Kuehne+Nagel vs. DB Schenker: A Comprehensive Comparison of Global Freight Services

Kuehne+Nagel leads the global airfreight forwarding market in 2023, moving 2.0 million tonnes and securing the top ranking. DB Schenker holds a strong position, ranking fourth with 1.1 million tonnes. Both companies play major roles in shaping the freight forwarding industry, where a handful of firms share over 30% of the market.

Kuehne+Nagel vs. DB Schenker remains a key topic for businesses seeking reliable logistics partners. This comparison uses current data to help companies choose the provider that matches their needs.

Key Takeaways

Kuehne+Nagel leads in global air and ocean freight with a wider network and strong digital tools.

DB Schenker excels in land transport, especially in Europe and Asia, and offers flexible contract logistics.

Both companies invest in technology and sustainability to improve service and reduce environmental impact.

Pricing is customized by shipment needs, with transparent digital platforms for easy quotes and cost control.

Choosing the right partner depends on your business size, region, and logistics complexity.

Company Profiles

Kuehne+Nagel Overview

Kuehne+Nagel stands as one of the oldest and most established logistics providers in the world. The company began operations in 1890 and now has its headquarters in Switzerland. With more than 80,000 employees globally, Kuehne+Nagel maintains a strong presence in North America, employing nearly 20,000 people in the region. The table below summarizes key company facts:

Company | Founding Year | Headquarters Location | Employee Count |

|---|---|---|---|

Kuehne+Nagel | 1890 | Switzerland (Schindellegi, Schwyz or Feusisberg) | More than 80,000 globally |

Kuehne+Nagel focuses on integrated logistics solutions and acts as a lead logistics provider for global supply chains. The company’s core business segments and service specializations include:

Global freight forwarding and supply chain management

Transportation services for sea, air, and road freight

Fulfillment, warehousing, and distribution

Customs clearance, cargo insurance, and e-commerce logistics

Project logistics and 4PL integrated logistics

Digital services such as order management, shipment management via myKN, and real-time road visibility

Industry focus on aerospace, automotive, consumer goods, healthcare, high-tech, industrial, and perishables

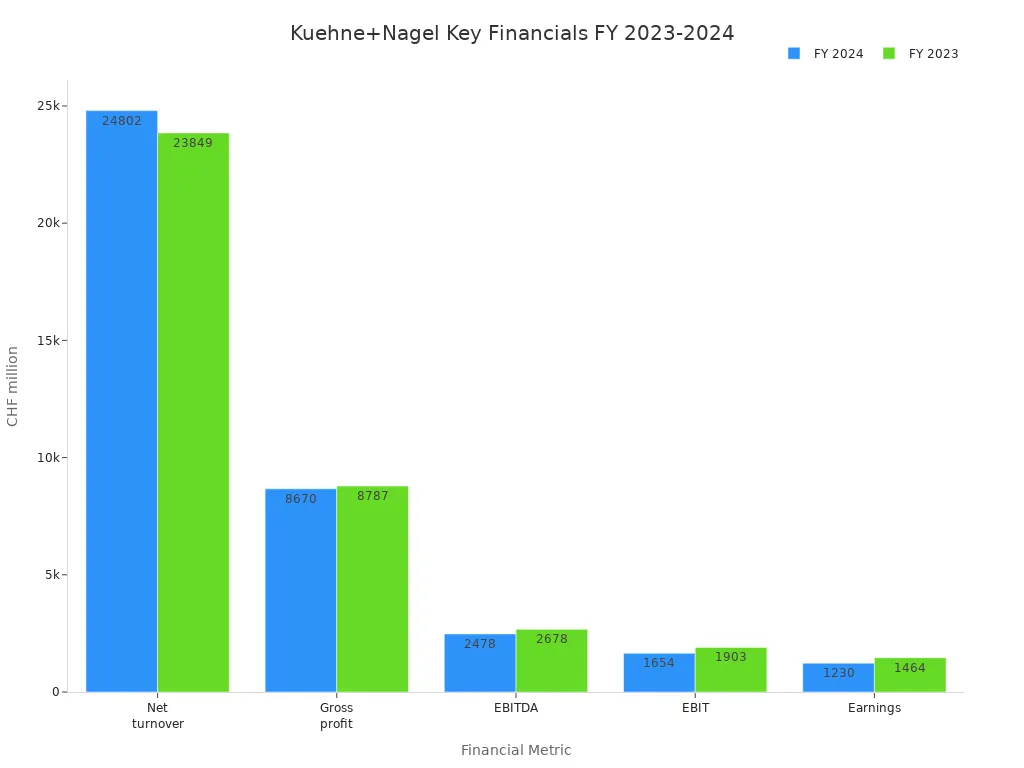

Kuehne+Nagel’s financial performance remains strong. In 2024, the company reported a net turnover of CHF 24.8 billion and earnings of CHF 1.2 billion. The following chart highlights key financial metrics for 2023 and 2024:

DB Schenker Overview

DB Schenker, founded in 2002 and headquartered in Essen, Germany, has grown rapidly to become a major player in global logistics. The company’s workforce in North America numbers over 11,000, reflecting a significant presence in the region.

Company | Founding Year | Headquarters Location | Employee Count |

|---|---|---|---|

DB Schenker | 2002 | Essen, Germany | N/A |

DB Schenker delivers total logistics services, including air, sea, and road transport, as well as contract logistics. The company specializes in niche products for key market verticals and offers customized solutions to meet individual customer needs. DB Schenker’s operations use both in-house equipment and subcontractors to handle complex cargo. The company positions itself as a one-stop shop for freight requirements, focusing on customer satisfaction and cost efficiency.

Following its acquisition by DSV, DB Schenker became part of a global logistics powerhouse with over €41 billion in annual revenue and a workforce exceeding 160,000 employees across more than 90 countries. This merger strengthens DB Schenker’s ability to provide integrated, end-to-end logistics solutions and enhances its global reach. The combined entity offers increased bargaining power and invests heavily in infrastructure and digital innovation, making it a reliable choice for global shippers.

Note: Kuehne+Nagel vs. DB Schenker remains a central comparison for businesses seeking comprehensive logistics solutions, as both companies offer extensive service portfolios and global networks.

Kuehne+Nagel vs. DB Schenker

Service Range

Kuehne+Nagel and DB Schenker both offer a wide range of freight services, but each company has unique strengths. Kuehne+Nagel leads in ocean and air freight, providing global coverage and advanced logistics solutions. DB Schenker excels in land transport, especially in Europe and Asia, and delivers strong contract logistics services. The table below compares their main service offerings:

Service Type | Kuehne+Nagel Details | DB Schenker Details |

|---|---|---|

Ocean Freight | World's largest ocean freight forwarder; 4.529 million TEUs in 2020; global network in 109 countries | Ocean freight volume of 2.042 million TEUs in 2020; strong presence in Europe, Asia, and US |

Air Freight | Second largest air freight forwarder globally; 1.433 million tonnes in 2020; acquisition of Apex enhanced trans-Pacific and Asian routes | Air freight volume of 991,000 tonnes in 2020; integrated international logistics services |

Land Transport | Road freight included as part of overland transport services | Land transport services offered; strong European and Asian market presence |

Contract Logistics | Provides contract logistics as a third-party logistics partner | Offers contract logistics and supply chain management services |

Global Presence | Over 100 countries worldwide | Strong presence in Europe, Asia, and the United States |

Market Position | Market leader in ocean and air freight volumes; extensive global network | Long history (founded 1872); focus on sustainability and efficiency in integrated logistics |

Kuehne+Nagel vs. DB Schenker shows that Kuehne+Nagel dominates in ocean and air freight, while DB Schenker stands out in land transport. Both companies provide contract logistics and supply chain management, but their geographic strengths differ.

Market Position

Kuehne+Nagel holds the top spot in global freight forwarding by revenue and volume. DB Schenker ranks among the top providers but falls behind Kuehne+Nagel in ocean and air freight metrics. The table below highlights their market positions:

Company | Revenue (US$ Billion) | Ocean TEUs (Million) | Air Metric Tons (Million) |

|---|---|---|---|

Kuehne+Nagel | 4.386 | 2.232 | |

DB Schenker | 30.392 | 1.909 | 1.326 |

Kuehne+Nagel vs. DB Schenker demonstrates that Kuehne+Nagel leads in both revenue and freight volumes. DB Schenker remains a major player, especially after its acquisition by DSV, which boosts its global reach and resources.

Industry rankings place Kuehne+Nagel consistently in the top three global logistics providers. DB Schenker often appears in the top five, especially when considered as part of DSV. This strong market presence ensures both companies can serve large multinational clients and complex supply chains.

Global Network

Coverage

Kuehne+Nagel and DB Schenker both operate on a global scale, but their reach differs in important ways. Kuehne+Nagel maintains a presence in over 100 countries, with direct operations in more than 65. DB Schenker covers 60 countries, focusing on key trade lanes and logistics hubs. The table below highlights their global coverage:

Company | Number of Countries Covered | Number of Territories Covered / Presence |

|---|---|---|

Kuehne+Nagel | Over 65 countries | Presence in over 100 countries |

DB Schenker | 60 countries | N/A |

Kuehne+Nagel’s broader network allows them to support complex, multinational supply chains. Their presence in emerging markets, such as the Middle East, continues to grow. DB Schenker’s network remains strong in Europe and Asia, serving major industrial and retail clients. Both companies help customers reach global markets, but Kuehne+Nagel offers a wider footprint.

Note: A wider network can improve delivery speed and flexibility for international shipments.

Infrastructure

Kuehne+Nagel and DB Schenker invest heavily in logistics infrastructure to support their global operations. Kuehne+Nagel operates an extensive network of warehouses and distribution centers. Their facilities enable efficient storage, order fulfillment, and rapid movement of goods worldwide. The company recently expanded into the Middle East through a strategic partnership with Tamer Logistics in Saudi Arabia, reflecting a commitment to growth in key regions.

DB Schenker manages over 850 warehouse and office locations around the world. Their contract logistics services include fulfillment, reverse logistics, and e-commerce warehouse operations. Value-added services such as quality checks, product customization, and packaging support a wide range of industries. DB Schenker also invests in green logistics fleets and regionalized hubs across the European Union. These hubs help improve delivery speed and efficiency for customers.

Kuehne+Nagel continues to expand its digitized inventory platforms and intermodal offerings, supporting high-volume retail logistics. DB Schenker’s focus on sustainable infrastructure and regional hubs strengthens their position in the European market. Both companies provide robust infrastructure, but their strategies reflect different priorities and regional strengths.

Technology

Digital Solutions

Kuehne+Nagel and DB Schenker both invest heavily in digital technology to improve logistics services. Kuehne+Nagel has made digital transformation a core part of its business strategy. The company’s leadership highlights digitization as a key pillar in its Roadmap 2026 and Vision 2030. This focus aims to create a digital ecosystem that enhances customer experience and operational excellence.

Kuehne+Nagel’s partnership with cargo.one brings advanced API technology into its CB Air air freight booking platform. This integration allows customers to access seamless e-booking with dozens of airlines and sales agents worldwide. The system delivers faster and more accurate quotes, making the booking process smooth and efficient. Kuehne+Nagel plans to process 85% of all air waybills digitally, showing a strong commitment to digital excellence. The company also benefits from cargo.one’s data quality assurance and expanding airline partnerships.

Kuehne+Nagel’s digital solutions help raise industry standards by simplifying workflows and improving connectivity.

DB Schenker also offers a suite of digital tools for logistics management. The company provides online booking, shipment management, and integration with third-party applications. Customers can connect their logistics operations with platforms like Salesforce and Shopify, making supply chain management more flexible.

Tracking

Shipment tracking stands as a critical feature for both companies. DB Schenker provides real-time GPS tracking for shipments. Customers receive updates on delivery time, shipment status, and location. The tracking system does not require users to log in, making it easy to access information. DB Schenker’s customizable dashboard lets users arrange widgets and quick links to fit their business needs.

Kuehne+Nagel offers digital platforms that provide shipment visibility and route optimization. The company’s technology supports global logistics and helps customers monitor their cargo. However, public details about the user interface or the depth of real-time tracking remain limited compared to DB Schenker.

DB Schenker emphasizes real-time visibility and user-friendly interfaces.

Kuehne+Nagel focuses on broad digital shipment visibility and operational optimization.

Both companies use technology to improve transparency and efficiency in global freight services.

Pricing

Structure

Kuehne+Nagel and DB Schenker use different pricing models to serve their global clients. Both companies offer customized quotes based on shipment size, route, and service level. They do not use a one-size-fits-all approach. Instead, they tailor prices to each customer’s needs.

Kuehne+Nagel uses a modular pricing system. Clients can select core freight services and add extra features, such as insurance or customs clearance. This approach helps businesses control costs and only pay for what they need. Kuehne+Nagel’s digital platform, myKN, allows users to get instant quotes for air and sea freight. The platform also shows available options and estimated delivery times.

DB Schenker uses a similar flexible pricing structure. The company provides quotes based on shipment details, urgency, and destination. DB Schenker’s online booking tool lets customers compare rates for different transport modes. The tool also helps users choose between standard and premium services.

Both companies adjust prices for fuel surcharges, peak season demand, and special handling requirements.

Feature | Kuehne+Nagel | DB Schenker |

|---|---|---|

Instant Online Quotes | Yes (myKN platform) | Yes (online booking tool) |

Modular Pricing | Yes | Yes |

Customization Options | Wide range | Wide range |

Volume Discounts | Available | Available |

Transparency

Transparency in pricing builds trust with customers. Kuehne+Nagel and DB Schenker both aim to make their pricing clear and easy to understand.

Kuehne+Nagel provides detailed breakdowns of costs on its digital platform. Clients can see base rates, surcharges, and optional service fees before booking. The company also explains any extra charges, such as customs duties or fuel adjustments.

DB Schenker also values transparent pricing. The company’s online tools show all cost components up front. Customers receive clear invoices that list each charge. DB Schenker’s customer service team answers questions about pricing and helps resolve billing issues.

Transparent pricing helps businesses plan budgets and avoid unexpected costs.

Both Kuehne+Nagel and DB Schenker use digital tools to improve pricing clarity. Their commitment to transparency supports long-term customer relationships.

Customer Support

Responsiveness

Kuehne+Nagel and DB Schenker both prioritize customer support as a key part of their service. Their teams respond quickly to inquiries and provide clear updates on shipment status. Kuehne+Nagel uses digital platforms to help customers track shipments and resolve issues. The company’s support staff answers questions through phone, email, and online chat. Customers often receive responses within hours, which helps reduce delays and confusion.

DB Schenker also invests in responsive customer service. Their support centers operate in major regions, including North America, Europe, and Asia. DB Schenker’s staff uses real-time tracking tools to give customers accurate information about their shipments. The company’s dashboard allows users to customize alerts and notifications. Many clients report high satisfaction with DB Schenker’s ability to solve problems quickly.

Fast and reliable customer support helps businesses avoid costly disruptions and maintain trust in their logistics provider.

Value-Added Services

Both Kuehne+Nagel and DB Schenker offer a wide range of value-added services that go beyond basic freight forwarding. These services help companies manage complex supply chains and meet regulatory requirements. Kuehne+Nagel provides supply chain consulting, customs clearance, warehousing, order management, and project management. Their team uses digital customs platforms and AI-driven compliance solutions to handle regulatory challenges.

DB Schenker delivers supply chain management consulting, executive logistics activities, e-commerce solutions, and intermodal transport. The company also offers customs brokerage-related services. DB Schenker’s experts help clients optimize supply chains and improve ESG reporting. Their specialized customs brokerage services support industries such as automotive and e-commerce.

Company | Value-Added Services Provided |

|---|---|

Kuehne+Nagel | Supply chain consulting, customs clearance and brokerage, warehousing, order management, project management, execution of air, rail, and sea freight |

DB Schenker | Supply chain management consulting, executive logistics activities, e-commerce solutions, leading logistics services, intermodal transport, customs brokerage-related services |

Kuehne+Nagel and DB Schenker continue to adapt to changing trade demands by investing in digital solutions and integrated trade management. Their value-added services help businesses stay competitive and compliant in global markets.

Performance

Reliability

Kuehne+Nagel and DB Schenker both have strong reputations for reliability in global freight services. Kuehne+Nagel uses advanced tracking systems and digital platforms to reduce errors and delays. Their teams monitor shipments closely and respond quickly to disruptions. Many customers report high satisfaction with Kuehne+Nagel’s ability to deliver goods safely and on time.

DB Schenker also invests in reliability. The company uses real-time GPS tracking and regional hubs to keep shipments moving smoothly. Their teams focus on minimizing transit risks and handling exceptions quickly. DB Schenker’s strong presence in Europe and Asia helps them maintain consistent service levels.

Note: Industry surveys show that both companies achieve on-time delivery rates above 95% for most routes.

Company | On-Time Delivery Rate | Key Reliability Features |

|---|---|---|

Kuehne+Nagel | 96% | Digital tracking, proactive monitoring |

DB Schenker | 95% | GPS tracking, regional logistics hubs |

Delivery Times

Delivery speed plays a key role in logistics. Kuehne+Nagel offers fast transit times for air and sea freight. Their digital booking tools help customers choose the quickest routes. Kuehne+Nagel’s global network supports rapid movement of goods, even in peak seasons.

DB Schenker stands out in land transport. Their strong European network allows for fast road deliveries. The company also provides express options for urgent shipments. DB Schenker’s teams work to reduce customs delays and optimize delivery schedules.

Kuehne+Nagel: Excels in international air and sea freight speed.

DB Schenker: Leads in road transport and regional express services.

Customers should review transit time estimates for their specific routes. Both companies provide detailed schedules and tracking updates to help businesses plan shipments with confidence.

Sustainability

Green Initiatives

Kuehne+Nagel and DB Schenker both invest in green logistics to reduce their environmental impact. Each company takes a unique approach to sustainability.

Kuehne+Nagel partners with airlines and logistics groups to expand the use of Sustainable Aviation Fuel (SAF). In a recent project, Kuehne+Nagel, LATAM, and Elite Group used 34,615 liters of SAF, made from used cooking oil, to transport over 1.6 million flower stalks. This effort cut about 55 tonnes of CO2 emissions and lowered the carbon footprint by 80% compared to regular jet fuel. Kuehne+Nagel also works with Cathay Cargo to grow SAF use in Asia. These partnerships support the company’s science-based emission reduction targets and help customers lower their supply chain emissions.

DB Schenker focuses on a broad range of green initiatives across air, ocean, and land transport. The company works with Microsoft Cloud Logistics to use SAF and Sustainable Marine Fuel (SMF). DB Schenker uses Hydrogenated Vegetable Oil (HVO) for ocean shipments between California and Texas. The company also deploys alternative energy trucks and HVO100 fueling stations in Europe and North America. DB Schenker upgrades its warehouses to high environmental standards, such as LEED Platinum and BREEAM Excellent certifications. These actions help reduce carbon emissions and improve energy efficiency.

Both companies show strong commitment to long-term sustainability and ESG goals, aiming to decarbonize logistics operations.

Kuehne+Nagel vs. DB Schenker presents two strong choices for global freight. Kuehne+Nagel leads in technology and carbon-neutral options, while DB Schenker stands out for sustainable logistics and industry expertise.

Company | Strengths | Weaknesses |

|---|---|---|

Kuehne+Nagel | Global expertise, digital innovation | Limited presence in some regions |

DB Schenker | End-to-end solutions, sustainability focus | Higher pricing |

Businesses should:

Match logistics needs with each provider’s strengths.

Compare service offerings, pricing, and customer support.

Monitor performance and maintain clear communication.

FAQ

What industries do Kuehne+Nagel and DB Schenker serve?

Both companies support many industries. Kuehne+Nagel works with aerospace, automotive, healthcare, and retail. DB Schenker focuses on manufacturing, e-commerce, automotive, and consumer goods. Their teams design solutions for each sector.

How do customers track shipments with these providers?

Customers use digital platforms for tracking. Kuehne+Nagel offers myKN for shipment visibility. DB Schenker provides real-time GPS tracking and a customizable dashboard. Both systems send updates and alerts.

Are there sustainable shipping options available?

Kuehne+Nagel provides carbon-free and biofuel shipping. DB Schenker uses alternative fuels and eco-certified warehouses. Both companies help clients lower their carbon footprint.

Which provider is better for European land transport?

DB Schenker leads in European land transport. Their network covers major trade routes and offers fast delivery. Kuehne+Nagel also provides road services but focuses more on global air and sea freight.

Can small businesses use Kuehne+Nagel or DB Schenker?

Small businesses can use both providers. However, their pricing and service complexity often suit larger companies. Small firms may find better value with regional logistics specialists.

See Also

Discover The Latest Trends In Sea Freight Shipping 2024

In-Depth Insights Into The Future Of LTL Freight

Complete Overview Of Leading Global Logistics Providers

New Approaches To Managing Suppliers In Cross-Border E-Commerce

How Cloud Technology Is Transforming Supply Chain Operations