Why Logistics Costs Remain High in the Automotive Industry

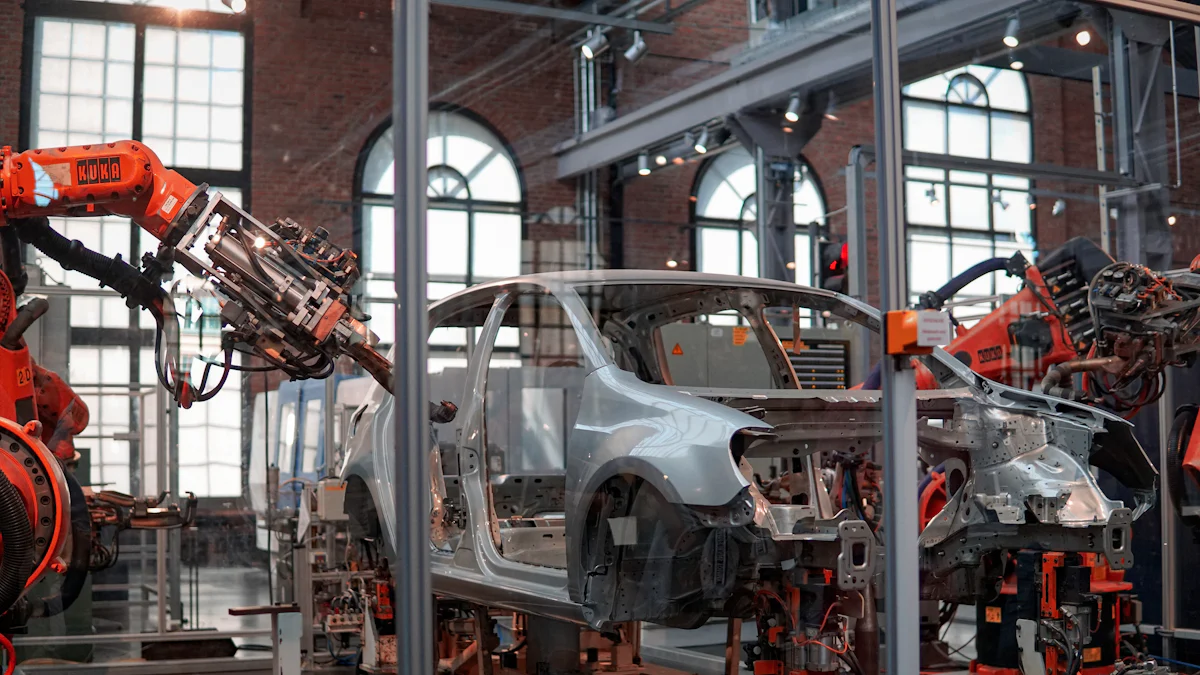

Logistics Costs Remain Persistently High in The Automotive Industry. Manufacturers face mounting pressures from the shift to electric vehicles, which increases production costs due to labor shortages and supply chain interruptions. Recent COVID-19 lockdowns in key regions slowed EV output and limited access to critical materials like lithium and cobalt. Companies also struggle with post-pandemic shipping surges, port congestion, tariffs, and rising inflation. These challenges disrupt operations for suppliers and raise prices for consumers.

Key Takeaways

Labor shortages and rising fuel prices drive up automotive logistics costs by increasing production downtime and transportation expenses.

Supply chain disruptions, port congestion, and tariffs cause delays and higher shipping fees, pushing costs higher for manufacturers and consumers.

Longer transportation distances and complex global supply chains add to logistics challenges and increase overall expenses.

Automakers face financial pressure from logistics costs, which raise vehicle prices and affect suppliers' stability.

Companies reduce costs by adopting automation, advanced tracking, lean management, and supplier diversification to improve efficiency and resilience.

Key Drivers

Labor and Workforce

Automotive logistics faces a persistent labor shortage. As of May 2024, manufacturers reported about 603,000 unfilled jobs. Average wages for production workers have climbed to $28 per hour. Employment in manufacturing dropped by 8.7% in 2023, and hours worked fell by 10.5%. These shortages lead to production downtime, which can cost between $600,000 and $3 million per hour. Even a single minute of downtime results in losses from $10,000 to $50,000. Companies must pay more for overtime and temporary staff, which increases logistics expenses and disrupts supply chains.

Fuel and Energy

Fuel and energy prices remain volatile. When fuel prices rise, transportation costs increase. Research shows that higher fuel prices, often driven by taxes or policy changes, cause people to drive less and reduce transportation demand. This effect leads to fewer vehicle miles traveled and higher costs for moving goods. Reports from the Federal Highway Administration confirm that rising fuel costs change consumer behavior, reduce traffic, and increase congestion. These changes force logistics providers to adjust routes and schedules, which adds complexity and cost.

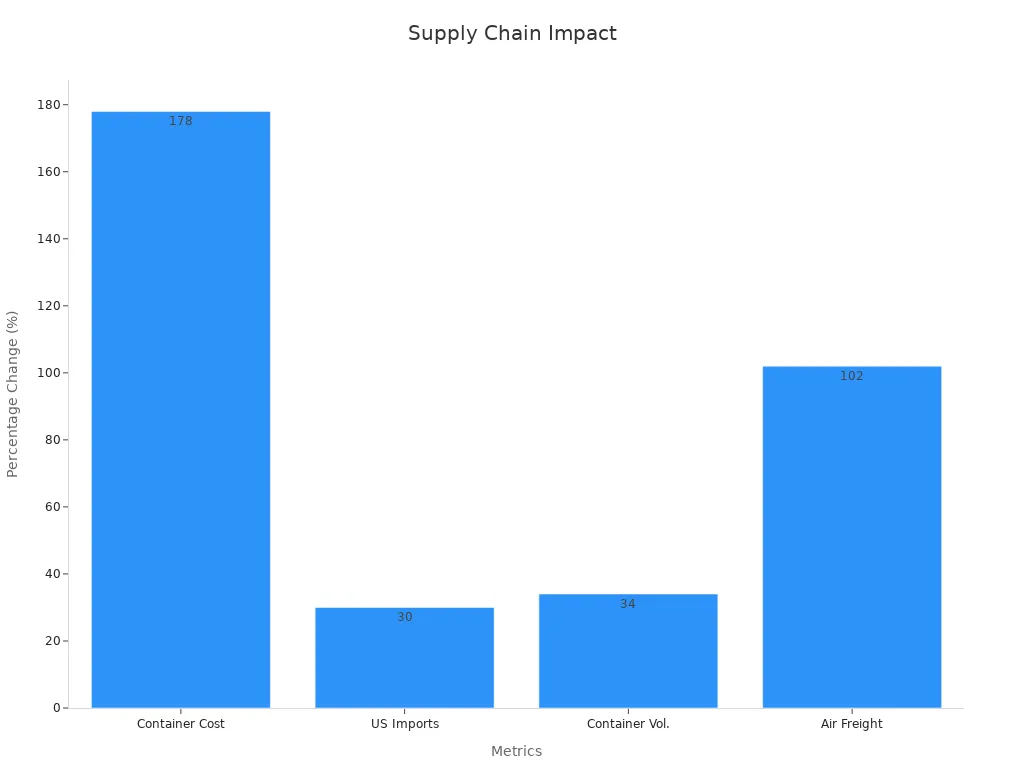

Supply Chain Disruptions

Supply chain disruptions continue to impact the automotive industry. After the COVID-19 pandemic, container shipping costs from China to the U.S. West Coast jumped by 178% in 2020. U.S. imports from Asia increased by 30% in December 2020 compared to the previous year. Ports handled 34% more containers from June to October 2020, causing congestion and delays. Air freight spot prices from Hong Kong to North America rose by 102%. These disruptions led to longer delivery times and higher shipping costs.

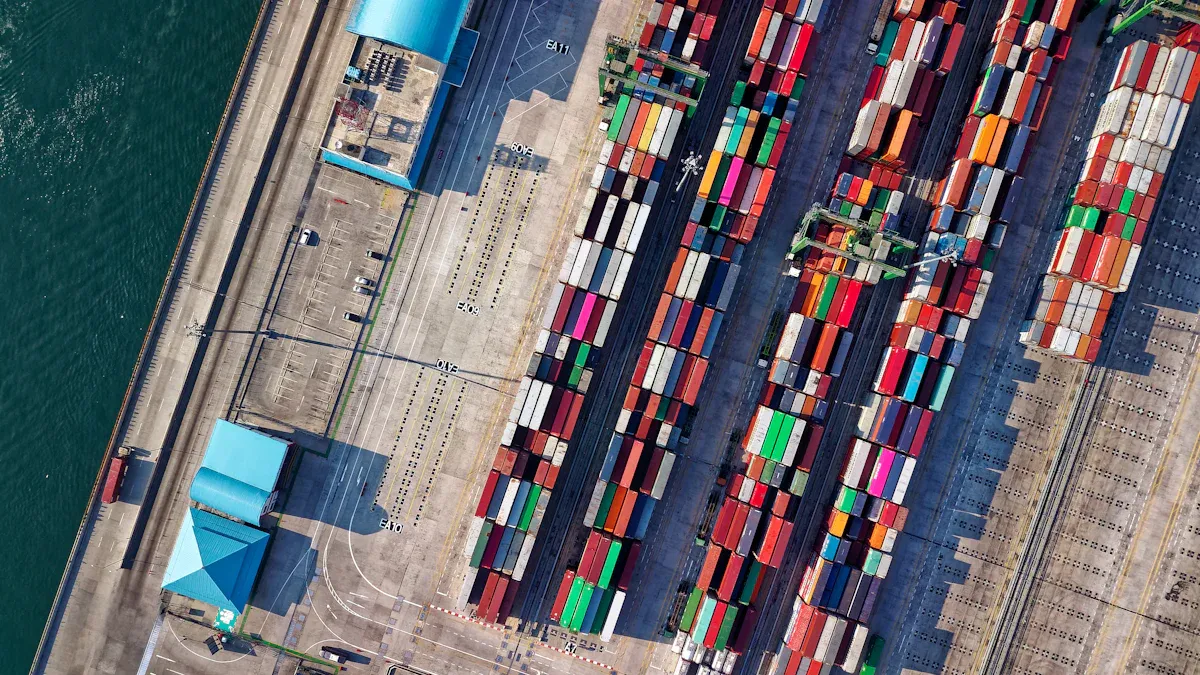

Port and Carrier Issues

Port congestion and carrier problems add to logistics costs. Over half of freight-dependent businesses pass congestion costs to consumers. About 19% absorb these costs, while others change routes or even close operations. A 20% increase in congestion can raise annual operating costs by $14 billion for freight industries. Regulations and lack of collaboration force trucks to take detours, increasing delivery times and reducing efficiency. In Asia, a 1% rise in port congestion leads to more than a 1% increase in freight rates.

Tariffs and Trade

Tariffs and trade regulations create uncertainty and increase costs. Sudden tariff changes cause delays, rerouting, and extra storage fees. Between late 2023 and early 2024, logistics costs rose by 13%, partly due to tariffs. Tariffs on cross-border returns add re-import duties, brokerage fees, and fuel surcharges. Over 63% of merchants now charge for returns, reflecting these pressures. Customs clearance delays and complex regional rules further complicate logistics, raising costs and reducing profit margins.

Logistics Costs Remain Persistently High in The Automotive Industry

Inflation and Input Costs

Inflation continues to drive up operational expenses across the automotive logistics sector. Companies now pay more for diesel, insurance, and labor. Since 2014, these costs have increased by about 34%. This rise makes it difficult for freight rates to drop, even when spot market rates remain steady. The cost of business logistics in the U.S. has reached $2.3 trillion, which is 8.7% of the nation’s GDP. These numbers show that logistics costs remain persistently high in the automotive industry. The Global Supply Chain Pressure Index (GSCPI) tracks ongoing supply chain disruptions. Spikes in this index match periods of higher goods inflation. The Multivariate Core Trend (MCT) inflation measure also stays above pre-pandemic levels, especially for goods and services outside of housing. The Baltic Dry Index (BDI), a key shipping cost indicator, shows that increases in shipping costs lead to lasting rises in import prices and overall inflation. These trends confirm that logistics costs remain persistently high in the automotive industry, with inflationary pressures showing no signs of easing.

Inventory and Storage

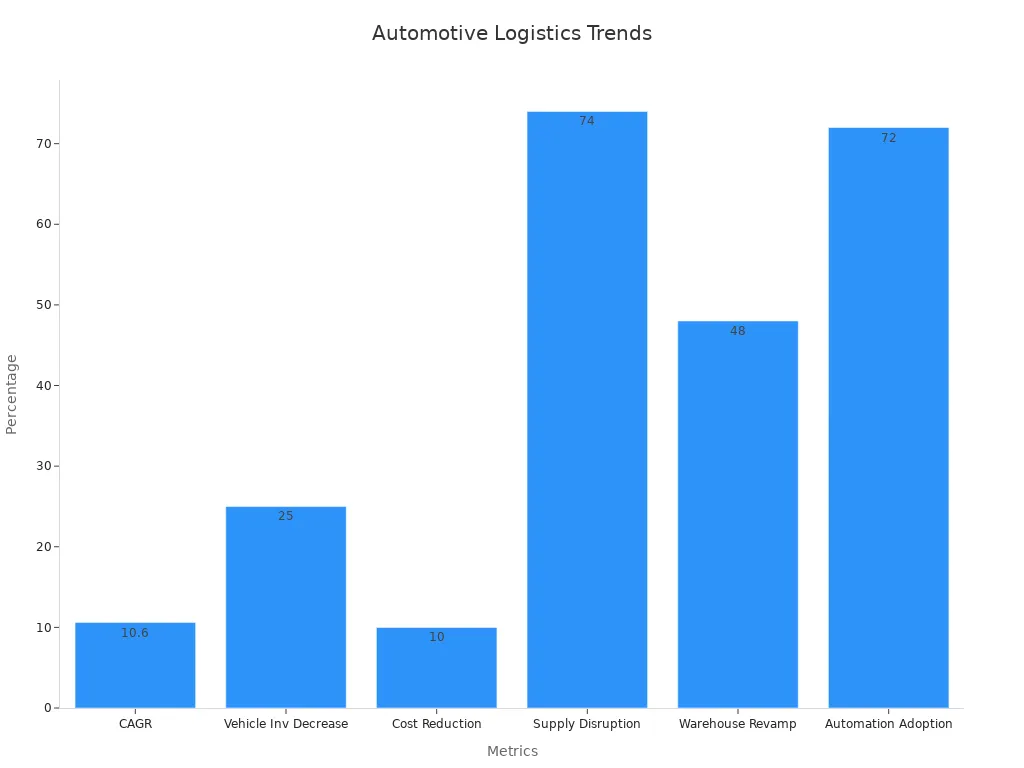

Managing inventory and storage presents another major challenge. Excess inventory ties up capital and increases storage and transportation expenses. The Inventory-to-Sales ratio has stayed between 1.36 and 1.39 since early 2023. This stability suggests a return to normal restocking cycles after the disruptions of the pandemic. However, some companies have built up inventory to avoid tariffs, which delays new shipments and keeps logistics costs elevated. The automotive logistics market size reached $235.8 billion in 2024 and is projected to grow to $645.8 billion by 2034, with a compound annual growth rate of 10.6%.

Statistic / Trend | Value / Description |

|---|---|

Automotive logistics market size (2024) | USD 235.8 billion |

Projected market size (2034) | USD 645.8 billion |

Compound Annual Growth Rate (CAGR) | 10.6% (2025-2034) |

Europe's vehicle selling inventory decrease by 2030 | 25% (from 280 million to 200 million vehicles) |

Potential inventory cost reduction by lowering stock-outs and overstocks | 10% |

Impact of supply chain disruptions | 74% of businesses experienced shipment delays and longer lead times |

Warehouse location reevaluation due to trade pattern shifts | 48% of businesses |

Adoption of real-time visibility and automation in supply chains | 72% of retailers plan to implement |

Challenges affecting costs | Fuel costs, workforce shortages, regulatory impacts |

Influence of just-in-time logistics | Reduces inventory costs by enabling parts delivery exactly when needed |

Market drivers | Globalization, rising vehicle demand, supply chain technology advancements |

Technological trends | Digital tracking, automation, AI, sustainable logistics solutions |

Reducing stock-outs and overstocks can lower inventory costs by 10%. Still, 74% of businesses have faced shipment delays and longer lead times. Nearly half of all businesses are reevaluating warehouse locations due to changing trade patterns. Most retailers plan to use real-time visibility and automation to manage inventory better. These factors all contribute to why logistics costs remain persistently high in the automotive industry.

Transportation Distances

Longer transportation distances also play a key role in keeping logistics costs elevated. As multinational companies spread production and consumption across more regions, goods must travel farther. This geographic fragmentation increases the complexity and cost of moving vehicles and parts. The quality of transportation infrastructure, such as ports and highways, can help reduce some costs, but cannot eliminate them. Longer distances mean higher fuel use, more labor hours, and greater risk of delays. These factors raise transaction costs and make logistics more expensive. In Asia, better transportation systems help offset some distance costs, but differences in infrastructure quality still affect trade and investment success. As companies continue to expand globally, logistics costs remain persistently high in the automotive industry due to these extended transportation routes.

Industry Impact

Manufacturers and Suppliers

Manufacturers and suppliers in the automotive industry face intense financial pressure from high logistics costs. Logistics expenses now account for about 8% of a vehicle’s retail price. Companies like Ford and Volkswagen have responded by restructuring supply chains and terminating long-term logistics contracts to control costs. Many suppliers struggle to stay afloat, with 38% of North American auto parts makers at risk of bankruptcy. Only one-third of suppliers hold investment-grade ratings, while the rest face financial instability. This environment forces automakers to adopt risk mitigation strategies, such as multiple sourcing, to avoid disruptions. The industry’s fragmented logistics sector, where the top ten providers hold less than 30% market share, creates fierce competition and keeps margins low. As a result, companies have limited resources to invest in modernization or green initiatives.

Supply Chain Coordination

Supply chain coordination has become more complex due to global events and market shifts. Geopolitical tensions and tariffs on imports from countries like China, Mexico, and Canada increase production costs and create uncertainty. Wars and conflicts disrupt the supply of critical materials, such as steel, and delay transportation routes. Natural disasters, including hurricanes and floods, often halt manufacturing and shipping, leading to further delays and higher costs. The COVID-19 pandemic caused plant shutdowns and shipment delays, which reduced production and created shortages. Semiconductor shortages have also increased delivery lead times and forced manufacturers to raise vehicle prices. The complexity of global supply chains, with reliance on multiple countries for parts, adds to coordination challenges and cost pressures.

Consumer Prices

Consumers feel the impact of high logistics costs through rising vehicle prices and related expenses. The average new car price in 2024 reached $48,759, reflecting increased costs from supply chain delays and higher shipping rates. Freight costs on key trade lanes, such as Asia to the US and Europe, have risen by 3% or more, with ocean rates doubling compared to pre-crisis levels. These increases get passed along the supply chain, raising the final price for buyers. Automotive insurance premiums have also surged by about 51% since 2019, driven by higher vehicle prices. To stimulate demand, automakers increased consumer discounts by 25% from December 2023 to December 2024, but many buyers still face affordability challenges.

Solutions and Outlook

Industry Strategies

Automotive companies use several strategies to control logistics costs and improve resilience.

Many adopt LEED sustainability certification for warehouses, which improves efficiency and reduces environmental impact by focusing on location, energy, and materials.

Automation helps address workforce shortages and boosts operational performance by handling repetitive tasks and improving data visibility.

Lean and Six Sigma principles, such as DMAIC and DMADV, help identify and remove waste in logistics processes, saving both time and money.

Standardized Transportation Management Systems (TMS) improve communication and coordination, reducing errors and costs.

Strong logistics teams and supplier diversification build resilience, ensuring companies can manage disruptions and maintain cost-effective freight solutions.

Overestimating supply chain disruption risks proves more cost-effective than underestimating them. Companies that invest in resilience—through supplier diversification, regionalization, and segmenting supply chains—avoid larger future expenses, even if short-term costs rise.

Technology and Innovation

Technology drives major improvements in automotive logistics. Companies use AI-powered route optimization, advanced demand forecasting, and automated inventory management to cut costs and boost efficiency.

Technology/Innovation | Application Area | Impact on Logistics Costs and Efficiency |

|---|---|---|

Delivery routing | Reduced transportation costs by 22%; 25% reduction in delivery times; 20% increase in on-time deliveries | |

Advanced Demand Forecasting | Inventory management | Minimized inventory holding costs by 30%; reduced overstocking and stockouts |

Automated Inventory Management | Warehouse operations | Cut manual labor costs by 35%; improved inventory accuracy and replenishment automation |

IoT Sensors | Real-time tracking | Enabled fleet optimization and shipment tracking, reducing delays |

Robotics and AI-powered automation improve order accuracy and reduce operational costs. Blockchain and IoT provide real-time tracking and transparency, preventing fraud and reducing delays.

Future Trends

The automotive logistics market continues to evolve. Electric vehicle sales rose by 35% in 2023, increasing the need for specialized logistics, such as temperature-controlled battery transport. E-commerce growth, with retail sales expected to exceed $4.1 trillion in 2024, drives demand for faster and more efficient logistics services. Companies invest in AI, IoT, and blockchain to optimize routing and real-time tracking, which can increase logistics efficiency by up to 20%. However, rising fuel prices, infrastructure gaps, and stricter environmental regulations may push costs higher. The industry also shifts toward sustainable solutions, such as electric trucks and renewable energy, aiming to lower long-term costs and environmental impact.

Logistics Costs Remain Persistently High in The Automotive Industry. Multiple factors drive these costs, including supply shortages, rising freight rates, and the need for specialized shipping.

Specialized shipping costs increased fivefold.

The industry adopted new frameworks to assess and improve supply chain resilience.

These challenges affect manufacturers, suppliers, and consumers. The industry must continue to adapt and innovate to manage disruptions and build stronger supply networks.

FAQ

What causes logistics costs to stay high in the automotive industry?

Automotive logistics costs remain high due to labor shortages, fuel price changes, supply chain disruptions, and longer transport distances. Companies also face higher tariffs and stricter regulations. These factors combine to keep expenses above pre-pandemic levels.

How do high logistics costs affect car prices for consumers?

High logistics costs increase the final price of vehicles. Manufacturers pass these expenses to buyers. Consumers pay more for new cars, insurance, and parts. Rising freight rates and shipping delays also contribute to higher costs at dealerships.

Why do electric vehicles (EVs) make logistics more expensive?

EVs require special handling and storage. Batteries need temperature control and careful transport. Companies must invest in new equipment and training. These changes raise logistics costs for automakers and suppliers.

What steps can companies take to lower logistics costs?

Companies can use automation, improve warehouse locations, and adopt advanced tracking technology.

They also diversify suppliers and use lean management methods.

These strategies help reduce delays, cut waste, and control expenses.

See Also

Enhancing Supply Chain Efficiency In Advanced Manufacturing Industries

Expert Advice For Overcoming Automotive Supply Chain Obstacles

Maximizing The Capabilities Of Automotive Supply Chain Networks

Improving Automotive Demand Forecasting Through Data-Driven Insights

Mastering Lean Logistics Strategies For Advanced Manufacturing Growth