Navigating the Disruptive Tariff Landscape

A sudden increase in tariffs can disrupt supply chains and squeeze profit margins. The 2025 US tariff regime raised the average effective tariff rate to 18.2%, the highest since the 1930s. Companies like Williams-Sonoma and Ralph Lauren changed sourcing strategies to manage costs and maintain supply chain stability.

Businesses must adopt adaptive strategies, build resilience, and form cross-functional teams to navigate disruptive tariff changes. Insurance solutions help shield financial losses when unexpected trade policies arrive.

Statistic / Metric | Value / Description | Economic Impact |

|---|---|---|

Average Effective U.S. Tariff Rate | 18.2% | Highest since 1930s, impacting imports |

U.S. Customs Collections (2025) | $113 billion | Record revenue, increased burden on importers and consumers |

Average Cost to American Households | $2,400 per household | Direct consumer cost from tariff-driven price hikes |

Key Takeaways

Disruptive tariffs raise costs for businesses and consumers, causing supply chain shocks and economic uncertainty.

Companies build resilience by diversifying suppliers, nearshoring production, and investing in technology like AI for better planning.

Financial strategies such as hedging, dynamic pricing, and insurance help protect profit margins from tariff risks.

Legal compliance requires updating contracts, improving documentation, and monitoring regulatory changes to avoid penalties.

Cross-functional teams enable fast, coordinated responses to tariff changes, helping businesses adapt and stay competitive.

Disruptive Tariff Impact

Economic Effects

The 2025 US tariff regime has changed the global economic landscape. Tariff revenues could reach about 1.1% of GDP if trading partners do not retaliate. If retaliation occurs, revenues may drop to 0.7% of GDP. Imports are expected to fall by $319 billion, while exports could decrease by up to 16%, or $530 billion. These changes create uncertainty for businesses and households. Many families may see their income drop by $1,300 to $4,700 each year.

Metric | Projection / Estimate | Notes |

|---|---|---|

Tariff Revenues | ~1.1% of GDP (optimistic, no retaliation) | Could fall to 0.7% of GDP if retaliation occurs |

Reduction in Imports | $319 billion | Based on Wharton Budget Model |

Reduction in Exports | Up to 16% ($530 billion) | Sensitive to retaliatory tariffs; conservative estimate is $149 billion (-0.5% GDP) |

Trade Deficit Change | -13% (non-retaliatory scenario) | Could worsen with retaliation; range from $651 billion reduction to $211 billion increase |

GDP Impact | Mixed effects, uncertain | Dependent on retaliation and fiscal policy responses |

Household Income Impact | Decrease of $1,300 to $4,700 per household | Reflects consumer wealth loss due to tariffs |

Government Revenue from Tariffs | $220 billion to $420 billion annually (amortized over 10 years) | Revenue use will affect overall economic impact |

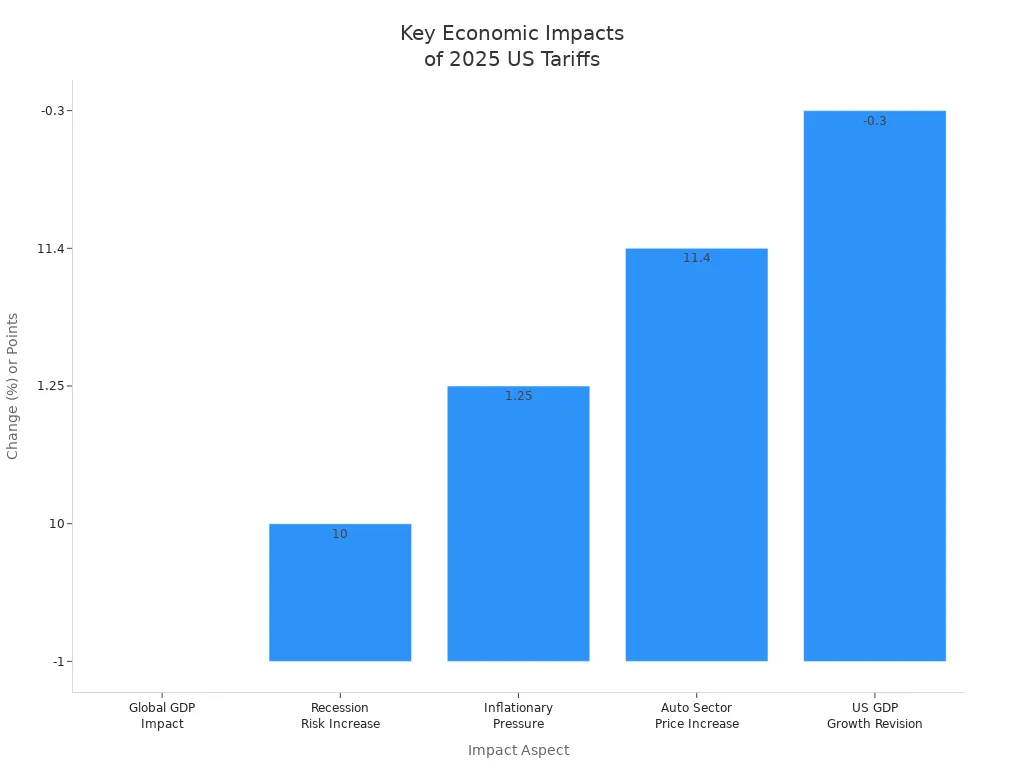

Tariffs act like a tax on businesses and families. Inflation rises as companies pass higher costs to consumers. The core Consumer Price Index increased by 0.3% in July, the largest monthly jump since early 2024. Many economists expect inflation to keep rising as tariffs remain in place.

Business confidence has dropped. Companies hesitate to invest and hire new workers. The risk of a global recession has climbed to 40% in 2025, up from 30% last year.

Previous disruptive tariff policies also hurt economic growth. President Trump's tariffs raised costs for American producers and led to job losses in manufacturing. Retaliatory tariffs from other countries made the situation worse. Many companies shifted supply chains to countries like Mexico and Vietnam, but overall economic growth slowed.

Supply Chain Shocks

Disruptive Tariff policies have caused major supply chain shocks. Companies face challenges with inventory planning and demand forecasting. Sourcing disruptions force businesses to find new suppliers when tariffs make old relationships too expensive. Cash flow problems grow as costs rise and lead times stretch longer.

A clear example comes from US retailers. Before tariffs on Chinese goods took effect, they increased imports by 40% to avoid higher costs. This frontloading led to a sharp drop in cargo at the Port of Los Angeles, with a 35% decrease after tariffs started. These shocks ripple through the global economy, causing delays, higher costs, and changes in sourcing strategies.

Tariffs also disrupt supply chain continuity for multinational companies. Customs clearance becomes more complex, and logistics coordination takes more time. Companies must diversify suppliers, increase local sourcing, and renegotiate contracts to stay resilient. Technology helps with advanced analytics and real-time monitoring of tariff changes.

Tip: Businesses can improve supply chain resilience by collaborating with suppliers and logistics providers, investing in scenario planning, and using flexible warehousing solutions.

Industry Differences

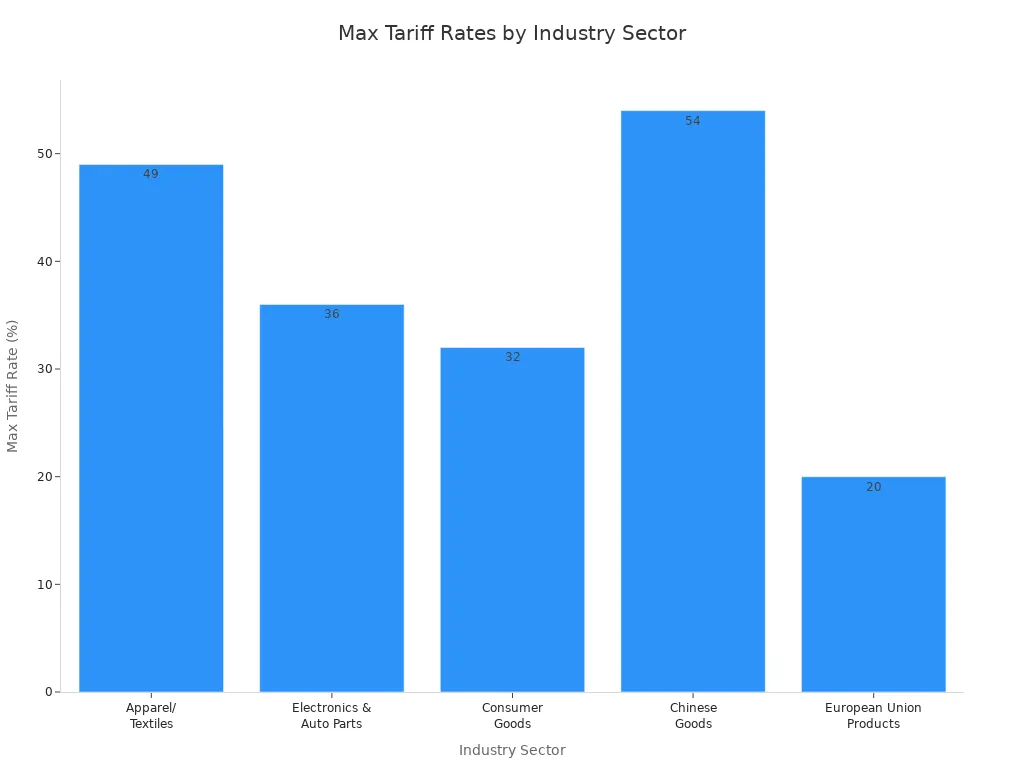

Disruptive Tariff policies do not affect all industries equally. Manufacturing sectors, especially apparel, textiles, electronics, and auto parts, face the highest tariff rates. Apparel and textile imports from Cambodia, Bangladesh, and Vietnam now face tariffs between 32% and 49%. Electronics and auto parts from Thailand, South Korea, and Japan see rates from 24% to 36%. Chinese goods, including machinery and furniture, face combined tariffs near 54%.

Industry Sector | Countries Affected | Tariff Rate Range | Key Products Impacted |

|---|---|---|---|

Apparel/Textiles | Cambodia, Bangladesh, Vietnam, Indonesia | 32% - 49% | Garments, footwear, textiles |

Electronics & Auto Parts | Thailand, South Korea, Japan, Taiwan | 24% - 36% | Electronics, appliances, auto parts |

Consumer Goods | Indonesia, India | 26% - 32% | Footwear, apparel, pharmaceuticals, jewelry |

Chinese Goods | China | ~54% (combined) | Electronics, machinery, furniture |

European Union Products | EU (27 member states) | 20% | Automobiles, luxury goods, foods, beverages |

The construction industry has felt the impact of tariffs on steel, aluminum, and lumber. Material costs have surged by 10% to 20%, causing project delays and budget overruns. Some construction projects now take 20-30% longer to finish. The IT industry faces risks from tariffs on semiconductor manufacturing facilities, which could slow future growth.

Disruptive Tariff changes force businesses to realign global strategies. Companies must rethink sourcing, production, and logistics to manage costs and maintain stability. Cross-functional teams help organizations adapt quickly and stay competitive in a high-tariff world.

Supply Chain

Resilience Strategies

Companies strengthen supply chains by adopting several proven strategies. They often pivot to regional hubs, placing production centers in locations with favorable tariffs near major markets. Many shift final assembly to consumer markets, investing in local facilities and supplier networks. Some decentralize operations, splitting global supply chains into semi-autonomous regional networks. This approach increases resilience, even though it adds complexity. Businesses also invest in digital infrastructure, using AI-driven demand planning and real-time visibility tools. They calculate total costs, including geopolitical risks and tariffs, to prioritize stable sourcing over just upfront savings.

Pivot to regional hubs

Assemble in end-markets

Decentralize operations

Invest in digital infrastructure

Derive total costs

Companies like Samsung and Foxconn localize production to avoid tariffs, while luxury car makers in India use local assembly to stay competitive.

These strategies lead to measurable outcomes. Inventory levels drop by 15-30%, service levels improve by up to 20%, and working capital exposure decreases. Companies also plan faster and respond more quickly to disruptions.

Nearshoring and Multi-Sourcing

Nearshoring brings production closer to home, reducing transportation times and costs. Mexico stands out as a popular destination, but companies must consider workforce skills and tariff uncertainty. Nearshoring supports supply chain control and speeds up responsiveness. However, it requires capital investment and careful planning. Multi-sourcing, or supplier diversification, reduces concentration risk and increases flexibility. Companies like General Electric and Apple have moved production to Mexico, Vietnam, and India, cutting delivery times and lowering logistics costs.

Nearshoring boosts resilience and supports ESG goals.

Multi-sourcing helps companies adapt to tariff changes.

Challenges include raw material sourcing, security risks, and fluctuating trade policies.

AI and Technology

Artificial intelligence transforms supply chain management. AI tools assess tariff risks, forecast changes, and recommend sourcing shifts. They evaluate supplier profiles, optimize logistics, and monitor trade compliance. Scenario modeling with AI simulates disruptions, helping companies prepare adaptive strategies. Digital twins and real-time control towers give end-to-end visibility, allowing teams to make fast, informed decisions. These technologies help companies maintain competitiveness and resilience, even when tariffs disrupt global trade.

Financial Strategies

Margin Protection

Companies protect profit margins in a high-tariff environment by using several financial strategies. Many use hedging and forward contracts to manage currency swings and tariff-related cost increases. These tools help stabilize costs and reduce financial risks. Businesses also implement price adjustment mechanisms, such as dynamic pricing, to pass some tariff costs to customers while staying competitive. Tax strategies, like transfer pricing adjustments and leveraging trade agreements, can reduce tariff burdens.

Some organizations strengthen their balance sheets, manage credit lines, and explore alternative financing to maintain capital flexibility. Technology and data analytics provide real-time visibility and predictive insights, helping finance teams respond quickly to changes. Transparent communication with stakeholders builds trust and keeps internal teams aligned.

Companies like CenterPoint Group and Essendant use contract renegotiation, group purchasing, and price optimization tools to secure better pricing and minimize tariff exposure. Others, such as Rattan Imports and Birchbury, diversify suppliers and adjust inventory strategies to protect margins.

Currency Risk

Tariffs and currency fluctuations often interact, making financial planning more complex. When tariffs increase the cost of imported goods, profit margins shrink. Currency swings can either worsen or soften these effects. For example, if a domestic currency strengthens after tariffs, import costs may fall, but export revenues could drop.

Businesses use financial instruments like hedging and forward contracts to manage these risks. Multi-currency accounts help avoid unnecessary conversions and improve cash flow predictability. Automated FX risk management tools lock in favorable rates and reduce exposure to market volatility. Companies also work with banking partners to optimize payment routing and reduce transaction fees.

Strong supplier relationships and flexible payment terms help companies adapt to shifting trade routes and regulatory requirements.

Insurance Solutions

Insurance plays a key role in managing risks from tariffs and political changes. Political risk insurance protects against government actions that could seize assets or restrict operations. Trade credit insurance covers losses if customers cannot pay, which is important when tariffs reduce demand or cause buyer defaults.

Other options include subcontractor default insurance for construction projects, directors and officers insurance for legal risks, and property-related insurances like marine cargo and builder’s risk. Companies should review policy wording and limits, coordinate risk management across teams, and stay updated on tariff policy changes to ensure adequate coverage.

Insurance Type | What It Covers |

|---|---|

Political Risk Insurance | Asset seizure, contract breaches, currency limits |

Trade Credit Insurance | Customer defaults, market demand loss |

Subcontractor Default | Construction delays, cost overruns |

D&O Insurance | Lawsuits from market losses |

Property-Related Insurances | Physical loss, trade disruption, sabotage |

Legal

Compliance

Businesses face a complex web of compliance challenges under new tariff regulations. The Department of Justice has increased enforcement against trade and customs fraud, making compliance more critical than ever. Companies must now address overlapping tariffs, reciprocal tariffs, and national security measures. Customs compliance programs that once sufficed now require comprehensive risk assessments and redesign.

Common compliance pitfalls include:

Inconsistent or missing documentation

Manipulation of geographic origin to reduce tariffs

Abnormal shipping routes

Misclassification of goods to lower tariff rates

Transactions among related parties

Overly complex supply chains

Underreporting or undervaluation of goods

Lack of transparency during audits

Frequent claims for tariff refunds

Regular changes in suppliers or manufacturers

High volume of tariff exemption claims

Unclear changes in ownership structures

These issues increase operational and reputational risks. Companies risk civil and criminal penalties if they fail to comply. Customs and Border Protection, along with Homeland Security Investigations, now scrutinize importers more closely. Businesses must invest in compliance infrastructure, conduct internal audits, and update protocols regularly.

Contract Review

Contract review has become essential in a volatile tariff environment. Many contracts lack clauses that address tariff fluctuations, which creates ambiguity and increases the risk of disputes. Failing to update contracts can lead to financial exposure, breaches, and unanticipated costs. Companies may lose competitive advantage or even threaten business stability.

Key clauses to review include force majeure and price adjustment provisions. Proactive contract updates ensure compliance and reduce legal risks. Documenting changes and consulting legal counsel help mitigate potential disputes and liabilities.

Regulatory Updates

Regulatory updates related to tariffs directly impact business operations and planning. New tariffs raise import costs, which businesses often pass on to consumers. This leads to higher prices and reduced profit margins. The unpredictability of tariff policies complicates forecasting, inventory management, and investment decisions.

Small businesses feel these effects most acutely. For example, Pacific Valley Foods, a small exporter, saw a 70% revenue decline after new tariffs and retaliatory measures. Companies must diversify suppliers, adjust pricing, and use scenario planning tools to manage risks. Automation and software solutions improve compliance and help businesses adapt quickly to regulatory changes.

Tip: Regularly monitor regulatory updates and invest in compliance technology to stay ahead of evolving tariff requirements.

Market Adaptation

Pricing Models

Companies use a range of pricing models to adapt to disruptive tariffs. Dynamic and algorithmic pricing lets businesses adjust prices in real time as tariffs change. Cost-indexed or formula-based pricing ties product prices to commodity indexes, so prices shift automatically with input costs. Many firms add tariff-indexed surcharges, which show customers exactly how tariffs affect prices and build trust.

Dynamic and algorithmic pricing for real-time adjustments

Cost-indexed pricing linked to commodity costs

Tariff-indexed surcharges for transparency

Volume commitments and preferential pricing for large orders

Flexible rebate programs to reward loyalty

Subscription and bundled offerings for stable pricing

Tailored agreements with indexation or renegotiation clauses

AI-driven pricing tools for precision and scenario planning

These models help companies keep margins stable, share risk with customers, and offer predictable pricing even when tariffs fluctuate.

Customer Communication

Clear and honest communication helps companies manage customer reactions to tariff-driven price changes. Businesses often provide rebates or purchase incentives to offset higher costs. In B2B markets, volume-based rebates encourage bulk buying. In B2C, loyalty rewards or store credits help retain customers. Companies explain the benefits of these incentives at the time of purchase.

Transparency and empathy matter. Customers accept price increases more when they understand the reasons and see fairness. Advance notice—usually 14 to 21 days—gives customers time to prepare. Simple language and visuals make tariff impacts clear. Collaborative language and reminders of product value reduce negative reactions. Offering tiered options, such as loyalty discounts or payment plans, helps maintain trust and conversions.

New Opportunities

Disruptive tariffs create new market opportunities for agile businesses. Many companies diversify supply chains to regions with better trade terms. Investment in automation and technology helps offset higher costs and boosts productivity. Firms explore alternative materials and suppliers to avoid tariffed goods. Dynamic pricing strategies and expansion into new markets or channels capture untapped demand.

Investment in automation and technology

Exploring alternative suppliers and materials

Expansion into new markets and channels

Strengthening supplier relationships

Stockpiling critical materials before tariff hikes

Some sectors, such as technology, benefit from increased demand for automation solutions. Companies also identify whitespace markets—areas with unmet needs and low competition. Shifts in investor capital flow toward undervalued regions and sectors highlight new opportunities in the changing trade environment.

Disruptive Tariff Strategies

Cross-Functional Teams

Cross-functional teams play a vital role in helping companies respond to Disruptive Tariff changes. These teams bring together experts from finance, operations, legal, supply chain, and communications. They work together to identify risks, set clear goals, and make fast decisions during tariff disruptions.

Clear decision-making protocols help teams avoid delays and keep projects moving.

Executive sponsors support teams without micromanaging, giving them the power to act quickly.

Leaders bridge gaps between departments, manage conflicts, and build trust. This creates a safe space for open communication and new ideas.

Aligning roles and responsibilities across departments reduces confusion and increases accountability.

Transparent communication, conflict management, and recognition of teamwork keep teams strong under pressure.

Cross-functional teams also use scenario planning. They combine knowledge from commercial, tax, and supply chain areas to model how tariffs might impact the business. The Chief Risk Officer often joins these teams to define risk tolerance and key risk indicators. Enterprise Risk Management groups help unify departments, monitor risks, and keep senior leaders informed. These teams can spot crises early, align leadership, and deploy resources quickly. By working together, they ensure business functions continue even when Disruptive Tariff events occur.

Tip: Companies should create a dedicated tariff response team with members from all key departments. This team can adapt quickly and keep the business running smoothly during tariff changes.

Continuous Improvement

Continuous improvement helps companies stay strong in the face of Disruptive Tariff disruptions. Many organizations build financial resilience by improving cost visibility and accountability. They flex supply chain strategies, using flexible sourcing or moving production to reduce tariff risks. Streamlining workflows and cutting waste helps companies find new ways to perform at their best.

Companies use advanced manufacturing technologies to boost agility and productivity.

Product design teams simplify and optimize products, lowering costs and improving profit margins.

Leaders build a cost-conscious culture, encouraging employees to join cost-saving efforts.

Clear metrics track progress and keep everyone accountable.

Digital transformation and automation in finance make it easier to handle complex tariffs.

Scenario planning tools and supply chain visibility platforms help manage global suppliers.

Automation in accounts payable and mass payments reduces errors and improves cash flow.

Real-time visibility into spending and supplier locations helps companies assess tariff impacts.

Agility in switching and onboarding suppliers allows quick responses to tariff changes.

Companies also use scenario planning to prepare for different tariff outcomes. They realign supply strategies, like expanding in India or investing in U.S. manufacturing. Research and development remain a priority, even during tough times. Leaders allocate resources based on results, localize supply, and stabilize margins. Innovation leaders align projects with cost and risk pressures to deliver results on time.

Note: Forward-stocking inventory, diversifying sourcing, and nearshoring production can help companies avoid tariff disruptions. Using foreign trade zones and bonded warehouses adds flexibility in managing inventory and duty payments.

Benchmarking

Benchmarking allows companies to measure their performance against industry leaders and adapt best practices for Disruptive Tariff management. By comparing key metrics, businesses can spot gaps and set realistic goals for improvement.

Companies track inventory turnover, lead times, and cost per unit to see how they stack up against competitors.

They review supplier diversification rates and the speed of switching suppliers during tariff changes.

Financial teams benchmark margin protection strategies, such as hedging and dynamic pricing.

Legal and compliance teams compare audit results and the frequency of regulatory updates.

Supply chain teams measure the effectiveness of scenario planning and digital tools.

Benchmarking also helps companies learn from others’ successes and failures. For example, firms that quickly adopted automation or diversified suppliers often outperformed those that did not. Regular benchmarking keeps organizations alert and ready to adjust strategies as Disruptive Tariff conditions evolve.

Companies that benchmark regularly can adapt faster, reduce risks, and maintain a competitive edge in a changing tariff landscape.

Companies build resilience by adopting proactive strategies. They strengthen supply chains, optimize financial planning, and update legal compliance. Teams assess readiness and adjust approaches to meet new challenges. Integrated planning supports continuous adaptation in a changing market.

Businesses should review their strategies and invest in innovation to stay competitive.

FAQ

What is a disruptive tariff?

A disruptive tariff is a sudden or significant tax on imported goods. It changes trade patterns, raises costs, and forces companies to adjust supply chains quickly. Businesses must act fast to manage risks and protect profits.

How can companies build supply chain resilience?

Companies build resilience by diversifying suppliers, using regional hubs, and investing in technology. They also plan for different scenarios and work closely with logistics partners. These steps help reduce delays and keep products moving.

Why do financial strategies matter during tariff changes?

Financial strategies help companies protect profit margins and manage risks. Tools like hedging, dynamic pricing, and insurance shield businesses from sudden cost increases. Strong financial planning keeps companies stable when tariffs disrupt markets.

What legal steps should businesses take to stay compliant?

Companies should review contracts, update compliance programs, and monitor regulatory changes. Regular audits and clear documentation help avoid penalties. Legal teams must stay alert to new rules and ensure all imports follow current laws.

See Also

Understanding Inflation Effects On Supply Chain Challenges

Expert Advice For Overcoming Automotive Supply Chain Issues

Complete Guide To Managing Supply Chain Interruptions