Supply Chain Outlook: Trends and Risks to Watch in the Second Half of 2025

The Supply Chain Outlook for the second half of 2025 highlights urgent challenges such as rising labor costs, data fragmentation, and cybersecurity threats. Companies face last-mile delivery expenses that account for over half of shipping costs, while poor data quality causes significant financial losses.

Proactive adaptation and investment in workforce upskilling, automation, and cloud-based collaboration will help organizations build resilience. The following table summarizes key challenge areas and their impacts:

Challenge Area | Impact in H2 2025 |

|---|---|

Last-Mile Delivery Costs | Up to 53% of shipping costs; automation reduces costs |

Data Quality | $12.9M annual loss per business; need for analytics |

Labor Costs | Drives automation and new delivery models |

Cybersecurity & Workforce | Requires upskilling for safe tech integration |

Key Takeaways

Diversify suppliers and production locations to reduce risks and improve inventory and profits, especially during disruptions.

Invest in technology like AI, automation, and real-time data tools to boost efficiency, visibility, and quick response to changes.

Focus on workforce training and upskilling to handle labor shortages and new technologies, ensuring a strong and adaptable team.

Prepare for risks from geopolitical tensions, economic shifts, climate events, cybersecurity threats, and new regulations by using data-driven risk management.

Build strong supplier partnerships and adopt sustainable practices to improve supply chain resilience, meet customer demands, and comply with regulations.

Supply Chain Outlook for H2 2025

Network Diversification

Companies continue to diversify their supplier networks to build resilience and reduce risk. They use multishoring strategies, combining nearshoring, onshoring, and farshoring, to avoid overreliance on any single region. This approach helps businesses respond quickly to disruptions caused by geopolitical tensions or natural disasters.

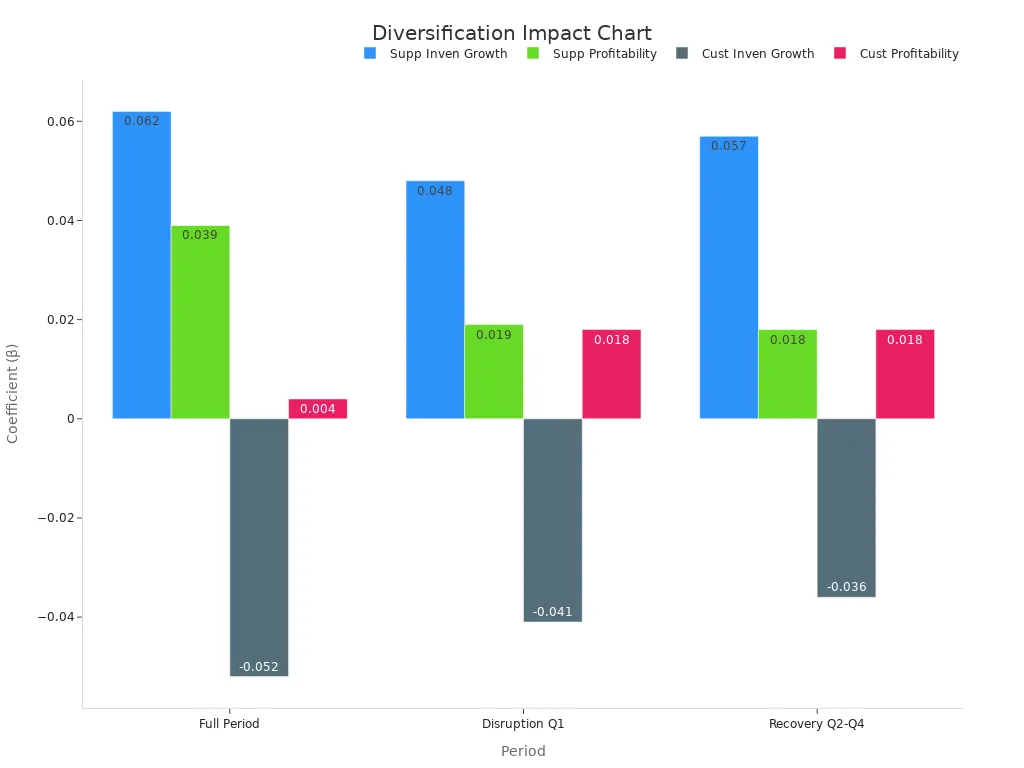

A recent study shows that supplier diversification leads to higher inventory availability and improved profitability. The table below highlights the positive effects of supplier and customer diversification on inventory growth and profitability:

Period | Diversification Type | Dependent Variable | Coefficient (β) | p-value | Interpretation |

|---|---|---|---|---|---|

Full Period | Supplier | Inventory Growth | 0.062 | 0.000 | Positive and significant effect on inventory availability |

Full Period | Supplier | Profitability (ROS) | 0.039 | 0.000 | Positive and significant effect on profitability |

Disruption (Q1) | Supplier | Inventory Growth | 0.048 | 0.000 | Positive and significant effect |

Disruption (Q1) | Supplier | Profitability (ROS) | 0.019 | 0.055 | Positive effect, marginally significant |

Recovery (Q2-Q4) | Supplier | Inventory Growth | 0.057 | 0.000 | Positive and significant effect |

Recovery (Q2-Q4) | Supplier | Profitability (ROS) | 0.018 | 0.092 | Positive effect, marginally significant |

Supplier diversification consistently improves inventory and profitability, especially during disruptions.

Manufacturers in the U.S. are increasing local production to reduce risks from long-distance supply chains. This trend supports the Supply Chain Outlook for H2 2025, as more companies seek to balance efficiency with resilience.

Tariff Mitigation

Tariff changes and trade policy shifts create uncertainty for global supply chains. Companies now use advanced strategies to reduce the impact of tariffs and maintain stable operations.

Multi-tier supply chain visibility uncovers hidden tariff risks deep in the network.

Scenario planning helps companies evaluate sourcing and routing options to optimize costs.

Real-time data reduces the need for high safety stocks, freeing up capital.

Digital platforms enable rapid reconfiguration of supplier relationships, shortening adjustment times from years to months.

Reviewing contracts for force majeure clauses and preparing for customer setoff actions help manage legal and financial risks.

Tariff engineering, such as reclassifying products, can legally reduce tariff exposure.

Companies that diversify suppliers across regions and use digital tools can respond faster to tariff changes, supporting a more resilient Supply Chain Outlook.

Technology and Automation

Technology adoption and automation remain central to the Supply Chain Outlook for H2 2025. Artificial intelligence, IoT, and automation tools improve efficiency, transparency, and responsiveness.

AI-driven analytics enhance demand forecasting, inventory management, and route optimization. For example, Logitech automated invoice processing and inventory management across 23 Asian companies, leading to better payment accuracy and vendor collaboration.

A KPMG report found that 87% of supply chain leaders consider visibility critical, and 61% prioritize developing it. Automation technologies enable real-time tracking, predictive maintenance, and adaptive inventory control. These improvements help companies respond quickly to disruptions and changing market demands.

Automation also strengthens relationships with vendors by enabling real-time communication and collaborative forecasting.

Customer-Centricity

Customer expectations continue to shape supply chain strategies. Companies focus on delivering personalized experiences, accurate order fulfillment, and transparent product information.

Recent analyses show that companies using customer-centric supply chain strategies achieve higher growth and profitability. For example, the top 90 supply chains adopting these strategies saw 13% higher growth and three times greater revenue contribution than peers. AI-driven demand planning software improves forecast accuracy, product availability, and lead times.

Real-time data sharing and supplier collaboration enhance customer experience by providing tailored delivery options and self-service portals.

A fast-casual restaurant chain used IoT sensors for real-time temperature and location monitoring, reducing product loss and improving supply chain visibility. These improvements lead to higher customer satisfaction and operational efficiency, supporting a positive Supply Chain Outlook.

Workforce and Labor

Labor shortages and rising costs remain major challenges for supply chains. As of June 2024, transportation and warehousing had nearly 450,000 job openings, one of the highest vacancy rates across industries. Thirty-seven percent of industry respondents report that workforce shortages impact customer service.

Companies invest in workforce training, upskilling, and automation to address these challenges. Automation technologies, such as autonomous freight vehicles and robotic warehouse operations, help reduce reliance on manual labor. The logistics sector also needs skilled professionals in both traditional and high-tech roles, including data analytics and operations management.

Businesses and governments collaborate to develop vocational training, apprenticeships, and STEM education.

Continuous upskilling and innovation build a future-ready workforce.

Proactive workforce strategies ensure supply chains remain resilient and efficient, supporting the overall Supply Chain Outlook for H2 2025.

Major Risks

Geopolitical Tensions

Geopolitical tensions remain a top risk for global supply chains in the second half of 2025. Ongoing conflicts, such as those in the Middle East and Ukraine, disrupt trade routes and increase transportation costs. Companies face sudden changes in tariffs and export controls, which can halt shipments or force rapid changes in sourcing strategies.

Manufacturers use advanced statistical models and scenario analysis to assess geopolitical risks. These tools help leaders identify vulnerable suppliers and plan for disruptions. For example, a news-based geopolitical risk measure, combined with supplier-customer data, shows that rising geopolitical risk leads companies to reshore supply chains and reduce foreign supplier reliance. This reshoring improves operational flexibility and performance during uncertain times.

Executives rely on simulations, risk mapping, and real-time dashboards to monitor geopolitical threats. These quantitative methods support both proactive and reactive risk mitigation. By integrating these tools into supply chain planning, companies can respond quickly to new conflicts and policy changes.

Companies that use data-driven risk analysis build more resilient supply chains and protect their operations from sudden geopolitical shocks.

Economic Instability

Economic instability creates uncertainty for supply chains worldwide. Fluctuations in inflation and interest rates increase production and transportation costs. Companies must adjust capital allocation and manage higher financing expenses for inventory and infrastructure.

Key economic indicators that predict supply chain vulnerabilities include:

Inflation rates, which raise costs across the supply chain.

Interest rates, which affect borrowing and investment decisions.

Economic cycles, which cause demand to rise or fall quickly.

Trade policies, such as tariffs and new agreements, which reshape sourcing and distribution.

Geopolitical risks, which add uncertainty and force rapid changes in export and import strategies.

Advanced forecasting methods, including AI and machine learning, which help predict disruptions by analyzing these indicators.

Companies use risk management strategies like diversification, scenario planning, and buffer stocks to reduce the impact of economic shocks. These approaches help maintain stability and ensure business continuity during market turbulence.

Climate and Natural Disasters

Climate change and natural disasters pose growing risks to supply chains. Extreme weather events, such as floods, wildfires, and hurricanes, disrupt transportation and damage infrastructure. For example, the floods in Valencia, Spain in October 2024 caused major damage to roads, railways, and ports. This region supports key industries like automotive and agriculture, so the floods had immediate and long-term effects on supply chain operations.

A recent analysis of 424 research publications shows a sharp rise in studies on supply chain resilience in disaster-prone environments, especially after 2020. The main themes include sustainability, risk management, and digital innovation. Survey data from 2024 reveals that 26.6% of organizations experienced negative effects from natural disasters in the past year. The most common impacts were loss of productivity (almost 80%), service disruption (75.4%), and customer complaints (70.1%).

Many organizations still do not analyze climate risks, but awareness is growing.

Supply chain mapping and climate risk analysis across multiple tiers are essential for building resilience.

Integrated, information-driven strategies help companies adapt to climate challenges and reduce operational, financial, and reputational damage.

Companies that include climate and disaster risks in their planning can better protect their supply chains and maintain service during extreme events.

Cybersecurity

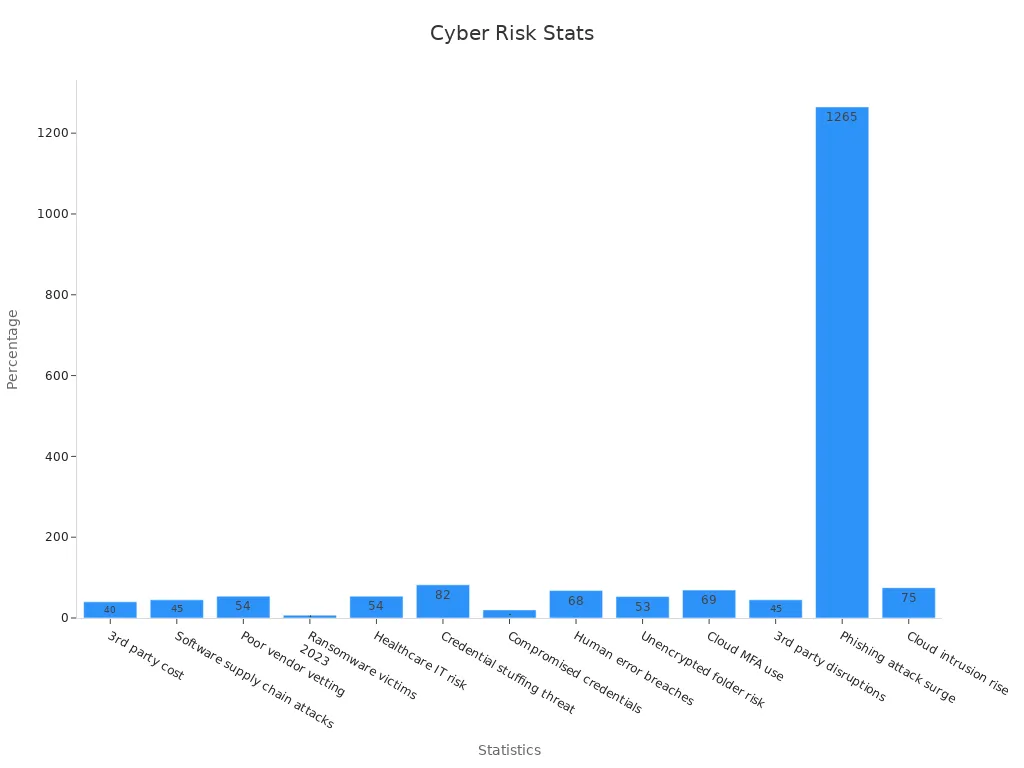

Cybersecurity threats continue to escalate, targeting supply chains with increasing frequency and sophistication. Attacks on third-party vendors and software supply chains now account for a significant share of incidents. In 2025, 45% of organizations are expected to face software supply chain attacks. Third-party cyber incidents cost 40% more than internal breaches, highlighting the need for strong vendor risk management.

Statistic Description | Data Point | Implication |

|---|---|---|

Third-party cyber incidents cost more | 40% higher cost | Stronger third-party risk management needed |

Organizations facing software supply chain attacks by 2025 | 45% | Rising third-party and supply chain risks |

Businesses not vetting third-party vendors | 54% | Increased cloud security breach risk |

New malware created daily | 300,000 | Rapid evolution of malware threats |

Malware attacks detected in 2023 | 6.06 billion | Massive frequency of attacks globally |

Organizations victim to ransomware in 2023 | 7% | Widespread ransomware impact |

Average cost of ransomware attack | $4.54 million | High financial strain from incidents |

Quantitative cyber risk analysis uses AI, blockchain, and predictive analytics to assign risk values and identify vulnerabilities. Real-time monitoring and anomaly detection help companies spot threats quickly and respond before major disruptions occur. Graph analytics and machine learning uncover hidden patterns and interdependencies, improving risk management. Blockchain supports vendor risk management, traceability, and incident response, reducing the risk of data breaches.

Companies that invest in layered defenses, user training, and continuous monitoring can reduce the impact of cyber threats and keep their supply chains secure.

Regulatory Changes

Regulatory changes in 2025 create new compliance challenges for global supply chains. Governments introduce stricter rules on environmental protection, chemical safety, and reporting requirements. For example:

The European Union's Packaging and Packaging Waste Regulation (PPWR) took effect in February 2025, targeting packaging waste and harmful chemicals.

The Chemicals industry package, expected in Q4 2025, will introduce new safety and compliance standards.

EU and UK REACH regulations require annual tonnage reporting by importers, increasing reporting and registration obligations.

China's draft Law on the Safety of Hazardous Chemicals signals future changes in chemical safety rules.

These regulations force companies to adopt sustainable logistics practices and improve compliance measures. The regulatory environment also pushes businesses to invest in digital transformation and sustainability. Companies that stay ahead of regulatory changes can avoid penalties and maintain smooth operations.

Proactive compliance and sustainability strategies help companies adapt to new regulations and support a positive Supply Chain Outlook for H2 2025.

Industry Focus

Retail

Retail supply chains are transforming rapidly to meet consumer expectations and market shifts. Companies invest in digital tools for real-time inventory tracking and supplier risk management.

AI-driven forecasting and replenishment tools help optimize inventory and improve customer experience.

Cloud computing adoption is projected to reach 82%, enabling innovations like digital twins and flexible access to supply chain data.

Over 30% of retail executives plan significant technology investments, focusing on AI, warehouse automation, and real-time inventory visibility.

Retailers also explore alternative revenue streams, such as consumer data monetization and supply chain services.

Retailers unify merchandising, supply chain, and store operations to improve decision-making and operational efficiency. This shift supports faster response to disruptions and evolving consumer demands.

Manufacturing

Manufacturers face ongoing challenges from trade uncertainties, tariffs, and supply chain risks. In Q1 2025, 73% of US manufacturers identified trade uncertainties as their top business challenge.

Mexico surpassed China as the leading US import partner for manufactured goods, reflecting a shift toward nearshoring.

Fewer than 8% of businesses believe they have full control over supply chain risks.

Companies like Helen of Troy have nearshored production to improve responsiveness and reduce geopolitical risk.

Firms rework logistics to store goods closer to consumer markets, enhancing agility and reducing lead times.

Manufacturers prioritize diversification, risk management, and technology adoption to maintain stability and competitiveness.

Logistics

Logistics providers adapt to elevated maritime freight costs and extended transit times.

Companies adopt nearshoring strategies for faster product cycles and increased agility.

Investments in AI, digital twins, and big data improve risk reduction and cost optimization.

Over 75% of organizations emphasize technology as essential for managing supply chain complexities.

61% of technology executives identify cybersecurity as a top threat to supply chain stability.

Dynamic routing and mode-shifting capabilities help logistics firms respond to disruptions and maintain service reliability.

Strategic Responses

Risk Assessment

Companies use advanced risk assessment methods to protect their supply chains. Multi-criteria decision-making tools like Fuzzy AHP, DEMATEL, and VIKOR help leaders rank and evaluate supply chain vulnerabilities. These methods combine expert judgment with data analysis, making risk evaluation more accurate. Simulation techniques, such as optimization and regression, allow teams to test how disruptions spread through the network. Many organizations also use scenario-based planning and predictive analytics to forecast risks and refine contingency plans. By using these tools, companies can prioritize resources and strengthen their Supply Chain Outlook.

Technology Investment

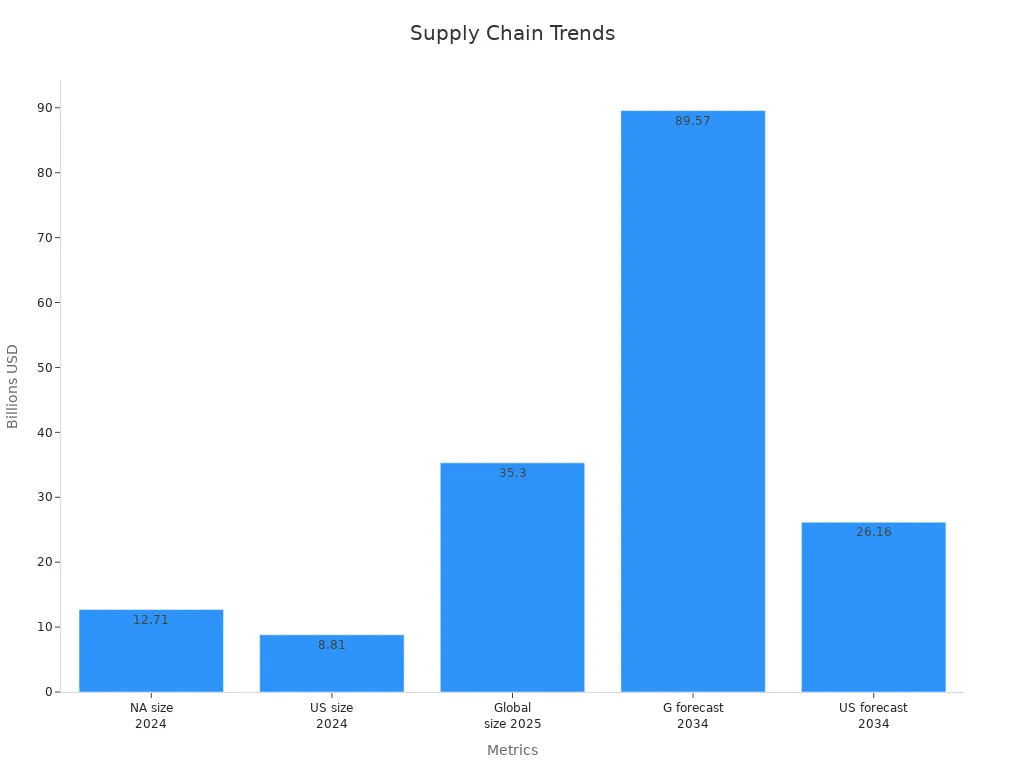

Investment in technology drives supply chain transformation. From Q3 2022 to Q1 2025, supply chain companies invested $115 billion in clean energy manufacturing. This surge, supported by government incentives, shows strong momentum and positive returns. The US blockchain market reached $10.8 billion in mid-2025 and is expected to grow by 58% by the end of 2026. Companies use blockchain and AI to improve transparency, traceability, and data sharing. These investments help businesses meet future demand and stay competitive.

Workforce Development

Workforce development remains a top priority. Programs like Primark’s Sudokkho Programme show that training leads to better job placement, higher income, and improved quality of life. The 60dB Workforce Development Index measures these outcomes, proving the value of upskilling. As Industry 4.0 evolves, companies need workers with advanced skills. Upskilling and reskilling programs boost employee retention and adaptability, helping supply chains remain resilient.

Sustainability

Sustainability shapes modern supply chain strategies. Companies like Diageo, Nestlé, Walmart, and IKEA set clear goals for emissions reduction, waste minimization, and renewable energy use. For example, IKEA’s switch to electric vehicles in Shanghai cuts over 300,000 kg of CO2 each year. The Global Reporting Initiative (GRI) framework helps companies track metrics such as greenhouse gas emissions, water usage, and recycling rates.

Regulatory changes and consumer demand make sustainability a strategic imperative for supply chains.

Supplier Collaboration

Supplier collaboration delivers real business value. Companies that work closely with suppliers see higher growth, lower costs, and better profitability. Real-time performance monitoring, powered by AI, tracks delivery accuracy and quality. Data-sharing platforms improve transparency and trust. For example, a consumer electronics firm uses AI to analyze supplier defect rates and shifts orders to top performers. These practices build stronger relationships and improve supply chain resilience.

The Supply Chain Outlook for H2 2025 highlights the need for agility and proactive risk management. Companies face challenges such as rising freight costs, shortages in foreign currency, and gaps in logistics expertise.

Technology adoption and continuous monitoring help organizations stay competitive. Leaders must adapt quickly to new developments and build strong, flexible supply chains.

FAQ

What is the biggest supply chain risk in late 2025?

Geopolitical tensions pose the greatest risk. Conflicts and trade disputes disrupt shipping routes and increase costs. Companies must monitor global events and adjust sourcing strategies quickly.

How can companies improve supply chain resilience?

Companies build resilience by diversifying suppliers, investing in automation, and using real-time data. Regular risk assessments and strong supplier relationships also help maintain stability during disruptions.

Why is technology investment important for supply chains?

Technology boosts efficiency and visibility. AI and automation help companies forecast demand, track shipments, and manage inventory. These tools support faster decision-making and reduce errors.

How do new regulations affect supply chains?

New regulations require companies to change processes, improve reporting, and adopt sustainable practices. Staying compliant helps avoid fines and keeps operations running smoothly.

What role does workforce development play in supply chain success?

A skilled workforce adapts to new technologies and changing demands. Training programs and upskilling ensure employees can handle advanced tools and maintain high performance.

See Also

Top Five Trends Shaping Future Supply Chain Efficiency

Why You Must Address Supply Chain Risks Immediately

Understanding Emerging Trends In Logistics Risk Management