Preparing for De Minimis Changes: 4 Questions Every Shipper Must Ask

You face a pivotal moment as De Minimis Changes take effect on May 2, 2025, for imports from China and Hong Kong. Imagine your daily shipments—nearly 4 million parcels—suddenly hit by new tariffs, fees, and paperwork. Will your supply chain withstand higher costs and stricter entry rules?

Lost sales, shipping delays, and damaged reputation can follow if you do not act quickly.

Proactive risk assessment and clear communication with partners help you stay ahead.

Ask the right questions now to protect your business from disruption.

Key Takeaways

Review your import shipments from China and Hong Kong to understand risks and update your processes before May 2, 2025.

Expect higher tariffs and fees on all shipments from these regions, so adjust your budgets and forecasts accordingly.

Keep clear and accurate shipping documents with required details to avoid delays and penalties.

Communicate regularly with your logistics partners using real-time data to keep your supply chain running smoothly.

Consider new sourcing countries like Vietnam and use shipment consolidation or U.S. fulfillment to reduce costs and improve delivery.

Immediate Actions

Assess Inventory Mix

Start by reviewing your current import processes, especially shipments from China and Hong Kong. You need to know what products you have, where they come from, and how they move through your supply chain.

Audit your entry filing practices to make sure they are accurate and on time.

Document your port arrival procedures so you have clear records.

Train your staff on new timing requirements to avoid mistakes.

Update your entry filing steps to match the new tariff deadlines.

Gather import data, map your suppliers, and calculate cost impacts.

Review and verify tariff classifications and HTS codes for possible savings.

Check your customs bond coverage to ensure it meets new tariff needs.

Tip: Accelerate critical imports by ordering key products before the De Minimis Changes take effect.

Identify At-Risk Shipments

You must find which shipments face the most risk under the new rules.

Keep a detailed classification index to avoid penalties.

Use a customs compliance manual to standardize your import steps.

Track all costs, including assists and royalties, for correct duty valuation.

Run regular post-entry audits to catch errors early.

Oversee customs brokers and freight forwarders with clear protocols.

Monitor changing regulations and adjust your compliance practices.

Map your supply chain to spot risk points and check for labor or environmental issues.

Use risk matrices and supply chain data to rank exposures.

Model risk scenarios, such as tariff increases, to prepare your response.

Digital tools like AI-powered customs software and real-time tracking help you spot and prioritize at-risk shipments. These tools can speed up border processing and reduce delays.

Communicate with Partners

Strong communication with your logistics partners is vital. Share updates about regulatory changes and shipment status often.

Track on-time delivery rates and order accuracy to measure reliability.

Use dashboards and real-time data sharing for clear, fast updates.

Regularly review key performance indicators (KPIs) like freight billing accuracy and dwell time.

Note: Timely, transparent communication keeps your supply chain running smoothly and helps you adapt quickly to new requirements.

Cost Impact

New Tariffs and Duties

You now face a very different cost structure for shipments from China and Hong Kong. The $800 de minimis exemption ended on May 2, 2025. All shipments, even low-value ones, must clear customs and pay new tariffs.

A 120% duty now applies to the value of each shipment.

Postal handling fees are $100 per package, rising to $200 after June 1.

These rules apply to postal, courier, and commercial freight.

Importers must handle more paperwork and stricter customs checks.

Over 100,000 shipments have already been rejected at U.S. ports for non-compliance.

The impact is clear. Landed costs have jumped, with some tariffs reaching 145%. Daily low-value shipments dropped by 85%, from nearly 4 million to about 600,000. Many businesses now consolidate shipments or use different entry types to manage costs.

Shipment Type / Carrier | Previous Duty Cost | New Duty Cost / Tariff | Percentage Increase |

|---|---|---|---|

China & Hong Kong Shipments | 0% (exempt) | 54% tariff or $100 fee | |

UPS, FedEx, DHL Low-Value Parcels | 0% (exempt) | 30% duty | 30% increase |

Budget Adjustments

You must update your budgets to reflect these higher costs. Rolling forecasts help you track changes in material and shipping costs. This approach gives you early warnings about rising expenses.

Use budget variance analysis to spot cost increases over 10%.

Adjust your forecasts often to keep up with new landed costs.

Review supplier prices and shipping fees each month.

Share updates with your finance team to avoid surprises.

Price Volatility

Shipping costs can change quickly. Over the past five years, rates have swung up and down due to fuel prices, supply chain disruptions, and new regulations.

Truck driver shortages and fuel price spikes have made shipping less predictable.

Regulatory changes add new compliance costs.

Global events can disrupt routes and raise prices overnight.

You need to forecast these changes. Use historical data and market trends to predict future shipping rates. Accurate forecasting helps you manage risks and set the right prices for your customers.

De Minimis Changes and Compliance

Documentation Updates

You must update your shipping documents to meet the new rules. Customs now requires more details for every shipment. You need to include the 10-digit HTSUS tariff classification number for all low-value products from China and Hong Kong. You must also provide the name and address of both the person claiming the exemption and the final recipient. Many companies have improved their shipment clearance by using summary filing by HTS code. For example, American Shipping companies saw a 13% drop in entry fees each year after making these changes. Automating customs document processing with AI also helped Metro Shipping reduce turnaround time and improve accuracy. These steps make your shipments move faster and lower your costs.

Entry Requirements

You face new entry requirements under the De Minimis Changes. Customs and Border Protection (CBP) now asks for more electronic data before your shipment leaves. Here are the main updates:

You must submit the 10-digit HTSUS code for every shipment.

Shipments covered by Sections 201, 232, and 301 tariffs do not qualify for the exemption.

You need to use an enhanced entry process with advance electronic submission of customs declarations and invoices.

Postal shipments from China and Hong Kong now have a $100 per item duty, which will rise to $200.

You must provide the clearance tracing identification number and country of origin.

These steps help CBP check your shipments quickly and keep your business in compliance.

Risk Management

You need strong risk management to avoid penalties and delays. Track your compliance by watching key metrics. For example, the "Regulatory Fines and Penalties" metric shows how many fines you get and how much they cost. Companies that improved their processes saw fewer penalties and lower costs. Use a table like this to track your progress:

Metric | Description | Why It Matters |

|---|---|---|

How fast you find compliance issues | Faster detection, fewer penalties | |

Mean time to issue resolution | How quickly you fix compliance problems | Quicker fixes, less risk |

Compliance expense per issue | Cost to resolve each compliance problem | Lower costs, better efficiency |

Customs now uses AI and statistical models to spot risky shipments. These tools help you catch problems early and keep your supply chain running smoothly. Following international standards, such as the WCO SAFE Framework, also boosts your compliance and protects your business as De Minimis Changes take effect.

Strategy Adaptation

Sourcing Alternatives

You can lower your risk by exploring new sourcing countries that still offer de minimis benefits. Many businesses now look to places like Vietnam for manufacturing. This shift helps you avoid higher tariffs and complex customs rules that come with De Minimis Changes.

Recent trade policy changes have removed the $800 duty-free threshold for some countries, making sourcing from others more attractive.

Companies that use de minimis exemptions can keep costs down and respond quickly to market trends.

Shein and Temu have shown how efficient supply chains and smart sourcing can lead to big savings and fast growth.

Vietnam stands out for several reasons. Labor costs are lower than in China or Mexico. The government supports factories with tax breaks and better roads. Vietnam also has trade deals with Europe and Asia, which means fewer tariffs and easier shipping. For example, a European sporting goods brand saved 20% on costs by moving production to Vietnam.

Factor | Vietnam | Mexico |

|---|---|---|

$2.50 - $3.50/hr | $3.50 - $5.00/hr | |

Trade Agreements | CPTPP, EU-Vietnam FTA, RCEP | Fewer with Asia/Europe |

Cost Savings Example | 20% (sporting goods brand) | N/A |

Government Support | Strong | N/A |

Tip: Review your supplier agreements and ask experts about new sourcing options to stay ahead of regulatory changes.

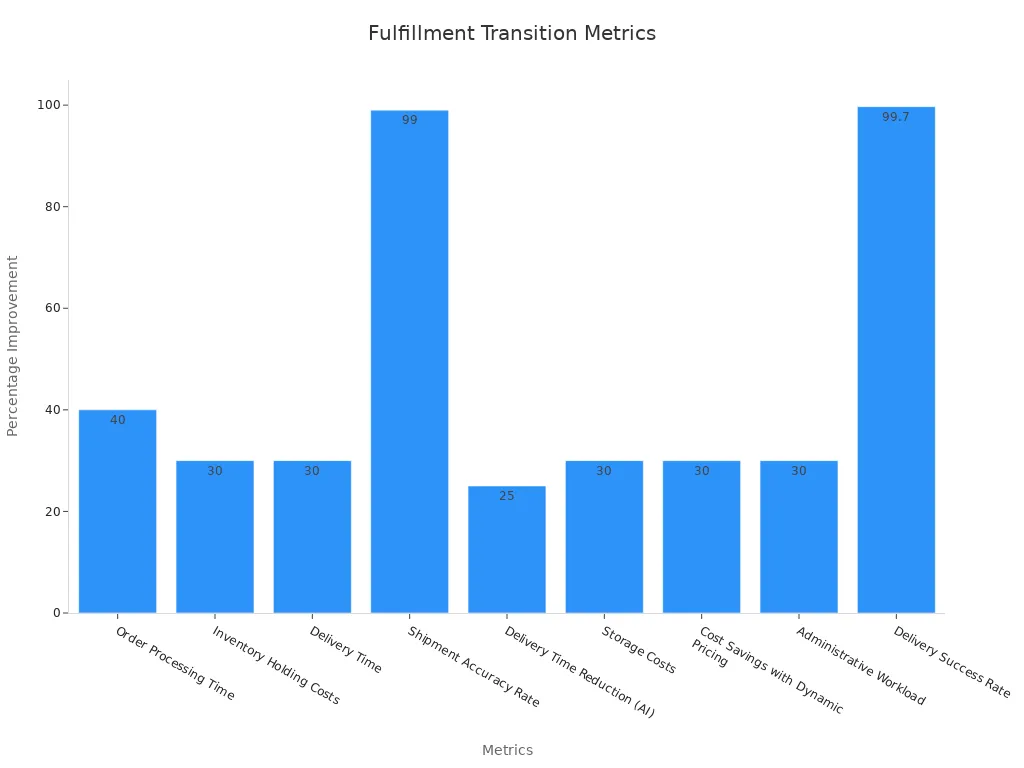

Fulfillment Shifts

Shifting your fulfillment to U.S. warehouses can help you avoid customs delays and extra tariffs. When you import in bulk, you pay duties once and then ship to customers faster. Many companies see a 30-35% drop in cost per order and cut delivery times from two weeks to just a few days. You also gain better control over your inventory and can scale up quickly.

Bulk shipping lets you lock in lower rates and avoid surprise fees.

U.S. fulfillment centers use advanced technology for fast, accurate order picking.

Over 70% of third-party logistics providers fill orders within 90 minutes.

Note: Domestic fulfillment improves delivery speed, reduces costs, and helps you meet customer expectations.

Shipment Consolidation

Combining shipments gives you more savings and helps the environment. When you consolidate, you fill trucks or containers more efficiently. This reduces the number of trips and lowers both shipping costs and carbon emissions. Studies show that increasing the load factor by consolidating shipments can cut transportation costs and CO2 output. Fewer long-haul shipments mean less fuel used and less money spent.

Use shipment consolidation to maximize vehicle space and reduce per-unit shipping costs.

Plan regular consolidation cycles to balance speed and savings.

Callout: Shipment consolidation not only saves money but also supports your company’s sustainability goals.

You face four critical questions: Are you ready for De Minimis Changes? Have you mapped at-risk shipments? Do you understand new cost impacts? Can your strategy adapt fast enough?

Recent industry data shows that supply chain disruptions and regulatory changes have caused $1.6 trillion in missed revenue across major industries.

New rules like the EU’s CBAM and CSDDD highlight the need for early planning and ongoing monitoring.

Stay alert. Review your supply chain strategy and seek expert advice. Start preparing now to keep your business strong.

FAQ

What is the de minimis exemption?

The de minimis exemption lets you import goods valued under $800 without paying duties. This rule changes for China and Hong Kong on May 2, 2025. You must pay new tariffs and follow stricter customs rules for these shipments.

How do de minimis changes affect my shipping costs?

You will see higher costs. Tariffs now apply to all shipments from China and Hong Kong, even low-value ones. Postal fees also increase. You need to update your budget and watch for price changes.

What documents do I need for compliance?

You must include the 10-digit HTSUS code, names and addresses for both sender and recipient, and detailed invoices. Customs now checks these details before your shipment leaves. Missing information can cause delays.

Can I avoid higher tariffs by changing suppliers?

Yes. You can source products from countries that still have de minimis benefits, like Vietnam. This helps you lower costs and avoid new tariffs. Review your supplier list and consider new options.

What steps help me prepare for these changes?

Start by mapping your supply chain, updating your compliance process, and talking with your partners. Use digital tools to track shipments and costs. Early action helps you avoid delays and extra fees.

See Also

Exploring The Latest Innovations In Sea Freight 2024

How To Cut Costs And Save On Supply Chain Spending

In-Depth Look At What Lies Ahead For LTL Freight

Understanding Emerging Trends In Logistics Risk Management

JUSDA Strategies To Strengthen Supply Chain Risk Preparedness