Sustainability and Green Logistics: Push for eco-friendly practices due to EU carbon regulations

The logistics industry faces mounting pressure as the EU extends its Emissions Trading System to shipping, covering over 124 million tonnes of CO2 emissions from maritime transport in 2021. New compliance rules increase costs and administrative complexity, making sustainability and green logistics essential for long-term viability.

Metric | Value |

|---|---|

USD 429,614.4 million | |

Expected revenue in 2030 | USD 681,691.6 million |

USD 929,245.1 million |

Europe’s market leads global green logistics, driven by strict climate neutrality goals for 2030 and 2050.

Improved profitability

New partnerships

Customer loyalty

Corporate responsibility

These factors push industry leaders to adopt eco-friendly solutions and prepare for future regulations.

Key Takeaways

The EU sets strict carbon emission targets for logistics, pushing companies to reduce emissions by up to 90% by 2040 and reach climate neutrality by 2050.

Sustainability and green logistics focus on eco-friendly transport, energy-efficient warehousing, waste reduction, and carbon offsetting to lower costs and improve brand reputation.

Logistics companies must meet tight reporting deadlines and use digital tools to track and verify emissions, avoiding fines and building trust with customers.

Investing in alternative fuels, route optimization, and digital solutions helps companies cut emissions, comply with regulations, and gain a competitive edge.

Collaboration, clear ESG goals, and early action enable logistics firms to overcome cost and technology challenges and succeed in the growing green logistics market.

EU Carbon Regulations

Emissions Targets

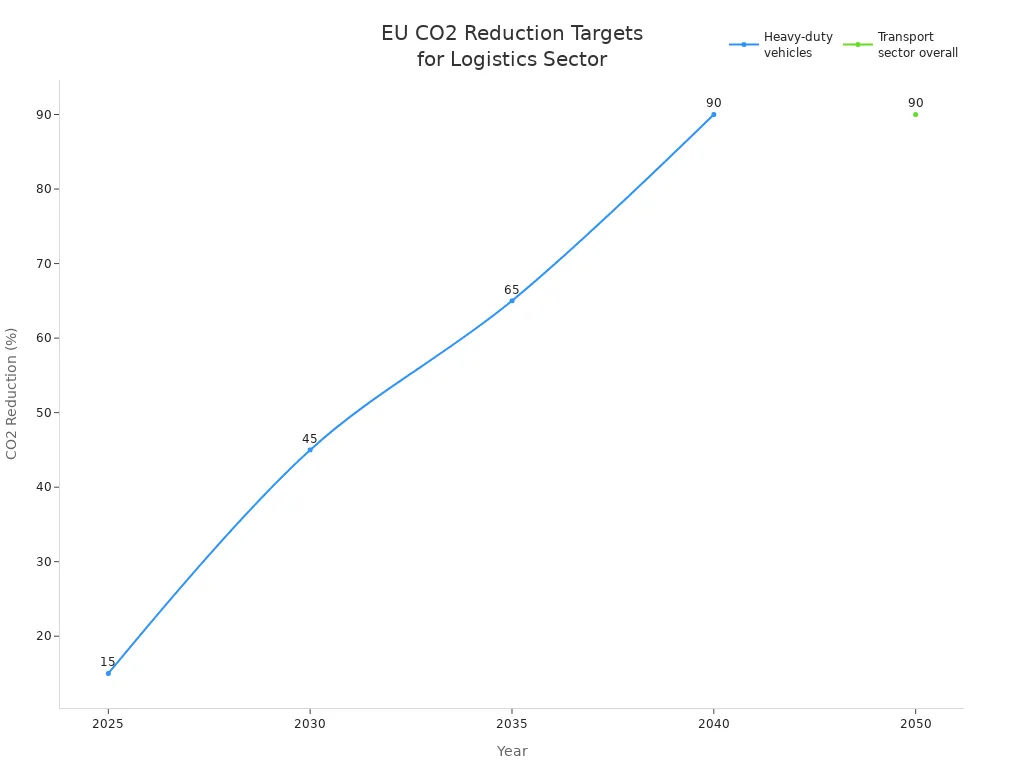

The European Union sets ambitious carbon emissions targets for the logistics sector. Heavy-duty vehicles, such as trucks and buses, must meet strict reduction goals over the next decades. The EU aims for a 45% reduction in CO2 emissions by 2030 compared to 2019 levels. By 2040, the target rises to 90%. The overall transport sector must reach climate neutrality by 2050, aligning with the EU’s legally binding climate law.

Year | CO2 Reduction Target | Reference Level | Sector/Scope | Notes |

|---|---|---|---|---|

2025 | 15% reduction | 2019 levels | Heavy-duty vehicles | Original target maintained |

2030 | 45% reduction | 2019 levels | Heavy-duty vehicles | Revised target under 'Fit for 55' |

2035 | 65% reduction | 2019 levels | Heavy-duty vehicles | New target introduced in 2023 revision |

2040 | 90% reduction | 2019 levels | Heavy-duty vehicles | New target introduced in 2023 revision |

2050 | 90% reduction | 1990 levels | Transport sector overall | Aligned with EU climate neutrality |

The EU stands out globally for its progress. Since 1990, the region reduced greenhouse gas emissions by 37% while its economy grew by 68%. In 2023, emissions dropped by 8%, the largest annual decrease in decades. These results show that the EU can decouple economic growth from emissions. The EU’s targets remain among the most ambitious worldwide, with policies like Fit for 55 and REpowerEU supporting further reductions.

Compliance Deadlines

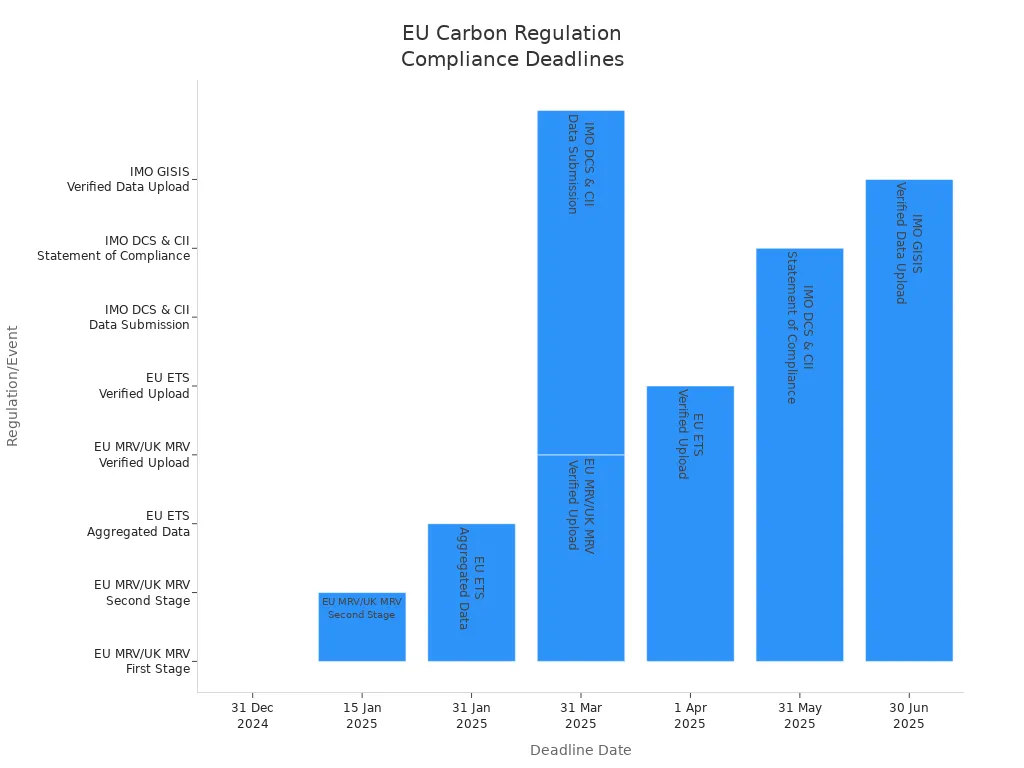

Logistics companies must meet several key deadlines to comply with EU carbon regulations. These deadlines require accurate reporting, data verification, and digital documentation. Missing these dates can lead to fines and reputational risks.

Regulation/Event | Deadline Date | Key Requirement/Action |

|---|---|---|

EU MRV/UK MRV First Stage | 31 December 2024 | Submit fleet and voyage data to Lloyd’s Register (LR) |

EU MRV/UK MRV Second Stage | 15 January 2025 | Submit emissions data to LR via Emissions Verifier portal |

EU MRV/UK MRV Verified Upload | 31 March 2025 | Verified data must be uploaded into THETIS-MRV and marked as verified |

EU ETS Aggregated Data Submission | 31 January 2025 | Submit company-level aggregated emissions data to Emissions Verifier portal |

EU ETS Verified Upload to Registry | 1 April 2025 | Upload verified emissions data into Union Registry and mark as verified |

IMO DCS & CII Data Submission | 31 March 2025 | Submit annual emissions data to LR for verification |

IMO DCS & CII Statement of Compliance | 31 May 2025 | LR issues Statement of Compliance on behalf of Administration |

IMO GISIS Verified Data Upload | 30 June 2025 | LR submits verified data into IMO’s GISIS platform |

Logistics companies should coordinate data early, perform gap analysis, and align internal processes to meet these deadlines. Timely compliance helps avoid penalties and supports the transition to greener operations.

Sustainability and Green Logistics

Key Principles

Sustainability and Green Logistics focus on reducing environmental impact while maintaining operational efficiency. Leading organizations define several core principles that guide these efforts:

Eco-friendly transportation uses electric vehicles, modernized fleets, and optimized routes to cut emissions and fuel use.

Energy-efficient warehousing relies on LED lighting, improved ventilation, and renewable energy sources to lower energy consumption.

Reverse logistics manages product returns, recycling, and zero waste initiatives to minimize landfill contributions.

Carbon offsetting supports ecological projects that balance out emissions from logistics operations.

Compliance with environmental regulations ensures regular audits and adaptation to new laws and standards.

These principles help companies lower costs, improve brand reputation, and conserve natural resources. The approach balances economic efficiency with environmental protection, supporting long-term sustainable development. Companies like DHL and Amazon have set ambitious goals, such as zero emissions by 2050, by investing in electric vehicles and renewable energy.

Companies that adopt Sustainability and Green Logistics principles often see both operational savings and stronger customer loyalty.

Industry Impact

Sustainability and Green Logistics have transformed the logistics industry. The expansion of the EU Emissions Trading System now requires shipping companies to monitor, report, and manage their carbon emissions. This change pushes companies to rethink route planning and fleet management. Many businesses now use alternative fuels and advanced tracking systems to meet strict reporting requirements.

The Corporate Sustainability Reporting Directive also compels logistics providers to disclose detailed sustainability data. This regulation increases transparency and accountability. Companies must now integrate carbon accounting into their strategies or risk financial penalties. As a result, many logistics firms redesign supply chains, shift to greener transport modes, and invest in technology to reduce emissions.

Logistics companies measure the effectiveness of their sustainability initiatives by tracking carbon emissions, especially in last-mile delivery. They use specialized software and analytics platforms to monitor emissions per vehicle and route. Accurate reporting and operational changes help reduce the overall carbon footprint and support compliance with evolving regulations.

Regulatory Influence

Reporting Requirements

Logistics companies face strict reporting requirements under current EU carbon regulations. These rules ensure that businesses monitor, verify, and disclose their greenhouse gas emissions accurately. The process begins with approval of a monitoring plan by the competent authority before the monitoring period starts. Companies must then track emissions throughout the year and prepare an annual emissions report. An accredited verifier checks this report for accuracy. The verified report must reach the competent authority by March 31 of the following year. By September 30, companies surrender the equivalent number of emission allowances in the Union Registry. The European Commission provides templates and digital tools, such as the ETS Reporting Tool (ERT), to support compliance.

Approval of a monitoring plan before the monitoring period.

Annual monitoring and preparation of emissions reports.

Verification of reports by accredited verifiers.

Submission of verified reports by March 31.

Surrendering emission allowances by September 30.

Use of official templates and digital tools.

Specific cycles for maritime and aviation operators.

Regulations like the Corporate Sustainability Reporting Directive (CSRD) and the UK’s SECR now require large logistics companies to report supply chain emissions. Accurate data has become essential for compliance and competitiveness. The GLEC Framework sets standards for emissions reporting in logistics, while the Carbon Border Adjustment Mechanism (CBAM) requires importers to purchase carbon certificates for embedded emissions.

Accurate reporting builds trust with regulators and customers, helping companies avoid fines and reputational risks.

Supply Chain Transparency

Supply chain transparency standards continue to evolve in response to EU carbon regulations. The CSRD and European Sustainability Reporting Standards (ESRS) require companies to disclose detailed carbon emissions data across Scope 1, 2, and 3, including emissions from suppliers. These standards demand reliable and comparable sustainability reports starting from the 2024 financial year. Businesses must trace product origins and emissions data deep into multi-tier supply chains. Importers face strict due diligence under regulations like EUDR and CBAM, with penalties for non-compliance that include fines, shipment confiscation, and loss of market access.

Regulation | Key Features | Scope and Impact | Compliance Consequences |

|---|---|---|---|

CSRD | Detailed sustainability reporting (Scope 1, 2, 3) | Large EU and non-EU companies | Fines up to €200k; mandatory FY 2024 |

EUDR | Deforestation-free supply chains | Importers of key commodities | Penalties up to 4% of turnover |

CBAM | Carbon pricing on imports | Importers of select goods | Carbon certificate payments; fines |

CSDDD | Human rights and environmental due diligence | Large EU companies | Fines up to €5 million |

LkSG | Human rights and environmental protection | German companies | Fines up to 2% of global revenue |

Companies must collaborate with suppliers to gather accurate data and assess risks. Robust data-gathering and risk assessment mechanisms help ensure compliance and document proof. ESG compliance now drives strategic decisions, transforming transparency from a burden into a competitive advantage.

Compliance Strategies

Alternative Fuels

Logistics companies across Europe now invest in alternative fuels to meet strict EU carbon regulations. The FuelEU Maritime regulation requires shipping and logistics firms to use renewable and low-carbon fuels such as biofuels, e-fuels, ammonia, and hydrogen. These fuels help companies comply with greenhouse gas intensity limits starting in 2025. However, the price gap between renewable and fossil fuels remains a challenge. For example, bio-methane costs 169% more than fossil LNG, and e-methanol can be up to 626% more expensive than its fossil counterpart. Despite these costs, EU policies like the Emissions Trading System and Alternative Fuels Infrastructure Regulation encourage investment in cleaner fuels and infrastructure.

Several leading companies have already adopted alternative fuels at scale:

Net Cargo Logistics GmbH, in partnership with C.H. Robinson, switched trucks to synthetic biofuel (HVO100), reducing up to 90% of net CO2 emissions. In eight months, they cut 217,350 kg CO2e, equal to eliminating emissions from 1.8 million kilometers of transport. This transition also improved shipper satisfaction and enabled better route optimization.

Other companies demonstrate the effectiveness of alternative fuels and electric vehicles:

Benore Logistic Systems tested battery electric yard trucks, confirming their viability for intensive operations.

Clean Energy supplies renewable natural gas to major transit fleets, replacing fossil fuels and delivering immediate environmental benefits.

The European Green Deal drives these changes by shifting compliance strategies toward sustainability and innovation. Companies now factor environmental costs into operations, invest in fleet modernization, and develop integrated sustainable transport solutions.

Digital Solutions

Digital solutions play a critical role in helping logistics companies comply with EU carbon regulations. Software platforms such as BigMile automate emissions data collection, analysis, and reporting. These tools align with standards like the GLEC Framework and ISO 14064, supporting scenario planning and transparent data sharing with customers. Early adoption of digital solutions simplifies compliance with regulations such as ETS2 and the Mobility Package and enhances a company’s sustainability credentials.

Digital tools offer several advantages:

They enable detailed tracking of emissions, especially Scope 3, which is often the largest part of a company’s carbon footprint.

Platforms like Zeigo Hub provide visibility into supply chain emissions, helping companies identify hotspots and collaborate with suppliers.

Technologies such as IoT, AI, and blockchain improve data accuracy, transparency, and regulatory adherence.

Digital Technology | Function in Logistics | Impact on Carbon Emissions |

|---|---|---|

IoT | Monitors real-time energy consumption | Enables precise energy use tracking, reducing waste |

AI | Optimizes routes and loads | Minimizes fuel consumption and emissions |

Blockchain | Ensures data integrity and trust | Supports compliance and transparency in sustainability claims |

Supply chain digitalization reduces carbon emissions by fostering green innovation and collaborative optimization among partners. This approach supports the goals of the Sustainable Logistics Framework, which balances operational efficiency, environmental responsibility, and economic viability. Companies that integrate digital tools into their operations gain a competitive edge and meet evolving regulatory demands.

Route Optimization

Route optimization stands as a powerful strategy for reducing carbon emissions in logistics. Companies use AI, machine learning, IoT, and real-time analytics to plan routes that consider traffic, weather, and vehicle load. Specialized software, such as FarEye’s green vehicle routing engine, reduces travel distances, fuel consumption, and idle times. Integration of electric and hybrid fleets with route optimization software further lowers the carbon footprint.

Key advancements in route optimization include:

Fuel-efficient routing algorithms that factor in vehicle capacity, delivery windows, and real-time traffic data.

Load consolidation to maximize vehicle capacity and reduce trips.

Geofencing technology for smarter, location-specific delivery routes.

Real-time tracking and predictive analytics to adjust routes dynamically.

Several companies lead the way in this area:

Wise Systems uses AI and real-time data for dynamic route optimization, cutting travel distances and fuel use.

OptimoRoute employs AI-powered planning with real-time traffic integration to minimize emissions.

DHL invests in electric vehicles and route optimization platforms to achieve sustainability goals.

Best practices for route optimization involve prioritizing high-grade roads, minimizing route length, and complying with local driving regulations. Companies also avoid unnecessary commodity transfers and reverse-order logistics to lower emissions. Combining route optimization with operational improvements and technology adoption is essential for reducing freight transportation emissions.

The European Green Deal and the Sustainable Logistics Framework both emphasize the importance of route optimization, digitalization, and alternative fuels. These strategies help companies align with environmental targets and achieve the goals of Sustainability and Green Logistics.

Market Trends

Growth Projections

The green logistics market in Europe shows strong growth. Analysts expect the market to double in size over the next decade. Companies respond to regulatory support and sustainability demands by investing in eco-friendly solutions. The market size reached $30 billion in 2024. Forecasts predict it will reach $60 billion by 2035. The compound annual growth rate (CAGR) stands at about 5.89% for green logistics. The broader logistics sector in Europe will grow at a CAGR of 6.6% from 2025 to 2033.

Metric | Details |

|---|---|

Market Size 2024 | $30.0 Billion |

Market Size 2035 | $60.0 Billion |

CAGR (2025-2035) | 5.89% |

Broader Logistics CAGR (2025-2033) | 6.6% |

This rapid expansion comes from new regulations and rising consumer awareness. Companies that invest in green logistics gain a competitive edge. They meet compliance requirements and attract new customers who value sustainability.

The market’s growth reflects a shift toward cleaner transport, better supply chain management, and advanced technology adoption.

Investment Drivers

Several factors drive investment in sustainable logistics across the EU. Companies face increasing sustainability demands and prioritize ESG (Environmental, Social, and Governance) goals. Regulatory pressure from the EU’s Fit for 55 package and global climate initiatives pushes firms to decarbonize operations. Transportation’s large share of greenhouse gas emissions motivates companies to seek cleaner solutions.

Key investment drivers include:

Technological innovation, such as AI, automation, and data analytics.

Infrastructure development, including electric vehicle charging stations and multimodal transport hubs.

Collaboration among logistics clusters, manufacturers, and stakeholders.

Market demand from eco-conscious consumers for sustainable delivery and warehousing.

Private equity and venture capital funding for ESG-aligned startups.

Projects like Clusters 2.0 promote freight transport by rail and collaborative platforms. These efforts improve load factors, reduce operational costs, and support economic growth while maintaining environmental neutrality. The EU’s Carbon Border Adjustment Mechanism (CBAM) also shapes investment decisions. Logistics providers adopt digital emissions tracking and AI analytics to comply with CBAM and gain a competitive advantage.

Companies that invest in sustainable logistics solutions position themselves for long-term success in a changing market.

Overcoming Challenges

Cost Barriers

Logistics companies face significant cost barriers when adopting green practices. Many sustainability initiatives require large upfront investments in new technology and infrastructure. Companies often struggle with short-term financial constraints that conflict with long-term sustainability goals. High costs for emerging green technologies, such as zero-emission vehicles, can be double those of traditional models. Small and medium-sized enterprises (SMEs) find these expenses especially challenging due to limited capital and low profitability. Administrative burdens, compliance costs, and the need for specialized staff add to the financial strain.

High initial investment for green vehicles and infrastructure

Financial constraints and uncertain return on investment

Complexity and costs of regulatory compliance

Internal resistance from employees used to traditional methods

Technology platforms and fiscal support, such as tax credits and guarantees, can help companies manage these costs and improve access to resources.

Technology Adoption

Adopting new technology for sustainability presents its own set of challenges. Many logistics firms lack formal sustainability goals or the expertise needed to implement advanced solutions. High costs, fear of operational disruption, and knowledge gaps slow progress. Companies address these issues by investing in training, using phased rollouts, and partnering with technology providers. They implement eco-friendly technologies like electric vehicles, cloud computing, and energy-efficient warehouses. Fuel and route optimization tools, such as automated fleet planning and driver routing applications, help reduce emissions and costs.

Predictive analytics and Transportation Management Systems (TMS) improve risk management and compliance tracking.

Managed Security Services Providers (MSSPs) offer expertise in data security and IT infrastructure, supporting smooth technology integration.

Scenario planning and digital freight routing help companies optimize operations and build resilient supply chains.

Collaboration

Collaboration plays a vital role in overcoming sustainability challenges. Public-private partnerships help build infrastructure, such as the EU’s Alternative Fuels Infrastructure Regulation, which mandates truck charging stations every 60 kilometers by 2030. Logistics companies also work closely with suppliers and customers to improve supply chain visibility and efficiency. For example, Cisco uses cloud platforms and data analytics to enhance collaboration, while Walmart and Procter & Gamble share real-time sales data to optimize logistics. These partnerships demonstrate how sharing information and aligning strategies can drive both operational and sustainability improvements.

Strong collaboration between governments, energy providers, and logistics stakeholders accelerates the transition to green logistics and supports industry-wide progress.

Actionable Solutions

Starting Steps

Logistics companies can begin their sustainability journey by following a clear set of actions:

Raise awareness among all stakeholders about the environmental impact of logistics, such as fuel use and packaging waste.

Assess the company’s carbon footprint using reliable tools and methods.

Take action by optimizing routes, switching to alternative fuels or electric vehicles, and reducing waste.

Track progress with key performance indicators (KPIs) to measure the impact of these changes and guide future improvements.

Early action builds a strong foundation for Sustainability and Green Logistics, helping companies adapt to new regulations and market demands.

ESG Integration

Integrating Environmental, Social, and Governance (ESG) criteria into logistics operations supports compliance and business growth. Companies align with EU regulations like the Corporate Sustainability Reporting Directive and the Carbon Border Adjustment Mechanism. They adopt electric vehicles, sustainable aviation fuel, and smart warehousing to cut emissions. Technology such as blockchain and AI improves supply chain visibility and data accuracy. Companies face challenges like fragmented ESG standards, data collection issues, and cost pressures, especially for small businesses. Leading firms like DHL and Maersk show that strategic ESG integration improves performance and attracts investment. Embedding ESG deeply into operations ensures long-term resilience and opens new business opportunities.

Adapting to EU carbon regulations secures long-term business success in logistics. Companies that embrace Sustainability and Green Logistics gain several advantages:

Stronger client loyalty with transparent reporting

Lower costs by reducing inefficiencies

Easier compliance and access to green financing

Industry studies show that sustainable practices drive market growth, improve efficiency, and reduce environmental impact. Companies can use emissions calculators, advanced management systems, and expert guidance to start their green journey today.

FAQ

What is green logistics?

Green logistics means using methods that reduce harm to the environment. Companies use electric vehicles, renewable energy, and efficient routes. These actions help lower carbon emissions and save resources.

How do EU carbon regulations affect logistics companies?

EU carbon regulations set strict emission limits. Companies must track and report emissions. They need to use cleaner fuels and new technology. Failure to comply can lead to fines and loss of business.

Which technologies help companies meet sustainability goals?

Many companies use digital tools like AI, IoT, and blockchain. These tools track emissions, optimize routes, and improve supply chain transparency. Technology helps companies meet targets and report data accurately.

Why is supply chain transparency important?

Supply chain transparency builds trust with customers and regulators. It helps companies find and fix problems quickly. Transparent supply chains also make it easier to meet legal requirements and improve sustainability.

See Also

JUSDA's Logistics Expansion Through Sustainable Efficiency Practices

Comprehensive Insights Into Eco-Friendly Transportation For Supply Chains

How Innovation Is Transforming Modern Supply Chain Logistics

Current Robotics Trends Driving Sustainability In Supply Chain Operations

Unlocking Supply Chain Efficiency With Expert Logistics Cost Strategies