New Energy Vehicle supply chain trends in India in 2025

India’s New Energy Vehicle sector is experiencing rapid transformation. Electric car sales have surged by 70%, driven by robust government incentives and the arrival of new models. Manufacturers and suppliers see digitalization as essential, with the supply chain digital transformation market expected to reach USD 3.23 billion by 2033. Real-time tracking and predictive analytics, powered by AI and IoT, now shape how companies manage logistics. These trends create new opportunities and challenges for all players in the market.

Key Takeaways

India's New Energy Vehicle market is growing fast, driven by government support, rising consumer demand, and better technology.

Strong government policies and incentives, like road tax exemptions, directly boost electric vehicle sales and affordability.

Digital tools and AI improve supply chain efficiency by enabling real-time tracking, predictive analytics, and cost reduction.

Localization of sourcing and production helps reduce risks, lower costs, and build a more resilient supply chain.

JUSDA offers tailored logistics solutions, including bonded warehousing and customs support, to help companies succeed in India's NEV market.

Market Trends

Growth Drivers

India’s New Energy Vehicle market is expanding quickly. Several factors contribute to this growth:

The market reached a value of USD 8.49 billion in 2024 and is expected to grow at a compound annual growth rate of 40.7% from 2025 to 2030.

Government initiatives, such as the FAME India Scheme, provide subsidies and support for charging infrastructure.

Consumers show greater awareness of environmental issues and seek cost-effective transportation.

Battery Electric Vehicles hold a 75.6% market share, driven by zero tailpipe emissions and strong incentives.

Automakers introduce new models designed for Indian buyers, increasing market reach.

Higher fuel prices encourage people to choose electric vehicles.

Urbanization and rising disposable incomes make NEVs more accessible.

Technological advances in batteries and vehicles improve performance and affordability.

JUSDA understands these drivers and helps clients adapt their supply chains to meet rising demand and evolving technology.

Government Policies

Government policies play a key role in shaping the NEV market. States that offer road tax exemptions see higher electric vehicle registrations. For example:

State | Policy Status | EV Registration Change (Q3 vs Q2 FY 2024-25) | Example Price Impact on Tata Nexon EV (Rs.) |

|---|---|---|---|

Maharashtra | 100% road tax exemption | +24.56% increase | Lower on-road price |

Uttar Pradesh | 100% road tax exemption | +23.91% increase | Lower on-road price |

Andhra Pradesh | Road tax reintroduced | -37.63% drop | N/A |

States that remove incentives see a sharp decline in registrations. These policies directly affect affordability and consumer interest. JUSDA tracks these policy changes to help clients plan logistics and inventory.

Consumer Demand

Consumer demand for electric vehicles continues to rise. Total EV sales grew by 20% from FY 2018-19 to FY 2019-20. Two-wheelers make up 97.5% of sales, showing a strong preference for this segment. About 500,000 EVs are registered in India, but this is still below the national target. Environmental concerns, public opinion, and knowledge about NEVs influence buying decisions. Most buyers want a minimum range of 100 km. Government incentives, such as the INR 100 billion allocated under FAME II, also boost demand. JUSDA uses these insights to design supply chain solutions that match consumer needs and market trends.

New Energy Vehicle Supply Chain

Key Players

India’s New Energy Vehicle supply chain features a mix of domestic and international companies. These organizations drive innovation, production, and distribution across the country. The main players include:

Manufacturers: Tata Motors, Ola Electric, Ather Energy, Mahindra Electric, and international brands like Tesla and BYD. These companies invest in research, develop new models, and expand production capacity.

Suppliers: Many suppliers focus on batteries, semiconductors, and electronic components. Key suppliers come from Japan, South Korea, and the United States, providing advanced technology and equipment.

Logistics Partners: Companies with strong local and global networks support the movement of raw materials and finished vehicles. They offer bonded warehousing, inland transport, and customs services.

Note: The Monte Carlo simulation of India’s electric vehicle battery supply chain shows that cost variability and risk management are important for these players. The mean total supply chain cost stands at about $505 million, with significant fluctuations due to raw material prices and demand changes. This highlights the need for robust logistics and supply chain solutions.

A table below summarizes the market share and roles of key regions in the NEV supply chain:

Country/Region | SME Market Share (%) | Role in NEV Supply Chain |

|---|---|---|

United States | Leads in wafer fab and packaging equipment | |

Japan | 29% | Strong in assembly and test equipment |

South Korea | 4.8% | Advanced SME industry, key for battery tech |

China | <2% | Domestic focus, growing influence |

Structure Overview

The New Energy Vehicle supply chain in India consists of several interconnected segments:

Manufacturing Segment: Holds a 20.6% market share as of 2023 and continues to grow. Manufacturers rely on efficient supply chain management to meet rising demand.

Large Enterprises: Represent 47.3% of the market. These companies use advanced systems to manage inventory, production, and logistics.

Small and Medium Enterprises (SMEs): Show an expected CAGR of 11.8%. SMEs adopt new supply chain solutions to improve efficiency and compete with larger firms.

Key features of the supply chain include:

Strong presence in India and ASEAN markets to handle local regulations.

Adequate freight capacity for growing production needs.

Local warehousing, including bonded warehouses, to optimize cash flow.

Experience with sensitive components like batteries and semiconductors.

Global logistics scope to connect OEMs, suppliers, and customers.

Commitment to green logistics and CO2 reduction.

Robust IT systems for real-time inventory and shipment tracking.

These elements ensure that the supply chain remains flexible, efficient, and ready to support the rapid growth of the New Energy Vehicle sector.

JUSDA in Indian Market

JUSDA plays a vital role in India’s New Energy Vehicle supply chain. The company supports electronic component suppliers and automotive clients by offering tailored logistics solutions. JUSDA’s services address common challenges such as price competition, service quality, and customs complexities.

JUSDA provides:

Bonded Warehousing: Temporary storage solutions in Bangalore, Hyderabad, and Pune help suppliers manage goods during customs applications. This service supports smooth transitions for companies relocating production lines to India.

Inland Transportation: Reliable delivery of raw materials and semi-finished products from ports and airports to factories. JUSDA ensures timely and safe movement of goods across key industrial cities.

Customs Compliance: Comprehensive support for customs clearance, IGCR, EPR, and BIS certification. JUSDA communicates with government departments to secure tax qualifications and regulatory approvals.

JUSDA’s digital information system streamlines cooperation and payment processes. The company’s expertise in handling sensitive electronic components and its focus on service quality set it apart in the Indian logistics market. By integrating advanced IT systems and offering differentiated VMI services, JUSDA helps clients reduce costs, improve efficiency, and achieve compliance.

Tip: Companies looking to enter or expand in India’s New Energy Vehicle market can benefit from JUSDA’s local knowledge, bonded warehousing, and end-to-end logistics solutions.

Tech Innovations

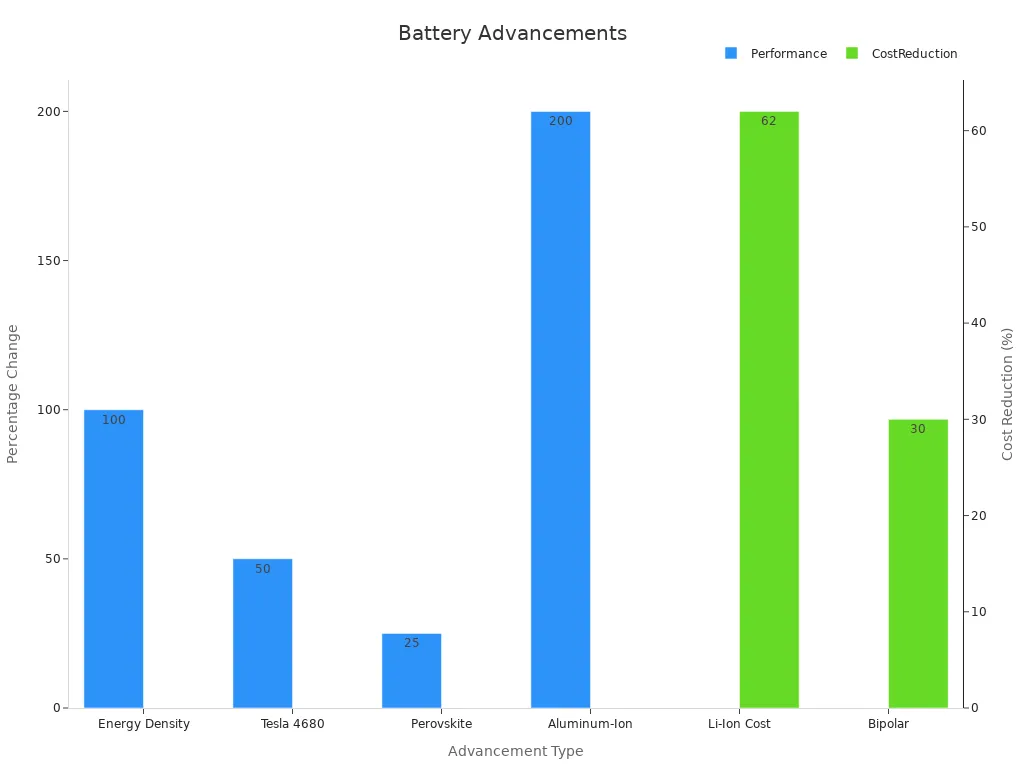

Battery Advances

India’s New Energy Vehicle sector benefits from rapid battery innovation. Companies like Iontra Inc. in Bangalore have developed advanced charging technology that can double the cycle life of lithium-ion batteries. This technology helps reduce battery replacements and lowers carbon emissions. Battery chemistries such as LFP and NMC now offer better safety and higher energy density. Research into solid-state batteries and new anode materials promises even greater performance and safety. Battery Management Systems (BMS) use software to monitor and protect batteries, making them last longer. India’s strong software industry supports this progress. Recycling programs recover valuable metals, helping India address lithium supply challenges and support sustainability.

Metric / Advancement | Description / Impact |

|---|---|

Energy Density Increase | Battery energy density expected to double from 250 Wh/kg in 2023 to 500 Wh/kg by 2030, enabling longer EV ranges and lighter packs. |

Lithium-Ion Battery Pack Cost Reduction | Costs projected to fall from $132/kWh in 2023 to below $50/kWh by 2030, making EVs more affordable. |

Battery Recycling Market | Projected growth from $4 billion in 2022 to $25 billion by 2030, supporting sustainability and material reuse. |

Digital Solutions

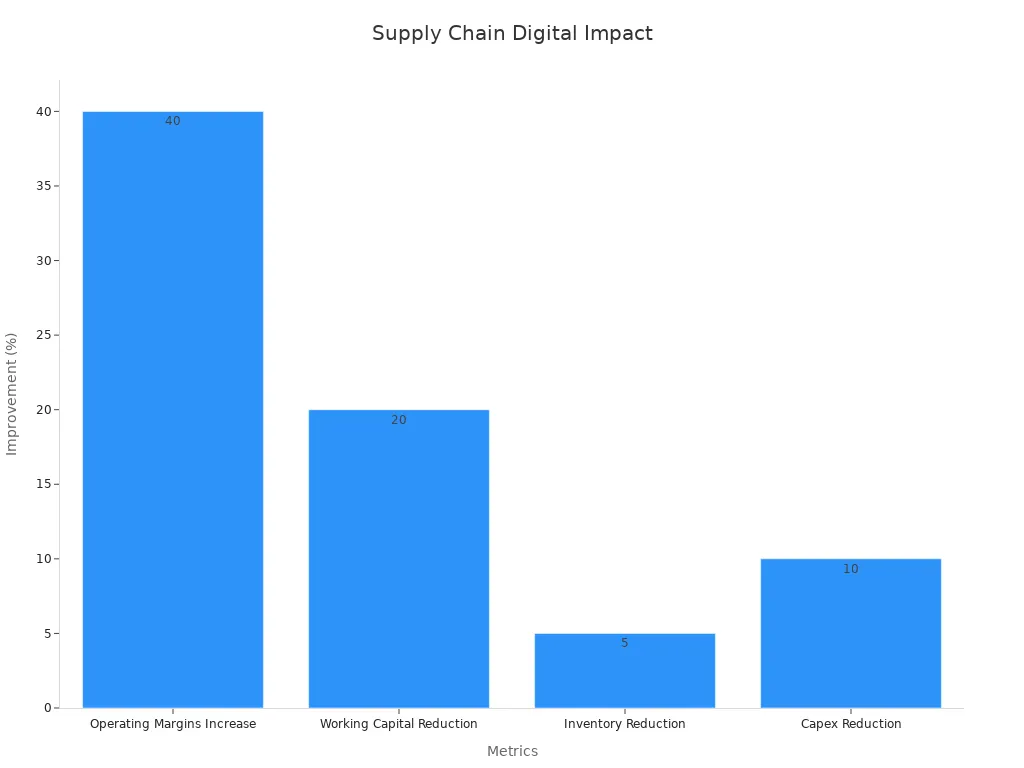

Digital platforms and AI now play a key role in supply chain management for New Energy Vehicle manufacturers. Companies that use digital supply chain solutions report 40% higher operating margins and 20% lower working capital. IoT-enabled command centers give real-time visibility and remote monitoring. AI and machine learning help optimize inventory, delivery routes, and warehouse operations. Robotics and 3D printing reduce costs and improve speed. Wearable devices and drones boost worker efficiency and safety. These technologies help companies respond quickly to changes and improve customer satisfaction.

Metric / Feature | Evidence / Outcome |

|---|---|

Operating Margins Increase | 40% higher operating margins reported by adopters of digital supply chain solutions |

Working Capital Reduction | 20% lower working capital observed |

Inventory Reduction | 5% reduction in inventory levels |

Supply Chain Cost Reduction | |

Revenue Gain | 10% increase in revenue attributed to digital SCM solutions |

JusLink AI

JUSDA’s JusLink AI Solution brings advanced intelligence to the supply chain. JusLink uses AI to analyze trends, predict freight rates, and forecast sales demand. The platform offers real-time risk monitoring and automated replenishment suggestions. JusElsa, the intelligent assistant, helps users interact with the system using natural language. JusLink integrates IoT, cloud computing, and big data to provide real-time supply chain visibility. This technology helps companies make better decisions, reduce costs, and improve efficiency. JusLink supports the entire supply chain, from material preparation to delivery and risk management, making it a valuable tool for the New Energy Vehicle industry.

Policy & Regulation

Compliance

Regulatory compliance shapes the New Energy Vehicle supply chain in India. Companies must follow strict rules for safety, emissions, and product standards. The government enforces certifications such as BIS for batteries and electronic components. Customs authorities require detailed documentation for imported parts. JUSDA helps clients manage these requirements by offering customs clearance and trade compliance services. Their team communicates with government departments to secure tax qualifications and ensure smooth import processes. This support reduces delays and helps companies avoid penalties.

Localization

Localization has become a key strategy for building a resilient supply chain in India’s NEV sector. Many companies now focus on sourcing materials and components locally. This approach shortens supply chains and reduces risks from global disruptions. Research shows that localization can lower the time needed to recover from disruptions and cut financial losses. Programs like Product and Vendor Development (PVD) help companies find and monitor local suppliers. Trust and strong relationships within local networks improve collaboration and innovation. Dedicated supply chain localization teams play an important role in making these strategies work. By reducing reliance on global sourcing, companies can avoid transport delays and trade restrictions. They also gain the ability to customize products for the Indian market.

Localization reduces supply chain disruption duration and financial losses.

Vendor development programs improve supplier quality and agility.

Trust-building in local networks boosts collaboration and innovation.

Local sourcing mitigates risks from transport delays and trade restrictions.

Supply chain localization teams ensure continuous improvement.

Trade Rules

Trade rules and tariffs have a direct impact on the NEV supply chain. In 2025, the US government increased tariffs on some Indian goods to 26%. This change affects the cost of raw materials and finished products. Tariffs on lithium, cobalt, and nickel have raised production costs by up to 15%. Lithium prices alone have increased by more than 20% in the past year. Companies respond by diversifying suppliers and investing in local battery production. India’s Production Linked Incentive (PLI) scheme supports this shift by encouraging domestic manufacturing. Trade agreements and government incentives help offset some tariff impacts. However, higher costs can squeeze profit margins and slow NEV adoption in price-sensitive markets. JUSDA assists clients by conducting tariff impact assessments and helping them navigate changing trade rules.

Challenges

Supply Disruptions

India’s supply chain for electric vehicles faces frequent disruptions. Delays often occur due to congestion at ports and highways. Weather events, such as heavy monsoons, can halt transportation for days. Many suppliers rely on imported components, which increases the risk of delays from global events. Outdated systems and lack of real-time tracking make it hard to respond quickly. Regulatory changes and sudden policy shifts can also interrupt the flow of goods. Companies must build flexible supply chains and use digital tools to monitor shipments and manage risks.

Cost Pressures

Manufacturers and logistics providers in India experience rising costs. Logistics expenses in India reach about 14% of GDP, which is higher than the BRICS average of 11%. Road transport accounts for 65% of logistics costs, but suffers from congestion and poor infrastructure. Railways, while important, have high freight rates that limit savings. Warehousing and inventory carrying add further pressure. The table below shows key cost factors:

Cost Factor / Statistic | Value / Description |

|---|---|

Logistics cost as % of GDP | About 14% (India) vs. 11% (BRICS average) |

Transportation share of total logistics costs | 65% |

Warehousing share of total logistics costs | 20% |

Inventory carrying share of total logistics costs | 15% |

Average railway freight rate (2022) | 1,200 INR (~$15) per metric ton |

Average air freight cost (2021) | 18 INR (~$0.225) per metric ton kilometre |

Regulatory complexities, such as multiple permits and varying state rules, increase expenses. The rapid growth in electric vehicle sales adds to logistics demand, making cost control even more important.

Infrastructure

India’s logistics infrastructure presents several challenges. Logistics cycle times in India range from 30 to 40 days, while China achieves similar tasks in just 12 days. The country lacks cohesive multimodal connectivity, which slows down the movement of goods. Most logistics providers operate in a fragmented, unorganized market. Only 15% of the sector is organized, making coordination difficult. Skill shortages in technology-driven logistics also limit efficiency. The government has launched initiatives like the National Logistics Policy and PM GatiShakti to improve digital integration and multimodal transport. Highway construction has increased from 12 km per day in 2014–15 to 37 km per day in 2023–24. However, underdeveloped port-led industrial zones and disconnected networks still cause delays and higher costs. Sustainable logistics practices and digital platforms, such as the Unified Logistics Interface Platform (ULIP), aim to improve efficiency and reduce expenses.

Note: Improving logistics efficiency is critical for India’s economic resilience and growth. Companies that invest in digitalization and multimodal solutions can better manage these infrastructure challenges.

Opportunities

Investment

India’s NEV supply chain offers strong investment prospects. The country’s GDP grew by 8.15% in 2023-2024, with an average annual growth rate of 8.3% over the past three years. Government reforms, such as the Make in India initiative and the Production Linked Incentive (PLI) scheme, support domestic manufacturing and exports. The government allocated INR 10 trillion in 2023-24 for infrastructure and logistics upgrades. Despite a recent decline in foreign direct investment, India aims to boost exports to USD 2 trillion by 2030. The supply chain management market reached USD 3.4 billion in 2023 and is projected to grow at 11.1% CAGR through 2030. Technology adoption, including AI and machine learning, drives this expansion. India’s charging infrastructure is also expanding, with about 76,000 public and captive EV charging points and a total installed capacity of 1.3 GW as of 2024. These factors create opportunities for investors in logistics, battery storage, and charging networks.

Localization

Localization strengthens India’s NEV supply chain and supports regional industry growth. Companies source more raw materials domestically, reducing import dependency by up to 40% by 2030. The PLI scheme encourages battery manufacturing, which currently meets only 20% of demand. Investments in automation and workforce development improve production efficiency. Uniform policies and infrastructure standardization enhance supply chain compatibility. Analytical modeling tools help companies optimize local production and guide strategic investments.

Aspect | Impact on Regional Industry Growth |

|---|---|

Domestic raw material sourcing | Reduces costs and supply chain risks |

Battery manufacturing | Attracts investment and creates jobs |

Automation and skill programs | Boosts efficiency and product quality |

Policy standardization | Improves supply chain resilience |

Analytical modeling | Guides data-driven investment decisions |

JUSDA’s solutions help clients leverage these localization trends by providing bonded warehousing, customs compliance, and digital supply chain management.

India as Hub

India is emerging as a global supply chain hub for NEVs. The country invests in advanced EV batteries, smart mobility, and manufacturing clusters. A skilled workforce of 200 million people, including rising female participation, supports scalable operations. Over 1,700 Global Capability Centers (GCCs) employ 1.9 million people, with projections to reach up to 2,500 centers by 2030. Renewable energy capacity exceeds 400 GW, supporting clean energy for NEVs. The National Green Hydrogen Mission and infrastructure expansion further strengthen India’s position. JUSDA enables clients to capitalize on these opportunities by offering integrated logistics, digital platforms, and compliance expertise, making India a preferred destination for global supply chain operations.

India’s supply chain for electric vehicles is changing fast. Companies see new trends in technology, policy, and consumer demand. They should invest in digital tools and AI for better tracking and planning. Logistics partners need to focus on compliance and local sourcing.

Adapting to new rules and tech will help businesses stay ahead. JUSDA offers expert support for those who want to optimize their supply chain in India.

FAQ

What are the main challenges in India’s NEV supply chain?

India’s NEV supply chain faces supply disruptions, high logistics costs, and infrastructure gaps. Companies must address customs complexities and manage imported components.

Digital tools and local sourcing help reduce these challenges.

How does JUSDA support NEV manufacturers in India?

JUSDA provides bonded warehousing, inland transportation, and customs compliance. The company’s digital systems streamline logistics and payment processes.

Clients benefit from faster deliveries

Improved regulatory compliance

Why is localization important for NEV supply chains?

Localization reduces import dependency and supply risks. Companies source materials locally, which lowers costs and improves supply chain resilience.

Benefit | Impact |

|---|---|

Lower costs | Higher efficiency |

Fewer delays | Better reliability |

What role does technology play in NEV supply chain management?

Technology enables real-time tracking, predictive analytics, and automation. AI and IoT improve inventory management and delivery speed.

Companies using digital solutions report higher margins and lower costs.

How can companies prepare for changing trade rules and tariffs?

Companies should diversify suppliers, invest in local production, and monitor policy changes. JUSDA helps clients assess tariff impacts and adapt supply chain strategies.

Stay informed

Build flexible supply networks

See Also

Top Five Trends Shaping Future Supply Chain Efficiency

Maximizing The Power Of Your Automotive Supply Chain

Robotics And Sustainability Trends Transforming Supply Chains

Expert Advice For Overcoming Automotive Supply Chain Challenges

Comprehensive Guide To Sustainable Transportation Within Supply Chains