The most profitable logistics companies

You might wonder who leads the shipping and freight industry today. Here are the top 10 most profitable logistics companies right now:

FedEx (revenue: $90.2 billion in 2023)

DHL

UPS (market cap: $118.09 billion)

Kuehne + Nagel

DSV

Deutsche Post AG

C.H. Robinson

Amazon

XPO Logistics

DB Schenker

Profitability in logistics companies depends on cash flow, net profit margin, and return on assets. Leading logistics companies use AI, automation, and real-time data for better logistics services, package delivery services, and transportation services. Many key U.S. logistics companies focus on shipping solutions for different industries.

Key Takeaways

The top 10 logistics companies generate over $500 billion in combined revenue, showcasing their massive scale and market influence.

Profitability in logistics relies on effective cash flow management, net profit margins, and return on assets, which are crucial for assessing company success.

Leading logistics firms leverage advanced technology like AI and automation to enhance service efficiency and improve delivery times.

E-commerce growth drives logistics companies to expand their networks, enabling faster shipping and better tracking for customers.

Sustainability initiatives, such as using electric vehicles and eco-friendly packaging, are becoming essential for logistics companies to attract environmentally conscious consumers.

Top 10 Most Profitable Logistics Brands

Largest Logistics Companies Overview

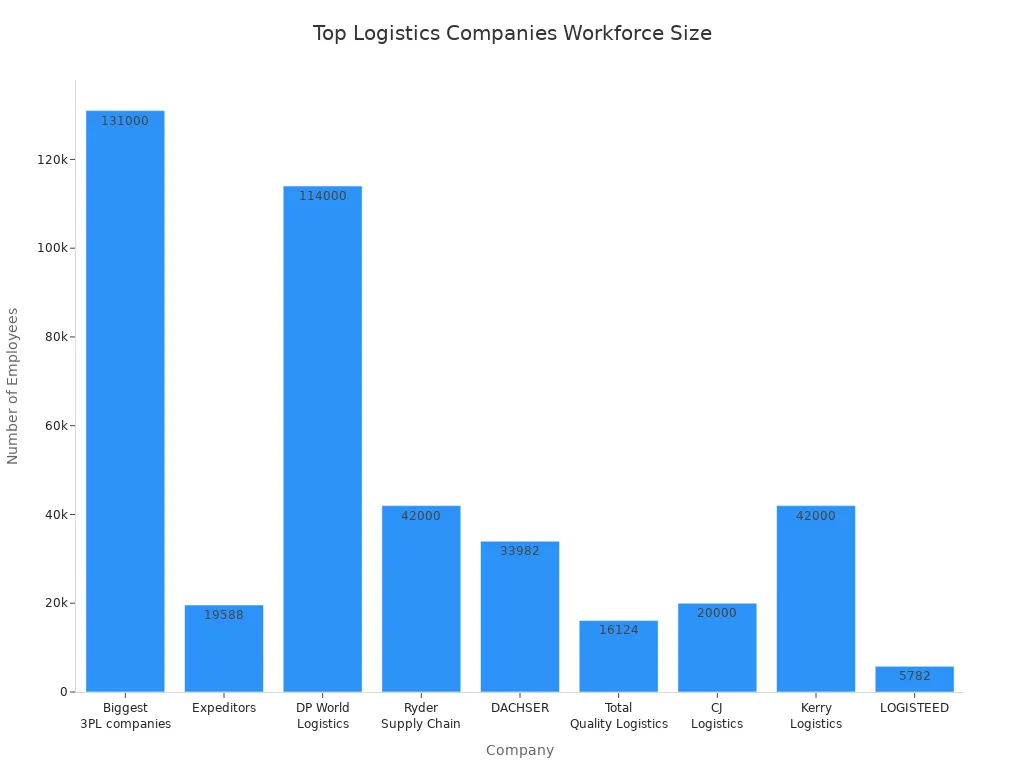

You probably see packages from the most profitable logistics brands every day. These companies move goods across the globe, making sure you get what you need fast. The largest logistics companies have huge networks, thousands of employees, and locations in almost every country. When you look at the top 10 most profitable logistics brands in the world, you notice their scale is massive. They handle shipping, air freight, trucking, and even drone delivery.

Here’s a quick look at how these giants stack up:

Company Name | Revenue (in million USD) |

|---|---|

United Parcel Service Inc | 97,287 |

Deutsche Post AG | 96,662 |

FedEx Corp | 83,959 |

C.H. Robinson Worldwide Inc | 23,102 |

538,842 |

The combined annual revenue of the top 10 most profitable logistics brands in the world reaches over $500 billion. That’s more than the GDP of some countries! You can see why these leading logistics companies dominate the market.

Most Profitable Logistics Brands in the World

Let’s break down what makes each most profitable logistics brand in the world stand out. You’ll find that the top 10 most profitable logistics brands in the world offer a mix of shipping, air cargo, sea freight, and contract logistics. They use advanced technology and smart logistics services to keep things moving.

Company Name | Revenue (in billions) | Primary Sources of Revenue |

|---|---|---|

UPS | Shipping, air freight, trucking, last-mile distribution, drone delivery | |

Deutsche Post: DHL Group | €63.3 | Air cargo, warehousing, global logistics services |

FedEx Corporation | $69.217 | Expedited deliveries, freight services, logistics solutions |

Kuehne + Nagel Inc. | $21.054 | Sea freight, air freight, contract logistics, overland transportation |

Nippon Express | $19.9 | Integrated transportation logistics solutions |

DB Schenker Logistics | $19.42 | Ground transport, ocean freight, air freight, supply chain management |

XPO Logistics | $16.392 | Freight brokerage, intermodal, last-mile distribution |

DSV Panalpina | $14.2 | Road, rail, sea, and air transportation services |

Nippon Yusen (NYK) | $16.5 | Shipping and end-to-end logistics solutions |

CJ Logistics | $13.42 | Contract logistics, freight forwarding, global transportation services |

Did you know? The most profitable logistics brand in the world often leads in innovation and global reach. You see their trucks, planes, and ships everywhere.

The most profitable logistics brands in the world employ hundreds of thousands of people. Their global presence means you benefit from fast and reliable deliveries, no matter where you live. When you choose the most profitable logistics brand in the world, you get access to the best shipping options and logistics services available.

Financial Metrics

Revenue and Net Income

When you look at leading logistics companies, you see that revenue and net income tell you a lot about their success. Revenue shows how much money a company brings in from logistics services like shipping, warehousing, and delivery. Net income is what’s left after paying all the bills, salaries, and other costs. If you want to compare companies, these numbers help you spot the winners.

Here’s a simple table that shows how experts measure profitability in logistics:

Metric | Description |

|---|---|

Gross Margin | Shows how well a company controls its costs. |

Net Profit Margin | Tells you how much profit remains after all expenses. |

Operating Profit Margin | Focuses on profit from main business activities. |

Return on Investment (ROI) | Checks if investments pay off. |

You might notice that some companies have steady revenue but their net income can change a lot. For example, over the years, some companies saw their net income drop even when revenue stayed the same. This can happen if costs go up or if there are big changes in the market.

Net Income (in $) | Revenue (in $) | |

|---|---|---|

2010 | 1 | 8.072B |

2011 | 1 | 8.072B |

2012 | -10 | 8.072B |

2013 | -18 | 8.072B |

Tip: Always check both revenue and net income when you want to know how well a logistics company is doing.

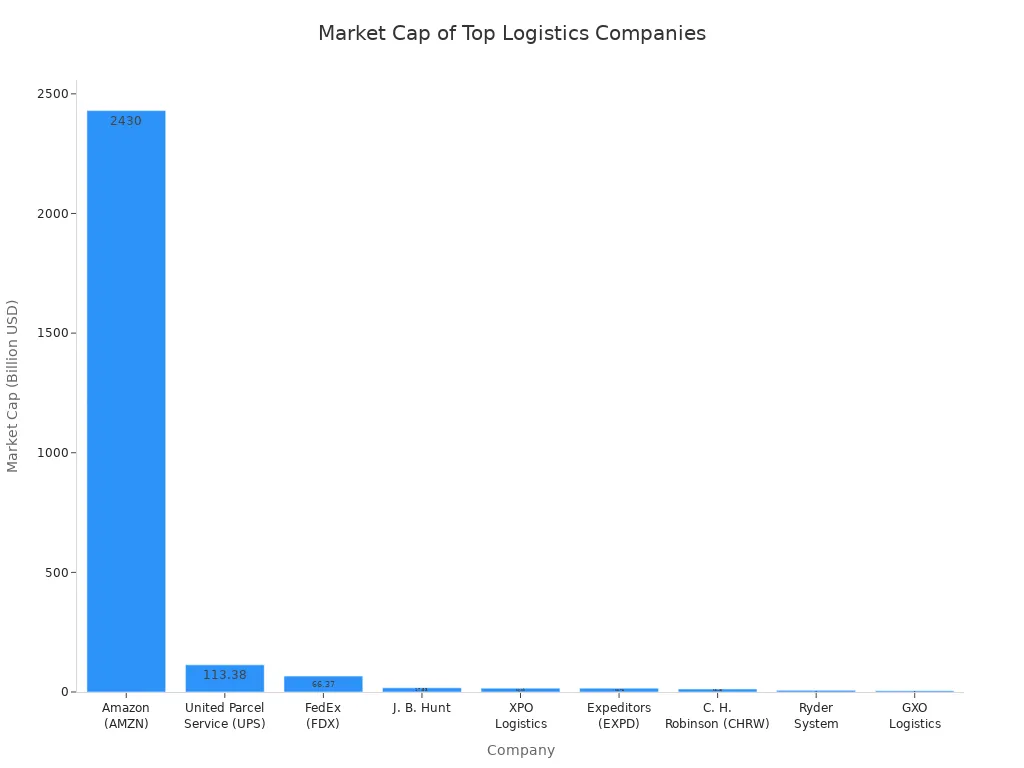

Market Capitalization

Market capitalization, or market cap, shows you how much investors think a company is worth. You get this number by multiplying the company’s stock price by the number of shares. The higher the market cap, the more valuable the company.

Here’s a quick look at the market caps for some leading logistics companies:

Company | Market Capitalization | Change Since October 2024 |

|---|---|---|

Amazon (AMZN) | $2.43 Trillion | +$0.47 Trillion |

United Parcel Service (UPS) | $113.38 Billion | +$0.96 Billion |

FedEx (FDX) | $66.37 Billion | +$2.65 Billion |

J. B. Hunt | $17.53 Billion | +$2.23 Billion |

XPO Logistics | $16.09 Billion | +$3.73 Billion |

Expeditors (EXPD) | $15.78 Billion | +$0.28 Billion |

C. H. Robinson (CHRW) | $12.45 Billion | -$0.06 Billion |

Ryder System | $7.00 Billion | +$0.70 Billion |

GXO Logistics | $5.40 Billion | -$0.48 Billion |

If you want to understand which companies lead the industry, market cap gives you a quick answer. You can see that Amazon sits at the top, but other companies like UPS and FedEx also play a huge role in global shipping.

Company Profiles

Amazon

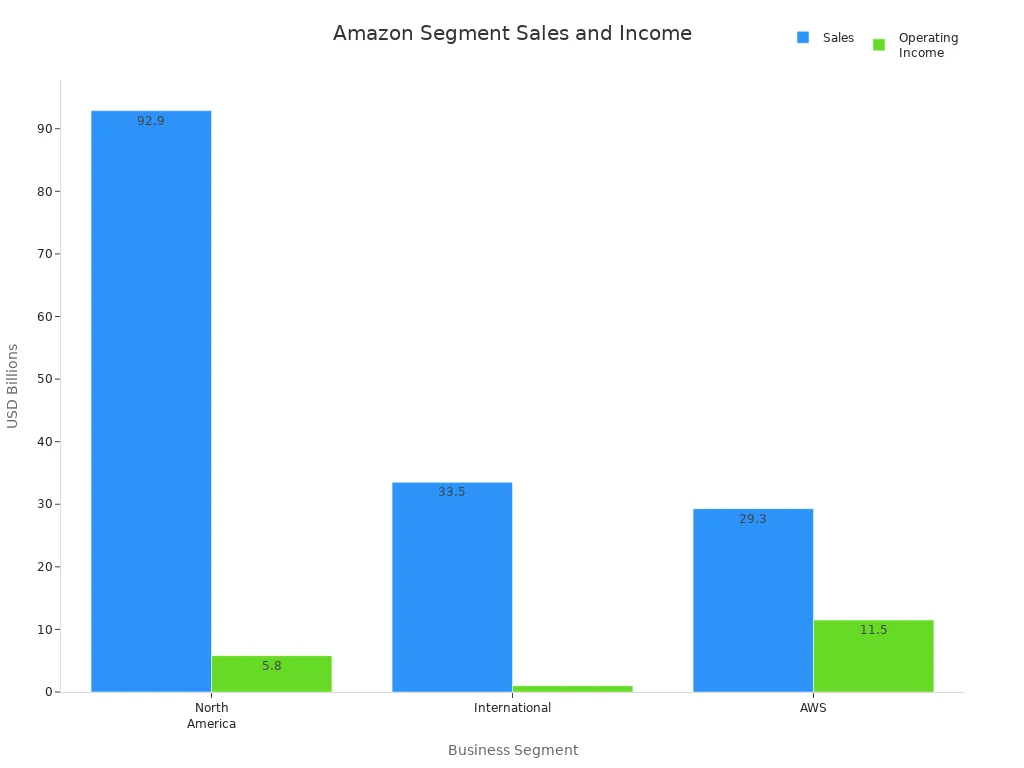

You see Amazon everywhere, but did you know its logistics operations are massive? Amazon splits its business into North America, International, and AWS segments. Each segment brings in billions of dollars every year. Take a look at how Amazon’s logistics business stacks up:

Segment | Sales (Year-over-Year Change) | Operating Income (Year-over-Year Change) |

|---|---|---|

North America | $92.9 billion (8%) | $5.8 billion (16%) |

International | $33.5 billion (5%) | $1.0 billion (11%) |

AWS | $29.3 billion (17%) | $11.5 billion (22%) |

Net Income | $17.1 billion (64%) | N/A |

Operating Cash Flow | $113.9 billion (15%) | N/A |

Free Cash Flow | $25.9 billion | N/A |

Amazon invests billions in its delivery network. You benefit from faster shipping and better service. When Amazon opens new facilities, it creates jobs and boosts local economies. For example, each new site adds about 170 jobs and can bring $500 million in economic growth to small towns. Amazon’s rural delivery initiative alone saw $4 billion in investment, helping underserved areas get packages quickly.

Amazon’s logistics investments created over 100,000 jobs.

Every new facility adds around 170 jobs.

Rural communities gained $500 million in economic growth.

Amazon’s control over its delivery infrastructure gives it a unique advantage. You get your orders faster, and Amazon reaches more customers in places other companies might miss.

DHL Supply Chain & Global Forwarding

DHL stands out among leading logistics companies for its global reach and strong financial results. You see DHL trucks and planes in almost every country. The company’s Supply Chain and Global Forwarding divisions drive most of its revenue.

Division | Q2 2024 Revenue (EUR million) | Q2 2025 Revenue (EUR million) | YOY Change (%) |

|---|---|---|---|

Supply Chain | 4,352 | 4,183 | -3.9 |

Global Forwarding, Freight | 4,880 | 4,620 | -5.3 |

Division | Q2 2024 EBIT (EUR million) | Q2 2025 EBIT (EUR million) | YOY Change (%) |

|---|---|---|---|

Supply Chain | 279 | 348 | 24.4 |

Global Forwarding, Freight | 280 | 196 | -29.7 |

DHL’s global network helps it run efficiently and adapt to changes in trade and tariffs. You benefit from reliable shipping, even when regulations shift. DHL’s acquisition of Inmar Supply Chain Solutions boosts its North American logistics capabilities. The company’s “Fit for Growth” strategy keeps it financially stable, even when facing challenges like tariff changes or regulatory issues.

DHL’s parent company, Deutsche Post DHL Group, reported an operating profit of €5.9 billion. This financial strength helps DHL manage risks and stay profitable, no matter what happens in the market.

Kuehne + Nagel

Kuehne + Nagel is one of the world’s top logistics companies. You might use their services for sea freight, air freight, or contract logistics. The company keeps growing, even when the global economy faces challenges.

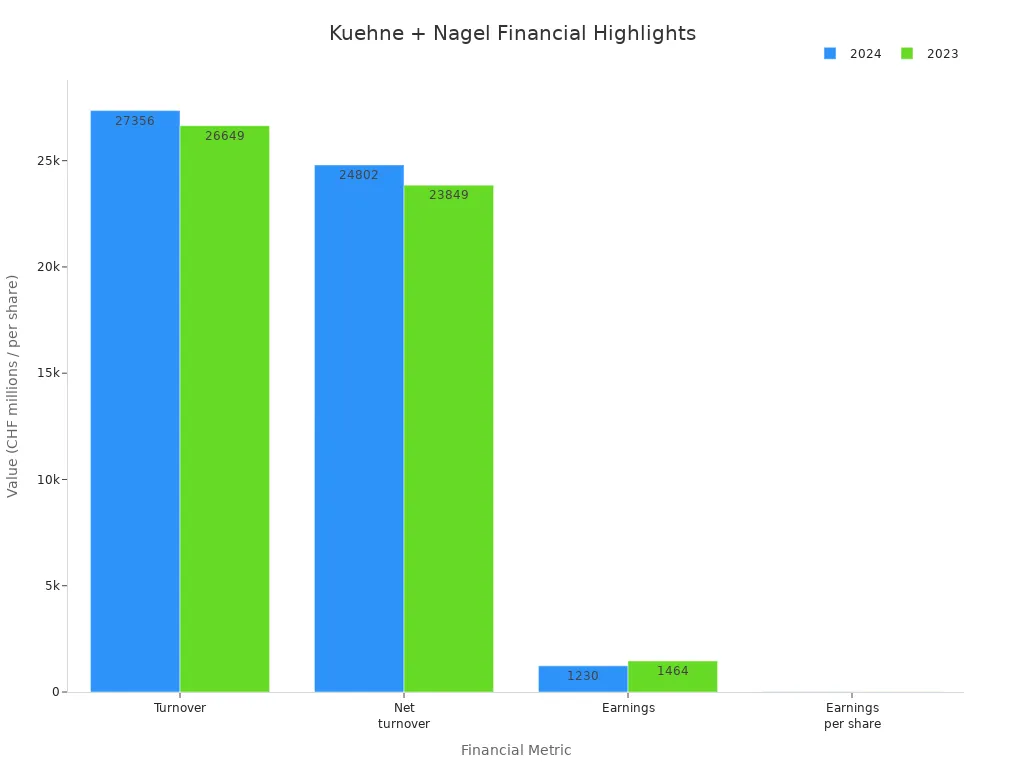

Metric | 2024 | 2023 | Change (%) |

|---|---|---|---|

Turnover | 27,356 | 26,649 | 2.7 |

Net turnover | 24,802 | 23,849 | 4.0 |

Earnings | 1,230 | 1,464 | -16.0 |

Earnings per share (CHF) | 9.97 | 12.06 | -17.3 |

Kuehne + Nagel keeps its profits steady by making smart moves. You see this in their recent acquisitions:

They bought 51% of IMC Logistics, boosting their U.S. market presence.

They acquired Farrow in Canada and City Zone Express in Southeast Asia, expanding road logistics.

A new automated distribution center for Adidas in Italy increased shipment capacity.

Kuehne + Nagel also grew volumes in Sea Logistics by 2% and Air Logistics by 7%, beating the overall market. You get reliable service because they keep investing in technology and expanding their network.

DSV

DSV is a global powerhouse in logistics. You might use DSV for shipping by road, air, or sea. The company’s revenue keeps climbing, showing strong growth.

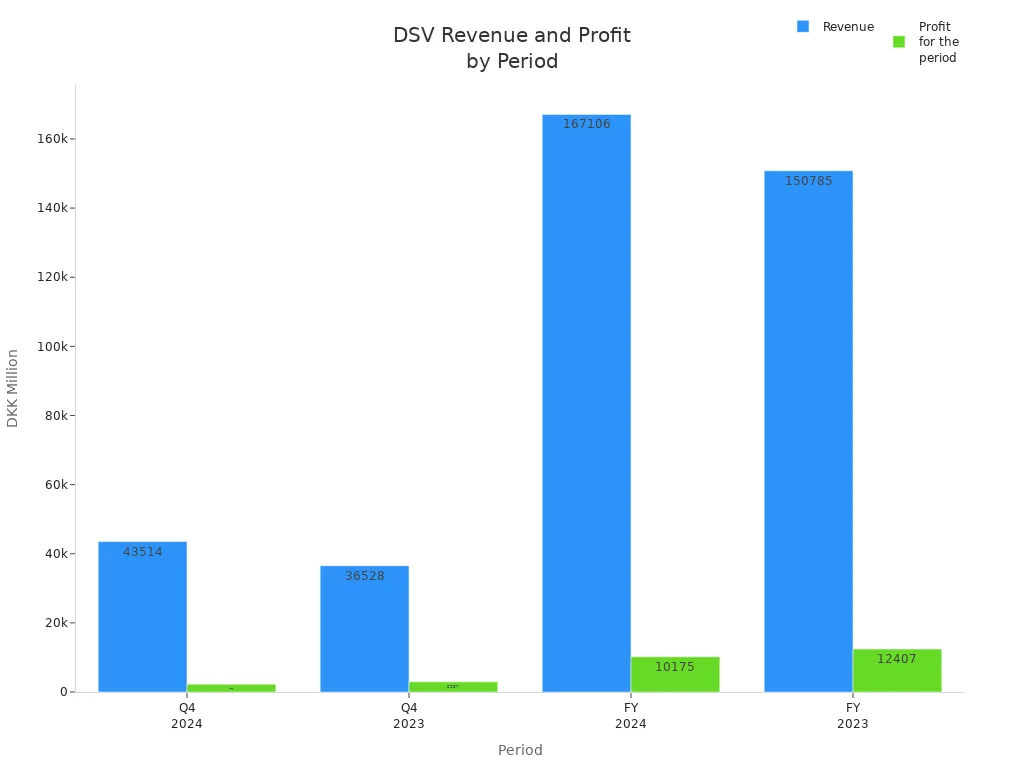

Key figures (DKKm) | Q4 2024 | Q4 2023 | FY 2024 | FY 2023 |

|---|---|---|---|---|

Revenue | 43,514 | 36,528 | 167,106 | 150,785 |

Gross profit | 10,788 | 10,447 | 42,974 | 43,818 |

Operating profit (EBIT) before special items | 3,936 | 3,950 | 16,096 | 17,723 |

Profit for the period | 2,225 | 2,937 | 10,175 | 12,407 |

Adjusted earnings for the period | 2,849 | 2,998 | 11,103 | 12,650 |

Adjusted free cash flow | 1,354 | 668 | 5,550 | 11,471 |

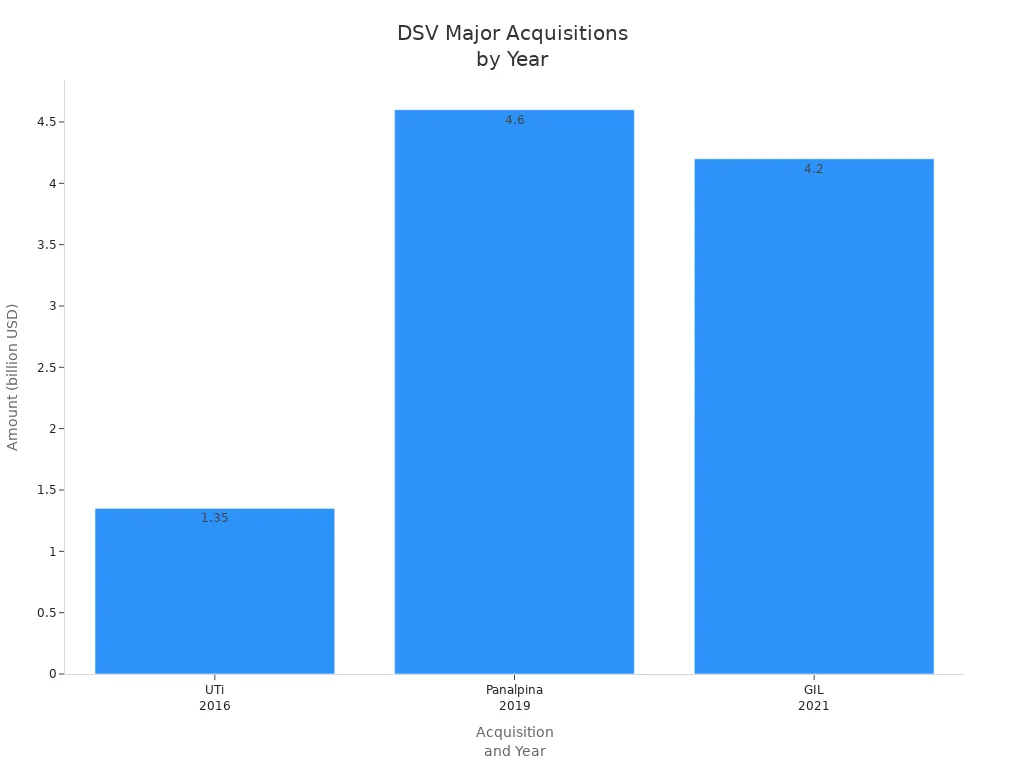

DSV’s revenue for 2024 hit $24.23 billion, up 10.67% from last year. You see DSV everywhere because they keep buying other companies to grow bigger. Here are some of their major acquisitions:

Acquisition | Year | Amount (in billion USD) | Significance |

|---|---|---|---|

UTi | 2016 | 1.35 | Expanded U.S. market |

Panalpina | 2019 | 4.6 | Enhanced global reach |

Global Integrated Logistics (GIL) | 2021 | 4.2 | Strengthened Middle East operations |

Schenker | 2024 | N/A | Made DSV the world’s largest logistics firm |

You benefit from DSV’s global network and strong service offerings. Their focus on growth means you get access to more shipping options and better logistics solutions.

UPS

UPS is a name you trust for fast deliveries. The company’s financial results show why it’s a leader in logistics.

Metric | Value |

|---|---|

Revenue (2025) | |

Revenue (2024) | $91.07 Billion USD |

Revenue (2023) | $90.95 Billion USD |

Market Capitalization | $72.07 Billion USD |

UPS keeps profits high by focusing on quality and efficiency. You see this in their service portfolio:

Evidence Type | Description |

|---|---|

Operational Turnaround | UPS managed cost pressures and returned to growth. |

Strategic Investments | The Frigo-Trans acquisition boosted healthcare logistics. |

Productivity Gains | Programs like 'Fit to Serve' and 'Network of the Future' improved cost efficiency. |

Revenue Quality Focus | Pricing strategies and network optimization favor higher-margin business. |

International Strength | Margin expansion in international operations. |

UPS invests in technology and new services. You get faster deliveries and more reliable shipping. Their international strength means you can send packages almost anywhere in the world.

FedEx

FedEx is one of the most recognized logistics companies. You probably use FedEx for shipping packages across the country or around the world. The company’s financial results show steady growth.

Metric | Fiscal 2025 | Fiscal 2024 |

|---|---|---|

Revenue | $87.7 billion | |

Operating income | $5.22 billion | $5.56 billion |

Operating margin | 5.9% | 6.3% |

Net income | $4.09 billion | $4.33 billion |

Diluted EPS | $16.81 | $17.21 |

Capital spending | $4.1 billion | $5.2 billion |

Stock repurchases | $3.0 billion | N/A |

FedEx stays profitable by using smart strategies. You benefit from their network optimization, which makes deliveries faster and cheaper. FedEx expands its e-commerce logistics to meet the needs of online shoppers. The company invests in digital transformation and sustainability, aiming for carbon-neutral operations by 2040. FedEx also focuses on small and medium businesses, giving you more choices for shipping.

Operational Strategy | Description |

|---|---|

Network Optimization | Streamlined delivery routes and processes. |

E-commerce Logistics Expansion | Services for online shopping and delivery. |

Digital Transformation | Technology investments for better service. |

Sustainability Initiatives | Carbon-neutral goals by 2040. |

International Market Strengthening | Expanded global services. |

Focus on Small and Medium Businesses | Tailored solutions for smaller companies. |

Deutsche Post AG

Deutsche Post AG is a giant in the logistics world. You see their services in Europe, Asia-Pacific, and the Americas. The company’s financial results show strong performance.

Metric | Value |

|---|---|

Revenue | EUR 84.52 billion |

Profit | EUR 3.45 billion |

Earnings per Share | EUR 2.96 |

Deutsche Post AG’s international presence helps it stay profitable. You benefit from their leadership in courier and postal services. The company holds nearly 6% of the global contract logistics market share.

Metric | Value |

|---|---|

Annual Revenues | €84 billion |

Revenue from Americas | €18.3 billion |

Express Business Revenue | €24.5 billion |

Global Forwarding Revenue | €18.4 billion |

P/E Ratio | 13.2x |

Sector Average P/E Ratio | 18.8x |

Employee Base | 600,000 |

Deutsche Post AG leads in courier and postal services across Europe and Asia-Pacific.

The company generates strong cash flow, helping it manage debt.

Tariff changes, especially in the U.S., affect pricing and financial performance.

You get reliable service because Deutsche Post AG adapts quickly to changes in the global market.

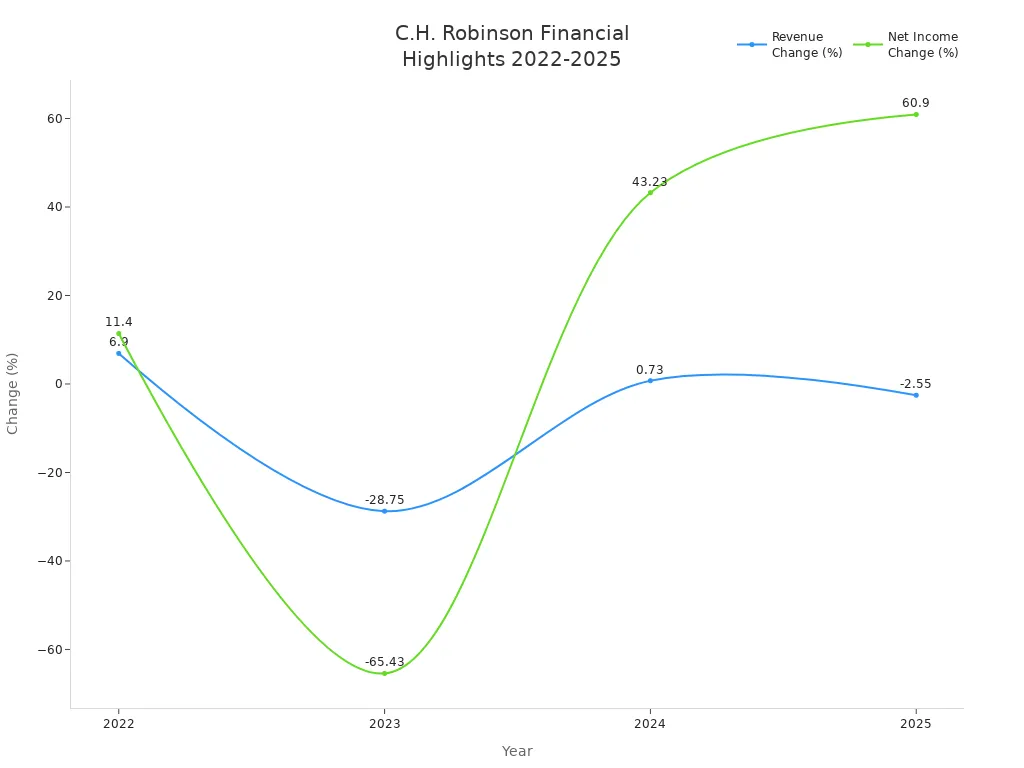

C.H. Robinson

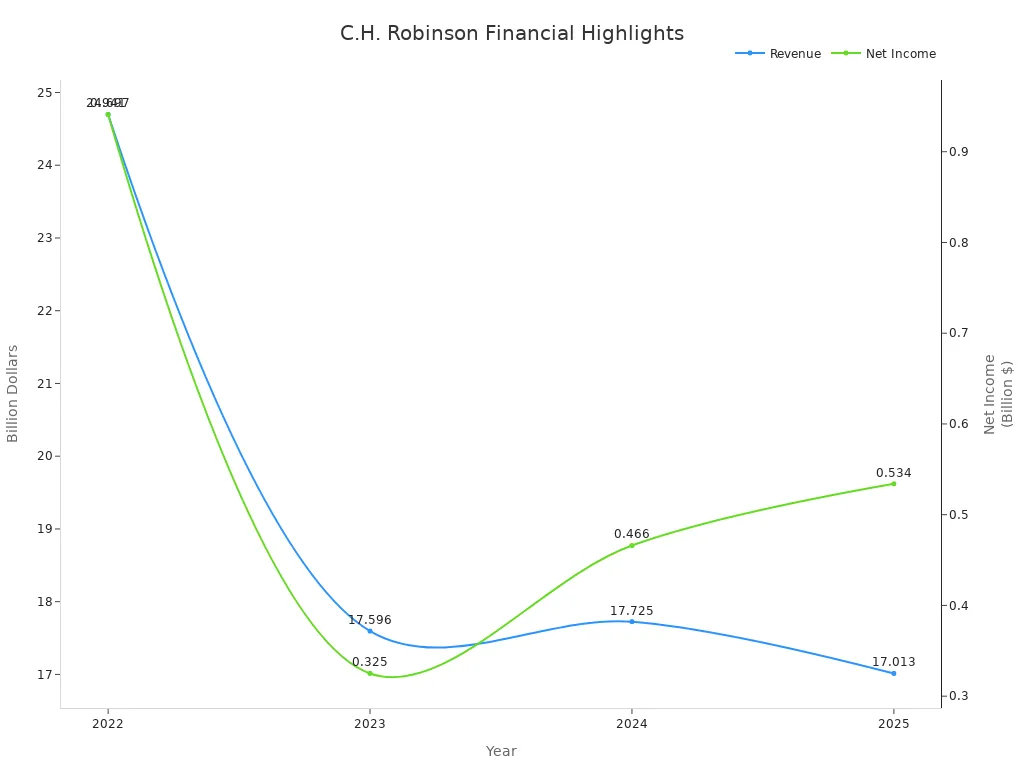

C.H. Robinson is a top player in logistics. You might use their services for freight brokerage and supply chain management. The company’s financial results show steady growth in net income, even when revenue fluctuates.

Year | Revenue (Billion $) | Net Income (Billion $) |

|---|---|---|

2025 | 0.534 | |

2024 | 17.725 | 0.466 |

2023 | 17.596 | 0.325 |

2022 | 24.697 | 0.941 |

Year | Revenue Change (%) | Net Income Change (%) |

|---|---|---|

2025 | -2.55% | +60.9% |

2024 | +0.73% | +43.23% |

2023 | -28.75% | -65.43% |

2022 | +6.9% | +11.4% |

C.H. Robinson stands out because it focuses on technology and partnerships instead of owning lots of trucks or warehouses. You benefit from their Navisphere platform, which handles over 23 million shipments every year. The company automates millions of shipping tasks, making deliveries faster and more efficient.

C.H. Robinson uses technology and partnerships, not asset ownership.

Navisphere platform processes 23.6 million shipments annually.

Real-time visibility and AI analytics improve customer experience.

You get smarter logistics solutions and better service because C.H. Robinson invests in technology.

What Sets Top Logistics Companies Apart

Services and Global Reach

You notice the difference when you work with top logistics companies. They offer a wide range of services that cover every step of the supply chain. You can ship packages across the country or send freight around the world. These companies have offices, warehouses, and partners in almost every major city. That means you get fast delivery and reliable service, no matter where you are.

Here’s what sets their services apart:

End-to-end visibility lets you track your shipment from start to finish.

Automated cargo tracking keeps you updated without extra effort.

Strong supplier relationships help your goods move smoothly.

Good communication makes it easy for you to solve problems quickly.

Customer service teams handle your questions and make sure you feel valued.

Tip: When you choose a company with global reach, you get fewer delays and better support.

Technology and Innovation

You see technology everywhere in the logistics industry. Leading logistics companies use the latest tools to make your shipping experience better. They invest in smart systems that help them work faster and more accurately.

Technology | Company Examples | Benefits |

|---|---|---|

IoT | DHL, Amazon, FedEx | Real-time tracking, improved fleet management, enhanced warehouse operations. |

Digital Twins | Maersk, DHL, FedEx | Operational optimization, simulation of routes, predictive maintenance. |

Cloud Computing | UPS, Amazon, DHL | Centralized data management, real-time visibility, scalability. |

Big Data Analytics | C.H. Robinson | Data-driven decision-making, demand forecasting, inventory management. |

Robotic Process Automation | GEODIS, Amazon, DHL | Automation of repetitive tasks, improved efficiency, reduced errors. |

Autonomous Vehicles | Nuro, Amazon, FedEx | Improved delivery methods, cost reduction, optimized routes. |

Blockchain | Walmart, Maersk, FedEx | Enhanced transparency, security, and traceability in transactions. |

You benefit from these innovations every time you get a package on time or see real-time updates on your phone.

Operational Efficiency

You want your shipments to arrive on time and in good shape. The most successful logistics companies focus on making their operations as efficient as possible. They use automation to cut down on mistakes and speed up deliveries. They also care about sustainability, so you know they try to reduce waste and use greener methods.

Here’s how they stay ahead:

They automate routine tasks to save time and lower costs.

They keep strong relationships with suppliers to avoid delays.

They offer excellent post-sale service, so you always feel supported.

They use eco-friendly practices to attract customers who care about the planet.

You get better service, faster shipping, and peace of mind when you choose a company that values efficiency.

Industry Trends

E-commerce Growth

You probably notice how online shopping keeps getting bigger every year. E-commerce growth changes the way logistics companies work. You want your package fast, and you expect to track it every step of the way. Companies now build more warehouses close to cities. This helps them deliver your orders quickly. You see more delivery vans in your neighborhood because of this trend. E-commerce also pushes companies to offer same-day or next-day shipping. You get more choices and faster service.

Digitalization

You live in a digital world. Logistics companies use new technology to make things easier for you. They use apps and websites so you can track your package in real time. Many companies use robots in warehouses to move boxes faster. You might even see drones delivering packages soon. Digitalization helps companies work smarter and save money. You get better updates and fewer mistakes with your deliveries.

Note: Digital tools help leading logistics companies give you a smoother experience.

Sustainability

You care about the planet, and so do many companies. They try to use electric trucks and bikes for deliveries. Some companies use recycled packaging to cut down on waste. You might see more green logos on delivery vans. Companies also plan routes to use less fuel. When you choose a company that cares about sustainability, you help protect the environment.

Economic Factors

You feel the effects of the economy in your daily life. Prices for fuel, labor, and materials can change quickly. Logistics companies must adjust to these changes. Sometimes, you might notice shipping costs go up. Companies look for ways to save money and keep prices fair for you. They might use bigger trucks or share space with other shipments. Economic factors shape how companies plan and deliver your packages.

You now know what makes the most profitable logistics companies stand out. Strong financial metrics, smart technology, and global networks drive their success. When you look at revenue, net income, and market cap, you get a clear picture of who leads the industry. Next time you compare logistics companies, check these numbers first. You will make smarter choices for your shipping needs.

FAQ

What makes a logistics company profitable?

You see profits rise when a company controls costs, uses smart technology, and keeps customers happy. Big networks and fast deliveries help, too. Companies that invest in innovation often lead the pack.

Tip: Watch for companies that use automation and data to boost profits.

How do logistics companies use technology?

You notice faster shipping and better tracking because companies use AI, robots, and real-time data. These tools help them plan routes, manage warehouses, and keep you updated on your package.

Real-time tracking

Automated warehouses

Route optimization

Why do market cap and revenue matter?

You get a quick idea of a company’s size and value by looking at market cap and revenue. High numbers show strong business and investor trust. These metrics help you compare companies easily.

Can small businesses use top logistics companies?

Yes! You can use services from big logistics brands even if you run a small shop. Many offer special plans for small businesses. You get access to global shipping, tracking, and customer support.

Note: Ask about small business discounts or flexible shipping options.

See Also

Discovering Top Global Logistics Firms: A Comprehensive Guide

Unlocking Logistics Savings: Expert Tips for Supply Chain Success

Best Five Logistics Solutions to Explore in 2024