Trump’s Reciprocal Tariffs and their impact on global automakers

Trump’s reciprocal tariffs aim to align U.S. import tariffs with those imposed by its trading partners, creating a significant shift in global trade dynamics. This policy directly impacts global automakers, as it threatens to disrupt integrated supply chains and increase production costs. For instance, Ford and GM estimate that these tariffs could raise their costs by $1 billion each. With automotive manufacturing supporting 10 million U.S. jobs, the stakes are high. The central question remains: How will these tariffs reshape the global automotive industry, from pricing to supply chain strategies?

The Concept of Reciprocal Tariffs

What are reciprocal tariffs?

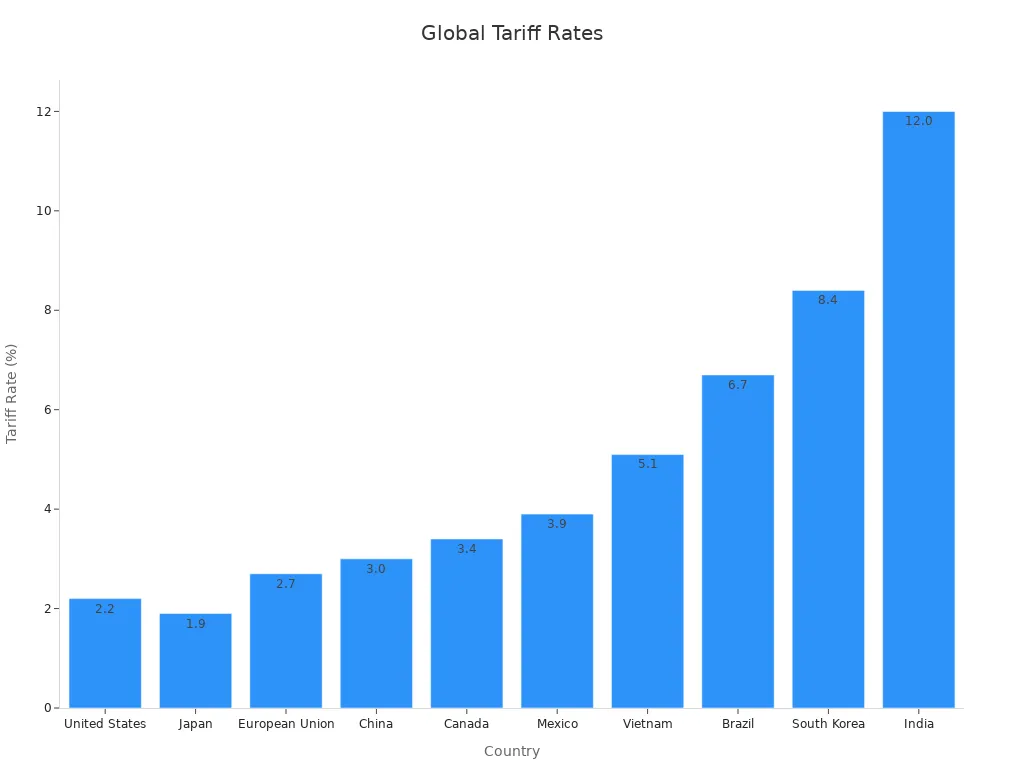

Reciprocal tariffs refer to import duties imposed by one country to match the tariffs applied by another country on its exports. This approach aims to create balanced trade relationships and prevent one-sided advantages. For example, if a country imposes a 10% tariff on U.S. cars, the U.S. could respond by applying the same rate to cars imported from that country. This principle of "mirroring" tariffs ensures that no nation disproportionately benefits from lower trade barriers.

Historically, reciprocal tariffs have played a significant role in shaping trade policies. The Reciprocal Tariff Act of 1934 allowed the U.S. president to reduce tariffs by up to 50% in exchange for similar reductions by trading partners, fostering global trade during the Great Depression. More recently, the U.S. Reciprocal Trade Act of 2019 and the Fair and Reciprocal Plan of 2025 have sought to reinforce this principle by addressing trade imbalances and ensuring fair competition.

The political and economic rationale behind the policy

The primary goal of reciprocal tariffs is to promote fairness in international trade. By aligning tariff rates, countries aim to eliminate trade imbalances and protect domestic industries from unfair competition. Proponents argue that this policy encourages trading partners to lower their tariffs, fostering a more equitable global trade environment.

From an economic perspective, reciprocal tariffs can incentivize domestic production. Higher import duties make foreign goods more expensive, encouraging consumers to purchase locally made products. Politically, this policy appeals to protectionist sentiments, as it demonstrates a commitment to defending national interests in global trade.

Controversies and challenges in implementation

Despite its intentions, the implementation of reciprocal tariffs faces significant challenges. Critics argue that this policy undermines the World Trade Organization's Most-Favored-Nation principle, which promotes equal treatment among member nations. Additionally, the elimination of the de minimis exception increases administrative burdens, as customs officials must assess duties on every package, straining resources.

The policy also risks triggering a cycle of tariff escalations, where countries continuously retaliate by raising tariffs. This could lead to over 3.1 million different tariffs, complicating compliance for businesses and governments. Furthermore, the legal authority for implementing such tariffs remains contentious, as trade policy primarily falls under Congress's jurisdiction. Imposing tariffs without congressional approval could result in legal challenges and further disrupt global trade norms.

Impacts of Reciprocal Tariffs on Global Automakers

Disruptions in global supply chains

Challenges in sourcing and logistics

Reciprocal tariffs have created significant challenges for automakers in sourcing and logistics. Many manufacturers rely on a global supply chain to procure essential components like engines, transmissions, and electronic systems. These tariffs increase the cost of importing these parts, forcing companies to rethink their procurement strategies. For instance, Ford and GM face an estimated $1 billion in additional costs due to tariffs on steel and aluminum. This financial strain disrupts production schedules and complicates inventory management.

Logistics networks also face pressure. Higher tariffs lead to increased customs checks and delays at ports, slowing down the movement of goods. Automakers must navigate these logistical hurdles while maintaining production timelines. The added complexity in transportation and customs processes further inflates costs, making it harder for companies to remain competitive in the global market.

Localization of supply chains to mitigate risks

To counter these disruptions, automakers are localizing their supply chains. By shifting production closer to key markets, companies aim to reduce dependency on imports and minimize tariff-related costs. For example, some manufacturers are investing in U.S.-based facilities to produce components domestically. This strategy not only lowers transportation expenses but also shields companies from future tariff uncertainties.

However, localization comes with its own set of challenges. Establishing new production facilities requires significant capital investment and time. Additionally, higher labor costs in regions like the U.S. can offset the savings from reduced tariffs. Despite these obstacles, localization remains a critical strategy for automakers to adapt to the evolving trade landscape.

Effects on vehicle pricing and market competitiveness

Higher consumer prices

Reciprocal tariffs have a direct impact on vehicle pricing. As production costs rise due to higher tariffs on imported components, manufacturers pass these costs on to consumers. The Anderson Economic Group estimates that new car prices could increase by $3,500 to $10,000. This price hike affects both new and used car markets. The Manheim Used Vehicle Value Index recorded a sharp rise in wholesale used car prices, driven by increased demand as consumers shifted away from expensive new vehicles. In Canada, similar trends emerged, with constrained imports further inflating prices.

These rising costs extend beyond individual buyers. Ride-share companies, rental agencies, and even insurance providers face higher expenses, creating a ripple effect across various sectors. Consumers ultimately bear the burden, as these businesses adjust their pricing to offset increased costs.

Loss of market share for import-dependent brands

Brands heavily reliant on imports face significant challenges in maintaining their market share. Japanese and South Korean automakers, for example, depend on the U.S. for a substantial portion of their exports. With reciprocal tariffs in place, these brands lose their price competitiveness. Higher tariffs make their vehicles more expensive, prompting consumers to consider alternatives from domestic manufacturers or other regions.

This shift in consumer behavior threatens the dominance of import-dependent brands in the U.S. market. Companies must either absorb the additional costs or risk losing customers to competitors. Both options strain profitability and force automakers to reevaluate their long-term strategies.

Broader Economic and Political Implications

Strained international trade relations

Retaliatory tariffs and their effects

The introduction of reciprocal tariffs has intensified global trade tensions. Many countries, including China, Canada, and the European Union, have responded with retaliatory tariffs targeting American goods. These actions have escalated trade disputes from bilateral disagreements to broader multilateral confrontations. For example, retaliatory measures have increased costs for U.S. businesses, disrupting established trade agreements and complicating international trade dynamics. This shift has created a global economic standoff, with nations reassessing their trade relationships with the U.S. and exploring alternative partnerships.

Impact on U.S. trade partnerships and global trade norms

Reciprocal tariffs challenge the stability of U.S. trade partnerships. By undermining the World Trade Organization's principles, these tariffs disrupt global trade norms. Many nations view this policy as a departure from multilateral agreements, leading to strained relationships. Countries like India and Brazil, which rely heavily on exports, face significant economic challenges. This policy has also encouraged some nations to strengthen regional trade agreements, reducing their reliance on the U.S. market.

Consumer behavior and market dynamics

Reduced demand for higher-priced vehicles

Rising vehicle prices due to reciprocal tariffs have altered consumer behavior. Many buyers are now avoiding expensive new cars, opting instead for used vehicles. A recent survey revealed that 56% of consumers expect price increases across various goods, influencing their purchasing decisions. This shift has also led to "doom spending," where consumers rush to buy products before prices rise further. In the automotive market, this behavior has driven up demand for used cars, creating a ripple effect across related industries.

Shift toward domestic automakers and alternative markets

Higher tariffs on imported vehicles have made domestic automakers more competitive. Consumers are increasingly choosing locally manufactured cars, which offer better pricing. This trend benefits U.S. automakers but poses challenges for import-dependent brands. Additionally, some consumers are exploring alternative markets, such as Southeast Asia, for more affordable options. This shift highlights the growing importance of regional trade partnerships in the global automotive industry.

Long-term effects on global economic growth

Slower growth in the automotive sector

The long-term effects of reciprocal tariffs include slower growth in the automotive sector. Higher production costs and disrupted supply chains hinder competition, reducing productivity. The International Monetary Fund warns that widespread trade restrictions could lower global GDP by up to 7%, equivalent to the combined economic output of France and Germany. This decline impacts not only automakers but also related industries, such as logistics and manufacturing.

Ripple effects on related industries

The economic slowdown in the automotive sector affects other industries. Reduced demand for vehicles leads to lower production of components like steel and electronics. Real estate markets also feel the impact, as slower economic growth reduces demand for industrial spaces. These ripple effects highlight the interconnected nature of global industries and the far-reaching consequences of trade policies.

Automakers’ Responses to Reciprocal Tariffs

Emergency strategies to mitigate tariff impacts

Accelerated shipments to the U.S. before tariff deadlines

Global automakers have adopted emergency strategies to minimize the financial burden of reciprocal tariffs. One prominent approach involves accelerating shipments of vehicles and components to the U.S. before tariff deadlines. This tactic allows companies to avoid higher costs associated with the new tariffs. For example, in early 2025, automakers from Europe and Asia significantly increased their exports to the U.S., with some brands reporting a 15% rise in shipments. This surge in activity strained logistics networks, leading to increased demand for shipping services and port facilities.

Stockpiling and inventory adjustments

Stockpiling has emerged as another critical strategy. Automakers are building up inventories in the U.S. to ensure a steady supply of components and vehicles. This approach helps mitigate potential production slowdowns caused by tariff-related disruptions. For instance, manufacturers of automotive electronics have increased their U.S.-based inventory to reduce transportation costs and tariff risks. Companies are also collaborating with dealerships to manage inventory levels effectively, ensuring that supply meets demand despite the volatile trade environment.

Supply chain restructuring and localization

Investments in U.S. manufacturing

To counter the long-term effects of reciprocal tariffs, automakers are investing in U.S. manufacturing facilities. By producing components and vehicles domestically, companies can reduce their reliance on imports and avoid tariff-related costs. However, this strategy requires significant capital investment and time. Despite these challenges, several automakers have announced plans to expand their U.S. operations, signaling a commitment to adapting to the new trade landscape.

Exploring low-tariff regions like Southeast Asia

Some automakers are exploring alternative production hubs in low-tariff regions such as Southeast Asia. These regions offer lower labor costs and favorable trade policies, making them attractive options for manufacturing. A multinational electronics corporation recently shifted its production to Southeast Asia, successfully reducing costs while maintaining competitive pricing. However, companies must address challenges like underdeveloped infrastructure and supply chain limitations in these regions.

Long-term strategies for resilience

Diversification of supply chains

Diversifying supply chains has become a key focus for automakers aiming to build resilience against tariff-related risks. By sourcing materials and components from multiple regions, companies can reduce their dependency on a single market. This approach not only mitigates the impact of tariffs but also enhances supply chain flexibility. For example, an automotive industry leader recently realigned its supplier base, shortening supply lines and diversifying risk.

Focus on innovation and cost efficiency

Innovation and cost efficiency are critical for automakers navigating the challenges of reciprocal tariffs. Companies are investing in advanced technologies to improve supply chain visibility and responsiveness. For instance, integrating digital tools can streamline operations and reduce costs. Additionally, automakers are focusing on developing cost-effective production methods to maintain their competitive edge in a tariff-driven market.

Trump’s reciprocal tariffs have reshaped the global automotive landscape. These policies disrupt supply chains, increase consumer prices, and provoke retaliatory measures. Automakers face rising costs, with companies like Ford and GM estimating $1 billion in additional expenses due to steel and aluminum tariffs.

Daniel Harrison, an automotive analyst, noted that these tariffs create chaos and uncertainty, reducing investment and slowing economic growth.

The future of the automotive industry hinges on adaptability. Companies must innovate, localize production, and diversify supply chains to navigate the challenges of protectionist trade policies effectively.

See Also

Maximizing Opportunities Within Your Automotive Supply Network

Exploring How Global Trade Policies Affect National Economies

Transforming Data Into Insights: Enhancing Automotive Demand Forecasting

Overcoming Obstacles in Automotive Supply Chains: Professional Advice

Understanding Inflation: Managing Disruptions in Supply Chains