The Ripple Effects of Tariffs on Global Trade and Economies

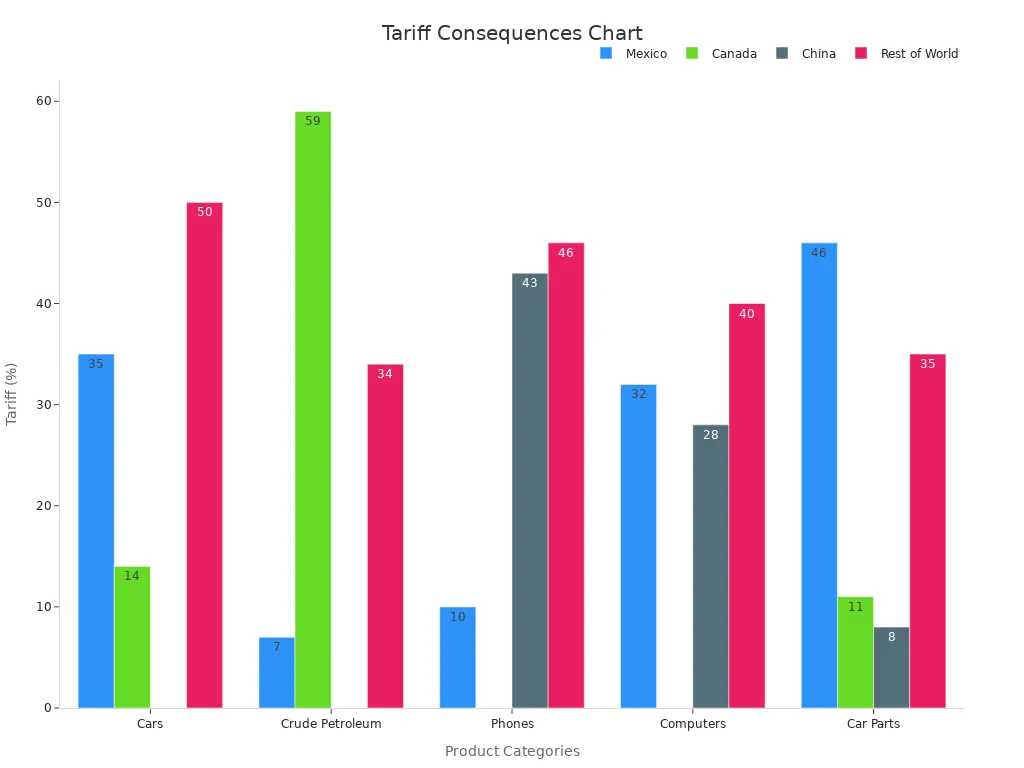

Tariffs are now a big part of global trade in 2025. These tools affect industries and economies in major ways. For instance, the average tariff rate (AETR) is now 12.4%. This happened because of new 25% tariffs on cars. Import costs from China went up by 22 cents per dollar. Mexico's AETR is now 30%, and Canada's is 20%. These changes show how tariffs can change trade and economic plans everywhere.

Key Takeaways

Tariffs make imports more expensive, raising prices for everyone. Knowing this helps families plan their spending better.

Countries are changing trade plans to depend less on one market. Using local suppliers can make economies stronger and safer.

Newer markets face problems and chances because of tariffs. Working with more trade partners can help them grow despite issues.

Leaders should create clear trade rules and help hurt industries. This can keep economies steady and support fair trading.

Smart supply chain ideas, like JUSDA’s, help businesses handle tariffs. These ideas keep companies competitive and successful.

The Evolution of Tariffs in Global Trade

Historical milestones in tariff policies

Tariff rules have changed a lot over 100 years. These changes show how trade and economies have shifted. In 1897, the Dingley Act raised tariffs to help U.S. industries. Later, the Underwood-Simmons Act of 1913 lowered tariffs and added income tax. The Smoot-Hawley Act of 1930 raised tariffs too high. This caused 25 countries to respond with their own tariffs. Trade between nations dropped sharply. For example, U.S. imports from Europe fell from $1,334 million in 1929 to $390 million in 1932. Exports also dropped from $2,341 million to $784 million. These actions made the Great Depression worse, showing the dangers of high tariffs.

In recent years, trade policies have changed focus. The Trade Act of 1974 helped speed up trade deals. NAFTA in 1994 aimed to lower import costs and grow economies. Later, the USMCA replaced NAFTA to handle new trade challenges.

The transition from protectionism to strategic economic tools

Early tariffs were used to protect local businesses from foreign goods. Over time, tariffs became tools for bigger goals. Governments now use tariffs to balance trade and protect ideas and inventions. For example, during the US-China trade war, tariffs were used to protect U.S. jobs and reduce reliance on Chinese goods.

This change shows how tariffs now serve new purposes. Instead of just protecting industries, tariffs are used to solve global issues. Leaders use them to shape trade ties and reduce risks in a connected world.

Tariffs as a response to global economic challenges

Tariffs are often used during tough economic times. Recent numbers show their worldwide effects. In the U.S., higher tariffs have hurt growth predictions, similar to the Great Depression. In Europe, tariffs may lower GDP by 0.2 to 0.3 percentage points. The UK faces slower growth, with forecasts below 1%, due to weak demand and trade worries.

In Asia-Pacific, countries like Vietnam and South Korea face risks from tariffs. But India and the Philippines seem better prepared. Latin America feels smaller but still important effects, even with less reliance on U.S. exports. Many industries that depend on trade are struggling, showing how tariffs impact economies everywhere.

Region/Sector | Impact Description |

|---|---|

US | Higher tariffs hurt growth predictions, like in the Great Depression. |

China | Facing problems that may need government action to reduce harm. |

Eurozone | GDP may drop by 0.2 to 0.3 percentage points due to tariffs. |

UK | Growth forecast below 1% because of weak demand and trade worries. |

Asia-Pacific | Vietnam and South Korea face risks; India and Philippines are stronger. |

Latin America | Smaller but important effects on growth, despite less U.S. trade. |

Sector-Specific | Trade-dependent industries feel the negative effects of tariffs. |

Regional Impacts of Tariffs on Global Trade in 2025

The United States: Managing trade gaps and local growth

The U.S. faces challenges with its trade gap and economy. In 2024, the trade gap grew to $918.4 billion, up 17%. Imports rose by 6.6% due to strong buying, while exports grew 3.9%. By February 2025, the gap shrank to $122.7 billion. This was due to a $2.9 billion rise in exports. This shows how tariffs affect trade and money flow.

Areas like the Midwest and Great Lakes, full of factories, face problems. A 25% tariff on car imports raised costs and hurt supply chains. Southern states like North Carolina and Alabama feel EU tariffs too. These tariffs hurt car plants in those areas. Across the U.S., 32% of factories plan to cut jobs because of tariffs. Still, the U.S. economy stays strong, helped by local buying.

China: Export troubles and staying strong

China faces problems as tariffs change its export trade. A 25% tariff on U.S. soybeans caused exports to drop 70–80%. This led to an 8–10% price drop for U.S. farmers. This shows the risk of depending on one market. To cope, China made new trade deals and grew local industries.

Even with these steps, export-based businesses still struggle. The government made plans to keep the economy steady. They focus on new ideas and being self-reliant. These actions show China's ability to adjust to global trade changes.

The Eurozone: Trade teamwork and steady economy

The Eurozone now focuses on trading within its own region. Exports between EU countries grow faster than exports outside the EU. Imports from non-EU partners dropped, while imports within the EU rose. This shows early signs of reshoring.

This shift helps the Eurozone stay stable. Trading more within the region lowers risks from tariffs. But fewer exports outside the EU hurt its GDP. The Eurozone's teamwork and focus on stability make it important in global trade.

Emerging Markets: Challenges and Chances in a Tariff-Driven World

Emerging markets (EMs) face both problems and chances with tariffs. These economies depend a lot on exports. This makes them sensitive to changes in trade rules. Tariffs can mess up supply chains and slow growth. But they also push countries to try new ideas and grow in different ways.

Opportunities in Emerging Markets

Emerging markets have found ways to handle tariff problems. Countries like India and the Philippines rely less on selling goods. They use their service industries to stay strong. North Asia and Latin America have grown by 3-5% due to fewer tariffs.

Some currencies, like the South Korean won (KRW) and Colombian peso (COP), react quickly to tariff changes. When tariffs drop, these currencies gained over 1.5% against the U.S. dollar. This shows how easing trade rules can help EM currencies grow.

Vulnerabilities in Emerging Markets

Even with chances, emerging markets still face risks from tariffs. Higher tariffs on all goods have hurt some currencies. The MSCI EM index dropped by 5%. Stocks in South Africa, Brazil, and Chile also fell, hurting growth.

Export-heavy countries like Taiwan, Korea, and Mexico are at risk. They depend on the U.S. for 24%, 16%, and 16% of their revenue. India, with only 4% goods-based revenue, is safer. Its service sector is key to its growth.

Scenario | What Happens | Effect on EM Currencies and Stocks |

|---|---|---|

More Tariffs | Highest tariffs on all goods | High-beta currencies drop; MSCI EM index falls 5% |

Same Tariffs | Current tariffs stay | Short-term ups and downs; currencies struggle with HKD |

Fewer Tariffs | Tariffs go down | 3-5% growth in North Asia and Latin America; stocks rise |

Emerging markets need to grow in new ways and trade more with neighbors. This can lower risks from tariffs and bring new chances for growth.

Sector-Specific Consequences of Tariffs

Automotive Industry: Supply chain problems and higher costs

The car industry faces big problems because of tariffs. A 25% tariff on foreign chips adds about $188 to each car's cost. This happens because 65% of chips come from other countries. Car makers must choose to pay these costs or charge buyers more. This makes cars more expensive.

Getting parts on time is also harder now. Asian suppliers take longer to deliver and still face tariffs. This slows down production and raises costs. Switching to U.S. suppliers costs a lot of money and time. U.S. factories can’t quickly make enough parts to meet demand. This raises prices for both new and used cars.

Note: A lack of workers and time to build new factories make things worse. Tariffs are causing long-term problems for the car industry.

Agriculture: Export limits and changing food prices

Tariffs have hurt farm exports, making food prices go up and down. Export limits during high food prices often cause bigger price changes. For example, from 2006 to 2008, export limits doubled. This happened at the same time as a big rise in food prices.

Tariffs also affect global farm trade. Countries that sell farm goods lose money, and shoppers pay more for food. Taxes on exports during tough times make things worse. This shows how trade rules are key to keeping food prices steady and affordable.

Technology: Protecting ideas and trade challenges

The tech industry faces special problems from tariffs and trade rules. Weak rules for protecting ideas make global trade harder. Companies avoid risky markets where their ideas might get stolen. This stops teamwork between countries.

The WTO TRIPS Agreement changed how knowledge is traded. It focuses on protecting ideas like intellectual property. These ideas are often shared through licenses, not products. Tariffs on tech items, like chips, make things even harder. Companies must deal with these rules while keeping their ideas safe. This shows how trade rules and tech growth are closely linked.

Manufacturing: Changes in factories and jobs

Tariffs have caused big changes in manufacturing. Factories and jobs are moving around the world. Higher import costs make companies rethink where they get materials. Many now choose local suppliers to avoid relying on other countries. This has led to factories being built closer to where products are sold, especially in areas with good trade rules.

Supply chains have also been affected by tariffs. Companies that depend on imported materials face problems. Prices for materials keep changing, making it hard to plan ahead. For example, industries like cars and electronics are losing money because of unpredictable costs. Other countries' tariffs in response have made things even harder. This forces companies to find new suppliers in different places.

Jobs have also been impacted by these changes. When factories move, new areas get more jobs, but old factory areas lose them. Workers in these places often need to learn new skills for different jobs. This has created chances for training programs to help workers get ready for new industries.

Here’s a table showing how tariffs affect manufacturing:

Insight Type | Description |

|---|---|

Higher Import Costs | Tariffs make imported materials cost more, lowering profits. |

Companies must change suppliers because of rising costs. | |

Changing Prices | Material prices are less stable, making planning harder. |

Trade Fights | Other countries' tariffs make it tougher for U.S. manufacturers. |

These changes show why planning is important for manufacturers. Companies need to invest in local factories, find new suppliers, and help workers learn new skills. By doing this, they can handle tariff challenges and stay strong in global trade.

Economic Indicators Affected by Tariffs

GDP Growth: Uneven effects and slower global trade

Tariffs affect GDP growth differently in each region. Countries with high tariffs, like China and Vietnam, face trade problems. Vietnam's 46% tariff rate has caused a big trade deficit. The UK, with a 10% tariff rate, has a small trade surplus. These differences show how tariffs impact economic balance.

Global GDP growth is slowing because of less trade. Retaliatory tariffs make things worse for export-heavy areas. Higher import costs discourage trade and hurt economies. Japan and South Africa, with tariffs of 24% and 30%, face bigger challenges.

Inflation: Higher prices for goods and services

Tariffs have raised inflation by making imports cost more. Businesses pass these costs to buyers, increasing prices in many areas. For example, a 25% tariff on imports from Canada, Mexico, and China added 0.5 to 0.8 points to inflation. If tariffs hit 60% on China and 10% on others, inflation could rise by 2.2 points.

Tariff Scenario | Impact on Core Inflation |

|---|---|

25% on Canada/Mexico + 10% on China | 0.5 to 0.8 percentage points |

60% on China + 10% on rest of the world | 1.4 to 2.2 percentage points |

Proposed 60% on China + 10% on others | Up to 2.2 percentage points |

This inflation makes life harder for families and businesses. It lowers buying power and raises costs for operations.

Consumer Prices: Higher costs for families

Tariffs have made consumer goods more expensive, especially essentials. Monthly import prices from China rose by 0.5%, ending 26 months of stable prices. Raw materials now cost nearly 2% more. This shows manufacturers are stocking up before tariffs increase again.

Families feel the impact differently based on income. Lower-income families cut spending on basics. Middle-income families spend less on non-essentials. High-income families are less affected but still plan to reduce spending.

Income Group | Cutting Spending on Essentials | Cutting Spending on Non-Essentials |

|---|---|---|

Lower-Income | More likely | Often cut spending |

Middle-Income | More likely | Many expect to cut spending |

High-Income | Less likely | 20% plan to cut spending on essentials |

Rising prices and lower buying power show how tariffs hurt families and businesses.

Trade Balances: Changing deficits and surpluses in different regions

Trade balances have shifted because of changing tariffs. These changes affect countries with trade surpluses and deficits differently.

Countries like Germany and Japan, which rely on exports, face problems. Higher tariffs from trading partners have lowered demand for their goods. For example, Germany's car exports to the U.S. dropped 12% in 2024. This happened because of a 25% tariff on imported cars. Japan's electronics exports also fell by 7% due to higher import taxes.

Deficit-heavy countries like the U.S. have mixed results. Tariffs aim to lower the trade gap but raise costs for industries. In early 2025, the U.S. trade deficit shrank slightly. This was due to a $2.9 billion rise in exports. However, this caused higher prices for consumers and supply chain issues.

Emerging markets feel both good and bad effects. Export-heavy nations like Mexico and Vietnam face challenges. Mexico's farm exports to the U.S. dropped 15% after new tariffs. Vietnam's textile orders from Europe fell by 10%. But some countries benefit from regional trade deals. For instance, the African Continental Free Trade Area (AfCFTA) boosted trade within Africa. This helped Kenya and Nigeria handle outside tariff problems.

Region/Economy | Key Impact |

|---|---|

Germany | 12% drop in car exports to the U.S. |

Japan | 7% decrease in electronics export income |

United States | Smaller trade deficit but higher consumer costs |

Mexico | 15% fall in farm exports to the U.S. |

Vietnam | 10% drop in textile orders from Europe |

Africa (AfCFTA) | More trade within Africa, reducing outside tariff issues |

These changes show how tariffs affect trade balances. Leaders must plan carefully to support growth and reduce trade problems.

The Role of JUSDA in Reducing Tariff Problems on Global Trade

JUSDA’s help with supply chain issues caused by tariffs

JUSDA helps solve problems caused by tariffs in global trade. Its smart supply chain tools help businesses handle higher costs and delivery delays. For example, U.S. farmers lose $3.6 to $5.9 billion yearly from soybeans and $0.9 to $1.4 billion from corn. These losses show why better supply chain plans are needed. JUSDA uses its logistics skills and advanced systems to cut costs and keep businesses competitive.

With over 155 service points worldwide, JUSDA connects transport systems smoothly. It solves key problems like customs delays, managing stock, and cross-border shipping. This helps businesses adjust to new trade rules while avoiding big disruptions.

JusTrade: Making customs clearance easier in tough tariff times

JusTrade, a customs service by JUSDA, makes global trade simpler. Its special SAAS platform uses AI and big data to follow trade rules. This reduces delays and makes processes faster.

JusTrade offers services like bonded zone expressways and cross-border shipping for industries like electronics and machinery. These tools help businesses deal with tariff problems better. Real-time tracking and easy communication reduce delays and keep production running. This system helps industries continue trading even with tariff challenges.

Improving global trade with JusLink and smart platforms

JUSDA’s JusLink platform changes supply chain management using IoT, cloud computing, and AI. It improves accuracy by 78% and speeds up inventory turnover, helping businesses make better choices.

Metric | Improvement |

|---|---|

Accuracy | 78% |

Inventory Turnover | Faster |

JusLink gives real-time updates on supply chains, helping businesses react quickly to tariff problems. Its predictions help manage stock and lower risks. By working with all partners, JusLink keeps trade smooth and strengthens global supply chains.

JUSDA’s focus on innovation makes it a leader in solving tariff issues. Its smart tools and custom solutions help businesses succeed in today’s complex trade world.

Long-Term Risks and Uncertainties of Tariffs

Retaliatory measures and geopolitical tensions

Tariffs often lead to counter-tariffs, increasing global tensions. Countries respond with their own tariffs to protect their economies. This creates a cycle of trade restrictions that hurt global trade. For example, retaliatory tariffs have slowed export growth in trade-dependent areas. Uncertainty about trade rules has also reduced business investments, especially in equipment.

Geopolitical issues make these problems worse. The Russia-Ukraine war has lowered global GDP by 1%. Blocked shipping routes, like the Suez Canal, caused $80 billion in lost output. While tariffs bring in money, like $96 billion in the U.S., they don’t help much overall. Leaders need to solve these problems to avoid long-term economic struggles.

Economic Factor | Impact Description |

|---|---|

Incremental Government Revenue | $96 billion from tariffs, but little effect on trade or growth. |

Global Economic Disruptions | Suez Canal blockage caused $80B in lost global output. |

Russia-Ukraine Conflict | Ongoing war reduced global GDP by 1%. |

Risks of recession and economic stagnation

New tariffs could raise the risk of economic slowdown. Higher tariffs may push rates to their highest in 100 years. This increases the chance of a recession. Deutsche Bank says tariffs could lower U.S. GDP by 1 to 1.5 percentage points. The New York Fed estimates a 30% chance of recession within a year.

Tariffs also raise inflation, making goods cost more. Higher prices reduce what people can afford. Retail sales grew only 0.2% in February, showing weak consumer confidence. Global fund managers are worried about slow growth. They blame trade policy uncertainty for these risks.

Supply chain realignments and regionalization trends

Tariffs are changing how companies manage supply chains. High tariffs on China are pushing businesses to move production to other regions. These include Asia, Europe, and Latin America. But small tariff differences between China and other places have slowed this shift.

New ideas like friend-shoring and near-shoring are becoming popular. Companies are adjusting supply chains to lower risks and depend less on one country. These changes match the rise of new trade groups. These groups aim to boost regional trade and reduce tariff impacts.

Note: Regionalization brings both chances and challenges. High tariffs everywhere could stop diversification and raise costs, especially in the U.S. Leaders must balance protectionism with plans to reduce long-term GDP losses.

Policy recommendations for reducing economic problems

Policymakers can take steps to lower the problems caused by tariffs. These ideas aim to make trade steady, strengthen economies, and reduce risks from unclear trade rules.

Work on trade agreements: Countries should focus on deals that lower tariff barriers. These deals help fair trade and give businesses a clear plan. For example, joining regional trade groups can help countries trade with more partners and depend less on one market.

Strengthen supply chains: Leaders should help industries build stronger supply systems. Supporting local factories and using many suppliers can lower tariff effects. Governments can also offer rewards for using smart tools like AI and IoT to make supply chains better.

Make trade rules clear: Simple and steady trade rules help businesses feel secure. Governments should create clear plans that explain tariff changes and when they happen. This helps companies prepare and avoid sudden problems.

Help affected workers and industries: Governments should give support to industries hurt by tariffs. Money aid, tax breaks, and job training programs can help businesses and workers adjust. For example, training programs can teach workers new skills for growing industries.

Boost innovation and competition: Leaders should invest in new ideas and research. Helping industries make valuable products can cut the need for imports and improve global trade strength. This also helps countries handle tariff challenges better.

Tip: Governments, industries, and global groups must work together to make these ideas work. Teamwork ensures stronger economies and steady growth.

By following these steps, policymakers can solve tariff problems and build a fairer and stronger global trade system.

JUSDA Solutions

To provide you with professional solutions and quotations.

Tariffs in 2025 have changed global trade and economies. The U.S. now has a 22.5% average tariff rate, the highest since 1909. This raised prices by 2.3% and costs families $3,800 yearly. Real GDP growth fell by 0.9 points, losing $180 billion each year. Smart tariff plans are needed to reduce these effects. Tools like JUSDA’s supply chain systems and JusTrade’s customs help cut costs and improve stability. Leaders and businesses should focus on new ideas, teamwork, and clear trade rules to handle this tariff-driven world better.

See Also

Exploring How Global Trade Policies Shape Economic Landscapes

Understanding The Importance Of Supply Chains In Global Trade

Analyzing Inflation: Strategies To Overcome Supply Chain Issues

Understanding The Trends In Logistics Risk And Their Effects

Addressing Challenges Of Supply Chain Growth In A Global Market