Mexico’s Nearshoring Surge Sparks a Cross-Border Logistics Boom — Redefining Infrastructure Demands in 2025

Mexico’s nearshoring surge is fueling rapid growth in cross-border logistics and transforming infrastructure needs across North America in 2025. U.S.–Mexico trade hit $74 billion in May 2025, with companies like BMW and Volvo expanding production and driving new demand for freight movement. Logistics leaders, such as JUSDA, respond by investing in transportation, energy, and industrial facilities. Upgrades to highways, rail networks, and port expansions like Veracruz and Lázaro Cárdenas show how urgent these changes are for all industry stakeholders.

Key Takeaways

Mexico's nearshoring trend boosts cross-border logistics, creating new opportunities for businesses and investors.

Companies benefit from lower labor costs and faster shipping times, making Mexico an attractive alternative to China.

Investments in infrastructure, such as border upgrades and transportation networks, are essential to support growing trade demands.

Advanced logistics services, including real-time tracking and AI technology, enhance supply chain efficiency and compliance.

Collaboration between governments and businesses is crucial for navigating regulatory challenges and ensuring sustainable growth.

Nearshoring Trends

Supply Chain Shifts

Mexico’s manufacturing sector is experiencing a major transformation. Companies are moving from basic assembly to advanced manufacturing, especially in automotive and electronics. This shift creates record demand for industrial real estate and highlights ongoing infrastructure challenges. Both the Mexican and Canadian governments are working to eliminate internal trade barriers, improve infrastructure, and boost domestic consumption. These efforts support nearshoring and help companies respond to global supply chain changes.

Technological advancements such as automation and AI are becoming essential in manufacturing processes. Sustainability initiatives are also gaining traction, with businesses leveraging Mexico’s renewable energy potential.

Trend | Description |

|---|---|

Shift to Advanced Manufacturing | Mexico is transitioning from low-cost assembly to advanced manufacturing across various sectors. |

Demand for Industrial Real Estate | There is a record demand for industrial spaces due to increased nearshoring activities. |

Growth in Key Industries | Significant growth is observed in automotive and electronics industries. |

Ongoing challenges related to infrastructure and security are impacting the sector. |

Trade Policy Impact

Recent trade policies have accelerated nearshoring in Mexico. U.S. tariffs on imports from China and Vietnam encourage companies to relocate operations to Mexico. The Biden administration’s additional tariffs under Section 301 have increased import duties on Chinese goods by 10%.

Most businesses prefer Mexico over full reshoring to the U.S. due to cost-effectiveness and benefits from the USMCA. These policies aim to reduce dependence on Chinese manufacturing and promote alternatives in Mexico and Latin America.

U.S. tariffs on imports from China and Vietnam drive companies to relocate operations to Mexico.

Only 20% of businesses consider full reshoring to the U.S.; most choose Mexico for cost and trade advantages.

Additional tariffs under Section 301 increase import duties on Chinese goods by 10%, prompting companies to seek alternatives.

Cost and Proximity

Mexico offers clear cost advantages and geographic proximity to North American markets. Affordable labor leads to lower total landed costs without sacrificing quality.

Shipments from Mexico reach North American markets in days, not weeks. Proximity allows companies to adjust production quickly and avoid delays from long transit routes.

Evidence Type | Description |

|---|---|

Cost Advantages | Labor costs in Mexico are lower than in the U.S., allowing for expense reduction without sacrificing quality. |

Geographic Proximity | Mexico's location enables shorter shipping times and reduced transportation costs, facilitating quicker market responses. |

Trade Agreements | The USMCA reduces tariffs and promotes free trade, enhancing cost efficiency for companies. |

Efficient logistics networks connect Mexico to the U.S. through major highways and railroads.

Companies benefit from rapid shipping and flexible production schedules.

The geographic closeness of Mexico to the U.S. significantly reduces shipping times, helping businesses meet modern consumer expectations.

Cross-Border Logistics Growth

Freight Volume Increase

Cross-border logistics between Mexico and the United States has experienced a significant surge in 2025. Companies have increased exports, with year-over-year growth reaching 4% in the first quarter. In April, overall exports rose by 5.8%. However, some sectors, such as automotive, saw a decline of 7.1%. Capital goods imports also dropped by 7.3% in the second quarter. Despite these fluctuations, the demand for freight services continues to rise as nearshoring accelerates.

Metric | Value |

|---|---|

Year-over-year growth in exports | 4% (Q1 2025) |

Decline in capital goods imports | 7.3% (Q2 2025) |

Overall increase in exports (April) | 5.8% |

Automotive sector decline | 7.1% |

Several sectors drive this growth. Automotive manufacturing remains a major contributor, with Mexico serving as a global leader. Electronics production has expanded, making the country a hub for high-quality goods. Aerospace, medical devices, and consumer goods also show strong performance. These industries benefit from skilled labor and proximity to North American markets.

Sector | Description |

|---|---|

Automotive Manufacturing | Mexico is a global leader in automotive manufacturing, with major companies establishing plants there. |

Electronics | The country has become a hub for electronics manufacturing, producing high-quality products efficiently. |

Aerospace | This sector is experiencing growth due to increased demand and investment in manufacturing capabilities. |

Medical Devices | Mexico is a key player in the production of medical devices, benefiting from skilled labor and proximity to markets. |

Consumer Goods | The sector is thriving as companies seek to meet market demands quickly and cost-effectively. |

New Trade Corridors

Nearshoring has led to the development of new trade corridors. The CaliBaja megaregion, which includes California and Baja California, has become a key area for semiconductor manufacturing. This region supports the growing demand for advanced electronics and strengthens the supply chain between the U.S. and Mexico.

Monterrey has emerged as a major hub for manufacturing and logistics. Its location near the U.S. border makes it a natural choice for companies following 'China+1' strategies. Businesses use Monterrey to streamline operations and reduce transit times.

The CaliBaja region also plays a vital role in the semiconductor value chain. Companies in this area benefit from close ties to both U.S. and Mexican markets, supporting efficient cross-border logistics and rapid delivery.

Advanced Logistics Services

Logistics providers have responded to these changes by offering advanced services. Companies now focus on customs compliance, international transportation, and comprehensive warehousing solutions. Real-time tracking platforms and digital documentation tools have become standard, improving supply chain visibility.

Service Area | Description |

|---|---|

Customs Compliance | Expertise in customs compliance and documentation. |

International Transportation | Management of road, ocean, and air transportation. |

Warehousing and Distribution | Comprehensive warehousing and distribution solutions. |

Logistics Technology Integration | Real-time tracking platforms and digital documentation tools. |

Supply Chain Visibility | Systems that enhance visibility across the supply chain. |

E-commerce Fulfillment | Specialized services for e-commerce logistics. |

Technology plays a central role in modern cross-border logistics. Providers use pre-validated documentation to reduce border crossing times. Automated compliance checks and AI-powered document verification streamline customs procedures. Real-time updates allow shippers to track cargo status through secure platforms. Advanced K9 inspection units, 24/7 GPS monitoring, and IoT integration ensure cargo safety and transparency.

JUSDA in North America and JUSDASR offer innovative solutions to support this growth. JUSDA provides transportation by truck, air, and ocean, serving industries such as electronics, automotive, and medical devices. The JusLink platform uses AI and IoT to deliver real-time insights and enhance logistics efficiency. JUSDASR specializes in cross-border e-commerce, offering advanced warehousing and last-mile delivery services. These solutions help businesses manage complex supply chains and meet the demands of a rapidly changing market.

Note: Advanced logistics services now include AI-powered document verification, automated customs declaration systems, and predictive analytics for processing times. These technologies improve efficiency and reduce delays at the border.

Infrastructure Demands

Border Expansions

Major U.S.-Mexico border crossings are undergoing significant upgrades to handle the surge in trade. Authorities have invested $74.9 million to expand border facilities. These projects include eight new toll booths, eight additional northbound lanes, and four multi-energy inspection portals. Two more lanes will be added to an existing bridge. The goal is to complete these improvements by 2028.

Project Details | Description |

|---|---|

Investment Amount | US$74.9 million |

New Toll Booths | 8 |

Northbound Lanes | 8 |

Bridge Lanes | 2 |

Inspection Portals | 4 |

Completion Target | 2028 |

New facilities will be built on the west side of the land port of entry. Upgrades include an improved inspection area, new access roads, and eight commercial secondary inspection bays. These changes will help reduce congestion and speed up cross-border logistics.

Warehousing Upgrades

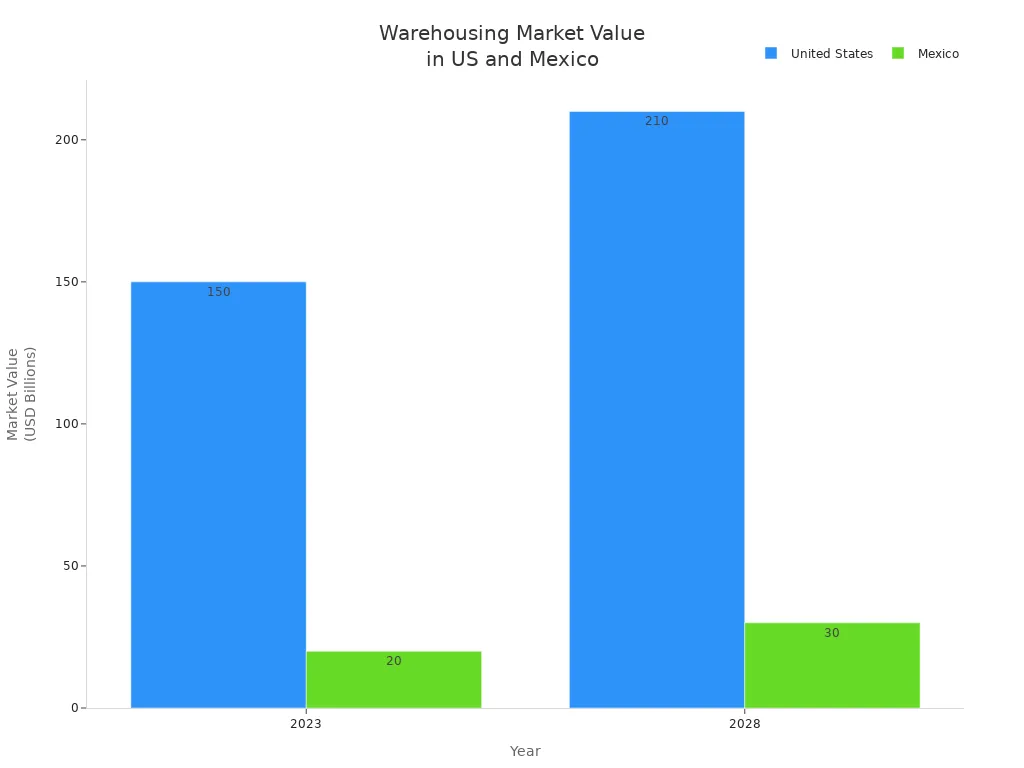

Warehousing facilities in both Mexico and the United States are expanding rapidly. The U.S. warehousing market was valued at $150 billion in 2023 and is expected to reach $210 billion by 2028. In Mexico, the market is projected to grow from $20 billion to $30 billion in the same period. Growth drivers include e-commerce, automation, and foreign investment. Facilities are being modernized to meet international standards and support advanced logistics technology.

Trend/Highlight | United States | Mexico |

|---|---|---|

Market Value | $150B (2023) → $210B (2028) | $20B (2023) → $30B (2028) |

Growth Drivers | E-commerce, automation, expansion | Manufacturing, FDI, location |

Modernization | Robotics, AI, IoT, cloud computing | Advanced logistics technology |

Transportation Networks

Investments in transportation networks are transforming the movement of goods. A 165-mile autonomous elevated freight guideway will connect terminals near Laredo and Monterrey. Four state-of-the-art terminals will support trailer drop-off and pickup, integrating truck moves with electric shuttles. This project aims to cut carbon emissions by up to 75% and improve supply chain resilience. Testing and phased roll-out are planned, with full operation expected by 2030–2031.

Customs Technology

Customs technology is evolving to streamline trade and reduce bottlenecks. Artificial intelligence now enables faster and more accurate customs clearance. Digital innovation supports agile rules and new digital tools. Blockchain technology ensures secure and transparent transactions. Electronic documentation, such as digital certificates and single window systems, reduces paperwork and delays. Cross-border cooperation between customs and the private sector strengthens the efficiency of cross-border logistics.

Key Focus Areas | Description |

|---|---|

Artificial Intelligence | Faster, more accurate customs clearance |

Digital Innovation | Agile rules and digital tools for business models |

Blockchain Technology | Secure, transparent transactions |

Electronic Documentation | Digital certificates, single window systems |

Cross-Border Cooperation | Stronger collaboration between customs and private sector |

JUSDA’s Role in Cross-Border Logistics

Industry-Specific Solutions

JUSDA delivers tailored solutions for industries such as electronics, automotive, medical devices, and oil and gas. JUSDA in North America addresses the unique logistics needs of these sectors by offering comprehensive transportation services, including truck, air, and ocean freight. The company’s expertise in risk management and regulatory compliance ensures safe handling of hazardous materials, such as lithium batteries. JUSDASR supports e-commerce merchants and manufacturers with professional direct express lines, first-mile logistics, and overseas warehousing. Strategic warehouse locations near major U.S. ports and airports enable quick distribution and cost savings. Dropshipping capabilities and specialized support for high-power energy storage products help businesses respond quickly to market demands.

JUSDA’s commitment to industry-specific solutions strengthens cross-border logistics by providing reliable, efficient, and compliant services. The company’s focus on customer relationship building and market analysis allows it to adapt to changing industry requirements.

Technology and Innovation

JUSDA leverages advanced technology to improve logistics efficiency and compliance. The company has received recognition as a top logistics brand for seven consecutive years. JUSDA focuses on building smarter, greener, and more resilient supply chains through innovation. Collaboration with world-renowned partners enhances logistics efficiency and drives continuous improvement.

Evidence Type | Description |

|---|---|

Recognition | JUSDA has been recognized as a top logistics brand for seven consecutive years. |

Focus Areas | Commitment to building smarter, greener, and more resilient supply chains through innovation. |

Collaboration | Emphasis on collaboration with world-renowned partners to enhance logistics efficiency. |

JusLink’s AI solution optimizes supply chain operations and monitors risks in cross-border logistics. The platform enhances demand forecasting, enabling accurate supply predictions. Predictive maintenance reduces downtime and keeps operations running smoothly. Route optimization improves delivery times and lowers costs. Big data analytics provide insights into supplier performance and inventory management, supporting risk mitigation. Real-time insights from AI and IoT enable data-driven decision-making throughout the logistics process.

JusLink's AI solution enhances demand forecasting for accurate supply needs.

Predictive maintenance reduces downtime and ensures smooth operations.

Route optimization leads to faster deliveries and lower costs.

Big data analytics support risk mitigation and inventory management.

Real-time insights from AI and IoT drive better decision-making.

JUSDA’s technology-driven approach ensures that businesses can navigate the complexities of modern cross-border logistics with confidence.

Challenges and Bottlenecks

Regulatory Hurdles

Cross-border logistics between Mexico and the United States faces several regulatory challenges. Companies must navigate complex customs regulations to avoid delays and fines. High traffic volumes at border entry points often cause congestion, especially during peak seasons. Security risks increase as trade volumes grow, making cargo theft and tampering a concern. Effective communication remains essential, but language and cultural differences can hinder trust and security.

Stringent customs compliance requirements

Border congestion due to high traffic volumes

Security risks such as cargo theft and tampering

Language and cultural barriers affecting communication

These hurdles require logistics providers to invest in advanced compliance systems and security measures. Companies that address these issues can reduce delays and improve supply chain reliability.

Energy and Environment

Multinational companies now seek secure, reliable, and clean energy for their operations in Mexico. This demand reflects new supply chain standards and the push for sustainability.

The evolving environmental legal framework in Mexico is essential for promoting renewable energy. It emphasizes the need for regulatory certainty to attract investments and develop infrastructure that supports clean energy initiatives.

Aspect | Impact on Logistics Operations and Infrastructure Development |

|---|---|

Compliance with Environmental Laws | Minimizes environmental impact and enhances operational efficiency. |

Adoption of Renewable Energy | Supports sustainable practices and improves competitiveness. |

Sustainable Supply Chain Management | Requires responsible sourcing and energy-efficient logistics. |

The environmental legal framework promotes renewable energy development. Consistency in public policies attracts private investment. Infrastructure development supports clean energy projects. Nearshoring drives Mexico’s transition to sustainable energy, and stricter ESG commitments influence supply chain standards.

Labor and Skills

The logistics sector in Mexico faces a significant shortage of skilled labor. The industry expects a shortage of 106,000 truck drivers by 2028, which impacts delivery times and efficiency. Nearly half of young professionals lack the necessary skills for logistics roles, according to industry experts. Employers struggle to fill vacancies, with 70% reporting difficulty finding qualified talent in logistics and transportation.

Shortage of truck drivers affecting delivery and efficiency

Many young professionals lack logistics skills

Employers struggle to fill logistics and transportation roles

Companies respond with upskilling, cross-industry hiring, and flexible work arrangements

Companies address these challenges by investing in training programs and offering flexible work options. Upskilling initiatives help bridge the talent gap and support the growth of cross-border logistics.

Market Outlook 2025

Infrastructure Priorities

Mexico and the United States have set clear priorities to support nearshoring and cross-border logistics in 2025. Companies see increased demand for warehouse space near border crossings. Modernization projects target key transportation corridors and border facilities. Stricter compliance requirements under the USMCA drive the need for better tracking and documentation systems. Infrastructure upgrades focus on expanding capacity, reducing congestion, and improving the flow of goods.

Warehouse expansion near border crossings

Enhanced tracking and documentation for compliance

Modernization of logistics infrastructure

These priorities help address operational challenges at major ports and support the growing needs of e-commerce and last-mile delivery.

Business Strategies

Leading companies are shifting their strategies to capitalize on the logistics boom. Geopolitical tensions and global supply chain disruptions have pushed manufacturers to seek alternatives to China, with Mexico emerging as a preferred option. The rise of e-commerce and nearshoring transforms the logistics sector, making efficiency, speed, and flexibility essential.

Companies invest in faster and more precise warehouse operations

Foreign direct investment in Mexico continues to rise, especially in industrial sectors

Businesses focus on compliance and leverage experienced partners for sustainable growth

Technology and automation play a key role in modernizing operations

Manufacturers and logistics providers seek resilience and cost-effective production closer to home. They modernize warehouse operations and invest in advanced technology to meet new market demands.

Policy and Collaboration

Policy changes and cross-border collaboration shape the future of logistics between Mexico and the United States. Recent executive orders, such as English-language proficiency requirements for truck drivers, may increase operational costs and cause delays. Infrastructure improvements and trade agreements like the USMCA enhance efficiency and reduce costs. However, new tariffs on auto imports from Mexico threaten to disrupt supply chains.

Businesses adapt by stockpiling inventory and diversifying supplier networks

Advanced technology helps companies navigate regulatory changes

Ongoing investment in logistics infrastructure supports long-term growth

Collaboration between governments and the private sector remains vital. These efforts ensure that cross-border logistics can meet the demands of a rapidly changing market.

Mexico’s nearshoring surge is reshaping logistics and infrastructure across North America. Businesses, logistics providers, and investors see new opportunities for economic growth and supply chain improvements.

Companies face a skills gap, especially in technical fields.

Collaboration with educational institutions remains essential.

Firms must adapt to e-commerce growth, use digital solutions, and prioritize sustainability.

Leading brands like JUSDA drive innovation with advanced technology and strong partnerships.

Success in 2025 will depend on teamwork, real-time data, and a focus on customer needs.

JUSDA Solutions

To provide you with professional solutions and quotations.

FAQ

What industries does JUSDA support in North America?

JUSDA serves electronics, automotive, medical devices, oil and gas, FMCG, new energy, heavy equipment, and bulk materials. The company provides tailored logistics and supply chain solutions for each sector.

How does JUSDA ensure compliance and safety for hazardous materials?

JUSDA emphasizes risk management and strict adherence to safety regulations. The company follows frameworks such as CFR, IMDG, and IATA. Employees receive specialized training to handle hazardous materials like lithium batteries.

What technology does JUSDA use to optimize supply chains?

JUSDA uses the JusLink intelligent supply chain platform. This platform integrates IoT, cloud computing, and big data. It provides real-time collaboration, demand forecasting, risk monitoring, and predictive analytics for efficient supply chain management.

Where are JUSDASR’s warehouses located in the United States?

JUSDASR operates warehouses on the West Coast, East Coast, and Central regions. These facilities are near major ports and airports, enabling quick distribution and cost savings for cross-border logistics.

See Also

Transforming Supply Chain Management With Cloud Solutions

The Future of Logistics Through AI Supply Chain

The Influence of Innovation on Modern Logistics

Industries Transformed By Cloud-Based Supply Chain Solutions

Exploring Supplier Dynamics in Global E-Commerce Innovations