Reciprocal Tariffs and their impact on Vietnam Manufacturing

Reciprocal tariffs refer to trade policies where one country imposes duties on imports equal to the tariffs its exports face in another country. This approach has immediate implications for Vietnam's manufacturing sector, which heavily relies on exports to the United States. In 2024, Vietnam exported goods worth $119.5 billion to the U.S., representing nearly 30% of its total export turnover. With the U.S. planning a 46% tariff on Vietnamese imports—higher than rates for regional countries like Bangladesh (37%)—the potential economic repercussions are profound. For example, new tariffs on bikes alone could cost Vietnam $22.5 million. Understanding these impacts is critical as Vietnam navigates this challenging trade landscape.

Key Takeaways

Reciprocal tariffs mean countries tax each other's goods equally, affecting Vietnam's factories a lot.

Vietnam depends on selling goods to the U.S., so high taxes, like a 46% tariff, can hurt its economy.

Selling to more countries can help Vietnam avoid problems from relying too much on the U.S.

Better trade deals can improve Vietnam's export terms and reduce tariff problems.

Using new technology in factories can make products better and lower extra costs.

What Are Reciprocal Tariffs?

Definition and Purpose

Reciprocal tariffs serve as a strategic trade policy aimed at addressing imbalances in international trade. They involve imposing tariffs on imports from countries that levy similar duties on exports. This tit-for-tat approach ensures fairness in trade practices while also achieving other objectives. According to trade analysts, these objectives include generating government revenue, restricting imports to protect domestic industries, and fostering reciprocity in global trade dynamics. By implementing reciprocal tariffs, countries aim to level the playing field and encourage equitable trade relationships.

The economic implications of reciprocal tariffs extend beyond trade balances. They influence domestic markets, affecting both producers and consumers. For instance, higher tariffs on imports can lead to increased production costs, which may result in higher prices for consumers. This highlights the broader impact of such policies on the economy.

Calculation Methods

Determining reciprocal tariffs involves analyzing trade data and identifying disparities in tariff rates. Countries often calculate these tariffs based on trade deficits, import-export ratios, and existing tariff rates. For example, the U.S. evaluates trade imbalances by comparing its exports and imports with specific countries. The table below illustrates how these calculations are applied:

Country | Trade Surplus (Deficit) in Goods | US Exports in Goods | US Imports in Goods | Alleged “Tariff Rate” | US Response |

|---|---|---|---|---|---|

Vietnam | -123,463.0 | 13,098.20 | 136,561.2 | 90% | 46% |

China | -295,401.6 | 143,545.7 | 438,947.4 | 67% | 34% |

European Union | -235,571.2 | 370,189.20 | 605,760.4 | 39% | 20% |

These calculations help policymakers determine appropriate tariff rates to address trade imbalances effectively.

Global Examples of Implementation

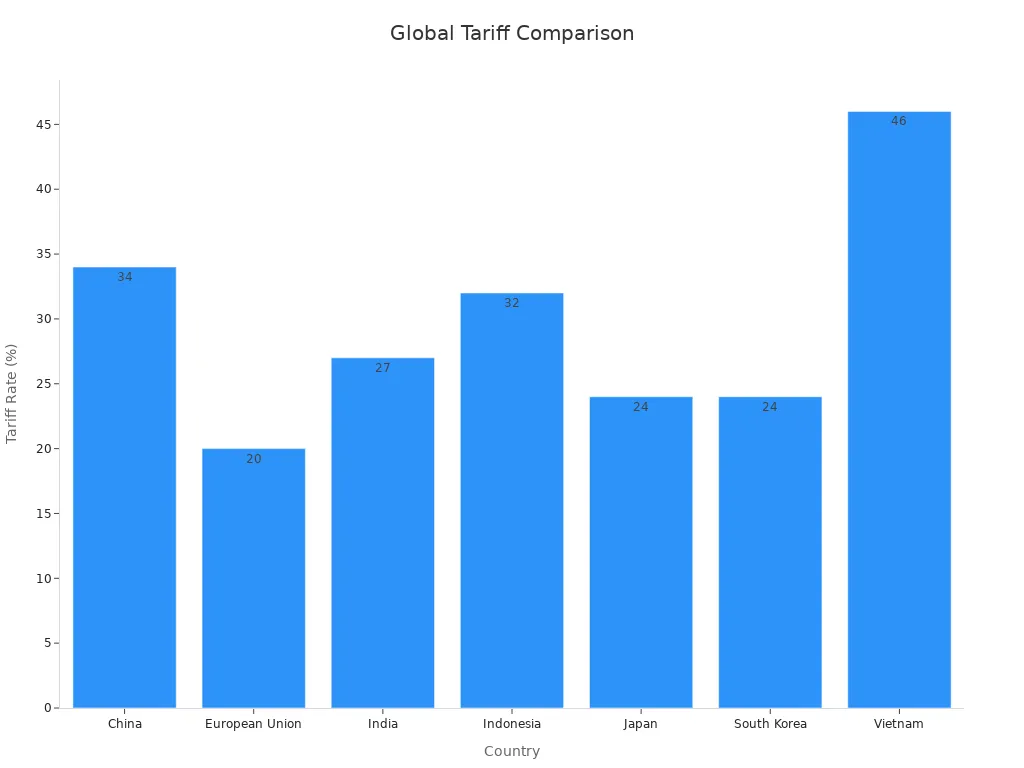

Countries worldwide have adopted reciprocal tariffs to protect their economic interests. For instance, Vietnam faces a 46% tariff rate under the U.S. reciprocal tariff policy, significantly higher than other nations like Japan (24%) and South Korea (24%). The chart below provides a visual comparison of reciprocal tariff rates globally:

Other examples include Brazil, which imposes an 18% duty on ethanol imports compared to the U.S. 2.5% duty, and India, which applies a 39% tariff on agricultural goods while the U.S. levies only 5%. These cases highlight the varying implementations of reciprocal tariffs and their impact on global trade.

Impacts of Reciprocal Tariffs on Vietnam Manufacturing

Effects on Textiles and Apparel Industry

Vietnam's textiles and apparel industry, a cornerstone of its manufacturing sector, faces significant challenges due to reciprocal tariffs. The U.S., Vietnam's largest export market for textiles, has imposed a 46% tariff on imports. This sharp increase disrupts the cost structure for manufacturers, many of whom operate on thin profit margins. Factories have reported canceled orders as buyers seek alternative suppliers with lower tariffs.

The economic impact is profound. The new tariffs could reduce Vietnam's economic growth by 1.2 percentage points this year. Economists have revised Vietnam's GDP forecast for 2025 to 5%, down from earlier expectations. This slowdown jeopardizes the country's ambitious goal of achieving 8% growth. Additionally, foreign direct investment in Vietnam's textile sector may decline, further straining the industry.

Challenges for Electronics Manufacturing

Vietnam's electronics manufacturing sector, which contributes significantly to its export revenue, also faces hurdles. The U.S. tariffs on electronics imports from Vietnam stand at 46%, compared to Vietnam's average tariff rate of 9.4%. This disparity creates a competitive disadvantage for Vietnamese manufacturers.

Country | U.S. Tariff Rate | Vietnam Tariff Rate |

|---|---|---|

Vietnam | 46% | 9.4% (average) |

The electronics sector relies heavily on exports to the U.S., making it vulnerable to these tariffs. The increased costs may force manufacturers to either absorb the financial burden or pass it on to consumers, potentially reducing demand. The persistent trade deficits faced by the U.S. further complicate the situation, as they lead to stricter trade policies that impact Vietnam's ability to compete in the global market.

Consequences for Furniture Exports

Vietnam's furniture industry, a major player in global exports, is not immune to the effects of reciprocal tariffs. The U.S. market accounts for a significant portion of Vietnam's furniture exports. The 46% tariff has led to a sharp decline in orders, with many U.S. buyers turning to other countries for their sourcing needs.

The industry also faces challenges in maintaining its supply chain. Rising costs for raw materials and logistics, coupled with the tariffs, have made it difficult for manufacturers to remain competitive. This situation threatens the livelihoods of thousands of workers employed in the sector and could lead to long-term economic repercussions.

Economic Implications of Reciprocal Tariffs for Vietnam

Trade Deficits and Export Revenue Decline

Vietnam's reliance on exports to the U.S. makes its economy vulnerable to trade imbalances. The introduction of reciprocal tariffs has widened Vietnam's trade deficit. In 2024, the U.S. accounted for 30% of Vietnam's GDP through exports. A 46% tariff on Vietnamese goods has drastically reduced export revenue. Industries like textiles, electronics, and furniture have reported significant order cancellations. This decline in exports has created a ripple effect, reducing national income and slowing economic growth.

The loss of export revenue has also impacted Vietnam's ability to invest in infrastructure and innovation. With fewer resources, the country faces challenges in maintaining its competitive edge in global markets. Economists predict that prolonged trade deficits could weaken Vietnam's economic stability.

Foreign Direct Investment (FDI) Reduction

Foreign direct investment plays a crucial role in Vietnam's manufacturing sector. However, reciprocal tariffs have made Vietnam less attractive to international investors. Higher production costs and reduced access to the U.S. market have discouraged companies from expanding their operations in Vietnam. For instance, multinational corporations in the apparel and electronics sectors are reconsidering their investment plans.

The decline in FDI has long-term implications for Vietnam's economy. Reduced foreign investment limits job creation and slows technological advancements. It also affects the transfer of skills and knowledge, which are essential for the country's industrial growth.

Supply Chain Disruptions

The implementation of reciprocal tariffs has disrupted Vietnam's supply chains. Manufacturers face higher costs for raw materials and logistics. Many companies have struggled to adapt to these changes, leading to delays in production and delivery. The furniture industry, for example, has experienced significant challenges in sourcing affordable materials.

These disruptions have forced businesses to explore alternative supply chain strategies. Some companies are considering relocating their operations to regions with lower tariffs. However, such moves require substantial investment and time, further straining resources.

Note: Supply chain disruptions not only affect manufacturers but also impact consumers. Delays and increased costs often result in higher prices for end products, reducing consumer demand.

Strategies to Address Reciprocal Tariffs

Diversification of Export Markets

Vietnam can reduce its vulnerability to reciprocal tariffs by diversifying its export markets. Relying heavily on the U.S. market has exposed the country to significant economic risks. Exploring opportunities in Europe, Asia, Africa, Latin America, and the Middle East can help mitigate these risks. Many trade strategy reports emphasize the importance of reducing dependence on a single market. They suggest conducting thorough market research to understand regional demands and tailoring products accordingly. For example, Vietnam’s textile and apparel industry could target emerging markets in Africa, where demand for affordable clothing is rising. Diversification not only spreads risk but also opens doors to untapped growth potential.

Strengthening Trade Negotiations

Improved trade negotiations can help Vietnam address the challenges posed by reciprocal tariffs. Policymakers should focus on fostering stronger bilateral and multilateral trade agreements. These agreements can provide more favorable terms for Vietnamese exports. For instance, Vietnam could leverage its membership in trade blocs like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) to negotiate reduced tariffs. Additionally, engaging in diplomatic dialogues with major trading partners can help resolve trade disputes. By presenting data on mutual economic benefits, Vietnam can advocate for fairer trade practices. Strengthened negotiations can also pave the way for long-term partnerships that benefit both parties.

Innovation and Technology Adoption in Manufacturing

Adopting advanced technologies can enhance Vietnam’s manufacturing competitiveness. Automation and digital tools can help reduce production costs, making Vietnamese goods more attractive despite higher tariffs. For example, smart manufacturing systems can optimize resource use and improve efficiency. The government can support this transition by offering incentives for technology adoption and investing in workforce training programs. Innovation also allows manufacturers to create higher-value products, which can command premium prices in global markets. By embracing technology, Vietnam can strengthen its position as a manufacturing hub and offset the impact of reciprocal tariffs.

Reciprocal tariffs have reshaped Vietnam's manufacturing landscape. These trade policies, designed to address imbalances, have disrupted key industries like textiles, electronics, and furniture. The economic consequences, including reduced export revenue and foreign investment, highlight the urgency for action. Businesses and policymakers must adopt proactive strategies to mitigate these challenges. Diversifying export markets, enhancing trade negotiations, and embracing innovation can help Vietnam adapt. With resilience and strategic planning, Vietnam can navigate these global trade challenges and maintain its position as a manufacturing leader.

FAQ

What are reciprocal tariffs, and why are they important for Vietnam?

Reciprocal tariffs are trade duties imposed to match the tariffs faced by a country's exports. They are crucial for Vietnam because its economy relies heavily on exports, especially to the U.S., where new tariffs threaten key industries like textiles and electronics.

How do reciprocal tariffs affect Vietnam’s manufacturing costs?

Higher tariffs increase production costs for manufacturers. Companies either absorb these costs, reducing profits, or pass them to buyers, making products less competitive globally. This impacts industries like furniture and apparel, which operate on thin margins.

Can Vietnam diversify its export markets to reduce dependency on the U.S.?

Yes, Vietnam can explore markets in Europe, Africa, and Asia. Diversification spreads economic risks and opens opportunities for growth. Emerging markets, such as Africa, show rising demand for affordable goods, making them viable alternatives.

What strategies can Vietnam adopt to counter reciprocal tariffs?

Vietnam can strengthen trade negotiations, adopt advanced manufacturing technologies, and diversify export markets. These strategies improve competitiveness, reduce dependency on single markets, and help mitigate the economic impact of tariffs.

How do reciprocal tariffs impact consumers in the U.S.?

Tariffs raise the cost of imported goods, forcing brands to increase prices. Consumers face higher costs for items like apparel and electronics. Low-income families bear the brunt, as their purchasing power diminishes due to inflation and price hikes.

See Also

Exploring How Global Trade Policies Shape Economic Landscapes

Enhancing Supply Chain Efficiency in High-Tech Manufacturing

Achieving Cross-Border Trade Success Through JUSDA Strategies

Essential Strategies for Achieving Manufacturing Success Today

Understanding High-Tech Manufacturing Consulting for Business Growth