Mexico: Cross-Border E-commerce's "New Special Economic Zone" Under the Tariff War

Mexico’s New Special Zone for cross-border e-commerce marks a pivotal shift in global trade. Positioned as a gateway to North America, Mexico has rapidly emerged as a powerhouse in online retail.

Mexico’s e-commerce market has nearly doubled in value since 2019.

By 2024, e-commerce volume is projected to reach US$97 billion.

Cross-border shopping is increasingly popular among Mexican consumers.

Opportunities | Challenges |

|---|---|

Boosts competitiveness of Mexican e-commerce | International sellers face new compliance costs |

Encourages Mexican SMEs to sell internationally | High shipping costs and long delivery times |

Increases product diversity for consumers | Fear of not receiving purchases or paying additional taxes |

Brands like JUSDA and solutions such as JusTrade play a key role in helping businesses navigate this evolving landscape.

Key Takeaways

Mexico's New Special Zone simplifies cross-border e-commerce with tax breaks and streamlined customs, making it easier for businesses to enter the market.

Investing in logistics infrastructure enhances delivery speed and reliability, allowing sellers to reach customers across North America efficiently.

JUSDA's JusTrade platform offers essential support for compliance and customs clearance, helping businesses navigate complex regulations.

The increase in the de minimis threshold to $100 allows consumers to shop duty-free, boosting sales for international sellers.

Local fulfillment centers improve delivery security and speed, addressing last-mile challenges and building customer trust.

New Special Zone Overview

Definition and Purpose

Mexico's New Special Zone for cross-border e-commerce represents a major regulatory and economic initiative. The government designed this zone to streamline international trade, simplify customs procedures, and encourage investment in logistics infrastructure. The New Special Zone aims to attract global brands and sellers by offering incentives that reduce operational barriers. Businesses benefit from improved customs clearance, lower taxes, and faster shipping times.

JUSDA supports companies entering the New Special Zone by providing advanced supply chain solutions. Their expertise in logistics and compliance helps sellers navigate complex regulations. JUSDA's JusTrade platform offers intelligent customs clearance, making it easier for international brands to access the Mexican market. These services ensure that shipments move efficiently and meet all legal requirements.

Strategic Importance

The New Special Zone holds strategic value for Mexico and its trading partners. Mexico's location gives it unique access to both North and South American markets. The country operates 32 ports, which enable efficient international shipping. Its proximity to the United States, with a border stretching nearly 2,000 miles, connects sellers to the largest consumer market in the world.

Mexico's ports and airports serve as vital hubs for global distribution.

The New Special Zone leverages these assets to expand e-commerce across two continents.

Sellers can reach millions of customers quickly and reliably.

JUSDA plays a key role in this ecosystem. Their logistics network and compliance expertise help brands overcome operational challenges. By partnering with JUSDA, businesses gain access to secure warehousing, real-time tracking, and risk management tools. These advantages position sellers to succeed in Mexico's fast-growing e-commerce market.

JUSDA Solutions

To provide you with professional solutions and quotations.

Key Features and Benefits

Regulatory Incentives

Mexico’s New Special Zone offers a robust set of regulatory incentives designed to attract global investment and simplify cross-border operations. The government provides complete exemption from Income Tax for the first three years to companies operating within the Development Hubs. After this period, businesses pay only half the standard rate, with further discounts available for those meeting employment targets. Operations inside these hubs also receive exemptions from Value Added Tax, and companies can recover VAT paid on external purchases for up to four years. These incentives create a favorable environment for international sellers and manufacturers.

Incentive/Regulation | Description |

|---|---|

Designated areas offering tax breaks, streamlined regulations, and infrastructure support to attract foreign investment. | |

Tax Exemptions | Companies may receive a complete exemption from Income Tax (ISR) for the first three years of operation in SEZs. |

Reduced ISR | In the following three years, companies pay only 50% of ISR, with potential for a 90% discount based on employment goals. |

IVA Exemption | Operations within Development Hubs are exempt from Value Added Tax (IVA), and companies can recover IVA paid on external purchases for four years. |

Export Tax | A 0% export tax on goods or services for participating companies. |

Businesses in these zones benefit from streamlined customs procedures and duty-free customs benefits. Eligible companies can apply for corporate income tax deductions and additional tax breaks for investments in priority sectors. The regulatory framework supports both large enterprises and small businesses, making Mexico’s New Special Zone a competitive destination for cross-border e-commerce.

JUSDA’s JusTrade platform helps companies take full advantage of these incentives. JusTrade provides intelligent customs clearance and compliance management, ensuring that shipments meet all regulatory requirements. JUSDA in North America offers tailored logistics solutions, helping businesses navigate the complexities of cross-border trade and maximize their tax benefits.

Tip: Companies operating in northern and southern border zones receive a tax credit of 50% of VAT, effectively reducing the rate from 16% to 8%. Taxpayers in these zones pay only two-thirds of the income tax on activities conducted there.

Infrastructure Upgrades

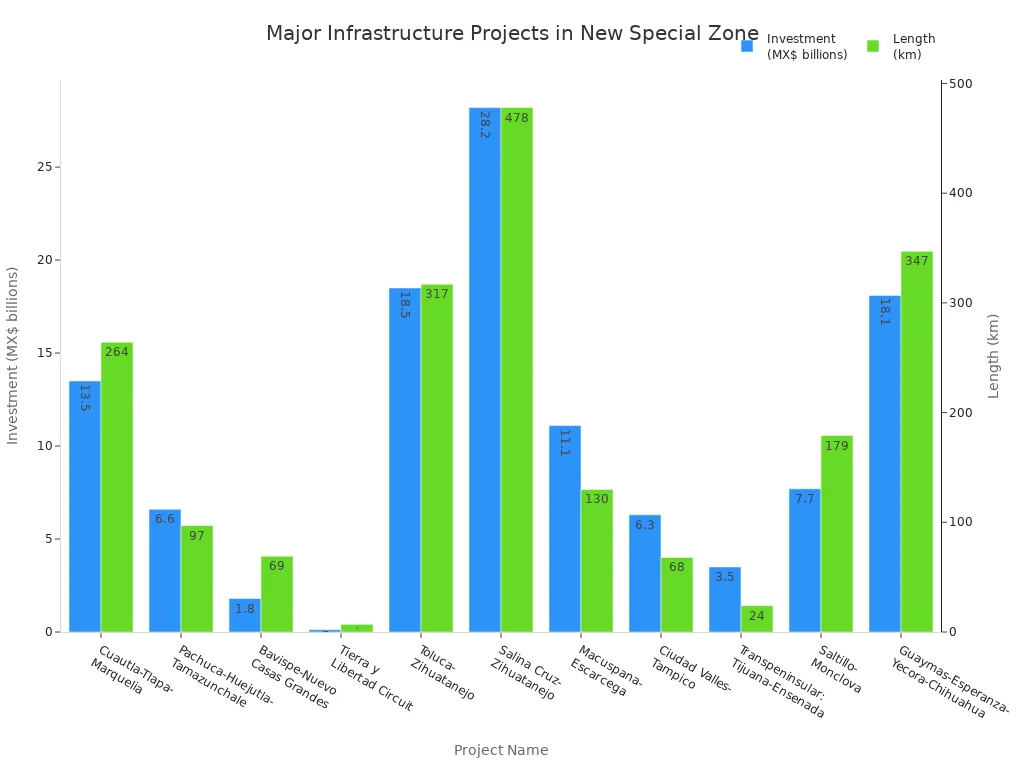

Mexico has invested heavily in infrastructure to support the New Special Zone and boost cross-border e-commerce. Major projects include new highways, expanded ports, and upgraded logistics hubs. These improvements reduce delivery times, increase shipping reliability, and lower transportation costs for sellers.

Project Name | Investment (MX$) | Length (km) |

|---|---|---|

Cuautla-Tlapa-Marquelia | 13.5 billion | 264 |

Pachuca-Huejutla-Tamazunchale | 6.6 billion | 97 |

Bavispe-Nuevo Casas Grandes | 1.8 billion | 69 |

Tierra y Libertad Circuit | 124 million | 7 |

Toluca-Zihuatanejo | 18.5 billion | 317 |

Salina Cruz-Zihuatanejo | 28.2 billion | 478 |

Macuspana-Escarcega | 11.1 billion | 130 |

Ciudad Valles-Tampico | 6.3 billion | 68 |

Transpeninsular: Tijuana-Ensenada, By-Pass | 3.5 billion | 24 |

Saltillo-Monclova | 7.7 billion | 179 |

Guaymas-Esperanza-Yecora-Chihuahua | 18.1 billion | 347 |

These infrastructure upgrades support faster and safer movement of goods. Sellers can rely on modern highways and logistics centers to reach customers across Mexico and North America. JUSDA in North America leverages these improvements, offering efficient cross-border transport and advanced supply chain management. Their network connects major industrial hubs, ensuring reliable delivery and secure handling of goods.

E-Commerce Opportunities

The New Special Zone unlocks significant opportunities for e-commerce businesses. Regulatory flexibility, tax breaks, and infrastructure upgrades make it easier for international sellers to enter the Mexican market. The implementation of the USMCA and changes to de minimis rules have further boosted cross-border sales.

The de minimis threshold in Mexico increased from $50 to $100. Consumers can now purchase goods worth up to $100 without paying import duties.

Duty-free shopping for products valued at $100 or less enhances affordability and encourages more frequent purchases.

Small and mid-sized retailers from the U.S. and other countries benefit from increased sales and easier market access.

Businesses in Special Economic Zones enjoy streamlined customs procedures and duty-free benefits. JUSDA’s JusTrade platform simplifies customs clearance, reducing delays and ensuring compliance with local regulations. Their SAAS platform integrates with clients’ ERP systems, providing real-time tracking and management of customs processes. JUSDA in North America supports sellers with tailored logistics solutions, helping them capitalize on Mexico’s e-commerce growth.

Note: SEZs offer tax breaks, regulatory flexibility, and infrastructure development benefits to businesses. Eligible companies can apply for corporate income tax deductions and additional tax breaks for investments in priority sectors.

International sellers can reach millions of new customers in Mexico’s fast-growing online market. JUSDA’s advanced supply chain solutions and local expertise position brands to succeed in this dynamic environment.

Logistics and Security Challenges

Last-Mile Delivery Issues

Mexico’s cross-border e-commerce faces several last-mile delivery challenges. The country’s vast geography and diverse terrain make it difficult to reach customers in remote areas. Urban centers experience heavy traffic congestion, which slows down deliveries. Infrastructure limitations in some regions further complicate the process.

Issue | Description |

|---|---|

Geographic Spread | Vast distances and varied landscapes make deliveries complex. |

Infrastructural Limitations | Some areas lack modern roads and facilities, causing delays. |

Urban Traffic Congestion | Major cities often see traffic jams, which slow down last-mile delivery. |

Investments in logistics infrastructure have improved delivery networks. Companies now simplify cross-border e-commerce processes and meet customer demands more efficiently. However, the need for door-to-door shipment visibility and effective supply chain mapping remains high.

Cargo Security Risks

Cargo theft continues to threaten Mexico’s logistics sector. Criminals often target trucks in transit, especially on key highway corridors like Tepotzotlan-San Juan del Rio and Saltillo-Monterrey. The State of Mexico and Puebla report high theft rates, with most incidents involving violence against drivers. Thieves prefer goods such as food, beverages, auto parts, and construction materials.

Cargo theft causes significant economic and operational losses.

Tractor-trailers and smaller vehicles are frequent targets.

The central states account for a large share of reported cases.

Despite a recent drop in theft cases, security remains a top concern for logistics providers and sellers.

Local Fulfillment Solutions

Local fulfillment centers offer a strategic solution to these challenges. JUSDA’s warehousing network in Mexico reduces delivery distances and improves shipment security. JusTrade’s customs expertise ensures compliance, helping businesses avoid costly delays and fines. Advanced security measures, such as GPS tracking and secure trailers, protect goods from theft and tampering.

JusLink’s AI Solution enhances supply chain visibility and risk management. Real-time monitoring and predictive analytics help companies respond quickly to disruptions. Local fulfillment also helps manage border congestion by using carriers with facilities near the border, expediting transfers.

Localized fulfillment transforms long, risky supply chains into fast, secure domestic operations. This approach builds trust with customers and strengthens a brand’s position in Mexico’s competitive e-commerce market.

Market Competition and Adaptation

Major Platforms in Mexico

Several major e-commerce platforms dominate Mexico’s New Special Zone. These companies have invested heavily in logistics, technology, and local partnerships to capture market share.

Mercado Libre holds over 50% of the market in the New Special Zone.

Amazon and Mercado Libre together control 85% of the local e-commerce market.

Mercado Libre’s gross merchandise value in Mexico surpassed USD 20 billion in 2023.

Amazon has invested MXN 110 billion (USD 5.3 billion) since entering Mexico in 2015.

Both companies continue to expand their fulfillment networks and improve delivery speed. Chinese e-commerce giants are also entering the market, bringing new products and competitive pricing.

Local vs. International Sellers

Local sellers often have an advantage in understanding Mexican consumer preferences and navigating local regulations. They can offer faster delivery and better customer service by using domestic warehouses and local carriers. International sellers, especially those from China and the United States, face more challenges with customs, taxes, and last-mile delivery.

As of 1 January 2025, the Mexican government implemented a series of new import regulations aimed at tightening control over cross-border e-commerce, curbing the practice of low-price dumping, and protecting local industries. These changes have had a significant impact on the sale of imported goods through platforms such as Amazon. In particular, customers outside of Mexico City have frequently experienced order cancellations or delivery delays due to customs issues.

International sellers must adapt quickly to these changes. Many now partner with local logistics providers or set up inventory in Mexican warehouses to reduce risks and improve customer satisfaction.

JUSDA’s Competitive Edge

JUSDA stands out by offering efficient logistics and compliance solutions tailored to the Mexican market. The company helps both local and international sellers overcome regulatory hurdles and delivery challenges. JUSDA’s JusTrade platform streamlines customs clearance and ensures shipments meet all legal requirements. Their local warehousing and advanced risk management tools help sellers avoid canceled orders and delivery delays.

JUSDA’s expertise in supply chain management allows brands to compete with established platforms. By leveraging local fulfillment and intelligent technology, JUSDA empowers sellers to adapt to Mexico’s evolving e-commerce landscape and succeed in the New Special Zone.

Regulatory Changes and Compliance

Customs Procedures

Mexico’s New Special Zone has introduced several changes to customs procedures for cross-border e-commerce. Sellers must now provide detailed documentation, including invoices and shipment information, for every import. Digital platforms such as Amazon and Mercado Libre collect taxes on behalf of sellers, ensuring proper tax treatment for imported goods. VAT applies to all imported goods, standardizing tax collection and increasing government revenue. The De Minimis value threshold of USD 50.00 no longer applies to most shipments, except those from Canada and the USA. A global tax rate of 19% now covers shipments valued up to USD 2,500. Importers of shipments over USD 1,000 must complete new customs registration.

Regulatory Aspect | Mexico's New Special Zone | Comparison to Other Hubs (General) |

|---|---|---|

VAT Certification | Real-time access to automated inventory control systems for tax authorities. | Varies; some hubs have less stringent access. |

Customs Duties | Increased scrutiny on anti-dumping and countervailing duties to protect local industries. | Other hubs may have different enforcement levels. |

Protectionist Policies | A shift towards more protectionist measures, including potential sanctions. | Some hubs maintain more open trade policies. |

VAT Rate | Reduced VAT rate of 8% in border regions to enhance competitiveness. | Other regions may not have such incentives. |

Tax Collection Rules

Foreign e-commerce companies must pay IVA tax on sales to Mexican shoppers, regardless of where payments are deposited. Companies must enroll in the Federal Taxpayer Registry and collect information from third-party sellers, including bank account details and location. Electronic receipts detailing tax payments withheld must be provided to third parties. These requirements ensure transparency and accountability in tax collection.

IVA tax applies to all sales to Mexican consumers.

Companies must register with Mexican tax authorities.

Sellers must provide electronic receipts for tax payments.

JUSDA’s JusTrade Solutions

JUSDA’s JusTrade platform helps sellers navigate these complex regulatory changes. JusTrade’s SAAS platform offers intelligent customs clearance, real-time tracking, and compliance management. Sellers benefit from automated documentation, accurate commodity classification, and seamless integration with ERP systems. JusTrade’s expertise reduces manual errors and ensures shipments meet all legal requirements.

Impact Area | Description |

|---|---|

Stricter Import Conditions | New regulations have led to canceled orders and stalled deliveries, particularly outside Mexico City. |

Compliance Requirements | Sellers must now act as registered importers, taking full responsibility for customs declarations. |

Technical Standards and Labeling | All goods must comply with specific standards and carry the 'MX NOM' mark, complicating operations. |

Banned Products | Certain items are banned from import, increasing the risk of customs seizures for sellers. |

Economic Ripple Effect | Small and medium-sized sellers face inventory bottlenecks and potential revenue loss due to delays. |

JusTrade empowers sellers to adapt quickly, minimize compliance risks, and maintain smooth operations in Mexico’s evolving e-commerce landscape.

Mexico’s New Special Zone offers unique opportunities for cross-border e-commerce. Businesses can reach Mexican consumers directly, partner with local distributors, or sell from abroad. Key risks include navigating customs regulations, understanding local consumer behavior, and overcoming logistics barriers. JUSDA, JusTrade, and JusLink’s AI Solution empower sellers with advanced logistics software, real-time tracking, and expert compliance support. The competitive landscape continues to evolve as digital transformation accelerates and major platforms expand. Companies that adapt quickly and leverage smart technology will thrive as Mexico’s market grows and new policies shape the future.

FAQ

What is Mexico’s New Special Zone for cross-border e-commerce?

Mexico’s New Special Zone is a government initiative that streamlines international trade. It offers tax breaks, simplified customs procedures, and upgraded infrastructure. Sellers can reach Mexican consumers more easily and benefit from faster shipping and lower costs.

How does JUSDA help businesses in Mexico’s New Special Zone?

JUSDA provides advanced logistics and supply chain solutions. The company offers secure warehousing, real-time tracking, and compliance support. Sellers use JUSDA’s JusTrade platform for intelligent customs clearance and efficient cross-border operations.

What are the main logistics challenges in Mexico?

Mexico faces last-mile delivery issues and cargo security risks. Urban traffic and remote areas slow shipments. Cargo theft remains a concern on major highways. Local fulfillment centers and advanced tracking help reduce these risks.

Why is compliance important for international sellers in Mexico?

Compliance ensures shipments meet Mexican regulations. Sellers must provide accurate documentation, pay taxes, and follow customs rules. JUSDA’s JusTrade platform helps businesses manage compliance, avoid delays, and prevent order cancellations.

Tip: Local warehousing and expert customs support help sellers succeed in Mexico’s fast-growing e-commerce market.

See Also

Exploring Supplier Partnerships in Global E-commerce Innovations

Achieving Success in International Trade Through JUSDA

Enhancing Global E-commerce Through Supply Chain Transparency

Discovering JUSDA's Latest Warehousing Solutions for Efficiency