Mexico Logistics: Current Hot Topics and New Opportunities

Mexico Logistics is transforming rapidly as businesses and governments diversify supply chains and invest in technology. Recent events, such as rising security risks in Jalisco and the Manzanillo port strike, have disrupted freight movement and increased demand for resilient solutions. E-commerce growth has further driven logistics innovation and last-mile delivery improvements.

JUSDA’s experience and technology-driven approach support companies seeking reliable logistics strategies in this dynamic environment.

Key Takeaways

Mexico is becoming a key logistics hub due to nearshoring, with many companies moving production closer to the U.S. to save time and costs.

Rapid e-commerce growth in Mexico drives demand for faster, smarter delivery and new technologies like automation and AI.

Sustainability and digital transformation are reshaping logistics, helping companies reduce waste and improve efficiency.

Security risks, infrastructure limits, and driver shortages challenge logistics but can be managed with technology and strong safety measures.

New opportunities arise from cross-border trade, government-backed logistics parks, and industry clusters, supported by JUSDA’s advanced solutions.

Mexico Logistics Trends

Nearshoring Shift

Mexico has become the largest supplier of goods to the United States, surpassing China in 2024. Exports from Mexico to the U.S. reached $39.81 billion by the end of 2023, showing an 8.1% increase year-over-year. In the first quarter of 2024, Mexico-U.S. trade volume totaled $200.1 billion, up 1.7% from the previous year. This growth reflects a major shift in supply chains, as companies seek to reduce risks and costs by moving production closer to North America. Many industries, such as automotive, aerospace, electronics, and medical devices, now rely on Mexico for manufacturing and assembly. About 20%-40% of the value in Mexican exports to the U.S. comes from U.S. inputs, showing strong regional integration. The USMCA trade agreement supports this trend by lowering tariffs and encouraging investment. Companies have also shifted container traffic from U.S. ports to Mexican ports, increasing the importance of Mexico Logistics in global trade. JUSDA helps businesses take advantage of nearshoring by offering cross-border logistics solutions and compliance support, making supply chains more resilient and efficient.

Tip: Nearshoring to Mexico not only reduces shipping times but also helps companies respond faster to market changes.

E-commerce Growth

E-commerce in Mexico is expanding rapidly, with a projected compound annual growth rate of 24% until 2027. The market is expected to reach $97 billion by 2024, making it the second largest in Latin America. This surge in online shopping has created new demands for logistics providers. Companies must now deliver products faster and more reliably, especially during peak events like Black Friday and Buen Fin. To meet these challenges, businesses are investing in automation, artificial intelligence, and predictive analytics. Mexico City has become a central hub for e-commerce logistics, with many companies leasing large industrial spaces for fulfillment centers. Innovations such as digital payments, smart lockers, and omnichannel strategies are changing how goods move from warehouses to customers. JUSDA supports this growth by providing advanced warehousing, last-mile delivery, and digital supply chain solutions tailored for the fast-paced e-commerce sector.

Sustainability Focus

Sustainability has become a key priority in Mexico Logistics. Leading companies are adopting green logistics practices, such as using electric vehicles, optimizing delivery routes, and recycling packaging materials. These efforts have led to measurable results, including a 6% reduction in greenhouse gas emissions and a 93% recycling rate for non-hazardous waste. Investments in renewable energy, like solar panels and wind turbines, further reduce the environmental impact of logistics operations. Some companies also hold certifications for preventing plastic pollution and regularly report on their energy and water use. JUSDA contributes to sustainability by integrating eco-friendly practices into its logistics network and offering solutions that help clients lower their carbon footprint. The company’s cloud-based platforms improve route planning and inventory management, reducing waste and supporting responsible growth.

Digital Transformation

Digital transformation is reshaping Mexico Logistics. Large logistics companies are moving away from paper and spreadsheets, adopting cloud-based systems like ERP, WMS, and TMS to manage operations. Artificial intelligence and automation are becoming essential tools for improving efficiency, predicting demand, and enhancing customer service. While many small and medium-sized firms still rely on traditional methods, those that invest in digital tools gain a strong competitive edge. Cybersecurity and talent development remain important challenges, as companies need skilled workers to manage new technologies and protect sensitive data. JUSDA leads the way in digitalization with its JusLink intelligent supply chain platform, which uses IoT, cloud computing, and big data to provide real-time visibility and analytics. These innovations help clients make better decisions, respond quickly to disruptions, and optimize every step of the supply chain.

Key Challenges

Security Risks

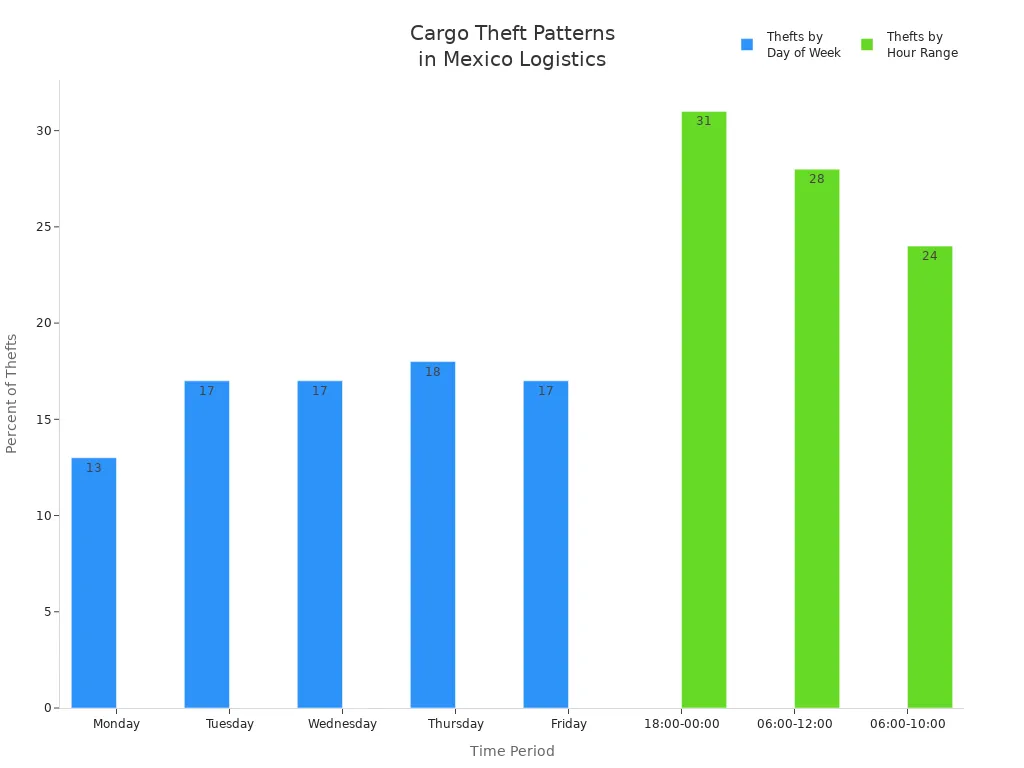

Security remains a top concern for Mexico Logistics. Cargo theft and violence against drivers have increased, especially in central and western states. Criminals use tactics like GPS jamming, fake police checkpoints, and armed assaults. The table below shows the main risks and their impact:

Aspect | Details |

|---|---|

Cargo truck hijackings, violent thefts | |

Criminal Tactics | |

Most Affected Regions | Mexico State, Puebla, Guanajuato, Jalisco, Michoacán, Hidalgo |

Economic Impact | Up to 5% of GDP lost annually |

Violence Involvement |

Recent events, such as the violence in Jalisco and the Manzanillo port strike, have disrupted supply chains and increased costs. JUSDA in North America uses advanced tracking, real-time monitoring, and strict compliance protocols to help clients reduce these risks.

Infrastructure Limits

Mexico’s logistics infrastructure faces limits in ports, highways, and railways. The Manzanillo port strike in May 2025 caused severe delays, with over 5,000 trucks blocked daily and cargo backlogs lasting weeks. Many roads and bridges need upgrades to handle growing trade volumes. These limits slow down deliveries and raise costs for businesses.

Labor Shortages

The logistics sector in Mexico faces a shortage of truck drivers. In 2023, the deficit reached 56,000 drivers and could rise to 106,000 by 2028. Low wages, safety concerns, and tough working conditions make it hard to attract new drivers. The table below highlights key facts:

Aspect | Details |

|---|---|

Driver Deficit | |

Causes | Low pay, security risks, few young or female drivers |

Company Actions | Training centers, safety apps, AI for driver safety |

Companies use technology and training to address these gaps, but more support is needed to keep Mexico Logistics moving.

Regulatory Changes

Freight companies must keep up with changing trade rules, tariffs, and safety standards. New regulations require cleaner fuels, stricter emissions checks, and digital customs documents. Compliance challenges include:

Meeting new environmental and safety standards

Ensuring proper insurance coverage for cross-border shipments

JUSDA in North America helps clients stay compliant by monitoring regulations, providing training, and using digital tools to manage documentation and risk.

New Opportunities

Cross-Border Trade

Cross-border trade between the United States and Mexico continues to surge. Key border crossings such as Laredo-Nuevo Laredo, El Paso-Ciudad Juárez, and San Diego-Tijuana handle thousands of trailers daily. Laredo alone processes about 16,000 trailers each day, with volumes expected to triple by 2050. This growth comes from Mexico’s economic expansion, nearshoring, and increased manufacturing activity.

Logistics providers now adapt by:

Using fuel-efficient vehicles and optimizing routes to meet sustainability goals.

Adopting digital tools like blockchain, IoT, and AI for better transparency and security.

Enhancing last-mile delivery to support booming e-commerce.

Upgrading customs brokerage and warehouse technologies to comply with USMCA requirements.

Offering bilingual expertise and hands-on shipment oversight to bridge cultural and operational differences.

JUSDA in North America supports these trends with a robust logistics network. Their Trenton, NJ hub and JusLink Smart Supply Chain Management Platform provide end-to-end visibility and automation. JUSDA’s services include Vendor Managed Inventory, cross-border logistics, and real-time tracking. These solutions help businesses expand confidently into the Mexican market, especially in high-value sectors like electronics, automotive, and medical equipment.

Note: Advanced transportation management systems help manage regulatory complexities, currency differences, and security risks in cross-border shipments.

Logistics Parks

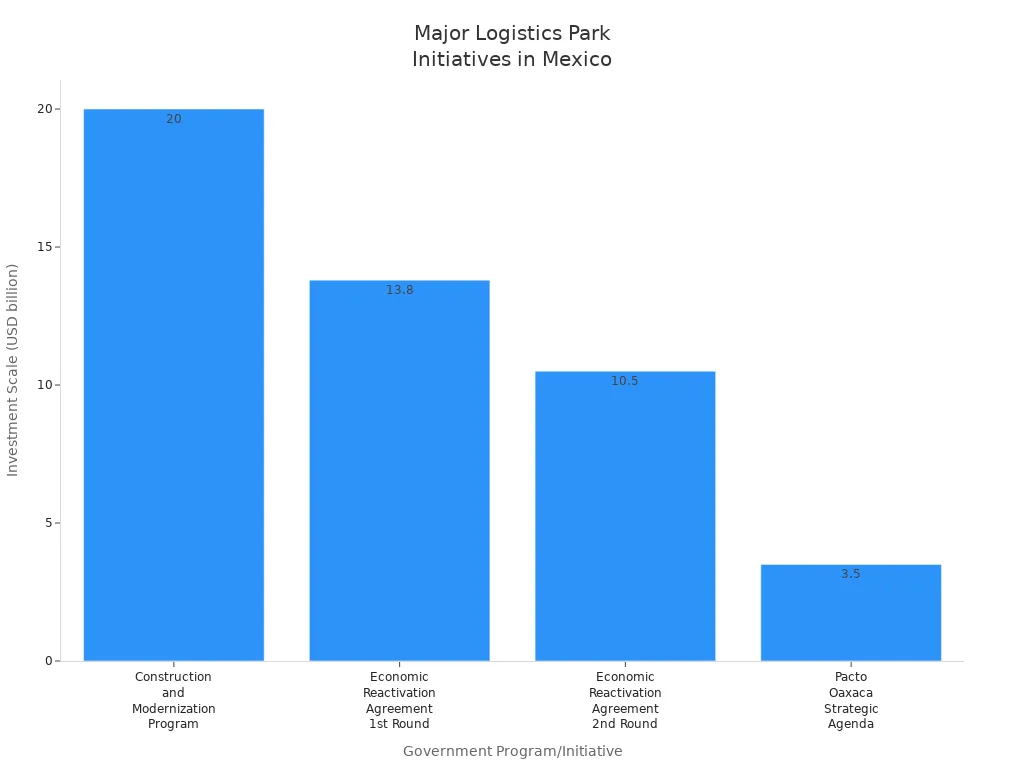

Mexico’s government has launched major initiatives to expand logistics and industrial parks. Plan México aims to develop 100 industrial parks by 2025, supporting industrial growth and regional equity. The plan encourages collaboration between federal and state governments and the private sector to attract investment and create jobs.

Program/Initiative | Timeframe | Investment Scale | Key Projects/Focus | Financing | Government Support |

|---|---|---|---|---|---|

Plan México | 2023-2025 | 100 parks | Industrial/logistics parks, regional equity | Public-private | High |

Construction and Modernization Program (CMP) | 2018-2024 | Over USD 20B | Maya Train, Trans-Isthmus Corridor, Dos Bocas Refinery | Public | High |

Economic Reactivation Agreement (Rounds 1 & 2) | 2020 | USD 24.3B | Roads, ports, railways, TMEC/USMCA corridor | 50% private | High |

Pacto Oaxaca Strategic Agenda | 2021 | USD 3.5B | Gas pipelines, industrial parks | Private | Focus on south |

The Isthmus of Tehuantepec Interoceanic Multimodal Corridor includes 10 new industrial parks with tax incentives to attract private investment. The government also promotes ESG practices and digital platforms to speed up investment processes. These efforts create new opportunities for logistics providers and manufacturers seeking modern, sustainable facilities.

Cluster Strategies

Cluster strategies play a key role in boosting logistics efficiency and competitiveness in Mexico. Business clusters, such as the Textile Cluster in Mexico City’s Granjas Mexico industrial zone, allow companies to share warehouses and logistics services. This approach reduces transportation costs and improves market position.

Other benefits of clusters include:

Employment growth and a skilled workforce through partnerships with universities.

Concentration of resources and innovation in sectors like pharmaceuticals, finance, and information technology.

Environmental gains by coordinating logistics to lower carbon footprints.

In the automotive sector, clusters help manage complex supply chains for customized production. Companies like Audi and Ford use advanced logistics services and employee training to handle unique customer orders and optimize supply chains. These clusters coordinate public and private sectors and educational institutions, building a skilled labor force and enhancing Mexico Logistics.

Food & Beverage Expansion

Food and beverage companies see strong opportunities to expand logistics operations in Mexico. The country’s strategic location provides easy access to both U.S. and Latin American markets, supported by 60 ports of entry along the U.S.-Mexico border. Nearshoring offers lower labor costs, shorter supply chains, and favorable trade agreements like USMCA.

Trade through the land port of Laredo, Texas, now surpasses major U.S. seaports, showing significant growth in cross-border logistics.

Companies like Walmart have opened fulfillment centers in Mexicali to reduce delivery times and shipping costs for southern U.S. customers.

Mexico’s shift to a knowledge-based economy and skilled labor clusters supports supply chain optimization and operational efficiency.

The pandemic accelerated American companies’ interest in nearshoring, moving supply chains closer to home.

The Mexico Food Logistics Market report highlights growth across regions, transportation modes, and product types. Cold chain and non-cold chain services continue to expand, meeting the needs of meat, dairy, and produce suppliers. These trends create new opportunities for logistics providers and food companies to serve a growing market.

JUSDA Solutions

JusLink AI

JUSDA’s JusLink AI platform brings advanced technology to supply chain management. The system uses artificial intelligence to analyze supply chain trends and predict market changes. JusLink AI helps companies forecast sales demand and plan inventory. The platform monitors risks in real time and sends alerts when disruptions occur. JusLink AI uses big data and cloud computing to give users a clear view of their supply chain. The intelligent assistant, JusElsa, answers questions and helps users solve problems quickly. JusLink AI supports decision-making and improves efficiency for logistics teams.

Tip: JusLink AI can help businesses avoid stockouts and reduce excess inventory by predicting demand more accurately.

Risk Control

JUSDA places a strong focus on risk control in logistics operations. The company uses a risk control tower to track shipments and monitor threats. Real-time data helps teams respond to problems like theft, delays, or strikes. JUSDA trains employees to follow safety rules and meet regulatory standards. The company uses strict protocols for handling hazardous materials, such as lithium batteries. JUSDA’s compliance system checks documents and ensures shipments meet international regulations. These measures protect cargo and keep supply chains running smoothly.

Risk Control Features | Benefits |

|---|---|

Real-time monitoring | Faster response to threats |

Employee training | Improved safety and compliance |

Hazardous material protocols | Safer transport |

Regulatory checks | Fewer delays at borders |

Industry-Specific Services

JUSDA offers tailored logistics solutions for many industries. Electronics companies use JUSDA for secure transport and fast delivery. Automotive clients rely on JUSDA for cross-border shipping and inventory management. Medical device makers trust JUSDA to handle sensitive products with care. FMCG brands benefit from JUSDA’s cloud warehousing and last-mile delivery services. Each solution matches the needs of the industry and helps companies grow in the Mexico market.

Electronics: Secure, temperature-controlled shipping

Automotive: Cross-border logistics and inventory support

Medical: Specialized handling and compliance

FMCG: Fast delivery and smart warehousing

JUSDA’s expertise helps clients overcome challenges and seize new opportunities in Mexico logistics.

Strategies for Success

Resilient Supply Chains

Building resilient supply chains in Mexico requires a proactive approach. Companies diversify suppliers within Mexico to reduce dependency and create redundancy. They implement Just-in-Time inventory systems, which lower costs and shorten lead times. Many businesses establish contingency plans with local manufacturers to prepare for disruptions. Technology adoption, such as automation and digital transformation, improves efficiency and responsiveness. Mexico’s proximity to the U.S. allows faster delivery and reduces transportation risks. Automotive and tech companies have shown that integrating Mexico into supply chains leads to cost savings and manufacturing expertise.

Tip: Continuous risk assessment and technological integration help companies stay agile and minimize disruptions.

Key Steps for Resilience:

Build redundancy by diversifying suppliers.

Develop robust continuity plans with real-time tracking.

Collaboration

Collaboration between logistics providers, manufacturers, and government agencies strengthens supply chain outcomes. Joint efforts with educational institutions help bridge the skills gap and attract local talent. Modernizing customs and logistics infrastructure, along with enhanced security measures, reduces delays and disruptions. Partnerships with experienced logistics providers streamline cross-border operations and improve transparency. Government initiatives support digital transformation and sustainability goals, aligning with corporate social responsibility.

Local supplier networks increase responsiveness.

Industry 4.0 technologies boost efficiency.

Talent Development

Talent development is essential for logistics success in Mexico. Companies invest in driver training, safety programs, and partnerships with technical schools. Advanced technology, such as driver monitoring systems and AI-driven analytics, improves performance and safety. Retention programs and inclusive leadership practices foster trust and collaboration. Engaging with local communities and educational institutions strengthens social bonds and company reputation.

Talent Development Practices | Benefits |

|---|---|

Training and safety programs | Improved performance |

Technology monitoring | Enhanced safety |

Stronger workforce |

Market Monitoring

Effective market monitoring relies on advanced tools and strategic partnerships. Telematics and driver behavior systems track vehicle performance and location. Integrated transportation management systems provide shipment oversight and risk management. Supply chain visibility platforms offer predictive analytics for quick response to disruptions. Physical security devices, such as GPS trackers and electronic seals, deter theft. Data analytics support trend identification and logistics planning. Collaborating with experienced logistics providers ensures strong security protocols and ongoing market insight.

Note: Ongoing market monitoring enables companies to adapt quickly and optimize logistics strategies for growth in Mexico.

Businesses can unlock growth in Mexico Logistics by investing in technology, building strong partnerships, and focusing on workforce development. They should leverage nearshoring advantages, adopt advanced analytics, and prioritize security improvements. Companies that collaborate with JUSDA gain access to innovative, secure, and efficient logistics solutions. Regularly evaluating supply chain strategies and embracing digital transformation will help organizations stay competitive and resilient in a changing market.

FAQ

What industries benefit most from JUSDA’s logistics solutions in Mexico?

Electronics, automotive, medical devices, and FMCG companies gain the most value. JUSDA tailors services for each sector, ensuring secure transport, compliance, and efficient delivery.

How does JUSDA manage logistics security risks in Mexico?

JUSDA uses real-time tracking, risk control towers, and employee training. The company follows strict safety protocols for hazardous materials and monitors shipments to prevent theft or delays.

Tip: Real-time monitoring helps teams respond quickly to security threats.

What technology does JUSDA use to improve supply chain efficiency?

JUSDA’s JusLink AI platform uses big data, IoT, and cloud computing. The system predicts demand, analyzes trends, and provides real-time visibility for better decision-making.

Technology | Benefit |

|---|---|

AI | Accurate forecasting |

IoT | Real-time tracking |

Cloud | Fast data sharing |

Can JUSDA support cross-border trade between the U.S. and Mexico?

JUSDA offers cross-border logistics, customs brokerage, and bilingual support. The company manages shipments through key border crossings and ensures compliance with USMCA regulations.

How does JUSDA help companies meet sustainability goals?

JUSDA integrates green logistics practices, such as route optimization and recycling. The company uses cloud-based platforms to reduce waste and supports clients in lowering their carbon footprint.

See Also

Understanding Emerging Trends In Logistics Risk Management

Exploring Revolutionary Technologies Shaping Logistics Tomorrow

Latest Innovations And Updates In Sea Freight 2024

Top Reasons To Join Leading Logistics Webinars Today

Explore Five Essential Events For Supply Chain Professionals