Who will lead the next era of air freight in the Asia - Pacific region?

The Asia-Pacific region has emerged as a global leader in air freight, driven by its rapid economic growth and strategic position in global trade. Airlines in this region experienced a 16.4% rise in international air cargo demand, with freight capacity growing by 12.6%. The freight load factor also increased to 62.8%, reflecting the region's ability to adapt to market shifts. These achievements highlight the importance of innovation and sustainability in shaping the future of air freight. As the industry evolves, the companies that prioritize these factors will lead the next era of air freight.

Key Takeaways

The Asia-Pacific area leads in air shipping. Its market may grow from $22 billion in 2023 to $51 billion by 2030.

Online shopping increases air shipping needs. It makes up 50% of cargo on main routes and will grow more.

Big airlines use new technology and add routes to work faster and handle more shipping needs.

Being eco-friendly is key for air shipping. Companies use green methods to cut pollution and look better to customers.

Airlines, delivery companies, and governments must work together. This teamwork can fix building issues and help air shipping grow.

The Current Landscape of Air Freight in the Asia-Pacific Region

Growth trends and market demands

The air freight industry in the Asia-Pacific region has experienced remarkable growth in recent years. This market generated a revenue of USD 22,235.4 million in 2023 and is projected to reach USD 51,501.9 million by 2030. A compound annual growth rate (CAGR) of 12.7% from 2024 to 2030 highlights the region's expanding role in global logistics.

Several factors contribute to this growth. Increasing demand for time-sensitive deliveries, particularly for high-value goods like electronics and pharmaceuticals, has driven the need for efficient air freight services. Additionally, the region's strategic location as a hub for global trade routes has strengthened its position in the logistics sector.

The following table illustrates the broader market size and growth trends:

Metric | Value |

|---|---|

Market size in 2023 | |

Market size in 2024 | USD 278.43 billion |

Revenue forecast in 2030 | USD 501.32 billion |

Growth rate | CAGR of 10.3% |

These figures underscore the increasing reliance on air freight to meet the demands of a fast-paced global economy. The Asia-Pacific region's ability to adapt to these demands positions it as a leader in the industry.

The impact of e-commerce and cross-border trade

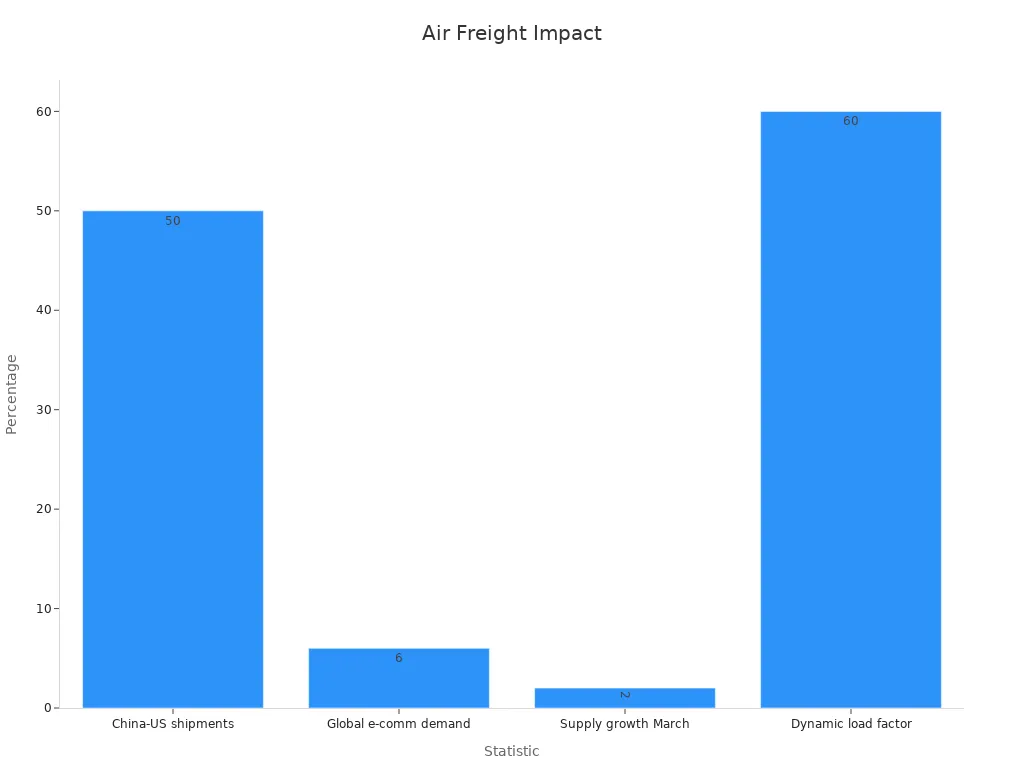

E-commerce has revolutionized the air freight sector, particularly in the Asia-Pacific region. The rise of online shopping platforms has led to a surge in cross-border trade, with e-commerce shipments accounting for 50% of cargo capacity on the China-to-US corridor. Globally, e-commerce contributes 6% to air freight demand, a figure expected to grow as online sales continue to rise.

The following table highlights key statistics related to e-commerce and air freight:

Statistic | Value |

|---|---|

Annual increase in cargo tonne kilometers (CTK) | 13.4% |

International air cargo volume increase (YoY) | 15.6% |

E-commerce sales projection by end of 2024 | $6.3 trillion |

Percentage of e-commerce packages transported by air | 20% (expected to reach 33% by 2027) |

Shenzhen Bao'an International Airport exemplifies this trend, with international e-commerce shipments increasing by 101% from January to July 2023. The growing reliance on air freight for e-commerce reflects the sector's ability to meet consumer expectations for fast and reliable delivery.

As e-commerce expands, air freight companies must adapt to handle higher volumes and optimize their operations. The Asia-Pacific region's focus on innovation and infrastructure development will play a crucial role in meeting these challenges and sustaining growth.

Government policies and infrastructure investments

Government policies and infrastructure investments have a profound impact on the air freight sector. In the Asia-Pacific region, initiatives such as the Belt and Road Initiative and the Regional Comprehensive Economic Partnership (RCEP) have facilitated smoother cross-border trade. These efforts have strengthened the region's position as a global leader in air freight.

Privatization of airports has also played a significant role in enhancing air freight capabilities. Nearly 20% of the world’s airports had been privatized as of 2020. Private equity firms have acquired 102 out of 437 privatized airports, leading to notable improvements in performance. Airports owned by private equity funds experienced an average increase of 20% in passengers per flight and an 84% rise in overall passenger traffic. Additionally, the odds of winning a quality award for these airports increased by six percentage points.

Governments in the region have also invested in advanced logistics infrastructure to support the growing demand for air freight. For example, the development of new cargo terminals and the expansion of existing facilities have improved capacity and efficiency. These investments ensure that the Asia-Pacific region remains at the forefront of global air freight, driving innovation and growth.

The combination of strategic airline initiatives, innovative logistics companies, and supportive government policies positions the Asia-Pacific region to lead the next era of air freight.

Innovations and Trends Shaping the Future

Digital technologies and automation in air freight

Digital transformation is reshaping the air freight industry, enhancing efficiency and profitability. Airlines and logistics companies are adopting advanced technologies to streamline operations. Key trends include the use of API integrations for real-time communication and AI-driven tools for capacity optimization. These innovations have improved operational workflows, reducing wait times by up to 75% through slot booking systems. Freight forwarders leveraging digital platforms have expanded their services, democratizing access to air freight solutions.

The financial benefits of digitalization are significant. Airlines have reported a 25% increase in revenue from improved capacity procurement. Additionally, selling capacity through digital tools has boosted revenue by 15%. These advancements highlight the transformative potential of technology in the air freight sector.

Sustainability and green logistics initiatives

Sustainability has become a priority for the air freight industry as environmental concerns grow. Companies are investing in green logistics initiatives to reduce their carbon footprint. Electric aircraft are being developed to lower emissions and operating costs, signaling a shift toward eco-friendly solutions. Sustainable aviation fuel (SAF) is also gaining traction, offering a cleaner alternative to traditional jet fuel.

Governments and organizations are encouraging these efforts through policies and incentives. For example, carbon offset programs and green certifications motivate companies to adopt sustainable practices. These initiatives not only benefit the environment but also enhance brand reputation, making sustainability a competitive advantage in the industry.

The rise of cargo drones and advanced air mobility

Cargo drones and advanced air mobility (AAM) are revolutionizing air freight, particularly in last-mile delivery. Companies like Amazon and DHL are utilizing drones for efficient transport of small packages. Drones dominate the AAM market due to their versatility and cost-effectiveness. Aircraft in the 100-300 kg range are gaining popularity for regional transport, balancing weight, range, and payload capacity.

The commercial sector is expected to hold a 71.5% market share in 2024, driven by the demand for efficient transportation solutions. These innovations are transforming logistics, offering faster and more sustainable delivery options. As technology advances, cargo drones and AAM will play a pivotal role in shaping the future of air freight.

Challenges and Opportunities in the Asia-Pacific Air Freight Sector

Infrastructure development and capacity constraints

The rapid growth of air freight in the Asia-Pacific region has exposed significant infrastructure challenges. Airports are struggling to keep up with increasing cargo volumes. The 2023 US Airport Infrastructure Needs Report highlights that cargo traffic is expected to grow to 167% of 2019 levels by 2040. This underscores the inadequacy of current infrastructure to handle future demands. Miami International Airport, for example, is addressing this issue by constructing a new facility to boost its cargo capacity by 50%. This proactive approach demonstrates the urgent need for modernization in air freight hubs.

In the Asia-Pacific region, similar challenges exist. Many airports face capacity constraints due to outdated facilities and limited expansion options. Addressing these issues requires substantial investment in infrastructure and technology. Governments and private stakeholders must collaborate to develop efficient cargo terminals and optimize existing resources.

Regulatory hurdles and international collaboration

Regulatory barriers often hinder seamless air freight operations across borders. The Asia-Pacific region, with its diverse regulatory frameworks, faces unique challenges in fostering international collaboration. On average, one billion passengers travel to, from, or within Asia annually. This number is expected to grow by 100 million each year, contributing to the doubling of global air traffic by 2030. To meet this demand, the region will require one-third of all new aircraft produced worldwide.

Harmonizing regulations across countries can streamline operations and reduce delays. Collaborative efforts between governments and industry players are essential to address these hurdles. Standardized policies and agreements can enhance efficiency and support the region's growing air freight needs.

Balancing growth with environmental concerns

The rapid expansion of air freight has raised environmental concerns. Sustainability is becoming a critical focus for the industry. Companies are adopting carbon tracking systems and exploring sustainable aviation fuels (SAF) to reduce emissions. These efforts align with growing pressure to meet environmental targets, which are reshaping business practices.

Balancing growth with sustainability requires innovative solutions. Airlines and logistics companies must invest in green technologies and prioritize eco-friendly operations. By doing so, they can address environmental challenges while maintaining their competitive edge in the global market.

Factors That Will Determine Leadership in the Next Era

Adaptability to shifting trade dynamics

Adaptability is a cornerstone of leadership in the evolving air freight industry. Companies must respond to shifting trade dynamics caused by geopolitical uncertainties, trade protectionism, and changing consumer demands. These factors are reshaping global supply chains and creating opportunities for those who can pivot quickly.

Trade protectionism and tariff actions in major economies are altering traditional trade routes. Air freight companies must adjust their strategies to accommodate these changes.

Geopolitical uncertainties have led manufacturers to adopt trends like "friendshoring" and "nearshoring," which prioritize regional supply chains over global ones.

The exponential growth of e-commerce has increased demand for air cargo services. Companies integrating e-commerce platforms with logistics solutions can enhance customer experience through faster shipping and better tracking.

The pharmaceutical sector exemplifies the need for adaptability. Specialized shipments require investments in temperature-controlled storage and advanced monitoring systems to ensure product integrity. Additionally, air freight plays a critical role in connecting smaller markets to the global supply chain, enabling consistent freight movement in these regions. Companies that streamline processes and adopt a proactive investment mindset will position themselves to lead the next era of air freight.

Tip: Embracing flexibility in operations and investing in infrastructure tailored to emerging trade patterns can help companies stay competitive in a dynamic market.

Balancing freighter and belly cargo operations

Balancing freighter and belly cargo operations is essential for optimizing air freight capacity. Passenger aircraft belly-hold capacity has grown significantly, offering opportunities for companies to maximize efficiency. However, dedicated freighters remain crucial for handling specialized shipments and high-demand routes.

Belly-hold capacity in passenger aircraft increased by 40.5%, while dedicated freighter capacity grew by only 1.6%.

In April and May, belly-hold capacity exceeded dedicated freighters by 4.6% in available cargo tonne-kilometers (ACTKs).

Despite this growth, international cargo capacity from passenger aircraft was 41.1% lower than that of dedicated freighters in May 2022.

The ability to balance these two modes of cargo transport determines operational success. Belly cargo offers cost-effective solutions for general goods, while freighters provide reliability for time-sensitive and high-value shipments. Companies that optimize both will reduce capacity shortages and improve profitability.

A hybrid approach, combining freighter and belly cargo operations, allows companies to adapt to fluctuating demand. Airlines like Cathay Pacific have demonstrated the effectiveness of this model, leveraging belly cargo for e-commerce shipments while maintaining dedicated freighters for specialized goods. This strategy ensures flexibility and resilience in the face of market changes.

Embracing sustainability and cost management

Sustainability and cost management are critical factors shaping the future of air freight. Companies must adopt eco-friendly practices while maintaining operational efficiency to meet environmental targets and reduce expenses.

Innovations like IoT, AI, and blockchain enhance operational efficiency and lower costs in air freight services.

Green logistics efforts could reduce carbon emissions by up to 20% by 2030.

Eco-friendly alternatives to traditional air freight operations are gaining traction, influencing service offerings and operational practices.

Sustainable aviation fuel (SAF) is emerging as a key solution for reducing emissions. Airlines investing in SAF programs are positioning themselves as leaders in green logistics. Additionally, carbon tracking systems and offset programs are helping companies align with global sustainability goals.

Cost management complements sustainability efforts. Digital tools like predictive analytics and automated systems streamline operations, reducing waste and improving profitability. Companies integrating sustainability into their corporate strategies will not only meet environmental standards but also gain a competitive edge in the market.

Note: Prioritizing green initiatives and leveraging technology for cost efficiency will enable companies to lead the next era of air freight while addressing environmental concerns.

The Asia-Pacific region stands poised to lead the next era of air freight by embracing innovation, adaptability, and sustainability. Collaboration among airlines, logistics firms, and governments will drive this transformation. For instance, air freight contributes one-third of airline revenue, while freighters carry over 50% of global cargo traffic. The projected 75% growth in the global freighter fleet by 2037 underscores the sector's potential. By balancing growth with environmental and technological advancements, the region can secure its leadership in the evolving air freight landscape.

Statistic Description | Value/Prediction |

|---|---|

Air freight's contribution to airline revenue in 2021 | One-third of airline revenue |

Expected growth of Asia markets in air cargo compared to world average | Faster than world average |

Projected growth of the global freighter fleet by 2037 | 75% increase (3,260 freighters) |

Percentage of air freight forwarders offering online registration | 60% |

Percentage of world air cargo traffic carried by freighters | More than 50% |

Demand for better service and competitive pricing from modern shippers | Increasing due to start-ups |

The future of air freight in the Asia-Pacific region depends on its ability to innovate and adapt while fostering multi-stakeholder collaboration.

FAQ

What role do cargo drones play in the future of air freight?

Cargo drones revolutionize last-mile delivery by offering faster and more cost-effective solutions. They dominate the advanced air mobility market, particularly for small package transport, and are expected to play a pivotal role in shaping logistics efficiency.

How are airlines balancing freighter and belly cargo operations?

Airlines optimize operations by combining freighter and belly cargo capacity. Freighters handle specialized shipments, while belly cargo offers cost-effective solutions for general goods. This hybrid approach ensures flexibility and resilience in meeting market demands.

What challenges does the Asia-Pacific air freight sector face?

The sector faces infrastructure constraints, regulatory hurdles, and environmental concerns. Airports require modernization to handle growing cargo volumes. Harmonizing regulations and adopting sustainable practices are essential for overcoming these challenges and ensuring long-term growth.

Tip: Collaboration among airlines, logistics companies, and governments can address these challenges effectively.

See Also

Exploring Innovations in Sea Freight Logistics for 2024

Transforming Logistics with AI: A Look Ahead

In-Depth Insights into the Future of LTL Freight

Navigating Future Logistics Through Digital Technology Advances