Mexico's Automotive Supply Chain: Key Developments

Mexico stands as a pivotal force in the global automotive industry, attracting substantial investments from major players. The country's role as the fourth largest vehicle exporter globally underscores its significance. Over 95% of Mexico's automotive production consists of light vehicles, with a remarkable 3,779,234 units produced in 2023 alone. The Automotive Supply Chain plays a crucial role in sustaining this growth. Recent developments in Mexico's automotive sector highlight its resilience and adaptability in an ever-evolving market landscape.

Overview of Mexico's Automotive Industry

Historical Context

Evolution of the automotive industry in Mexico

The Mexican automotive industry began its journey in the mid-20th century. Ford Motor Co. established a plant in Mexico in 1925, marking a significant milestone. This move played a crucial role in shaping the industry's growth and success. General Motors followed suit in the mid-1930s, solidifying Mexico's position as a favorable choice for low-cost production. The passing of NAFTA in 1994 further propelled the industry, providing greater traction and opening new avenues for expansion.

Key milestones in the development of the supply chain

The development of Mexico's automotive supply chain witnessed several key milestones. The establishment of major automotive plants laid the foundation for a robust supply network. The strategic location of Mexico facilitated seamless integration into global supply chains. The adoption of advanced manufacturing technologies enhanced efficiency and competitiveness. The sector's contribution to Mexico's manufacturing output reached 17.6%, making it the second largest automobile manufacturing nation in the Western Hemisphere.

Current Landscape

Major players in the Mexican automotive market

The Mexican automotive market hosts several major players. Ford, General Motors, and other global giants have established a strong presence. These companies contribute significantly to the industry's output and innovation. The presence of numerous suppliers and component manufacturers strengthens the supply chain. The collaborative ecosystem fosters growth and development within the sector.

Recent trends and statistics

Recent trends in Mexico's automotive industry reflect resilience and adaptability. The industry produced nearly 3.6 million light vehicles in 2021, marking a 17% increase from the previous year. The total production capacity reached 5 million vehicles. The sector employs over 1 million professionals and includes around 300 research and development centers. Nearshoring has gained popularity, driven by the need for localized supply chains and reduced shipping times. The positive trade balance, with a surplus exceeding $16 billion, underscores the industry's competitiveness and importance to the national economy.

Automotive Supply Chain and Policy Impacts

Trade Agreements

USMCA and its implications

The United States-Mexico-Canada Agreement (USMCA) has reshaped the Automotive Supply Chain in Mexico. The agreement mandates that 75% of a vehicle's content must originate from North America. This requirement applies to light vehicles, while heavy trucks require 70% North American content. Core auto parts must also come from the United States, Canada, or Mexico. These rules ensure duty-free access for goods meeting the content requirements.

USMCA encourages automakers to increase their presence in Mexico. The agreement offers new business opportunities for U.S. exporters. Local original equipment manufacturers (OEMs) and suppliers in Mexico seek to increase inputs from North American sources. The policy fosters a robust and efficient supply chain within the region. Automakers with established supply lines to Mexico experience fewer delays during global disruptions.

Other international trade agreements

Mexico participates in various international trade agreements beyond USMCA. These agreements enhance the country's role in the global Automotive Supply Chain. Mexico's strategic location facilitates integration into global supply networks. The country benefits from agreements with the European Union, Japan, and other nations. These partnerships expand market access for Mexican automotive products. The agreements also attract foreign investment, boosting local manufacturing capabilities.

Government Regulations

Environmental policies

Environmental policies play a crucial role in shaping Mexico's automotive sector. The government enforces regulations to reduce emissions and promote sustainability. Automakers must comply with strict emission standards. These policies drive innovation in vehicle design and production processes. Manufacturers invest in cleaner technologies and alternative fuels. The focus on sustainability enhances the competitiveness of Mexico's Automotive Supply Chain.

Labor laws and their effects

Labor laws significantly impact the automotive industry in Mexico. The government enforces regulations to protect workers' rights and ensure fair wages. Labor reforms under USMCA require compliance with higher standards. These changes affect production costs and operational strategies. Companies must adapt to new labor conditions while maintaining efficiency. The focus on labor rights strengthens the industry's reputation and attracts global partners.

Challenges Facing the Automotive Supply Chain

Economic Factors

Currency fluctuations

Currency fluctuations present a significant challenge for Mexico's automotive supply chain. The value of the Mexican peso often experiences volatility against major currencies like the U.S. dollar. This fluctuation impacts the cost of imported raw materials and components. Manufacturers face difficulties in maintaining stable pricing strategies. Currency instability affects profit margins and financial planning. Companies must implement hedging strategies to mitigate risks associated with currency fluctuations.

Inflation and cost pressures

Inflation and cost pressures pose additional challenges for the automotive industry in Mexico. Rising costs of raw materials and labor increase production expenses. Inflationary trends affect the purchasing power of consumers. Higher costs lead to increased vehicle prices, impacting sales volumes. Manufacturers must optimize operations to manage cost pressures effectively. Efficient resource allocation and cost control measures become essential for sustaining competitiveness.

Infrastructure Issues

Transportation and logistics challenges

Transportation and logistics challenges hinder the efficiency of Mexico's automotive supply chain. Inadequate infrastructure affects the timely movement of goods. Congested roads and limited rail networks cause delays in transportation. Inefficient logistics systems increase lead times and operational costs. Companies invest in improving logistics capabilities to enhance supply chain efficiency. Strategic location offers advantages, yet infrastructure improvements remain necessary.

Technological advancements and gaps

Technological advancements and gaps present both opportunities and challenges. Mexico's automotive sector embraces Industry 4.0 technologies. Automation and digitalization improve manufacturing processes. However, gaps in technology adoption create disparities in efficiency. Some companies struggle to integrate advanced technologies into operations. Investment in research and development centers fosters innovation. Bridging technological gaps enhances competitiveness in the global market.

Opportunities for Growth and Innovation

Technological Advancements

Adoption of Industry 4.0 technologies

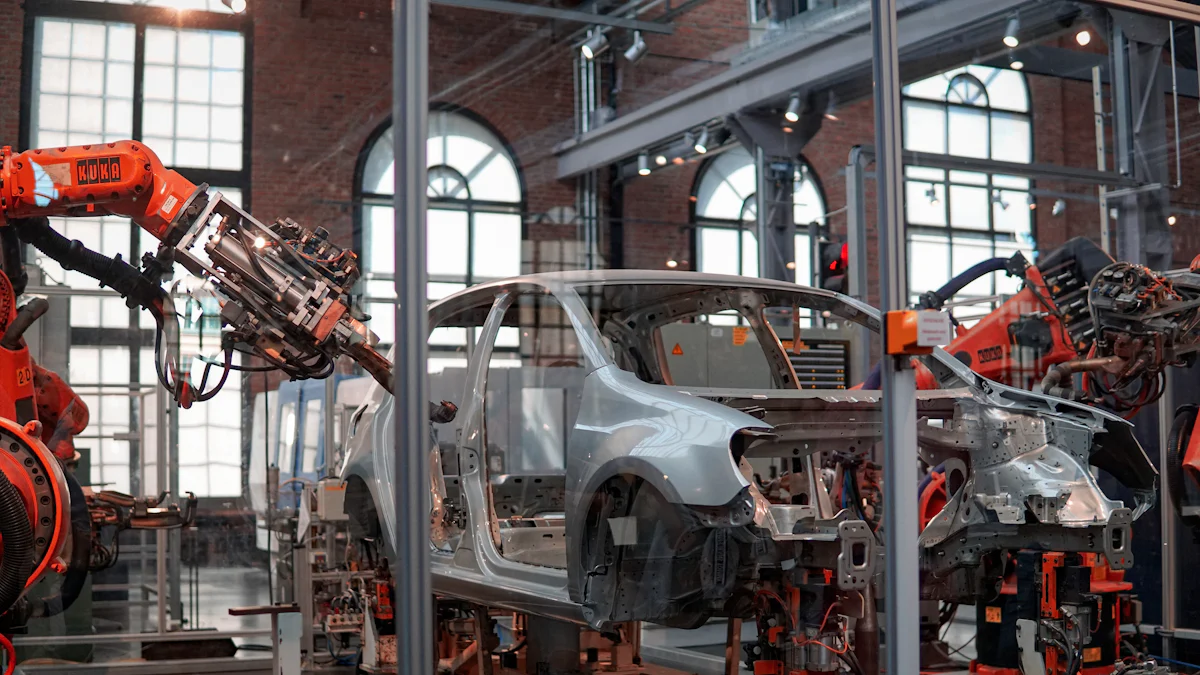

The Mexican automotive industry embraces Industry 4.0 technologies to enhance efficiency and competitiveness. Automation and digitalization transform manufacturing processes. Factories integrate advanced robotics and artificial intelligence into production lines. These technologies improve precision and reduce human error. The adoption of smart manufacturing systems optimizes resource allocation. Data analytics provide insights for better decision-making. Mexico's commitment to technology adoption strengthens its position in the global Automotive Supply Chain.

Innovations in manufacturing processes

Innovations in manufacturing processes drive growth in Mexico's automotive sector. Companies invest in research and development to create cutting-edge solutions. The focus on electric and hybrid vehicles reflects a shift towards sustainable transportation. New materials and techniques enhance vehicle performance and safety. The industry prioritizes energy efficiency and environmental sustainability. Collaborative efforts between automakers and technology providers foster innovation. Mexico's automotive industry remains at the forefront of technological advancements.

Strategic Partnerships

Collaborations with international firms

Strategic partnerships with international firms play a crucial role in Mexico's automotive industry. Collaborations facilitate knowledge exchange and expertise sharing. Global automakers establish joint ventures with local companies. These partnerships enhance production capabilities and market reach. International collaborations attract foreign investment and boost economic growth. The integration of global best practices strengthens Mexico's Automotive Supply Chain. Partnerships with leading technology firms drive innovation and competitiveness.

Investment opportunities in the supply chain

Investment opportunities abound within Mexico's automotive supply chain. The country's strategic location offers access to key markets. Investors capitalize on the growing demand for automotive components. Infrastructure development projects create avenues for investment. The focus on nearshoring attracts companies seeking localized supply chains. Investment in logistics and transportation infrastructure enhances efficiency. Mexico's favorable business environment encourages investment in the automotive sector.

Mexico's automotive industry stands at the forefront of a transformative era. The sector has embraced innovation and positioned itself as a leader in the global manufacturing landscape. Recent developments have strengthened the domestic supply chain, reinforcing Mexico's reputation as an automobile-building dynamo. The trend towards more technologically advanced cars produced in Mexico is expected to continue. The industry is poised to capitalize on Mexico's position as a global automotive hub. Adapting to changes will ensure sustained growth and continued influence in the worldwide market.

See Also

Maximizing the Potential of Your Automotive Supply Chain

Mastering Automotive Supply Chain Challenges with Expert Advice

Discovering Robotics Innovation: Supply Chain Transformation

Artificial Intelligence in Supply Chain: Transforming Logistics for the Future

Efficient Strategies for Resolving High-Tech Manufacturing Supply Chain Challenges