The Ripple Effect of US Tariffs on China’s Air Logistics Industry

The recent implementation of US tariffs on small parcels has sent shockwaves through China’s air logistics sector. This policy change has disrupted a system that once thrived on efficiency and cost-effectiveness. Industry analysts predict significant consequences for operations.

Delivery costs are projected to rise by up to 50%, increasing financial strain on logistics companies.

Shipment times will likely extend from 7–14 days to 14–21 days, rivaling sea freight durations.

Customs clearance costs per parcel, previously 10 cents, are now expected to reach $3.

These changes threaten the sector’s ability to meet consumer expectations, posing critical questions about its future adaptability.

Key Takeaways

US tariffs on small packages have made delivery 50% pricier, hurting logistics companies' profits.

Shipping times may grow from 7–14 days to 14–21 days, making air shipping less appealing than sea shipping.

Removing the de minimis rule means higher customs fees for Chinese products, so sellers must change their prices.

Logistics companies are finding new markets and using technology to stay competitive with the new tariffs.

Shoppers are buying more items early to avoid price hikes, which changes how people shop and affects demand.

Overview of the New US Tariffs on Small Parcels

Key changes in the de minimis policy

The de minimis policy, which determines the threshold for duty-free imports, has undergone significant changes. Previously, the United States allowed imports valued under $800 to enter duty-free, one of the highest thresholds globally. This policy provided a competitive advantage for cross-border e-commerce, particularly for small parcels from China. However, the recent adjustment eliminates this exemption for Chinese goods, subjecting them to tariffs regardless of their value.

A comparison of global de minimis thresholds highlights the disparity:

Country/Region | De Minimis Threshold | Additional Notes |

|---|---|---|

United States | $800 | One of the highest globally |

European Union | €150 (approx. $156) | Lower than U.S. threshold |

China | 50 Yuan (approx. $7) | Stricter rules with pre-registration required |

This shift marks a departure from the previous policy, aligning with broader trade strategies aimed at addressing trade imbalances.

Scope and rates of the new tariffs

The new tariffs on small parcels from China introduce a multi-layered structure. Goods now face cumulative tariffs ranging from 55% to 60%, with some reaching as high as 89%. The policy includes:

A 10% global tariff effective April 5, 2025.

Higher reciprocal tariffs starting April 9, 2025.

Sector-specific tariffs, such as a 25% levy on automotive goods, effective April 3, 2025.

These rates significantly increase the cost of importing goods, particularly for e-commerce platforms reliant on low-cost products. The added financial burden reshapes the competitive landscape for Chinese exporters and logistics providers.

Rationale behind the policy shift

The rationale for these changes stems from multiple factors. Policymakers emphasize reciprocity, deficit reduction, and domestic protection as key drivers. However, critics argue that the policy lacks transparency and fairness. For instance:

The 10% baseline tariff contradicts the principle of reciprocity by targeting low-tariff allies.

Exemptions for certain nations create an uneven playing field.

Residual analysis suggests additional penalties for high-deficit developing countries.

The administration frames these tariffs as a means to protect national security and reduce trade deficits. Yet, the complex calculation process and selective exemptions raise questions about the policy's true objectives.

Impact on China’s Air Logistics Sector

Rising operational costs and squeezed profit margins

The cancellation of the de minimis policy has significantly increased operational costs for China’s air logistics companies. Freight rates have surged, with trans-Pacific and Asia-Northern Europe container rates now 50% higher than in April and nearly three times higher than a year ago. Prices for shipments from Asia to the U.S. West Coast hover around $6,000 per forty-foot equivalent unit, exceeding $7,500 for deliveries to the East Coast. These elevated costs directly impact profit margins, forcing companies to reevaluate their pricing strategies.

High interest rates, currently at 7%, further exacerbate the financial strain. Logistics providers face difficulties investing in technology and infrastructure, which are essential for maintaining competitiveness. The reliance on low-cost strategies becomes unsustainable as tariffs on small parcels from China increase product costs, reducing consumer demand and order volumes. This decline in cargo sources creates a vicious cycle, where insufficient load factors dilute transportation costs, squeezing profit margins even further.

Challenges in maintaining efficiency and competitive pricing

Efficiency and competitive pricing have long been the cornerstones of China’s air logistics sector. However, the new US Tariffs on Small Parcels disrupt this balance. A study on Zhengzhou’s aviation logistics cluster highlights the sector's moderately low competitiveness, stemming from inadequacies in foundational and regulatory subsystems. These weaknesses hinder the ability to streamline operations and optimize pricing strategies.

The extended customs clearance process adds another layer of complexity. Logistics companies must allocate additional resources to comply with new regulations, including detailed reporting to U.S. Customs and Border Protection. This increases the risk of delays and errors, undermining the speed advantage of air freight. As shipment times extend from 7–14 days to 14–21 days, customers may shift to alternative modes of transport, such as sea freight, further challenging the sector’s ability to retain its competitive edge.

Disruptions in air cargo routes and capacity

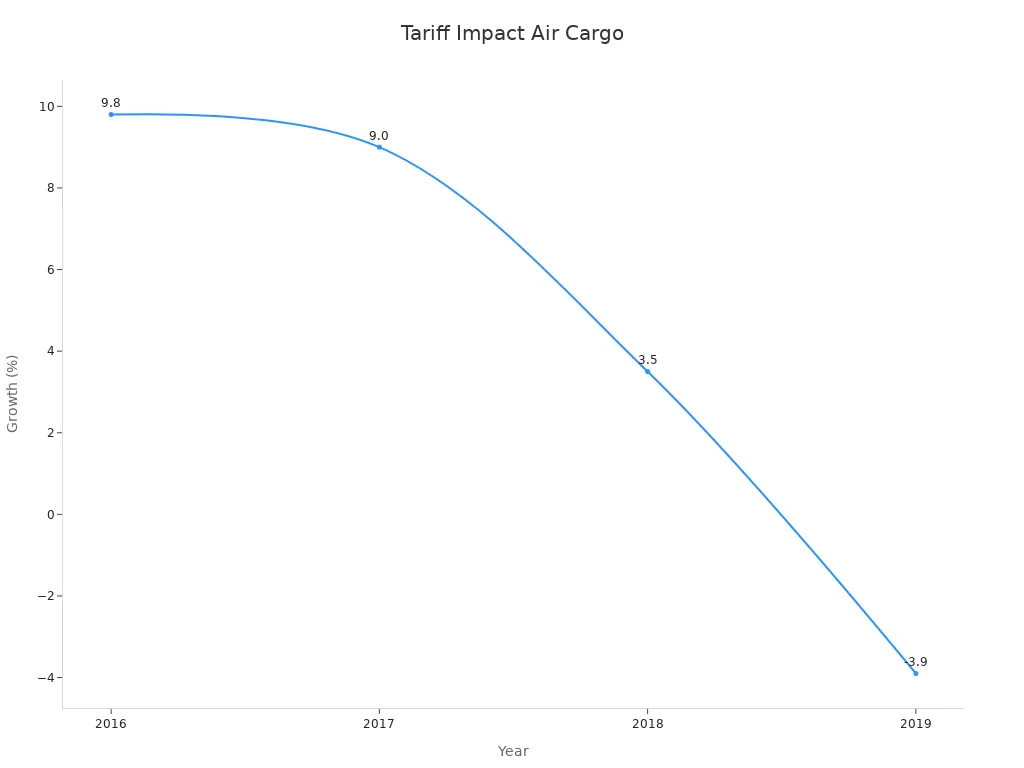

The policy shift has also disrupted air cargo routes and capacity planning. Reduced demand for cross-border e-commerce parcels forces logistics providers to reconsider their route networks and fleet utilization. Historical data illustrates the volatility in air cargo demand growth and load factor changes:

Year | Air Cargo Demand Growth (%) | Load Factor Change (%) | Freighter Fleet Growth (%) |

|---|---|---|---|

2016 | 9.8 | N/A | N/A |

2017 | 9.0 | N/A | N/A |

2018 | 3.5 | -2.6 | N/A |

2019 | -3.9 | N/A | 4% (widebody), 5% (narrowbody) |

The decline in demand growth and load factors underscores the challenges in maintaining profitability. Wide-body freighters, once in high demand, now face underutilization, leading to inefficiencies in fleet operations. Logistics companies must adapt by exploring alternative markets and optimizing their capacity to align with shifting trade flows.

Emerging markets such as ASEAN, Latin America, and Russia offer potential opportunities. For instance, China’s exports to Brazil increased by 22% year-on-year in 2024, while exports to Russia grew by 4%. By diversifying trade routes and focusing on these regions, air logistics providers can mitigate the impact of reduced U.S. demand and stabilize their operations.

Broader Implications for Trade and E-Commerce

Effects on cross-border e-commerce platforms and sellers

The removal of the de minimis exemption for Chinese goods has forced cross-border e-commerce platforms to reevaluate their operational strategies. Sellers who relied on duty-free imports now face higher costs, which disrupt their pricing models. Many brands are adjusting their global strategies to maintain profitability amidst rising tariffs. This shift has created a ripple effect across the industry, impacting logistics providers, sellers, and consumers alike.

A significant 81% of e-commerce decision-makers believe that changing tariffs and regulations could jeopardize their global strategies.

The U.S. government plans to extend the removal of the de minimis exemption to all countries, further complicating customs processes and increasing costs.

Brands are exploring alternative sourcing options and diversifying their markets to mitigate the financial strain caused by tariffs.

These changes highlight the need for innovation and adaptability within the e-commerce sector. Sellers must navigate complex regulatory landscapes while maintaining competitive pricing and customer satisfaction.

Shifts in consumer behavior and demand

Tariff adjustments have triggered noticeable shifts in consumer behavior. Many shoppers are acting preemptively, stocking up on goods before price increases take effect. This trend is particularly evident in categories reliant on imported products, which face significant challenges due to rising tariffs.

Recent foot traffic data shows consumers visiting warehouse clubs at record levels, pulling forward demand as they anticipate tariff impacts.

Categories such as electronics and apparel, heavily dependent on imports, are experiencing heightened demand as consumers prepare for potential cost hikes.

These behavioral changes reflect growing consumer awareness of trade policies and their economic implications. While some buyers may temporarily increase spending, others may reduce discretionary purchases, leading to long-term shifts in demand patterns. Retailers must adapt by offering promotions or sourcing alternative products to retain customer loyalty.

Changes in global trade dynamics and supply chains

The new US tariffs on small parcels have reshaped global trade dynamics, prompting businesses to reconsider their supply chain strategies. The end of de minimis benefits has increased customs costs and extended processing times, creating inefficiencies in international trade. Companies are now exploring alternative trade routes and emerging markets to offset the impact of reduced U.S. demand.

Region | Export Growth (2024) | Key Opportunities |

|---|---|---|

ASEAN | +15% | Rising demand for consumer goods |

Latin America | +22% (Brazil) | Expanding middle-class consumption |

Russia | +4% | Increased demand for industrial goods |

These shifts underscore the importance of diversification in global trade strategies. Logistics providers are focusing on regions like ASEAN and Latin America, where export growth remains strong. By aligning supply chains with emerging markets, businesses can stabilize operations and reduce dependency on traditional trade partners.

Note: The evolving trade landscape presents both challenges and opportunities. Companies that adapt quickly to these changes will gain a competitive edge in the global market.

Strategic Responses by Chinese Logistics Companies

Diversification of markets and trade routes

Chinese logistics companies are actively diversifying their markets and trade routes to mitigate the impact of US tariffs. By shifting focus to emerging markets such as ASEAN, Latin America, and Russia, these companies aim to reduce dependency on the United States. This strategy not only spreads risk but also builds resilience against regional disruptions.

Risk reduction: Diversified supply chains help companies avoid large-scale impacts from supplier or regional failures.

Building resilience: Companies can adapt to unexpected changes, ensuring smooth operations even during crises.

Encouraging innovation: Collaborating with diverse suppliers introduces new technologies and processes, enhancing competitiveness.

For instance, China's exports to Brazil grew by 22% in 2024, while exports to Russia increased by 4%. These figures highlight the potential of emerging markets as viable alternatives to traditional trade routes.

Note: Diversification also ensures compliance with complex trade regulations, reducing the burden of navigating tariff policies.

Investments in alternative logistics solutions

To adapt to the evolving trade landscape, Chinese logistics companies are investing in alternative logistics solutions. Retailers are prioritizing flexible technologies, such as predictive analytics and nimble warehouse management systems, to enhance operational efficiency. These tools provide end-to-end visibility, enabling companies to assess risks and make data-driven decisions.

Many businesses are relocating supply chains to countries like Vietnam and India, reducing exposure to US tariffs.

Advanced logistics technologies allow companies to respond quickly to market demands, ensuring scalability and cost management.

The 64% drop in container bookings in early April 2025 underscores the urgency of adopting innovative solutions. By leveraging these technologies, logistics providers can maintain profitability while navigating tariff-induced disruptions.

Collaboration with international partners to reduce costs

Collaboration with international partners has become a cornerstone strategy for Chinese logistics companies. By forming alliances with global players, they can share resources, optimize routes, and reduce operational costs. These partnerships also facilitate knowledge exchange, fostering innovation and efficiency.

Tip: Joint ventures with regional logistics firms in ASEAN and Latin America can help Chinese companies tap into local expertise and infrastructure.

Such collaborations not only lower costs but also enhance service quality, enabling companies to remain competitive in a challenging global market.

The US tariffs on small parcels have reshaped China’s air logistics sector, increasing operational costs and complicating customs procedures. These changes have disrupted efficiency and reduced profitability, forcing companies to reevaluate their strategies.

Key Insight: The ripple effects extend beyond logistics, influencing global trade dynamics and consumer behavior.

Chinese logistics providers are exploring emerging markets and investing in innovative solutions to adapt. Collaboration with international partners and diversification of trade routes will likely define the sector’s future. These strategies may foster resilience and unlock new growth opportunities in a rapidly evolving global economy.

FAQ

Why are operational costs rising for Chinese logistics companies?

The removal of the de minimis exemption has introduced tariffs and complex customs procedures. These factors increase transportation and administrative expenses. Additionally, reduced cargo volumes dilute cost efficiency, further straining profit margins for logistics providers.

What opportunities exist for Chinese logistics companies despite the tariffs?

Emerging markets like ASEAN, Latin America, and Russia offer growth opportunities. Diversifying trade routes and investing in innovative logistics solutions can help companies adapt. Collaboration with international partners also reduces costs and enhances operational resilience.

How might consumer behavior change due to these tariffs?

Consumers may stockpile goods before price hikes or shift to alternative products. Discretionary spending could decline as prices rise, altering demand patterns. Retailers must adapt by offering promotions or sourcing cost-effective alternatives to retain customer loyalty.

See Also

Analyzing Current Trends in Logistics Risk Management

Transforming Future Logistics Through Artificial Intelligence Innovations

Exploring How Global Trade Policies Affect Economic Growth

The Role of Cloud Solutions in Modern Supply Chains

Understanding the Importance of Supply Chains in Global Trade