How Trump’s Tariffs Are Affecting Global Supply Chains

Recent months have brought a series of executive orders and legal changes to Trump’s tariffs, reshaping global trade.

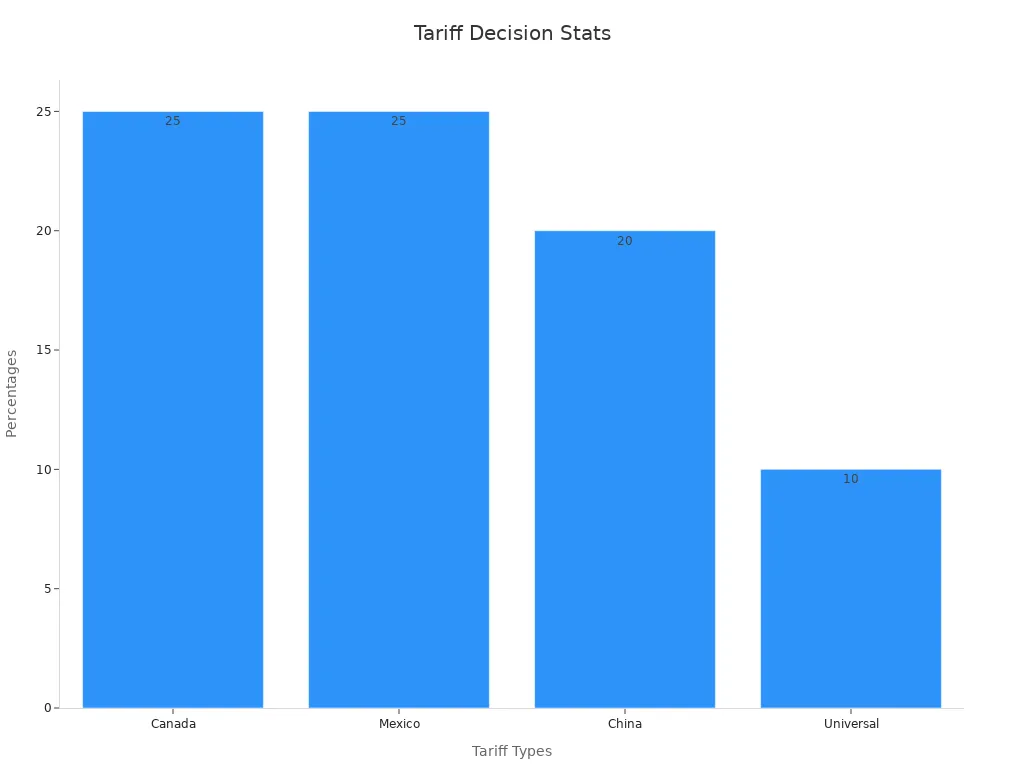

February saw new 10% tariffs on Chinese imports, 25% tariffs on Mexico and Canada, and increased rates for steel and aluminum.

March and April introduced “reciprocal” tariffs and auto import duties, with some exemptions for automakers.

Supply chain professionals now face higher costs and longer delays due to these shifts.

Key Takeaways

Trump’s tariffs remain mostly in effect in 2025, with higher rates on steel, aluminum, autos, and fentanyl-related products impacting major trading partners like China, Canada, Mexico, and the EU.

These tariffs increase costs and delays in supply chains, forcing companies to raise prices and rethink sourcing, compliance, and contract strategies.

Legal rulings have challenged some tariffs, but appeals keep most tariffs active, creating ongoing uncertainty for businesses.

Trade negotiations, including deals with Vietnam and talks with China, use tariffs as leverage to improve market access and reduce some duties.

The July 2025 tariff freeze deadline is a key moment; companies should prepare for possible tariff changes by using scenario planning and staying updated through trusted sources.

Trump’s tariffs: Current Status

Tariff Rates and Scope

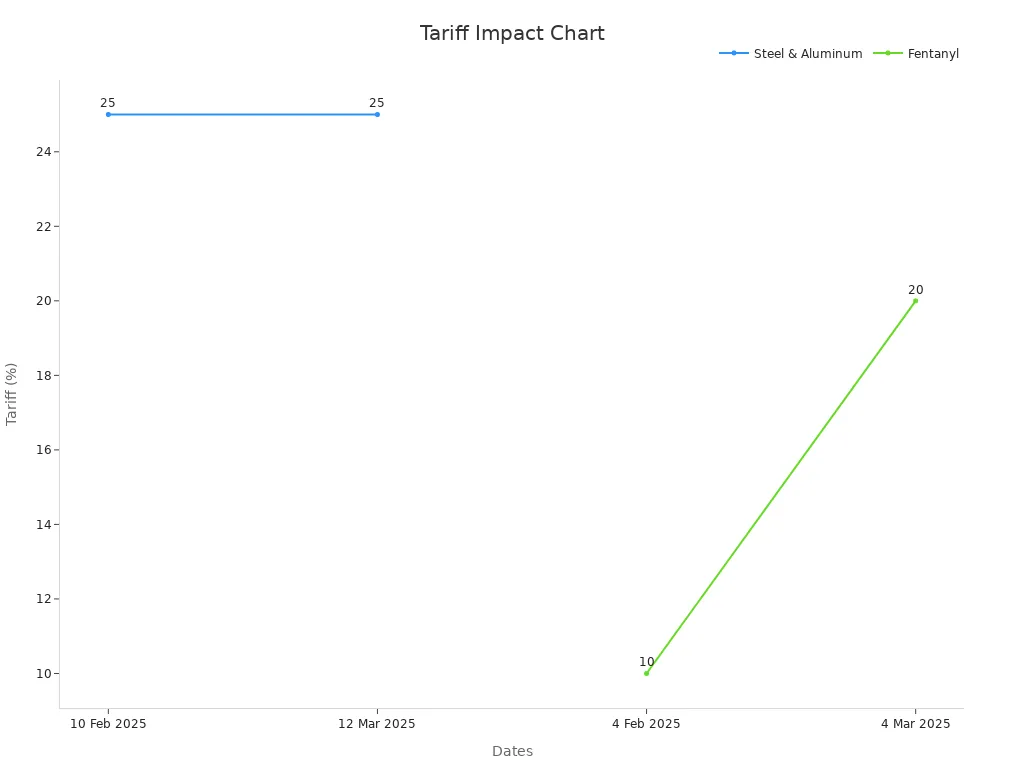

Trump’s tariffs have reshaped the global trade landscape in 2025. The administration imposed a 10% global tariff on most imports, with targeted increases for specific goods. Steel and aluminum tariffs rose from 25% to 50%, citing national security and domestic industry support. The government also introduced a 20% tariff on fentanyl-related products from China, aiming to curb illegal drug flows. These measures cover a wide range of products, including electronics, autos, and agricultural goods.

The scope of Trump’s tariffs extends to major trading partners such as China, Canada, Mexico, and the European Union. Some products, like certain electronics, received exemptions, while others faced new duties under the stacking order executive order. The administration implemented a 90-day freeze on reciprocal tariffs, pausing further increases while negotiations continue.

Trade policy uncertainty has reached historic highs, as measured by the TPU index. This uncertainty causes businesses and households to delay investments and purchases, which slows economic growth. Studies show that the uncertainty surrounding Trump’s tariffs has a real impact on GDP and investment, beyond the direct cost of the tariffs themselves.

Industry reports and government data confirm that these tariffs have led to higher prices for consumers and businesses. For example, a 2023 US International Trade Commission report found that nearly all of the costs from steel, aluminum, and Chinese tariffs passed through to US prices. The White House Fact Sheet from June 2025 highlights increased capacity utilization and investment in domestic industries, but also notes inflationary pressures and shifts in consumer spending.

Recent Legal Actions

Legal challenges have played a major role in shaping the current status of Trump’s tariffs. On May 28, 2025, the U.S. Court of International Trade (CIT) issued a unanimous ruling that declared certain tariffs unlawful under the International Emergency Economic Powers Act (IEEPA). The decision affected the 20% fentanyl-related tariffs on Chinese products, 25% tariffs on Canadian and Mexican goods, and the universal 10% tariffs on all trading partners. However, Section 301 and Section 232 tariffs, including those on steel and aluminum, remain in effect.

Aspect | Details |

|---|---|

Court Decision Date | May 28, 2025 |

Decision Type | Unanimous ruling declaring IEEPA tariffs unlawful for all importers |

Tariffs Affected | - 20% fentanyl-related tariffs on Chinese products |

Appeal Status | Appeal filed with U.S. Court of Appeals for the Federal Circuit (CAFC) |

Stay Request | Government requested stay of execution to keep tariffs in place during appeal |

CAFC Action | Lifted initial block but temporarily stayed CIT injunction pending further review |

Briefing Schedule | Through June 9, 2025 |

The government quickly appealed the CIT ruling. The U.S. Court of Appeals for the Federal Circuit (CAFC) granted a temporary stay, allowing the tariffs to remain in place during the appeal process. The legal battle continues, with a briefing schedule set through June 9, 2025. Businesses affected by these tariffs, especially Canadian exporters and related US companies, face ongoing uncertainty as the courts decide the final outcome.

Key Trade Deals

Trade negotiations have become a central tool in managing the impact of Trump’s tariffs. The administration used tariffs as leverage to secure new agreements, most notably with Vietnam and ongoing talks with China. The Vietnam deal promises zero tariffs on US corn, soybeans, and soybean meal, improving market access for American farmers. Current tariffs on US meat exports to Vietnam range from 8% to 30%, but the new agreement will reduce these rates and enhance competitiveness.

Aspect | Details / Figures |

|---|---|

Vietnam Corn Consumption | 16 million metric tons annually (small compared to China’s 300 million metric tons) |

U.S. Meat Exports to Vietnam 2024 | Beef: 5,052 metric tons valued at $43 million; Pork: 4,662 metric tons valued at $10 million |

Current Tariffs on Meat Products | Range from 8% to 30% depending on product type (e.g., chilled beef carcass 30%, chilled pork 22%) |

Tariffs on Corn, Soybeans, Soybean Meal | Currently low (1%-2%), will go to zero under Vietnam deal |

Vietnam Deal Tariff Impact | Promises zero tariffs on U.S. exports, improving competitiveness against countries with duty-free access |

Expert Opinions | Vietnam deal positive but not a market mover without a large China deal with substantial purchase agreements |

Market Impact | Vietnam deal provides some tariff relief and market access; real impact depends on a major China deal |

Strategic Use of Tariffs | Tariffs used as leverage in trade negotiations, especially to push for larger China agreements |

Market analysts observed a rally in grain and livestock markets after the Vietnam deal announcement, driven by improved sentiment and technical buying. However, experts note that Vietnam’s market is much smaller than China’s. Only a major agreement with China, including large purchase commitments, would significantly shift global commodity markets. Trump’s tariffs remain a strategic lever in these negotiations, shaping both market access and trade volumes.

The US Trade Tariff Exposure Tool and WTO data show that tariff policies directly influence trade volumes, supply chain stability, and economic power balances between major economies. These metrics help businesses assess risk and adapt to changing trade environments.

Trump’s tariffs have also prompted legislative changes, such as the Reciprocal Trade Plan and adjustments to Section 232 tariffs. These moves represent a significant shift from traditional trade policy, challenging established international agreements and increasing the complexity of global supply chains.

Countries and Products Affected

China, Canada, Mexico, EU

China, Canada, Mexico, and the European Union face the largest impacts from Trump’s tariffs. The United States raised tariffs on China to as high as 125% through a series of tit-for-tat actions. The EU saw its effective tariff rate climb from below 2% to about 17%. Canada and Mexico received targeted tariffs on steel, aluminum, and autos. These measures led to major shifts in trade flows and economic output.

US tariffs on China, Canada, and Mexico include steel, aluminum, and cars, with each country facing unique rates and product lists.

The EU responded with its own tariffs, causing US exports to the EU to drop by up to 66% in some scenarios.

Canada and Mexico remain highly dependent on the US market, with over 75% of their exports going to the United States.

Export Share (2022) | Import Share (2022) | Key Export Commodities | Key Import Commodities | Notes | |

|---|---|---|---|---|---|

U.S. - China | 7.7% | 14.8% | Soybeans, machinery | Electronics, diverse goods | Trade shares declined since 2018; US lost market share in agriculture |

U.S. - Mexico | 77% | 56% | Machinery, electronics, oil | N/A | Mexico relies heavily on US trade |

U.S. - Canada | 75% | 56% | Cars, machinery, electronics | N/A | Canada’s top export is vehicles; China is second-largest destination |

Steel, Aluminum, Fentanyl, More

Steel, aluminum, and fentanyl-related products stand at the center of current trade actions. The US imposed a 25% tariff on steel and aluminum imports, effective March 2025, and expanded these to include derivative articles. Canada supplies nearly 40% of US steel imports, making it especially vulnerable to these changes. Aluminum tariffs increased prices for raw materials and affected industries like craft beer, where aluminum cans now make up 75% of packaging volume.

Fentanyl-related imports from China received a 10% tariff in February 2025, which doubled to 20% in March. The US also applied 25% tariffs on automobiles and parts. Canada retaliated with its own 25% tariffs on US steel, aluminum, and autos, disrupting cross-border trade.

Recent data shows that steel and aluminum imports dropped by nearly one-third since 2016. Domestic steel capacity utilization peaked at 80% in 2021 but fell to 75.3% by 2023. Aluminum capacity utilization rose to 61% in 2019, then declined to 55% by 2023. These shifts highlight the broad impact of Trump’s tariffs on both imports and domestic production.

Exemptions and Suspensions

Some sector-specific exemptions exist, but most are temporary and expected to phase out soon. Electronics and certain auto parts received short-term relief, but the administration plans to expand tariff coverage. The 90-day freeze on reciprocal tariffs paused new increases, but this window will close in July 2025.

Note: Tariffs on steel, aluminum, and autos remain under Section 232 and are exempt from the reciprocal tariff regime, adding complexity for compliance teams.

Three scenarios shape the future: a milder status quo with partial suspensions, full tariffs on more products like pharmaceuticals and electronics, or full tariffs plus retaliation. Each scenario brings different risks for supply chains and trade volumes. Companies must monitor these changes closely to manage costs and compliance.

Negotiations and Future Moves

Ongoing Talks

Trade negotiations remain active as the July 2025 tariff freeze deadline approaches. Countries like the EU, Japan, South Korea, and Vietnam continue to meet with U.S. officials. Many nations, including ASEAN members and Australia, have submitted proposals or requested extensions. U.S. Trade Representative Jamieson Greer reports that talks are advancing quickly, with the EU and other partners seeking reciprocal solutions. Technical meetings and video conferences help keep negotiations on track. The EU has proposed a "zero for zero" tariff deal, but the U.S. has not accepted it yet. Countries such as Cambodia, Malaysia, and Taiwan have made progress, while others like Japan and South Korea face deadlocks over auto and steel tariffs.

Status/Key Issues | Date | |

|---|---|---|

EU | Ongoing, contingency plans for July 9 | June 26, 2025 |

Japan | Deadlocked on auto tariffs | June 19, 2025 |

South Korea | Requests extension, steel disputes | June 30, 2025 |

Vietnam | Nearing deal, frequent talks | June 25, 2025 |

Canada | Resumed talks, digital tax dropped | June 30, 2025 |

Tariff Freeze Expiry

The July 9, 2025 deadline marks the end of the 90-day tariff freeze on most imports. During this period, Trump’s tariffs set a 10% baseline, with higher rates for steel and aluminum. Experts highlight this date as a turning point. Businesses face uncertainty, as the freeze allowed time for negotiations but also imposed $82.3 billion in direct costs. If no new deals emerge, tariffs could rise sharply, increasing inflation and supply chain costs. Countries like South Korea have requested extensions, showing the deadline’s importance in ongoing talks.

Possible Scenarios

Companies and policymakers prepare for several outcomes:

Extension of the Freeze: The U.S. may extend the freeze, giving more time for talks and avoiding immediate tariff hikes.

Targeted Tariff Increases: Tariffs could rise for specific products or countries, leading to retaliation and higher costs.

Broad-Based Tariff Hikes: All tariffs could increase, disrupting global trade and supply chains.

Firms use scenario planning, supply chain mapping, and digital tools to manage risks. They analyze tariff exposure, renegotiate contracts, and diversify sourcing. AI-powered forecasting and real-time data help companies adapt to rapid changes. Experts warn that these actions will shape global trade for years to come.

Impact on Supply Chains

Business Costs

Companies face rising expenses as a direct result of new tariff policies. Many small and medium-sized businesses (SMBs) report higher import costs and expect these increases to continue. A late 2024 survey by the Federal Reserve Bank of Boston highlights several key findings:

Importers expect costs to rise by more than 1.5 percentage points within a year under current tariff scenarios.

Under a 10% tariff, importers anticipate cost increases of about 3.6 percentage points.

Firms plan to pass these costs to customers, with expected price hikes reaching 5 percentage points over two years.

The survey included 444 firms and tested different tariff levels to estimate effects on costs and prices.

Non-importing firms expect their costs to fall, showing that tariffs impact importers most.

SMBs predict average tariffs of 20% for China and 15% for Mexico and other regions.

According to the Richmond Fed, most tariffs increase costs for domestic consumers and firms. In 2025, over 30 percent of CFOs named trade and tariffs as their top business concern, up from just 8.3 percent the previous quarter. This shift shows how sensitive businesses have become to tariff-driven cost changes.

Compliance and Legal Risks

Tariff changes create new compliance challenges for supply chain teams. Companies must track shifting product lists, monitor legal rulings, and adjust documentation. Legal risks grow as courts review the legality of certain tariffs. Firms face penalties if they misclassify goods or miss new deadlines. Many businesses invest in compliance software and legal support to manage these risks. Supply chain leaders must stay alert to avoid costly mistakes and ensure they follow all regulations.

Tip: Regularly review updates from trusted sources like Supply Chain Dive to stay ahead of compliance changes.

Retaliatory Actions

Trading partners have responded to US tariffs with their own measures. These retaliatory actions increase uncertainty and disrupt established supply chains. The table below summarizes recent international responses:

Country | Retaliatory Tariff Details | Effective Date |

|---|---|---|

China | 34% tariff on all US imports, targeting agricultural products and energy | April 10, 2025 |

Canada | 25% tariff on US-origin autos, expanded surtax on a wider range of US goods | April 2025 |

European Union | Reinstated tariffs on US steel and aluminum; new tariffs on agricultural products, alcohol, textiles, household items | Mid-April 2025 |

Brazil | Announced retaliatory measures; WTO challenge citing violation of US commitments | 2025 |

Japan | Considering countermeasures; initiated talks to seek tariff exemptions | 2025 |

South Korea | Expressed opposition; considering countermeasures | 2025 |

Malaysia | Expressed opposition; considering countermeasures | 2025 |

These actions force companies to rethink sourcing, pricing, and logistics strategies. Firms that export to these countries must prepare for higher costs and possible delays.

Trump’s tariffs continue to reshape global supply chains. Supply chain professionals face rising costs, shifting sourcing locations, and new compliance risks. Major countries impacted include China, Canada, Mexico, and the EU, with steel, aluminum, and autos among the hardest-hit products.

Companies now use scenario planning, data analytics, and supplier diversification to adapt.

Experts recommend regular audits, accurate tariff code classification, and proactive contract updates.

Stay informed on policy shifts and key dates, such as the July 2025 tariff freeze expiration, with resources like Supply Chain Dive.

FAQ

What is the current status of Trump’s tariffs in 2025?

Most tariffs remain in effect. The U.S. government continues to enforce 10% global tariffs and higher rates for steel, aluminum, and fentanyl-related products. Legal appeals and ongoing negotiations may change these rates soon.

Which countries face the highest tariffs from the U.S.?

China, Canada, Mexico, and the European Union face the highest tariffs. The U.S. targets these countries with increased duties on steel, aluminum, autos, and select electronics.

How do these tariffs impact supply chain costs?

Tariffs raise import costs. Companies report higher prices for raw materials and finished goods. Many businesses pass these costs to customers, which leads to higher prices in stores.

Tip: Firms use scenario planning and supplier diversification to manage rising costs.

Are any products exempt from current tariffs?

Some electronics and auto parts have temporary exemptions. Most exemptions are short-term and may end after the July 2025 tariff freeze. Companies should monitor updates closely.

Where can supply chain professionals find reliable updates?

Supply Chain Dive provides timely news, expert analysis, and free newsletters. Professionals can subscribe to stay informed about tariff changes, legal actions, and trade negotiations.

See Also

Exploring How Global Trade Policies Shape Economic Growth

The Importance Of Supply Chains In International Trade

Understanding Inflation Through Supply Chain Challenges Today