What Every Business Should Know About Cargo Transportation Insurance

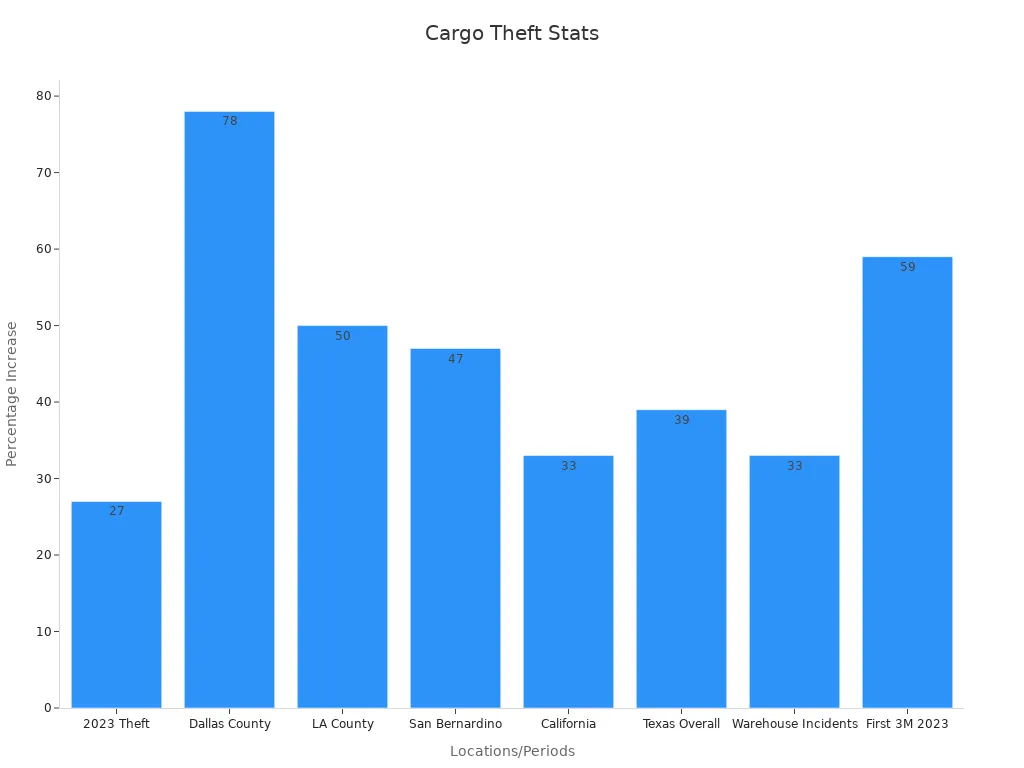

Cargo transportation insurance helps your business avoid losing money. It protects you when goods are moved from one place to another. Theft and damage are big problems. In 2024, cargo theft went up by 27%. JUSDA can help you lower these risks.

Statistic Description | Data / Percentage |

|---|---|

Total cargo theft incidents in U.S. & Canada (2024) | |

Increase in theft incidents compared to 2023 | 27% increase |

Percentage of incidents at warehouses | 33% (one in three incidents) |

Key Takeaways

Cargo transportation insurance keeps your goods safe from loss, theft, or damage when shipping. It helps your business avoid losing a lot of money.

Pick the right insurance type and coverage for your cargo’s value, shipping method, and risks. Check your policy often to make sure you are still protected.

Work with experts like JUSDA to learn about your insurance needs. They help you manage risks and make sure your shipments follow laws and contracts.

Cargo Transportation Insurance Basics

What Is It?

Cargo transportation insurance keeps your goods safe while moving. You buy this insurance to help if your goods get lost, stolen, or damaged. It works for land, air, and sea shipping. Many things can go wrong when you ship products. Accidents, fires, storms, and piracy can cause big problems. This insurance helps you get money back if something happens to your cargo.

The official meaning says cargo insurance protects shipments from loss, damage, or theft during travel. There are different types of coverage you can pick. Some policies protect against almost every risk. Others only cover certain dangers. For example, "All-risks" policies give wide protection. Named perils policies only cover listed events like fire or sinking. Insurance does not cover everything. It usually does not pay for losses from bad packing, delays, or if you leave cargo behind.

Note: The OECD International Transport and Insurance Costs database shows the cost of insuring and moving goods worldwide. This information helps you see why insurance is important for global trade.

Why It Matters

Shipping goods comes with many risks. Even small mistakes can cost a lot of money. For example, almost 25% of big container ship problems happen because someone gave the wrong cargo details. More than half of checked containers have at least one problem. Dangerous goods cause 15% of deaths on container ships. Fires, accidents, and lost containers happen every year.

Risk Aspect | Statistic / Fact | Expert Commentary / Impact |

|---|---|---|

Mis-declared cargo in incidents | Nearly 25% of serious container ship incidents are due to mis-declared cargo | Mis-declared cargo is a key factor in container fires; lack of unified global regulation complicates control. |

Container inspection deficiencies | Over 50% of inspected containers had one or more deficiencies | High rate of deficiencies highlights inspection challenges and risks in cargo safety. |

Dangerous goods and fatalities | Accidents involving dangerous goods accounted for 15% of container ship casualty fatalities | Incorrect declaration and preparation of dangerous goods contribute significantly to fatal accidents. |

Container losses at sea | Over 3,100 containers lost in 2020-2021, more than 4x previous period | Large container ships vulnerable to weather and securing failures; new regulations to mandate reporting. |

Fires on container vessels | 64 ships lost in 5 years mainly due to fires; fires often linked to mis-declared cargo | Fires cause major losses and delays; difficult to detect and fight at sea with small crews. |

Specialist skills erosion | Increase in project cargo losses due to lack of specialist vessels and trained crews | Delays and high-value losses occur; need for improved training and procedures emphasized by experts. |

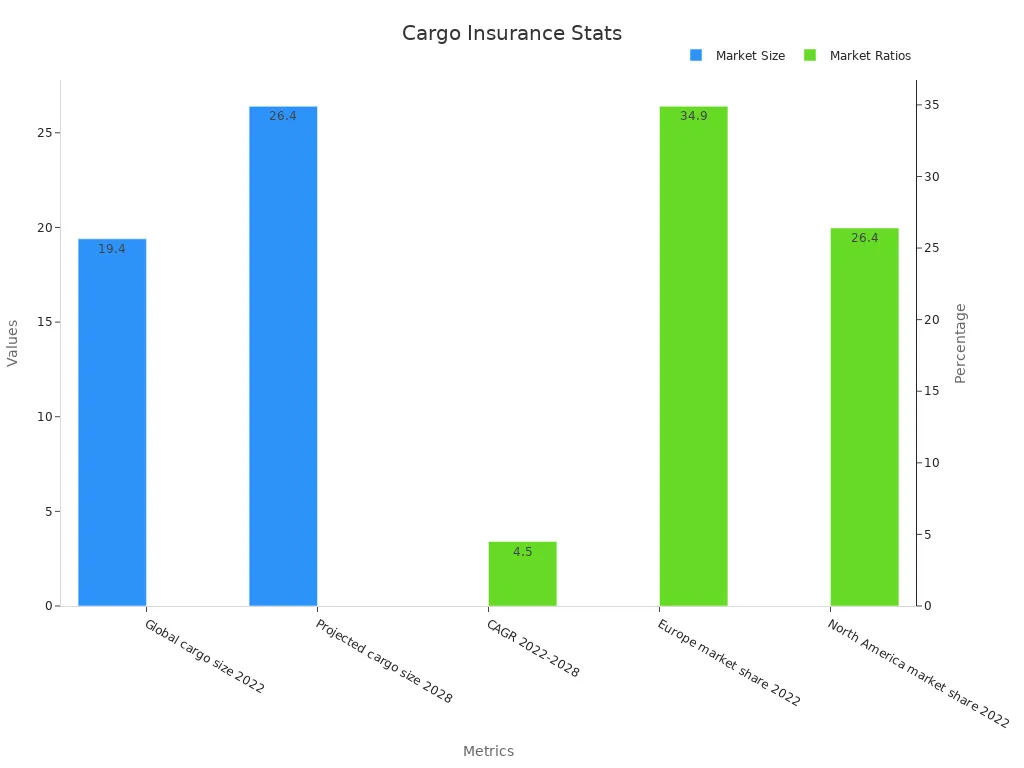

Cargo insurance is important because so many goods are shipped each year. In 2022, over $7 trillion worth of container cargo was shipped worldwide. The global cargo insurance market was $71.4 billion in 2022. It could grow to $106 billion by 2032. This means more companies want to keep their shipments safe.

Metric | Value | Year/Period |

|---|---|---|

Global cargo insurance market size | $71.4 billion | 2022 |

Projected market size | $106 billion | 2032 |

CAGR (Compound Annual Growth Rate) | 4.1% | 2023-2032 |

Annual goods transported by ship | 11 billion tons | Annually |

Annual shipping trade value | Over $14 trillion | 2019 |

You also have to follow the law. In the United States, the Federal Motor Carrier Safety Administration says some carriers must have cargo insurance. This rule helps protect you and your customers from loss or damage during shipping.

Tip: Always read your insurance policy to know what it covers and what it does not. This helps you avoid problems if something goes wrong.

Cargo transportation insurance helps you worry less. You know your business will not lose a lot if there is an accident. You can focus on growing your company because your shipments are protected.

Coverage and Exclusions

What’s Covered

When you get cargo insurance, you want to know what it covers. Most plans protect you from the main dangers during shipping. These dangers are things like damage, theft, fire, and sudden problems. The table below shows the most common risks that are covered:

Covered Risk / Cause | Frequency Rank | Value Rank / % of Claims Value | Notes |

|---|---|---|---|

Damaged Goods (handling, storage, packing) | Third largest by value | Most claims involve physical damage from poor handling or storage | |

Theft and Pilferage | Third most frequent cause | N/A | Includes theft from ports, warehouses, or during transit |

Fire and Explosion | N/A | Top cause by value (18% of claims value) | Linked to mis-declared dangerous cargo and battery fires |

Temperature Variation | Noted as a concern | N/A | Common in pharmaceutical shipments |

Inadequate Shipping Containers | Noted as a concern | N/A | Substandard containers can let water in and damage cargo |

Supply Chain Disruptions | Impacting claim frequency | N/A | Caused by incidents, natural disasters, cyber-attacks, or labor shortages |

Climate Change | Emerging factor | N/A | More extreme weather events now affect claims |

Damaged goods and theft are the top reasons people make claims. Fire and explosion cause the biggest money losses. Temperature changes and bad containers also cause trouble, especially for fragile items. Problems in the supply chain and climate change are now bigger issues.

Tip: Check if your insurance covers temperature changes or supply chain problems. Some plans need extra coverage for these risks.

JUSDA helps you lower these risks. They use smart technology and know a lot about the industry. JUSDA’s JusLink AI Solution gives you updates and warnings in real time. This helps you stop problems before they start. JUSDA also makes special insurance for different businesses, like electronics, cars, and medical supplies. You get the right coverage for your business.

What’s Not Covered

Cargo insurance does not cover every problem. You should know what is not included so you do not get surprised. Here are some things that are not covered:

Inherent Vice: Insurance will not pay if the goods spoil or break down on their own. For example, food that goes bad by itself or chemicals that are not stable.

Latent Defect: If your cargo has a hidden problem from when it was made, insurance will not pay for damage from that problem.

Improper Packaging: If you use weak or old packaging and your cargo gets damaged, insurance will not pay.

Willful Misconduct: If you or your workers do something wrong on purpose or try to cheat, insurance will not pay.

Unexplained Loss or Shortage: If cargo goes missing with no proof, or if it is stolen from an unlocked truck or by workers, insurance might not pay.

A real story shows why these rules matter. In August 2020, someone broke into a trucking company’s trailer and stole some cargo. The company had to show records, photos, and proof of security steps to make a claim. The insurance company checked all the proof and asked for clear stories. This shows you need good records and must follow safety rules. If you do not, your claim could be denied.

Note: Always read your insurance plan and ask questions about what is not covered. Good records and safe packing help you get the most from your insurance.

JUSDA’s experts can help you learn what your insurance covers and what it does not. They work with you to lower risks and keep your cargo safe during shipping.

Types of Cargo Insurance

When you check cargo insurance, you find many types. Each type protects your cargo in a different way. You must know which one is best for your business.

All-Risk

All-Risk cargo insurance gives the most protection. This type covers almost every risk during shipping. It helps if your goods are lost, stolen, or damaged. But it does not cover risks the policy says are not included. Most businesses pick All-Risk for expensive or breakable cargo. You want this if you ship electronics or medical equipment.

All-Risk insurance protects against all risks except those not covered.

You feel better because your cargo is safe from most dangers.

JUSDA helps you see if All-Risk cargo insurance fits your shipments. Their team checks your cargo and shipping needs to find the best choice.

Named Perils

Named Perils cargo insurance only covers risks listed in the policy. If your cargo faces a danger not named, you do not get help. This insurance works well for less valuable goods or when you know the main risks. For example, you might use Named Perils if you ship bulk items or things that are not breakable.

Named Perils insurance covers only the risks shown in the policy.

You pay less for this type, but you take on more risk.

JUSDA can help you look at your cargo and pick Named Perils insurance if it fits your needs.

Per Shipment vs. Open Policy

You can buy cargo insurance for each shipment or get an open policy. Per shipment insurance covers one load at a time. This is good if you ship cargo only a few times a year. Open policy covers all your shipments for a set time. If you ship cargo often, open policy saves you time and money.

Tip: JUSDA helps you pick the right freight insurance plan. Their experts use smart tools to track your cargo and handle your insurance needs.

You need the right cargo insurance to keep your business safe. JUSDA’s team helps you compare choices and pick the best freight insurance for your cargo.

Cargo Insurance vs. Liability Insurance

Key Differences

You might wonder how these two insurances are not the same. Cargo insurance protects your goods when they are being shipped. If your cargo is lost, stolen, or damaged, this insurance pays you back. Freight insurance is only for the shipment itself. It pays for the value of your cargo, not other problems.

Liability insurance is different. It helps if someone says your business hurt them or broke their things. This insurance does not pay if your cargo is lost or damaged. For example, if a truck crash hurts a person or breaks a building, liability insurance pays for that. The Schneider resource says cargo insurance covers your goods, but liability insurance covers bigger business risks.

Insurance Type | What It Covers | When It Applies |

|---|---|---|

Cargo Insurance | Loss or damage to cargo during transit | When goods are lost, stolen, or damaged |

Liability Insurance | Third-party injury or property damage | When your business faces legal claims |

When to Use Each

Use cargo insurance if you want to protect your shipment’s value. If you ship expensive or breakable items, you need this insurance. Freight insurance is also good for shipping overseas or when the carrier’s coverage is not enough. The Martex Farms story shows why. Their mangoes got ruined by a hurricane, and the carrier’s insurance did not pay for everything. Because they had cargo insurance, they got all their money back, even for shipping costs.

Liability insurance is best if you need help with legal claims. If someone gets hurt or something is broken during shipping, this insurance helps pay. You need both types to keep your business safe. Cargo insurance protects your goods, and liability insurance protects you from lawsuits.

Tip: Always look at your contracts and shipping rules. Make sure you have the right freight insurance for your cargo and your business.

Factors Affecting Insurance

Cargo Value

How much your cargo is worth changes your insurance cost. If you ship expensive goods, you need more coverage. This makes your insurance price go up. As global trade got bigger, insurance costs also went up. If you ship things like electronics or luxury items, you will pay more for insurance. When trade slowed down during COVID-19, insurance prices dropped too. When trade picked up again, insurance prices went up. This means insurance costs change with the value of what you ship.

Transport Mode

How you move your cargo changes your insurance price. Some ways of shipping are riskier than others. Here are some examples:

Shipping by barge costs more than by vessel. Barges have more risk from storms and tipping over.

Ocean shipping usually costs more than air shipping. Ocean cargo is in transit longer and faces more dangers.

Rail shipments, like on the China-Europe Block Train, have special risks. These include cold weather and security problems along the way.

Think about these risks when you pick how to ship your cargo. The right insurance keeps your goods safe no matter how you ship them.

Policy Exclusions

Every insurance plan has things it will not cover. These are called exclusions. Common exclusions are damage from bad packing, spoilage, and losses from cheating. If your cargo has a hidden problem or you break safety rules, insurance may not pay. Always read your plan carefully. Ask your provider about any exclusions that could hurt your cargo. Good records and safe shipping help you avoid claim problems.

Tip: Check your insurance plan before every shipment. This helps you know what is covered and what is not.

When to Buy Freight Cargo Insurance

High-Value Goods

You should think about freight cargo insurance for expensive shipments. High-value cargo is usually worth $100,000 or more. Many things can put these shipments at risk. Some risks are driver work hours and accident records. How the cargo is tied down and if the truck is in good shape also matter. Theft is a big problem, especially for electronics and home goods. Fragile or items that need certain temperatures are at risk too. Bad packing or unsafe habits can cause damage. Security at places where you unload and dangerous roads are also risks. Even if your shipment is less than $100,000, you might still need insurance. This is true if it is easy to break or could get stolen. You should get an expert to check how much your cargo is worth. Look at your insurance plan often. JUSDA’s JusLink AI Solution helps you watch for risks and make your cargo safer.

International Shipments

Freight cargo insurance is very important for shipping between countries. Some laws limit how much money you get if something goes wrong. These laws include the Marine Insurance Act of India, the Carmack Amendment, and the Hague-Visby Rules. If your cargo is lost or damaged, you might not get all your money back. The Titanic sinking showed that limited rules can mean big losses for cargo owners. JUSDA’s worldwide team helps you protect your shipments in other countries. They also help you follow all the rules.

Legal and Contract Needs

Sometimes you must have freight cargo insurance because of laws or contracts. Many contracts say you need insurance before you ship. Some countries or trade partners will not take your goods without proof of insurance. Always check your contracts and local laws. JUSDA’s experts help you follow the rules and pick the best insurance for your business.

Tip: Check your freight cargo insurance often. Make sure it fits your shipping needs and the law.

Choosing Cargo Insurance

Understanding Incoterms

Incoterms are rules that tell who is in charge of cargo at each shipping step. You should learn these rules before you buy cargo insurance. If you pick the wrong Incoterm, you might not have enough coverage. For example, with FOB, you are responsible after the cargo is loaded. With CIF, the seller pays for insurance until the cargo gets to your port. Always make sure your insurance matches your Incoterm. This way, you do not miss out on protection.

Working with Providers

Picking the right provider helps you get good cargo insurance. You should find providers who give support and know your business. JUSDA’s experts help you look at risks and choose the best freight insurance. Good teamwork makes a big difference. Here are some ways to work well with your provider: 1. Set clear packing rules for your cargo. 2. Ask your provider to count and track pieces during shipping. 3. Share easy KPIs to check how carriers do. 4. Work together on claims to save money. 5. Get your team and vendors to talk about risks. You can also make joint risk plans and share good ideas. This teamwork keeps your supply chain safer and protects your cargo.

Reviewing Policy Terms

Always read your cargo insurance policy closely. Look for what is covered and what is not. Check for things like bad packing or delays that are not covered. Make sure your freight insurance fits your cargo’s value and shipping route. Review your insurance often as your business changes. JUSDA’s team can help you understand your policy and change coverage if you need it.

Tip: Check your cargo insurance every year. Update your policy if you change suppliers, routes, or cargo types.

JUSDA Solutions

To provide you with professional solutions and quotations.

Cargo transportation insurance helps your business avoid losing a lot of money. It is smart to look at your insurance often because things can change. JUSDA has experts and good tools to help you with supply chain risks.

Make sure you check what insurance you need now and talk to an expert.

See Also

Comprehensive Insights Into Leading Worldwide Logistics Firms

Analyzing Emerging Trends In Logistics Risk Management

Discover The Latest Developments In Sea Freight 2024