacturers to expand their market share. Higher tariffs on Chinese electronics, textiles, and automotive components have prompted global companies to seek alternative suppliers. India’s lower tariff rates and robust manufacturing ecosystem make it an attractive option.

For instance, the electronics sector has seen major manufacturers relocate to India due to its strong R&D capabilities and cost advantages. Similarly, the automotive industry benefits from export-oriented production, leveraging India’s competitive labor costs. By aligning production with global demand and maintaining high-quality standards, Indian manufacturers can secure a larger share of the U.S. market.

Attracting foreign investment through competitive labor and production costs

India’s competitive labor and production costs continue to attract foreign investment across various sectors. Post-pandemic supply chain diversification has made India a preferred destination for sourcing. The country’s manufacturing costs in pharmaceuticals are 30%-35% lower than in the U.S. and Europe, while the automotive and chemicals sectors also offer significant cost advantages.

Key factors driving investment:

Cost Efficiency: Lower labor costs in labor-intensive industries like textiles and automotive.

Skilled Workforce: A large pool of engineers and IT professionals enhances manufacturing capabilities.

Government Initiatives: Programs like ‘Make in India’ streamline processes and attract investors.

Environmental Compliance: Lower CO2 emissions compared to China align with global sustainability goals.

India’s proximity to growing markets in Southeast Asia and the Middle East further strengthens its position as a regional manufacturing hub. By leveraging these advantages, the Indian Manufacturing Industry can attract sustained foreign investment and drive long-term growth.

The U.S. tariff policies present both immediate challenges and long-term hurdles for the Indian manufacturing industry. Sectors like steel and electronics face operational inefficiencies and rising costs, while demand forecasting remains a persistent issue. Government initiatives, such as the National Steel Policy 2017 and the Production Linked Incentive (PLI) Scheme, aim to modernize operations and enhance capacity, targeting 300 MTPA of crude steel production by 2030-31.

A balanced approach is essential to address short-term disruptions while fostering long-term resilience. Economic reviews highlight that 50.2% of strategic focus should prioritize long-term goals, while 24.8% should address immediate impacts. Policymakers and industry leaders must collaborate to integrate sustainable practices and fiscal strategies, ensuring the sector's growth aligns with global trade dynamics.

Note: A unified effort between the government and manufacturers can transform challenges into opportunities, securing India's position as a global manufacturing leader.

FAQ

What are the immediate effects of U.S. tariffs on Indian exports?

U.S. tariffs have increased costs for Indian exporters, reducing their competitiveness in the American market. Sectors like textiles, electronics, and automotive face significant challenges due to higher tariff rates and disrupted supply chains.

How can Indian manufacturers reduce dependency on the U.S. market?

Indian manufacturers can diversify export markets by exploring opportunities in regions like the European Union, ASEAN, and Africa. Tailoring products to meet regional demands and leveraging trade agreements can further reduce reliance on the U.S.

What role do trade agreements play in mitigating tariff impacts?

Trade agreements enhance market access by reducing or eliminating tariffs. They also provide preferential treatment for exports, attract foreign investment, and create a predictable trade environment for manufacturers.

How can India position itself as an alternative to China in global supply chains?

India offers competitive labor costs, a growing manufacturing base, and strategic proximity to key markets. By improving infrastructure and adopting advanced technologies, India can attract businesses seeking alternatives to China.

What long-term strategies can strengthen the Indian manufacturing industry?

Investing in infrastructure, fostering innovation, and implementing regulatory reforms are critical. Upskilling the workforce and adopting advanced manufacturing technologies can enhance global competitiveness and ensure sustainable growth.

See Also

Enhancing Supply Chain Efficiency in High-Tech Manufacturing

Understanding High-Tech Manufacturing Consulting for Business Growth

Essential Strategies for Achieving Success in Manufacturing

Strengthening Supplier Partnerships in High-Tech Manufacturing Together

Expert Advice for Overcoming Automotive Supply Chain Challenges