The Impact of the New US-Vietnam Trade Agreement on Supply Chains

The US-Vietnam Trade Agreement brings rapid changes to global supply chains. New tariffs and expanded market access now redefine sourcing and production choices for companies. For example, the tariff on Vietnamese exports to the US now stands at 20%, while US goods enter Vietnam tariff-free. Compliance requirements also grow more complex as transshipped goods face a 40% tariff. These shifts demand close attention from supply chain professionals, procurement teams, and business leaders.

Metric | Value | Explanation |

|---|---|---|

$15.9 billion | Goods rerouted due to previous tariffs | |

14.3% | Year-over-year increase in total exports | |

US market share of Vietnam’s exports | $119.6 billion | Largest export destination |

Key Takeaways

The US-Vietnam Trade Agreement changes tariffs, with a 20% tariff on Vietnamese exports to the US and zero tariffs on US goods entering Vietnam, pushing companies to rethink sourcing and pricing.

The agreement opens new market opportunities for US exporters by allowing tariff-free access to Vietnam, encouraging growth in sectors like agriculture and machinery.

Companies face stricter rules on transshipment and compliance, requiring careful tracking of product origins and strong documentation to avoid high tariffs and penalties.

Supply chain strategies like localization and diversification help businesses reduce risks, lower costs, and improve resilience against global disruptions.

Vietnam is becoming a key manufacturing hub, attracting investment and driving supply chain shifts, while companies must stay alert to evolving trade policies and adapt quickly.

Immediate Impact

Tariff Changes

Tariff changes have created a new landscape for companies trading between the United States and Vietnam. The Trump administration's policies raised the U.S. weighted average applied tariff from 1.5% in 2022 to an estimated 16.0%. Without changes in trade behavior, the average effective tariff rate would reach 14.4%. After accounting for import reductions, the rate stands at 12.3%, the highest since 1941. These numbers show how much tariffs have increased for many trading partners.

Sector/Industry Level | Tariff Rate Before BTA | Tariff Rate After BTA |

|---|---|---|

Overall (2-digit level) | 23.4% | 2.5% |

Manufacturing | 33.8% | 3.6% |

Agriculture & Primary | Modest reductions | Modest reductions |

This table highlights the dramatic drop in tariffs after the U.S.-Vietnam Bilateral Trade Agreement (BTA), especially in manufacturing. Companies now face a 20% tariff on Vietnamese imports to the U.S., while U.S. exports to Vietnam enter with zero tariffs. These changes force businesses to rethink sourcing and pricing strategies.

Market Access

The agreement has opened new doors for U.S. exporters. American companies now enjoy tariff-free access to Vietnamese markets. This shift encourages more U.S. products to enter Vietnam, boosting export opportunities and supporting economic growth.

Companies are already adjusting their supply chains:

Many firms are moving production from China to Vietnam and other Southeast Asian countries.

Businesses seek to diversify supply chains, making them stronger against global risks.

The deal is expected to help new markets grow and improve supply chain resilience.

These immediate impacts push companies to realign their operations. They must adapt quickly to stay competitive in a changing trade environment.

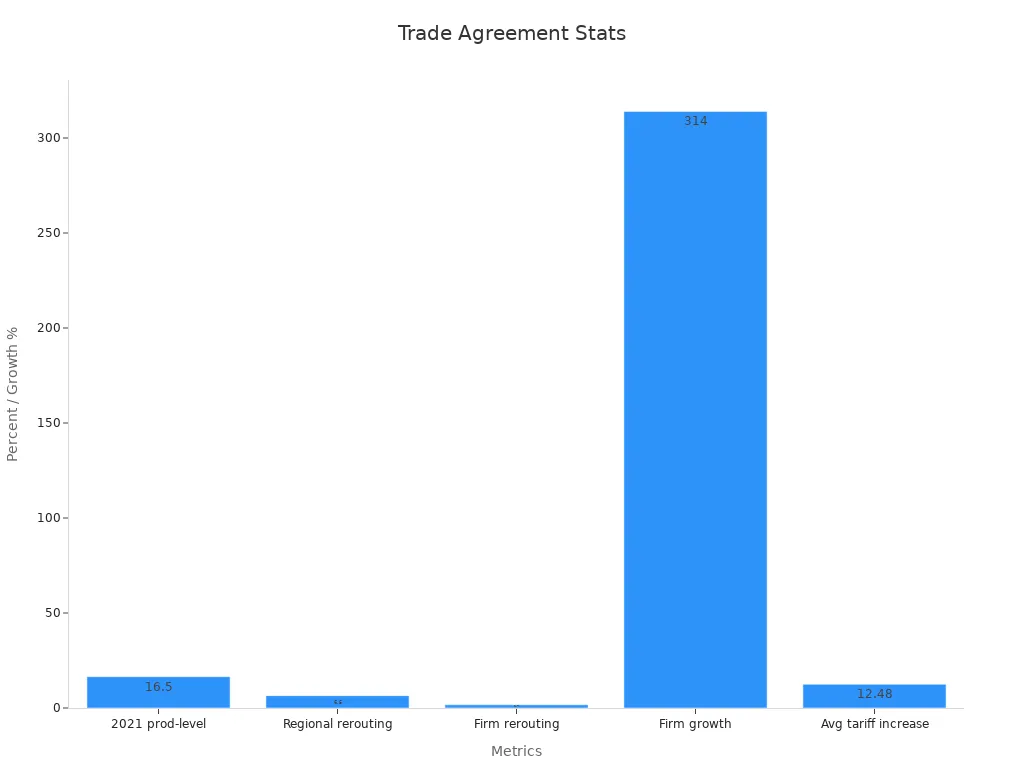

US-Vietnam Trade Agreement Provisions

Tariff Structure

The US-Vietnam Trade Agreement introduces a new tariff landscape that changes the way companies plan their supply chains. Vietnamese goods entering the US now face a 20% tariff. At the same time, US products can enter Vietnam without any tariffs. This shift creates both challenges and opportunities for businesses on both sides.

South Korean firms, such as Samsung, have invested heavily in Vietnam. Samsung alone has invested $23.2 billion and exported $54.4 billion worth of goods from Vietnam last year. This makes up 13.4% of Vietnam’s total exports.

The competitiveness of Vietnamese goods in the US market now depends on how the new tariff rates compare to those of China and other regional players.

Many companies, including those from South Korea, are reviewing their business plans because of the uncertainty around the new tariffs.

ANZ Bank reports that the agreement reduces uncertainty for businesses in Vietnam, helping the country remain an attractive manufacturing hub.

The agreement sets a benchmark for other Asian countries in future trade talks.

The new tariff structure forces companies to rethink sourcing and manufacturing locations. Some may shift production to countries with lower tariffs. Others may invest more in Vietnam to take advantage of its strong manufacturing base and improved market access for US goods.

Transshipment Rules

The agreement also targets transshipment, which is when companies reroute goods through Vietnam to avoid higher tariffs. Goods identified as transshipped now face a 40% tariff. This rule aims to stop companies from using Vietnam as a backdoor to the US market.

Bloomberg estimates that Vietnam could lose up to 25 percent of its US exports in the long term because of stricter transshipment enforcement. This loss could impact over 2 percent of Vietnam’s annual GDP. The agreement does not set a clear rule for what counts as transshipment. However, analysts expect US authorities to use a near-zero tolerance approach. Even goods with as little as one percent Chinese content could face the higher tariff. This strict standard means companies must track the origin of every component in their products.

Compliance Requirements

The US-Vietnam Trade Agreement brings new compliance challenges for supply chain managers. Companies must now prove the origin of their goods and follow strict documentation rules. This process requires careful record-keeping and regular audits.

Recent trade agreements, such as those involving the US, EU, and Canada, have added more rules about labor standards and digital trade. These agreements now include monitoring, cooperation, and dispute settlement systems.

The US, EU, China, and India each have different rules for digital trade and data governance. These differences affect how companies manage cross-border data and digital transactions.

Regional trade agreements now include flexible rules for new technologies like artificial intelligence. These rules focus on cooperation and setting up frameworks for future growth.

Companies must adapt to these evolving requirements. They need to invest in compliance systems and train staff to handle new documentation and reporting standards. Strong compliance helps avoid costly penalties and keeps supply chains running smoothly.

Tip: Businesses should review their supply chain routes and sourcing strategies regularly. Staying updated on compliance rules can help avoid unexpected costs and delays.

Sector Impacts

Electronics

Electronics manufacturers face new challenges and opportunities under the US-Vietnam Trade Agreement. Many global brands, including Samsung, have invested in Vietnam to take advantage of its skilled workforce and competitive costs. The 20% tariff on Vietnamese exports to the US increases costs for electronics shipped to American consumers. Companies may look for ways to localize production or shift some operations to other countries. Despite these changes, Vietnam remains a key hub for electronics assembly and export. Firms must monitor tariff changes and adjust their supply chains to stay competitive.

Textiles

The textiles sector shows clear signs of adjustment after the trade agreement.

U.S. apparel import growth slowed to 3.2% in value and 1.5% in quantity in early 2025, down from 18-19% increases in late 2024.

Unit prices of U.S. apparel imports rose, with Vietnam's import unit price up by 3.6%.

Sourcing diversification by U.S. fashion companies slowed, while top Asian suppliers kept or slightly increased their market shares.

Vietnam and ASEAN countries export about 40% of their apparel to the U.S., showing strong market dependence.

Near-shoring from Western Hemisphere countries declined in quantity, but use of trade agreement rules increased.

Vietnam's textiles sector is growing moderately, with a projected 3.35% increase in value added by 2025. The EU-Vietnam Free Trade Agreement and rising demand for sustainable fabrics support this growth. Government policies and favorable economic conditions also help the sector expand.

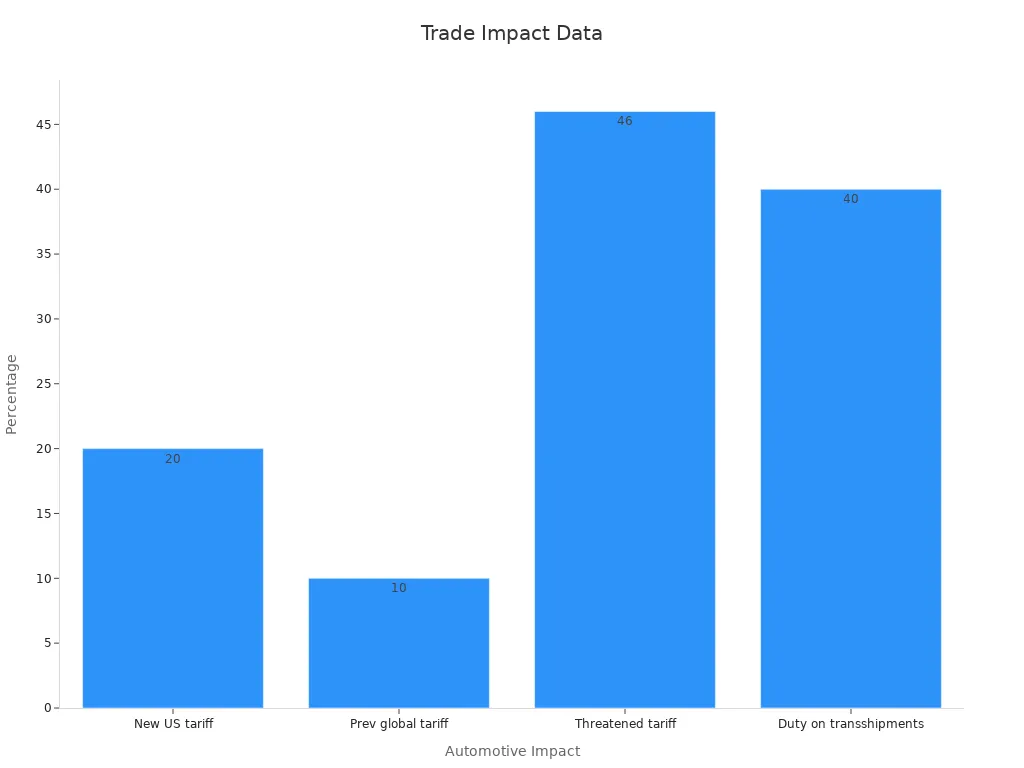

Automotive

The automotive industry experiences significant changes due to the new tariff structure. The US-Vietnam Trade Agreement sets a 20% tariff on Vietnamese automotive imports to the US, double the previous global rate but lower than the threatened 46%. Vietnam exported $1.1 billion in vehicles and components to the US in 2024. The agreement also imposes a 40% duty on transshipments from third countries, discouraging tariff circumvention.

Aspect | Numerical Value | Explanation |

|---|---|---|

New US tariff on Vietnamese automotive imports | 20% | Double the previous 10% global tariff |

Previous global tariff | 10% | Baseline before the new agreement |

Threatened US tariff (not applied) | 46% | Higher tariff initially threatened |

Vietnam's automotive exports to US (2024) | $1.1 billion | Value of vehicles and components exported |

Duty on transshipments from third countries | 40% | Duty to prevent tariff circumvention |

Agriculture

Agriculture faces both opportunities and challenges under the new agreement. Technical measures, such as Sanitary and Phytosanitary (SPS) and Technical Barriers to Trade (TBT), increase the chance for Vietnamese agricultural firms to enter the US market. SPS measures can restrict trade volume, while TBT measures help expand import volumes, especially for large firms. Tariffs act as trade barriers, reducing both market entry and trade volume. Agricultural products often face higher trade costs due to perishability and strict standards. The new trade agreements and technical regulations encourage market entry and expansion, but effects differ by product type and firm size.

Note: Agricultural exporters must pay close attention to technical standards and compliance requirements to succeed in the US market.

Supply Chain Strategies

Localization

Localization helps companies adapt to new tariffs and compliance rules. By moving production and distribution closer to key markets, businesses can lower shipping costs and respond faster to customer needs. Many firms now build factories or warehouses near demand centers. For example, Tesla’s Gigafactory and Amazon’s local fulfillment centers show how localization improves delivery speed and supply chain control. The table below highlights the benefits of this approach:

Aspect | Evidence | Impact |

|---|---|---|

Reduced Transportation Costs & Lead Times | Localized supply chains near demand clusters | Lower shipping expenses, faster delivery |

Resilience Against Disruptions | Local suppliers faced fewer interruptions during COVID-19 | Improved stability and quick response |

Consumer Demand for Sustainability | Supports premium pricing for local products | |

Regulatory Incentives | Policies like the U.S. CHIPS Act support local production | Encourages compliance and cost savings |

Technological Advancements | Automation and 3D printing enable local manufacturing | Makes localization more affordable |

Companies that localize can also meet growing consumer demand for sustainable and transparent products. Regulatory incentives and new technologies make this strategy even more attractive.

Diversification

Diversification strengthens supply chains by reducing reliance on a single country or supplier. The US-Vietnam Trade Agreement encourages companies to explore new sourcing options and spread risk. Many firms now use a "China+1" strategy, adding Vietnam or other countries to their supply networks. This approach helps protect against disruptions and market changes.

Different sectors feel supply chain pressures in unique ways, so diversification strategies must fit each industry.

Companies use reshoring, friendshoring, and vertical integration to manage risk.

Quantitative models show that diversified supply chains recover faster from shocks and shortages.

International cooperation and infrastructure investment also support resilience.

By diversifying, businesses can handle global uncertainties and keep operations running smoothly.

Compliance Planning

Compliance planning has become essential under the new trade agreement. Companies must track the origin of every product and follow strict documentation rules. Regular audits and staff training help avoid costly mistakes. Firms that invest in compliance systems can adapt quickly to changing regulations.

Tip: Supply chain managers should review routes and sourcing plans often. Staying updated on compliance rules prevents delays and extra costs.

Strong compliance planning supports supply chain integrity and builds trust with partners and customers.

Risks and Opportunities

Geopolitical Tensions

Geopolitical tensions shape both risks and opportunities for supply chains in Vietnam and the broader region. Recent years have seen disruptions from the Sino-US trade war and the COVID-19 pandemic. These events caused shortages, higher transportation costs, and production delays. Companies responded by shifting production away from China and toward Vietnam, especially in the Red River Delta. This move created a new mobile phone production cluster and strengthened Vietnam’s role as a manufacturing hub.

Aspect | Evidence of Risks | Evidence of Opportunities |

|---|---|---|

Geopolitical Context | Trade wars and pandemics disrupted supply chains and increased costs. | Companies adopted "China+1" strategies to diversify sourcing. |

Production Network Shift | Decoupling from China’s coastal regions due to rising risks. | Recoupling with Vietnam, boosting regional development and new clusters. |

Corporate Strategy | Firms adjusted schedules and inventory to manage disruptions. | Strategic diversification improved resilience and regional growth. |

Regional Impact | Global and regional trade faced instability and delays. | Vietnam emerged as a key beneficiary and production hub. |

A recent study shows that external geopolitical risks and economic policy uncertainty from major trade partners affect Vietnam’s stock market. Economic policy uncertainty has a stronger impact on market volatility than geopolitical risks. These factors can cause both short-term and long-term changes in returns. Policymakers and investors use this information to manage risks and plan for uncertainty.

Note: Companies that join global value chains often learn and adapt through real-world experience. Process innovation after entering export markets helps firms minimize risks and seize new opportunities.

Investment Trends

Investment patterns have shifted as companies adapt to new supply chain realities. Several trends stand out:

Tariffs on Chinese inputs push Vietnam to reduce its reliance on China for manufacturing.

U.S. agribusiness firms, such as Deere & Co. and Bakery Products International, benefit from tariff-free access and rising demand in Vietnam.

Vietnam’s real estate and infrastructure sectors attract more investment because they face fewer transshipment risks and depend less on Chinese components.

Textile and electronics sectors in Vietnam experience margin pressures and supply chain challenges due to their links with China.

Investors use hedging strategies, like currency forwards and short positions in Chinese tech ETFs, to manage risks from currency changes and geopolitical shifts.

Funding now favors sectors less exposed to Chinese supply chain risks, with growing interest in U.S. agribusiness and Vietnam’s domestic industries.

These trends highlight how companies and investors respond to changing risks and opportunities. By focusing on process innovation and diversification, firms can build more resilient supply chains and capture new growth.

Future Outlook

Long-Term Shifts

Vietnam stands at the threshold of major supply chain transformation. By 2030, the country aims to become a leading logistics hub in Southeast Asia. This vision relies on large-scale infrastructure upgrades and a focus on digital transformation. Foreign investment continues to rise as companies seek to diversify supplier bases and reduce exposure to geopolitical risks. Businesses invest in advanced technologies to boost supply chain resilience and efficiency.

Key strategies for the next decade include:

Diversifying supply chains to avoid overreliance on any single market.

Integrating new technologies for better visibility and faster decision-making.

Adapting to evolving trade policies and compliance requirements.

Investing in logistics management to reduce costs and improve delivery times.

Building production facilities closer to end markets.

Strategy/Factor | Objective/Driver | Benefit/Challenge |

|---|---|---|

Supply Chain Diversification | Reduce dependency on single markets | Mitigate risk of disruption |

Technological Integration | Improve visibility and responsiveness | Enhance operational efficiency and decision-making |

Legislative Compliance | Adapt to new policies | Protect profit margins and competitive edge |

Logistics Management | Cost and efficiency of goods movement | Adaptation to disrupted supply lines |

Proximity to Markets | Localized manufacturing | Investment in new production facilities |

Egypt’s Vision 2030 offers a global example. The country’s push for localization and infrastructure investment has attracted more foreign direct investment and strengthened its manufacturing base. This approach highlights how strategic planning can shape supply chain evolution.

Policy Watch

Trade policy will remain a moving target. Regular monitoring and adaptation are essential for companies operating in global markets.

Ongoing policy reviews by the Treasury Department and the White House Council on Supply Chain Resilience help identify risks and opportunities. Enforcement actions, such as updates to the Uyghur Forced Labor Prevention Act Entity List, show a commitment to ethical sourcing. Adjustments to tariff exclusions and new investigations into labor practices reflect a flexible approach to trade remedies.

Participation in multilateral agreements, like the WTO Fisheries Subsidies Agreement, signals a willingness to engage with evolving international rules. National security advisors now emphasize integrated economic strategies, moving beyond traditional trade liberalization. Companies that stay alert to these changes will better manage risks and seize new opportunities.

Vietnam’s export share to the US has grown sharply, with the trade surplus reaching $116 billion in 2022. This shift highlights Vietnam’s rising role as a supply chain hub.

Companies should diversify suppliers, invest in digital tools, and build strong local partnerships. They must also monitor policy changes and focus on sustainability to stay resilient as trade rules evolve.

FAQ

What is the main change in tariffs under the new US-Vietnam Trade Agreement?

The United States now applies a 20% tariff on imports from Vietnam. U.S. exports to Vietnam enter with zero tariffs. This change affects sourcing and pricing for many companies.

How does the agreement address transshipment?

The agreement sets a 40% tariff on goods identified as transshipped through Vietnam. This rule discourages companies from rerouting products to avoid tariffs. Firms must track product origins closely.

Which industries feel the biggest impact?

Electronics, textiles, automotive, and agriculture experience the most significant changes. Each sector faces new compliance rules, cost structures, and sourcing challenges.

What steps can companies take to adapt?

Companies can localize production, diversify suppliers, and invest in compliance systems. Regularly reviewing supply chain routes helps avoid unexpected costs and delays.

Does the agreement create new opportunities for U.S. exporters?

Yes. U.S. exporters now have tariff-free access to Vietnam’s market. This access supports growth in sectors like agriculture, machinery, and consumer goods.

See Also

The Importance Of Supply Chains In Worldwide Trade

How Global Trade Policies Shape Economic Growth And Stability

Addressing Challenges In Expanding Supply Chains Globally

Robotics Technology Transforming The Future Of Supply Chains